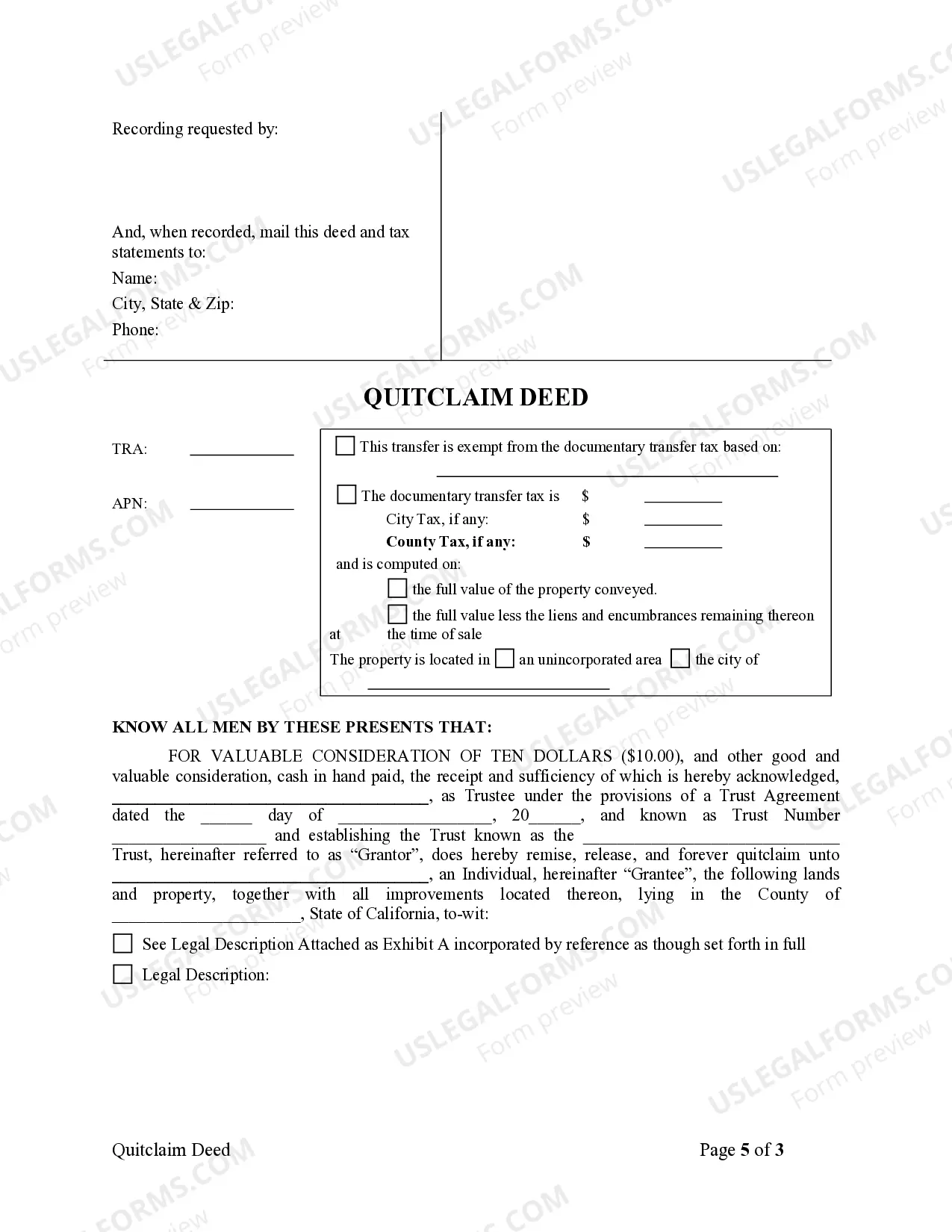

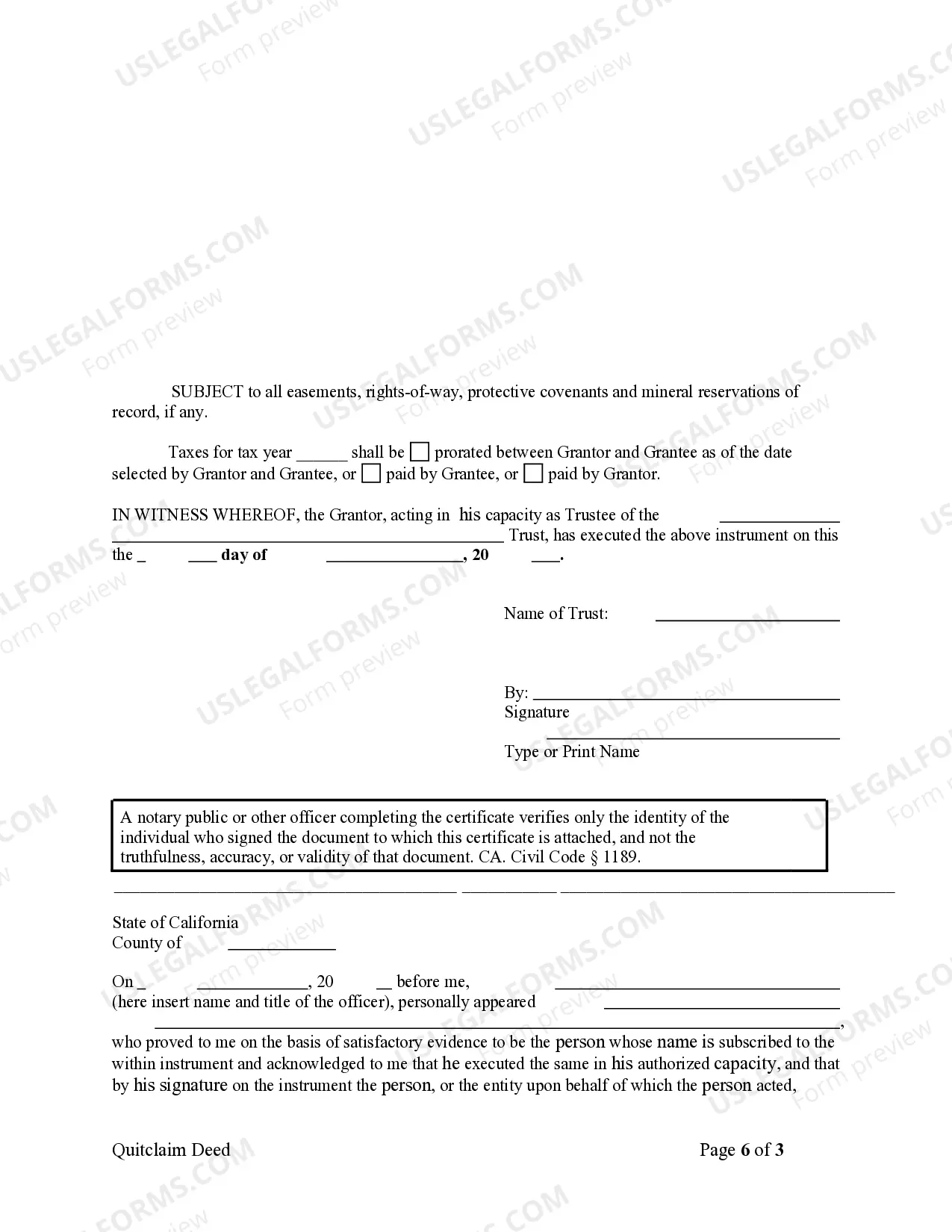

This form is a Quitclaim Deed where the grantor is a Trust and the grantee is an individual.

A Norwalk California Quitclaim Deed — Trust to Individual is a legal document used in the state of California to transfer ownership of real estate from a trust to an individual. This type of deed is commonly used when the property is held in a trust and the trust or (the person who set up the trust) wants to transfer the property to a beneficiary or someone else. The Norwalk California Quitclaim Deed — Trust to Individual serves as evidence of the transfer and ensures that the new owner has clear and marketable title to the property. It should be noted that a quitclaim deed does not guarantee that the property is free from any liens or encumbrances, it simply transfers the interest of the trust to the individual without making any warranties. There are different types of Norwalk California Quitclaim Deeds — Trust to Individual, namely: 1. Norwalk California Quitclaim Deed — Trust to Individual with Full Covenants: This type of deed offers the highest level of protection for the individual acquiring the property. It guarantees that the property is free from any encumbrances, liens, or claims, even those that may arise from before the trust was established. 2. Norwalk California Quitclaim Deed — Trust to Individual with Limited Covenants: This type of deed provides some protection for the individual acquiring the property, but it only guarantees against encumbrances, liens, or claims that may arise during the time the property was held in the trust. 3. Norwalk California Quitclaim Deed — Trust to Individual without Covenants: This type of deed offers the least amount of protection for the individual acquiring the property. It does not make any guarantees as to the condition of the title or any encumbrances, liens, or claims that may exist on the property. When using a Norwalk California Quitclaim Deed — Trust to Individual, it is important to consult with a real estate attorney or a qualified professional to ensure that the deed is valid and legally binding. Additionally, it is advisable to conduct a thorough title search to identify any potential issues or claims on the property before completing the transfer. In conclusion, a Norwalk California Quitclaim Deed — Trust to Individual is a legal document used for transferring ownership of a property held in a trust to an individual. Different types of deeds offer varying levels of protection for the individual acquiring the property. It is crucial to seek legal advice and conduct a title search before completing the transfer.