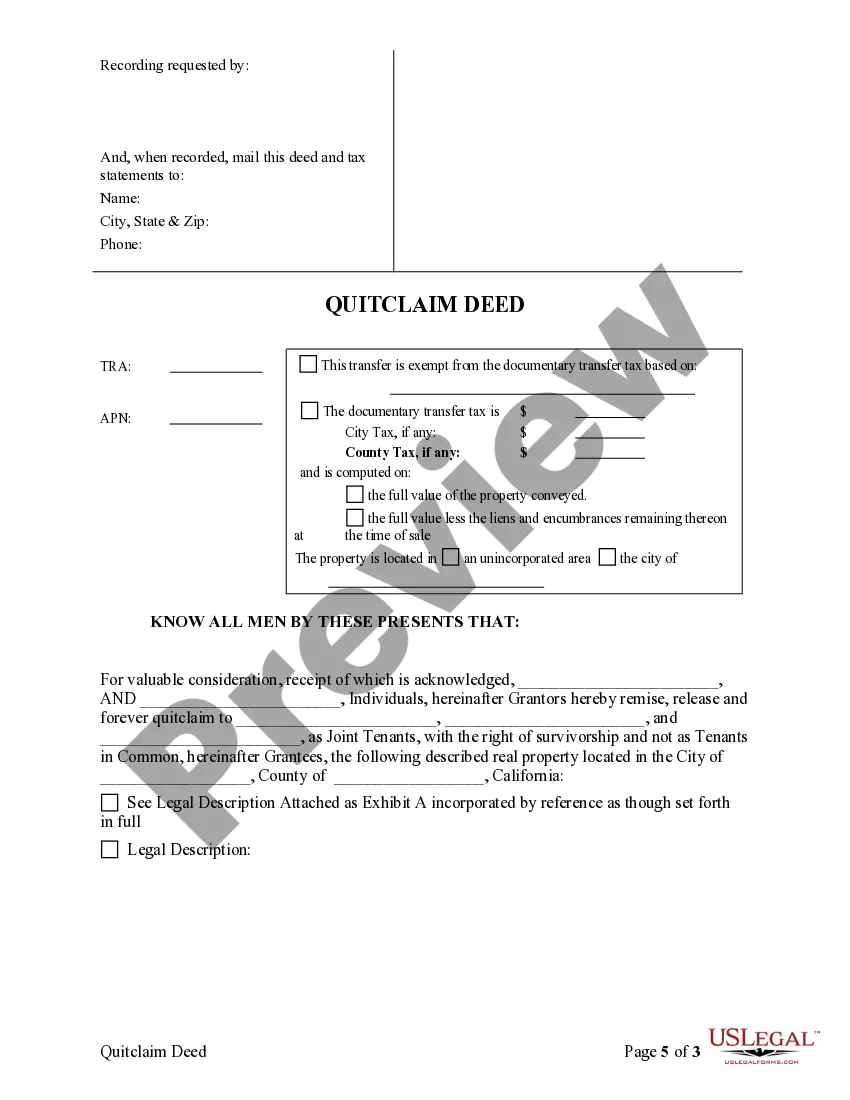

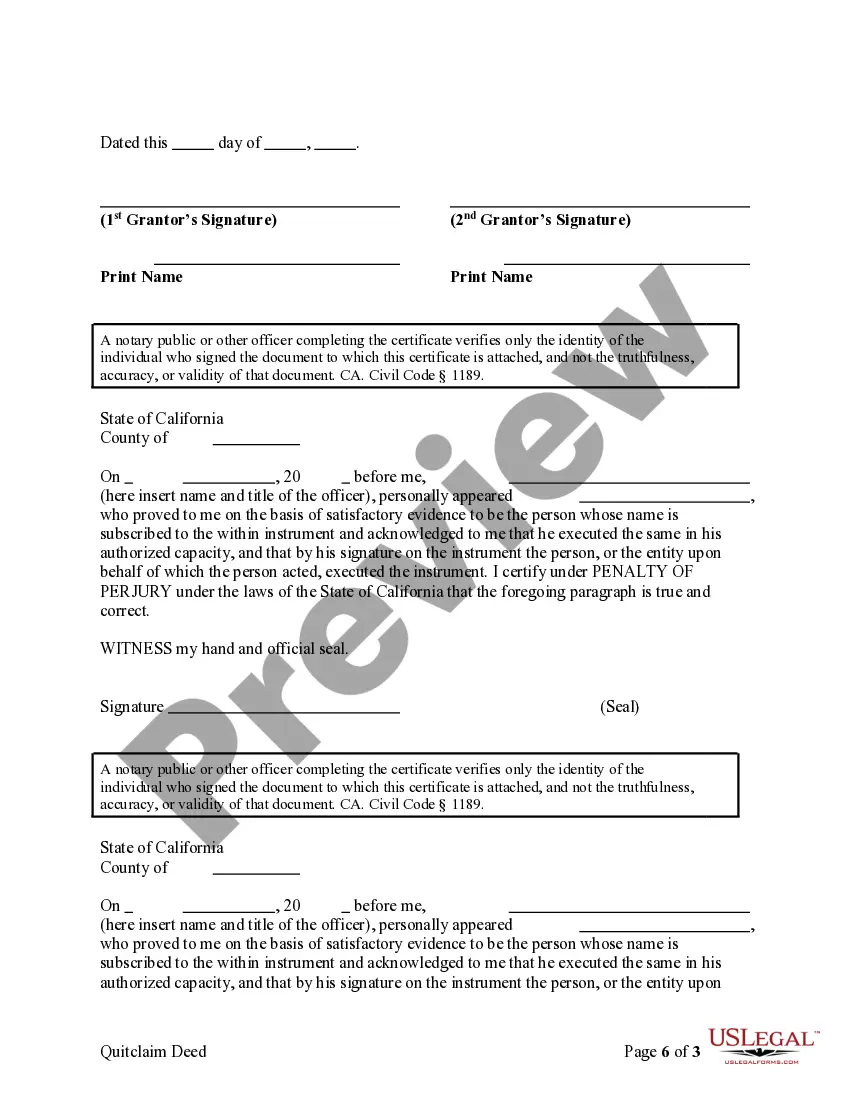

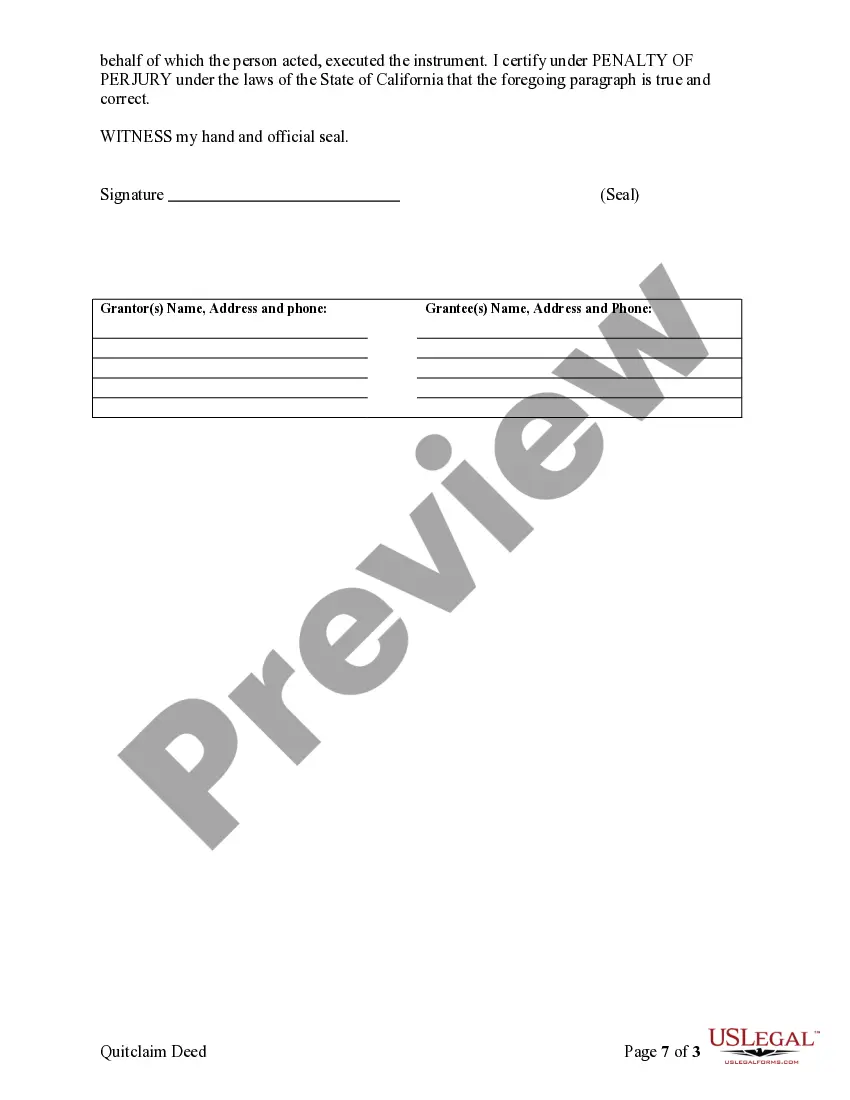

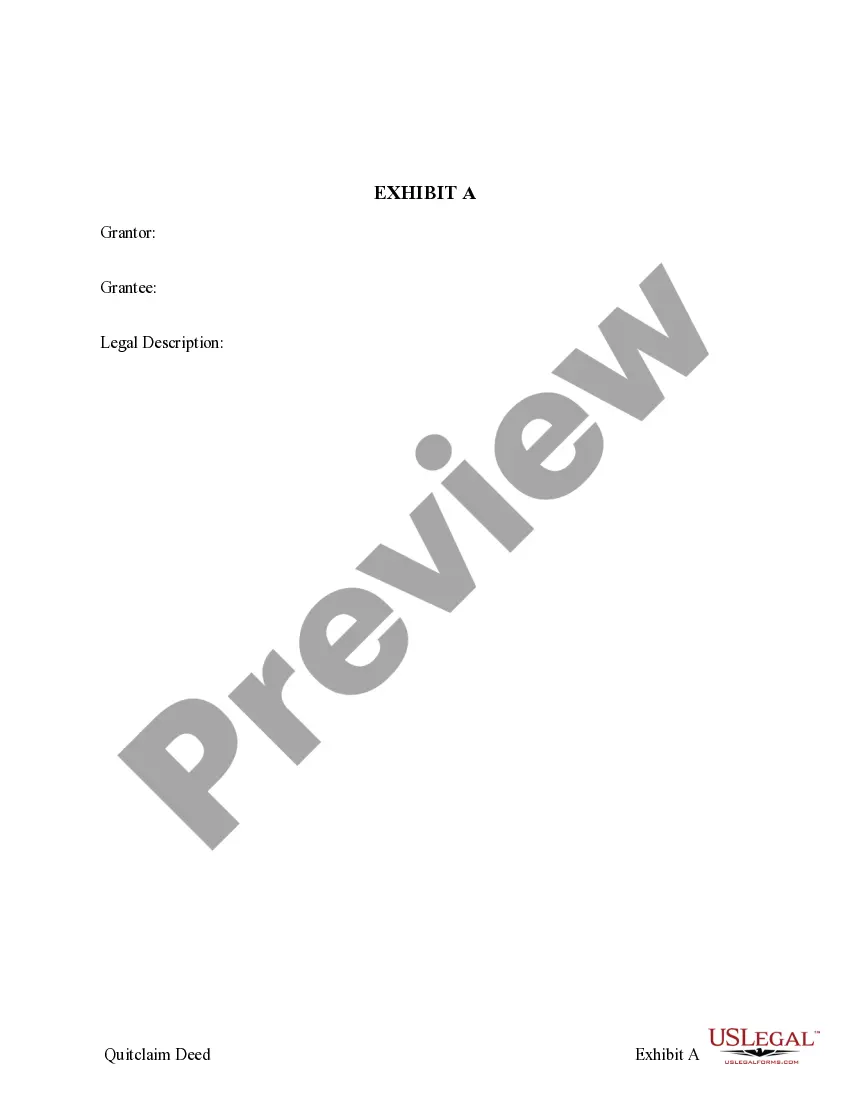

This form is a Quitclaim Deed where the grantors are two individuals and the grantees are three individuals holding title as joint tenants.

A San Jose California Quitclaim Deed from two Individuals to Three Individuals as Joint Tenants is a legal document used to transfer ownership of a property between two parties to three parties, with the new owners holding the property as joint tenants. In this type of quitclaim deed, the two individuals who are transferring ownership, also known as the granters, are relinquishing their rights and interest in the property to the three individuals who are receiving ownership, known as the grantees. This means that the two granters are giving up any claims they have on the property and transferring it to the three grantees. The term "joint tenants" refers to the ownership arrangement after the transfer is complete. Joint tenants have equal and undivided rights to the property, meaning they all own an equal share and have the right to possess and use the entire property together. If one joint tenant were to pass away, their share automatically transfers to the surviving joint tenants, rather than being subject to probate or going to their heirs. It's important to note that there may be different types of San Jose California Quitclaim Deeds from two Individuals to Three Individuals as Joint Tenants, depending on specific circumstances or variations in the legal language used. However, the overall purpose and structure of the deed remain the same, involving the transfer of ownership from two individuals to three individuals as joint tenants. Some possible variations could include specifying the details of the property being transferred, such as the address or legal description, or including additional terms or conditions agreed upon by the parties involved. In summary, a San Jose California Quitclaim Deed from two Individuals to Three Individuals as Joint Tenants is a legal document used for the transfer of ownership of a property between two parties to three parties, with the new owners holding the property as joint tenants.