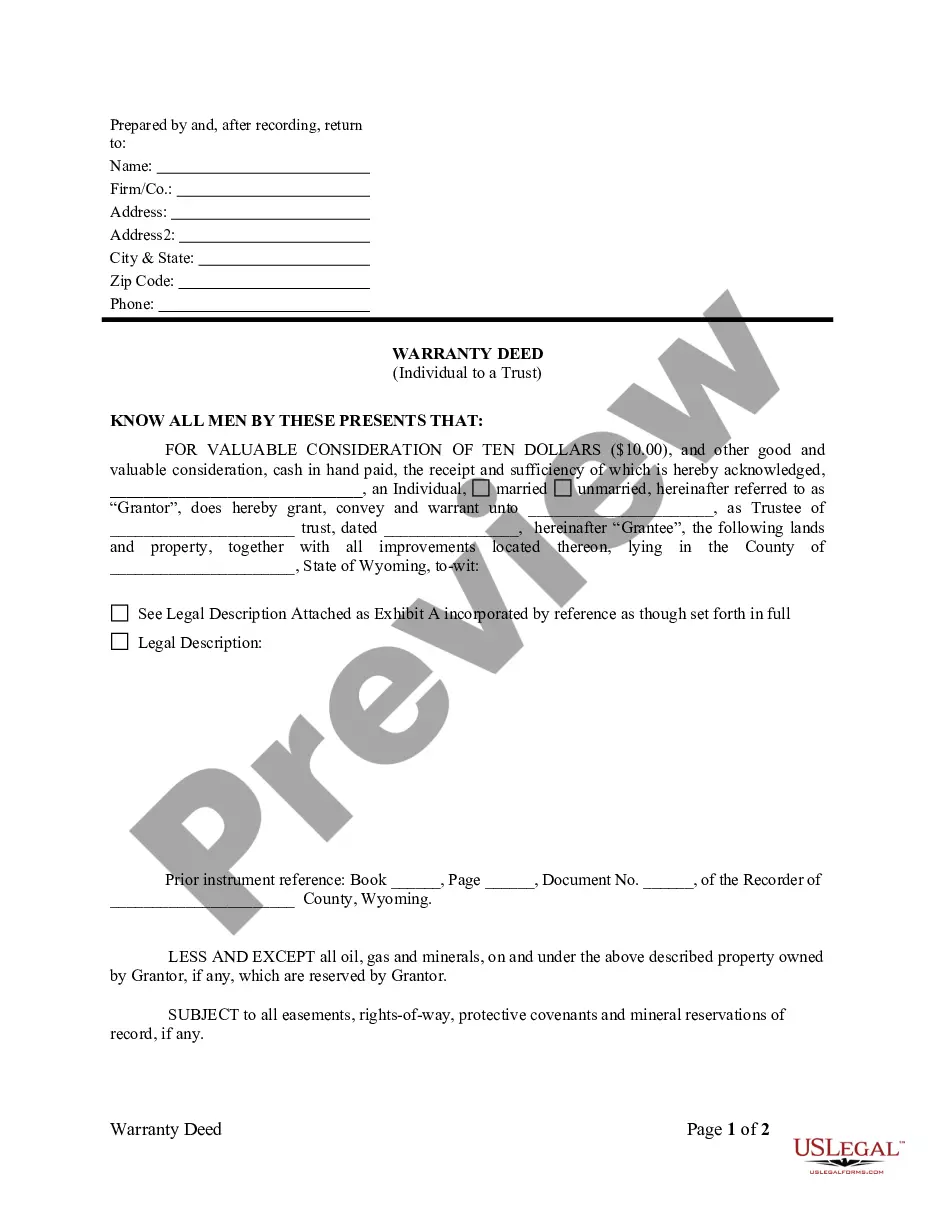

This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is a trust and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

El Monte California Grant Deed from a Trust to LLC is a legal document that allows for the transfer of real property from a trust to a limited liability company (LLC) located in El Monte, California. This type of deed is commonly used in estate planning or business restructuring scenarios when the property held in a trust needs to be transferred to an LLC. The El Monte California Grant Deed from a Trust to LLC serves as evidence of the transfer and provides details regarding the parties involved, the property being transferred, and the terms and conditions of the transfer. It is crucial to adhere to the specific legal requirements of the state and local jurisdiction in order to ensure the validity and enforceability of the deed. There are various types of El Monte California Grant Deeds from a Trust to LLC that may be used depending on the specific circumstances: 1. Trust-to-LLC Transfer Grant Deed: This is the most common type, where a property held in a trust is transferred to an LLC. This ensures that the property is effectively transferred and owned by the LLC. 2. Revocable Trust-to-LLC Transfer Grant Deed: In this case, the property is transferred from a revocable trust to an LLC. A revocable trust allows the trust or (property owner) to maintain control over the property during their lifetime, but after their passing, the property is typically transferred to an LLC for ease of management and protection of assets. 3. Irrevocable Trust-to-LLC Transfer Grant Deed: This type of grant deed is used when the property is held in an irrevocable trust. An irrevocable trust is one where the trust or relinquishes control of the property permanently. In this situation, the property can be transferred to an LLC for asset protection, liability limitation, or tax planning purposes. 4. Testamentary Trust-to-LLC Transfer Grant Deed: If the property is held in a testamentary trust, meaning it is passed down through a will upon the passing of the granter, a testamentary trust-to-LLC transfer grant deed may be used to transfer the property to an LLC. It is important to consult with a qualified attorney or legal professional when dealing with El Monte California Grant Deed from a Trust to LLC to ensure compliance with applicable laws and regulations.