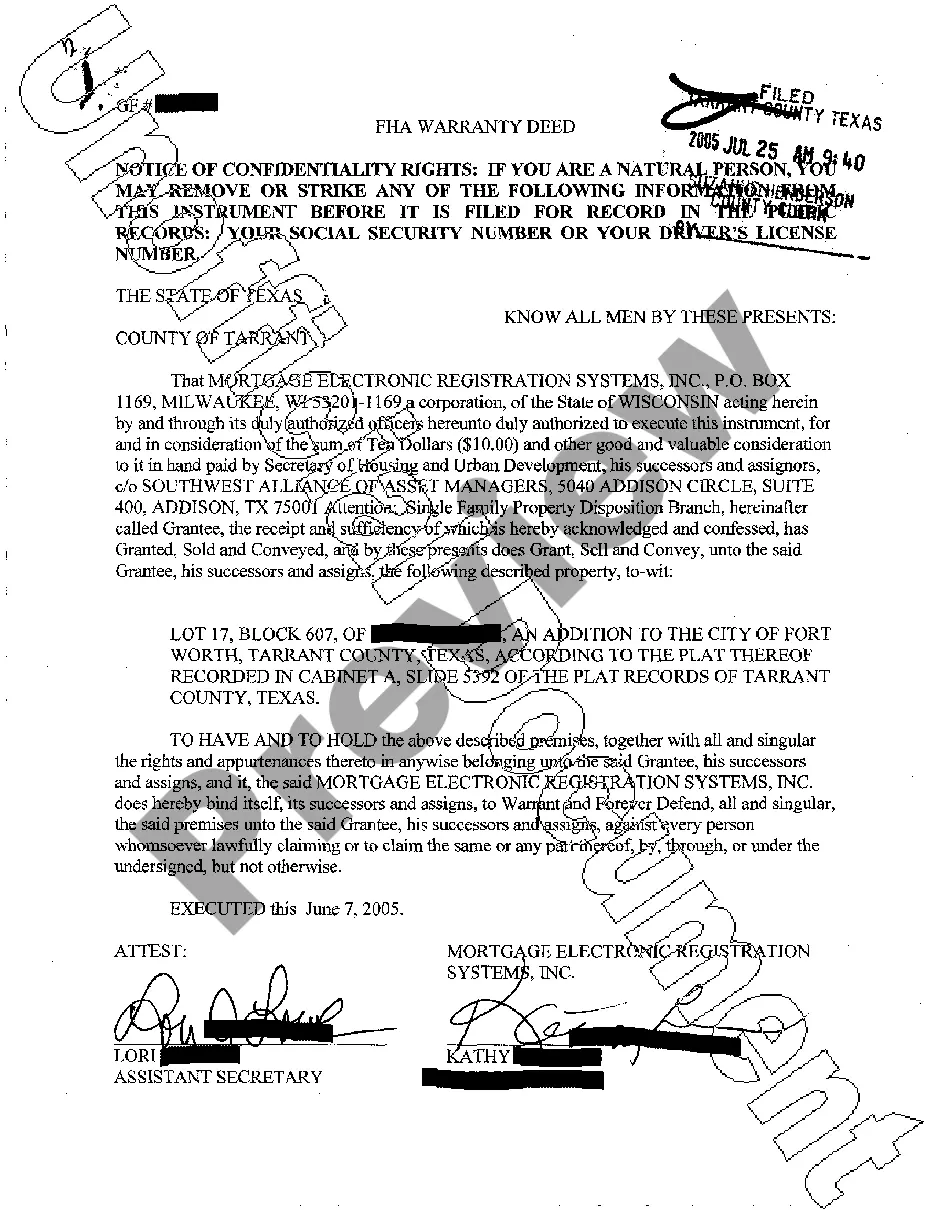

This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is a trust and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A San Jose California Grant Deed from a Trust to LLC is a legal document that transfers ownership of a property from a trust to a Limited Liability Company (LLC) in San Jose, California. This transaction is commonly used when the property is held in a trust and the owner wants to transfer the ownership to an LLC for various reasons, such as asset protection, liability mitigation, or business planning purposes. A grant deed is a specific type of deed used in California that guarantees the granter's ownership of the property and states that there are no undisclosed or outstanding claims against it. This type of deed typically includes the legal description of the property, details of the transfer, identification of the granter (the trust), and the grantee (the LLC). It requires the signature of the granter and may need to be notarized or recorded with the county recorder's office to be legally valid. Some common variations of the San Jose California Grant Deed from a Trust to LLC include: 1. General Grant Deed: This type of grant deed transfers the property from the trust to the LLC without any specific warranties or guarantees. It simply transfers whatever interest the trust has in the property to the LLC. 2. Special Grant Deed: In contrast to a general grant deed, a special grant deed includes specific warranties or guarantees. For example, the trust may warrant that it has not sold or encumbered the property during its ownership, or that it has full legal authority to transfer the property to the LLC. 3. Quitclaim Deed: While not technically a grant deed, a quitclaim deed is another type of deed commonly used to transfer property in San Jose, California. A quitclaim deed transfers the property "as-is" without any warranties or guarantees. It is often used when the transfer is between family members or in situations where the granter's interest in the property is uncertain. It is important to consult with a qualified attorney or real estate professional to determine the most suitable type of San Jose California Grant Deed from a Trust to LLC for your specific circumstances and to ensure that all legal requirements are met during the transfer process.