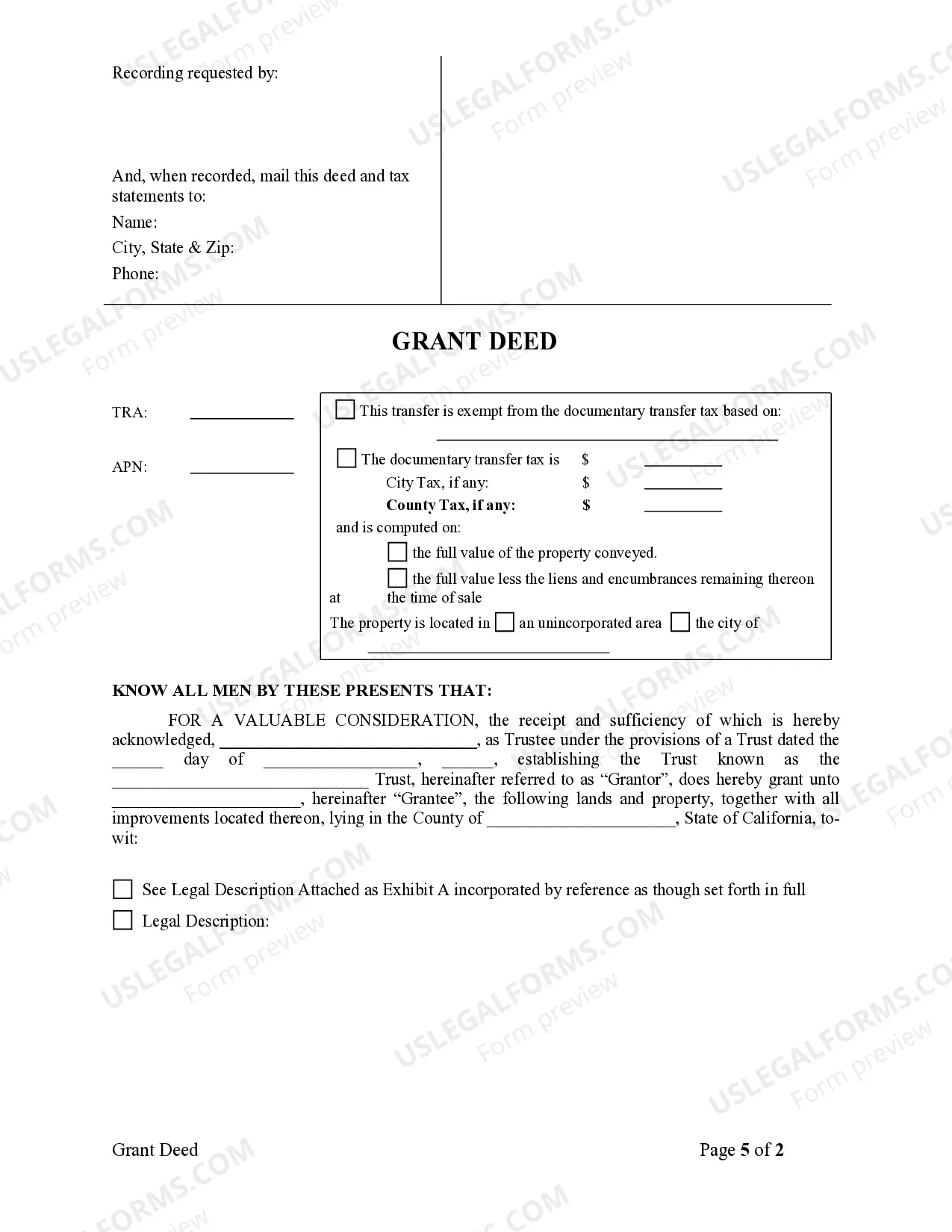

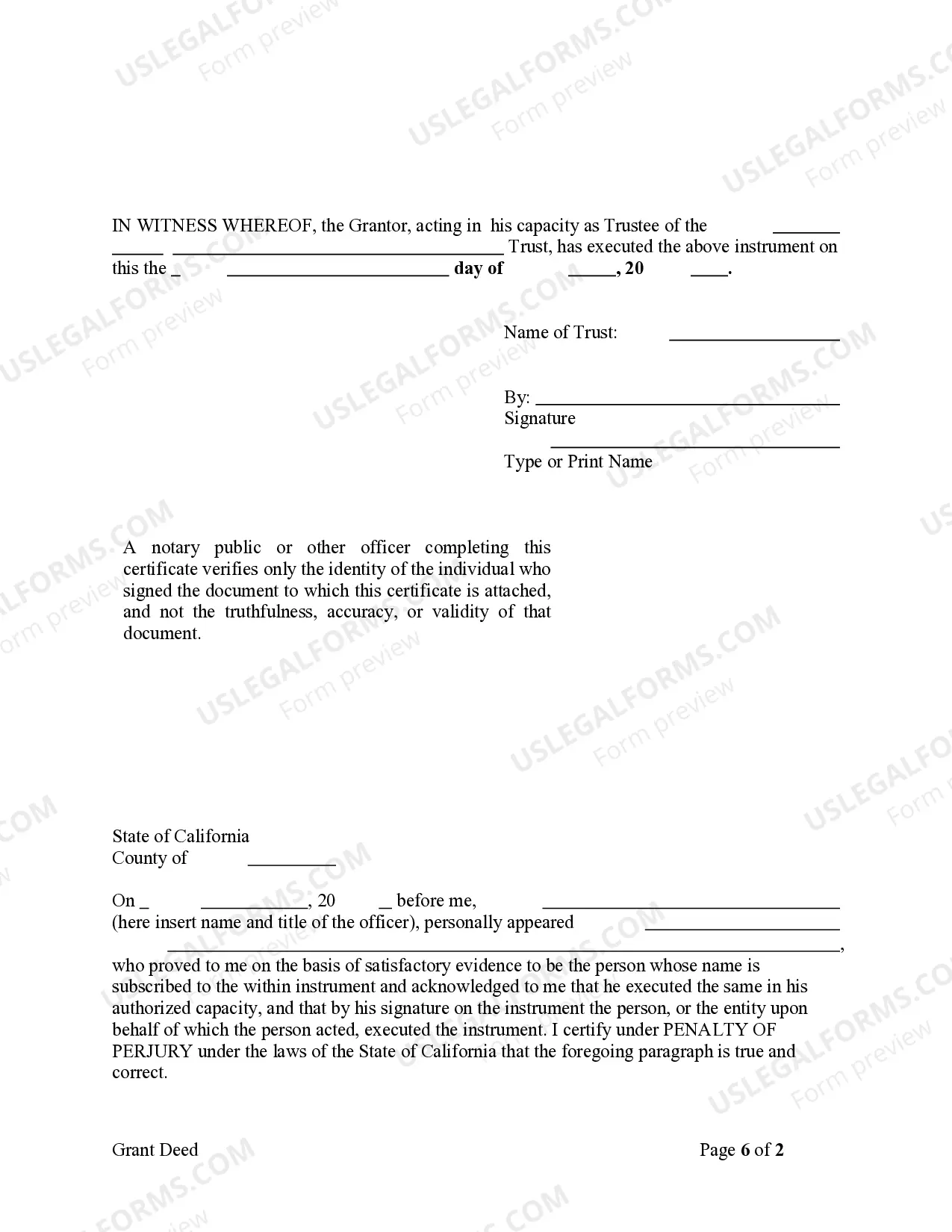

This form is a Grant Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

A Contra Costa California Grant Deed — Trust to Individual is a legal document that transfers ownership of real property from a trust to an individual in Contra Costa County, California. This type of deed is commonly used when a property held in a trust needs to be transferred to an individual beneficiary. The Contra Costa California Grant Deed — Trust to Individual serves as proof of the transfer of title from the trust to the individual, ensuring that the beneficiary now has legal ownership and control over the property. It is an important document that should be accurately prepared and recorded with the County Recorder's Office to establish a clear chain of title. Keywords: Contra Costa California, Grant Deed, Trust to Individual, real property, ownership, transfer, trust beneficiary, legal document, County Recorder's Office, chain of title. Different types of Contra Costa California Grant Deed — Trust to Individual may include: 1. Revocable Trust Grant Deed — Trust to Individual: This type of grant deed allows a property owner who has placed their property in a revocable trust to transfer ownership to an individual beneficiary. The revocable trust allows the property owner to maintain control over the property during their lifetime while ensuring a smooth transfer to the designated beneficiary upon their death. 2. Irrevocable Trust Grant Deed — Trust to Individual: With an irrevocable trust grant deed, the property is transferred from the trust to an individual beneficiary, but unlike a revocable trust, the transfer is permanent and cannot be changed or revoked by the trust or. This type of trust is often used for estate planning purposes or to protect assets from creditors. 3. Testamentary Trust Grant Deed — Trust to Individual: A testamentary trust grant deed is created through a will and takes effect upon the death of the trust or. It allows the property to be transferred from the trust to an individual beneficiary according to the instructions outlined in the trust or's will. This type of trust is commonly used for estate planning to ensure the orderly distribution of assets after death. 4. Special Needs Trust Grant Deed — Trust to Individual: A special needs trust grant deed enables the transfer of property from a trust to an individual with special needs. This type of trust is designed to preserve eligibility for government assistance programs while providing for the beneficiary's supplemental needs. 5. Land Trust Grant Deed — Trust to Individual: A land trust grant deed is a type of trust used specifically for real estate investment purposes. It allows the transfer of property from a land trust to an individual beneficiary while maintaining privacy and flexibility in managing the property. In conclusion, a Contra Costa California Grant Deed — Trust to Individual is a crucial legal document used to transfer real property from a trust to an individual beneficiary. Various types of grant deeds exist depending on the nature and purpose of the trust involved. It is essential to consult with a knowledgeable legal professional to determine the appropriate grant deed type for your specific situation.