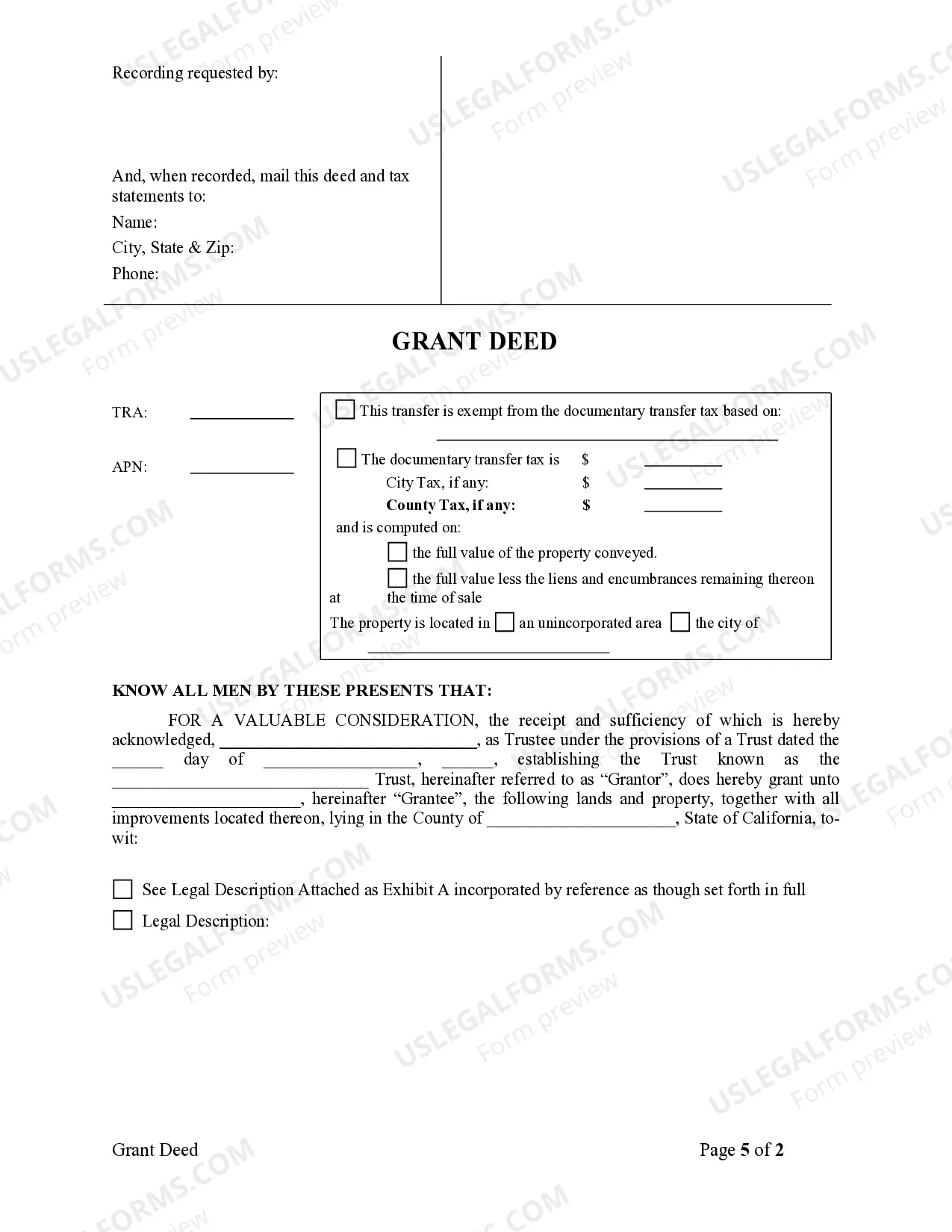

This form is a Grant Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

Riverside California Grant Deed - Trust to Individual

Description

How to fill out California Grant Deed - Trust To Individual?

Are you searching for a trustworthy and economical provider of legal forms to obtain the Riverside California Grant Deed - Trust to Individual? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a set of forms to facilitate your divorce process through the court, we have everything you need. Our platform provides over 85,000 current legal document templates for personal and business purposes. All the templates we offer are not generic and are tailored to the specifications of different states and regions.

To acquire the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please note that you can download your previously purchased form templates at any time from the My documents section.

Is this your first time using our platform? No problem. You can easily create an account, but first, make sure to do the following: Check if the Riverside California Grant Deed - Trust to Individual complies with your state and local regulations. Review the form’s description (if available) to understand who and what the document is intended for. Rerun the search if the form isn’t suitable for your legal needs.

Try US Legal Forms today, and put an end to spending endless hours searching for legal documents online.

- You can now register your account.

- Select the subscription option and proceed to payment.

- After payment is completed, download the Riverside California Grant Deed - Trust to Individual in any available format.

- You can revisit the website at any time and redownload the document at no additional cost.

- Acquiring current legal forms has never been more straightforward.

Form popularity

FAQ

To correct a grant deed in California, you typically need to draft a corrective deed, which identifies the original deed and explains the correction. This document must be signed by the same grantor, and notarization is necessary. After completing the corrective deed, record it with the county recorder's office to ensure all records are updated. For help with this process, consider using US Legal Forms for a straightforward solution regarding Riverside California Grant Deed - Trust to Individual.

One major mistake parents make when setting up a trust fund is failing to clearly outline the terms and conditions. This can lead to confusion and disputes later on. Moreover, not adequately funding the trust can render it ineffective. It’s critical to understand these aspects, especially when planning your Riverside California Grant Deed - Trust to Individual.

Filling out a California grant deed requires including the names of both the grantor and grantee, along with a specific description of the property. Ensure that the grantor signs the deed before a notary public, and date the document accordingly. Double-check for accuracy to prevent any complications, especially when dealing with Riverside California Grant Deed - Trust to Individual arrangements.

Transferring property out of a trust in California involves creating a new deed to reflect the change. This deed should include the names of the trust and the individual receiving the property. Once the deed is completed, you must file it with the county recorder's office. For assistance with the process, US Legal Forms can provide templates tailored for Riverside California Grant Deed - Trust to Individual scenarios.

In California, the grant deed must be signed by the grantor, who is the person transferring the property. If the property includes multiple owners, all owners must sign the document. The grantee does not need to sign, but it's good practice for them to acknowledge the transaction. For detailed guidance on this process, consider using the resources at US Legal Forms regarding Riverside California Grant Deed - Trust to Individual.

In California, a grant deed must contain specific elements to be valid. It should include the grantor's and grantee's names, a legal description of the property, and the current date. Additionally, it must be signed by the grantor and be notarized. Adhering to these requirements ensures the effectiveness of a Riverside California Grant Deed - Trust to Individual.

To fill out a grant deed form in California, first, clearly write the names of the grantor and grantee. Then, include a complete legal description of the property being transferred. Make sure to sign the deed in front of a notary public. Lastly, remember to keep a copy for your records, as this is crucial when dealing with Riverside California Grant Deed - Trust to Individual situations.

Filing a deed of trust in California involves several important steps. First, you must prepare the deed, ensuring it complies with Riverside California laws concerning grants and trusts. After that, you need to submit the completed deed to the recorder's office in the appropriate county, along with the required fees. Using a reputable service like US Legal Forms can simplify this process, guiding you through the legal requirements specific to Riverside California Grant Deed - Trust to Individual.

Transferring a house deed to a family member in California requires executing a Riverside California Grant Deed - Trust to Individual. Start by obtaining the necessary forms and consulting with a legal expert if needed. Fill out the grant deed accurately, including details about the property and the new owner. After signing the deed, ensure you submit it to the county recorder's office to make the transfer official.

To transfer a property title to a family member in California, you typically need to use a Riverside California Grant Deed - Trust to Individual. This legal document allows you to officially change the ownership of your property. First, gather any necessary information about the property, such as its legal description and the current owner's details. Once completed, file the grant deed with the county recorder's office to finalize the transfer.