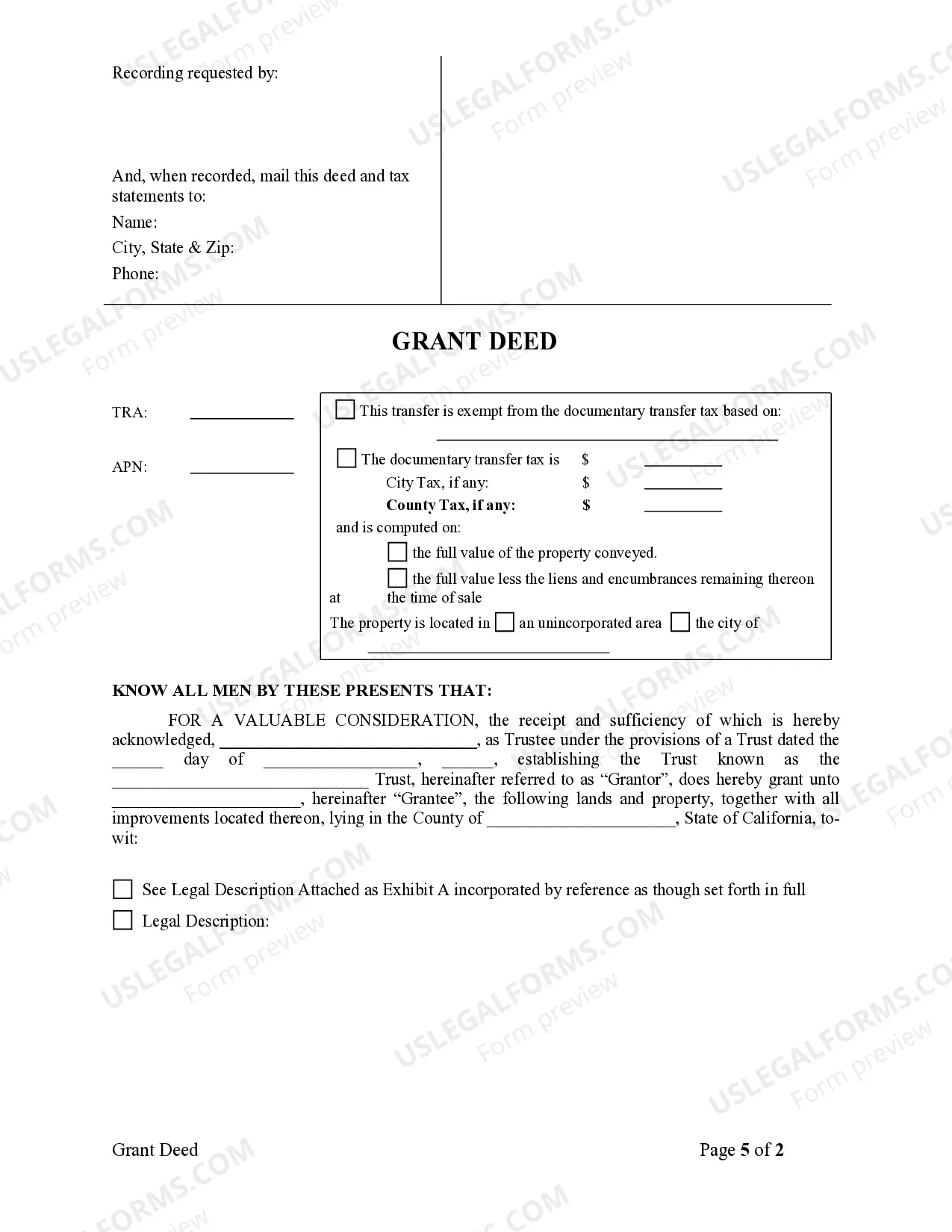

This form is a Grant Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

A San Jose California Grant Deed — Trust to Individual is a legal document used in real estate transactions that transfers ownership of a property from a trust to an individual. This type of deed is commonly employed when a property that is held in a trust needs to be transferred to a specific individual. The grant deed is a crucial part of the transfer process, as it legally documents the change of ownership. It contains relevant details such as the names of the trust and the individual receiving the property, the legal description of the property, and any relevant restrictions or covenants. It also acknowledges that the property is being transferred without warranties, meaning that the trust is not guaranteeing the condition or title of the property. When referring to types of San Jose California Grant Deed — Trust to Individual, the term is not commonly used in this context. However, there may be variations or specific conditions surrounding the transfer, such as transfers to family members, transfers involving multiple individuals, or transfers with certain restrictions. These specifics can be addressed within the grant deed itself, but typically they do not change the main purpose or structure of the document. Overall, a San Jose California Grant Deed — Trust to Individual is a legal instrument that is used to transfer ownership of a property held in a trust to an individual. It is an essential document in real estate transactions, ensuring that the transfer is properly documented and legally binding.