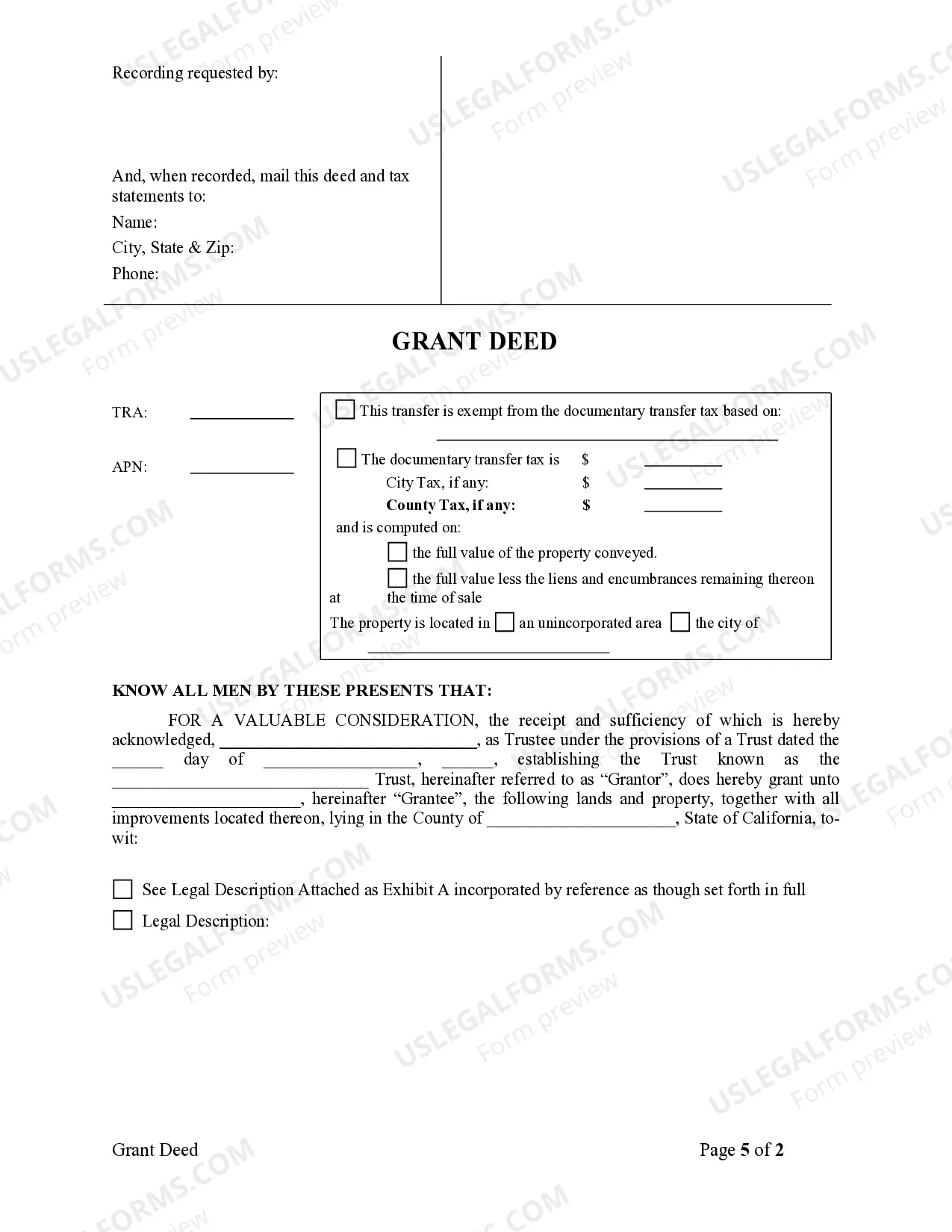

This form is a Grant Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

A Stockton California Grant Deed — Trust to Individual is a legal document that transfers ownership of real estate from a trust to an individual in the city of Stockton, California. This type of deed is commonly used in estate planning or when a property is being distributed or sold from a trust to an individual beneficiary or buyer. The Stockton California Grant Deed — Trust to Individual serves as evidence of the transfer, providing important details such as the names of the granter (trust) and grantee (individual), the legal description of the property, and any restrictions or special conditions related to the transfer. It is essential to follow the proper legal procedures when executing this deed to ensure it is valid and enforceable. In Stockton, California, there are a few different types of Grant Deeds that fall under the category of Trust to Individual transfers. These include: 1. General Grant Deed — Trust to Individual: This type of deed transfers the property with no specific warranties or guarantees from the trust to the individual. It simply conveys whatever interest the trust has in the property to the individual. 2. Special Warranty Grant Deed — Trust to Individual: This type of deed also transfers the property from trust to individual, but the granter (trust) provides a limited warranty. They guarantee that during the time of their ownership, they have not done anything to harm the title or encumber the property. 3. Quitclaim Deed — Trust to Individual: While not technically a grant deed, a quitclaim deed is another option for transferring property from a trust to an individual. Unlike a grant deed that conveys the granter's interest, a quitclaim deed transfers the granter's interest, if any, without any warranties or guarantees. It is crucial to consult with a qualified real estate attorney or a trust professional when executing a Stockton California Grant Deed — Trust to Individual to ensure compliance with all relevant laws and regulations. These professionals can guide you through the process and make sure the transfer is properly recorded with the appropriate government agencies, securing the ownership rights of the individual receiving the property.