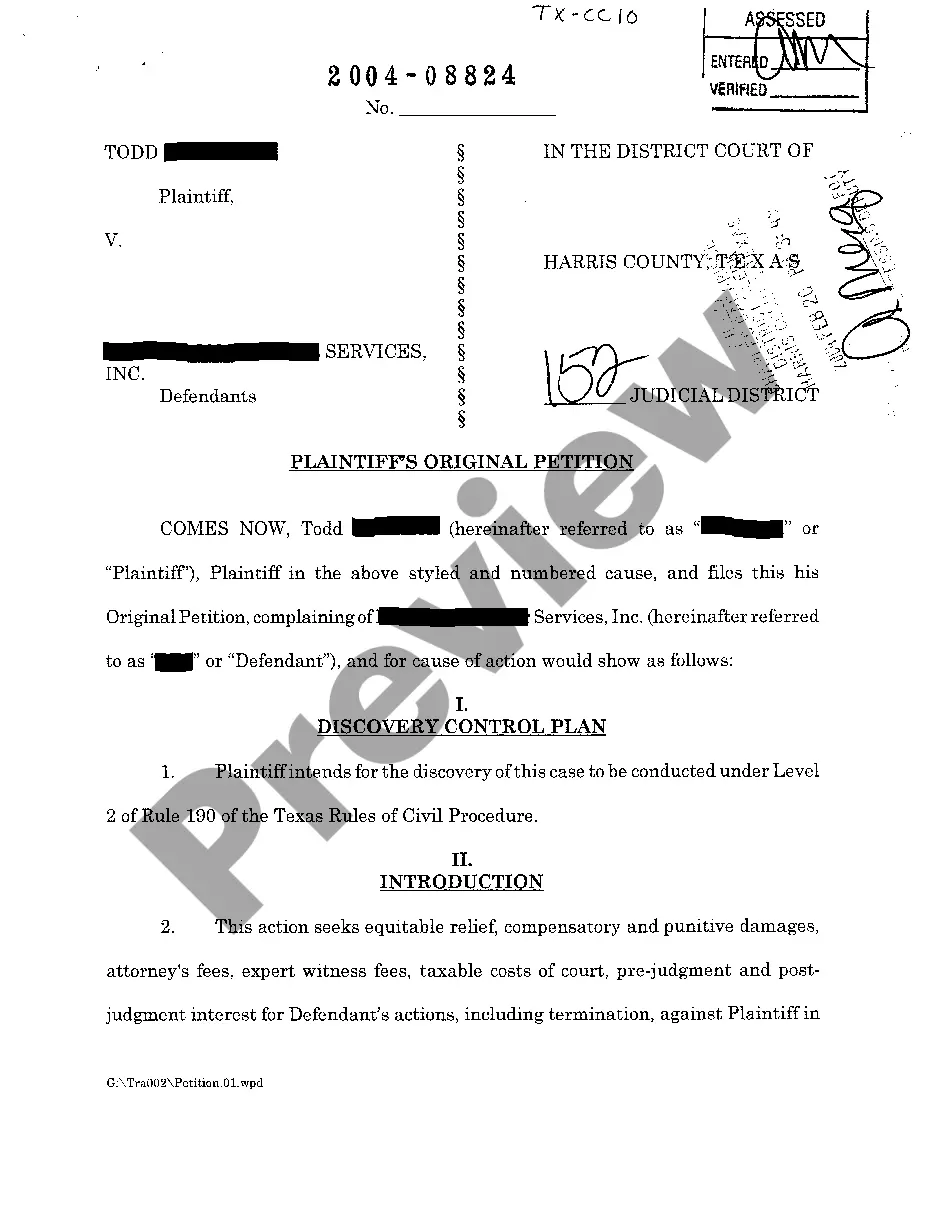

Application for Earnings Withholding Order: An Application for Earnings Withholding asks the Sheriff to garnish the wages of the Judgment Debtor. It states that he/she has not satisfied the judgment against him/her, and the Judgment Creditor wishes to recoup some of his/her losses.

El Cajon California Application for Earnings Withholding Order — Wage Garnishment is a legal process that allows creditors to collect unpaid debts from individuals who reside or work in El Cajon, California. This application is specifically designed to initiate the wage garnishment process to ensure that the owed amount is repaid. The primary purpose of the El Cajon California Application for Earnings Withholding Order — Wage Garnishment is to provide a mechanism for creditors to collect their debts efficiently and legally. By obtaining an earnings withholding order, creditors can deduct a certain portion of the debtor's wages directly from their paycheck until the owed amount is satisfied. This process ensures that the creditor receives regular payments towards the debt and reduces the risk of non-payment or default. The El Cajon California Application for Earnings Withholding Order — Wage Garnishment is typically filed by creditors after obtaining a judgment against the debtor. It is crucial to note that wage garnishment is subject to certain limitations and regulations defined by state and federal laws. Therefore, it is essential for creditors or their legal representatives to follow the appropriate legal procedures when filing the application. While there may not be different types of El Cajon California Application for Earnings Withholding Order — Wage Garnishment, it is important to mention that there are different types of debts that can be subject to garnishment. These include unpaid credit card bills, medical bills, personal loans, unpaid child support or alimony, and unpaid taxes, among others. To initiate the El Cajon California Application for Earnings Withholding Order — Wage Garnishment, creditors should gather relevant information such as the debtor's personal details, employment information, judgment details, and the owed amount. It is recommended to seek legal advice or consult with an attorney experienced in debt collection and wage garnishment to ensure proper filing and compliance with the applicable laws. In conclusion, the El Cajon California Application for Earnings Withholding Order — Wage Garnishment is a legal tool used by creditors to collect outstanding debts from individuals residing or working in El Cajon, California. By obtaining an earnings withholding order, creditors can deduct a portion of the debtor's wages until the owed amount is repaid. It is essential for creditors to follow the appropriate legal procedures and seek professional guidance to ensure a successful garnishment process.