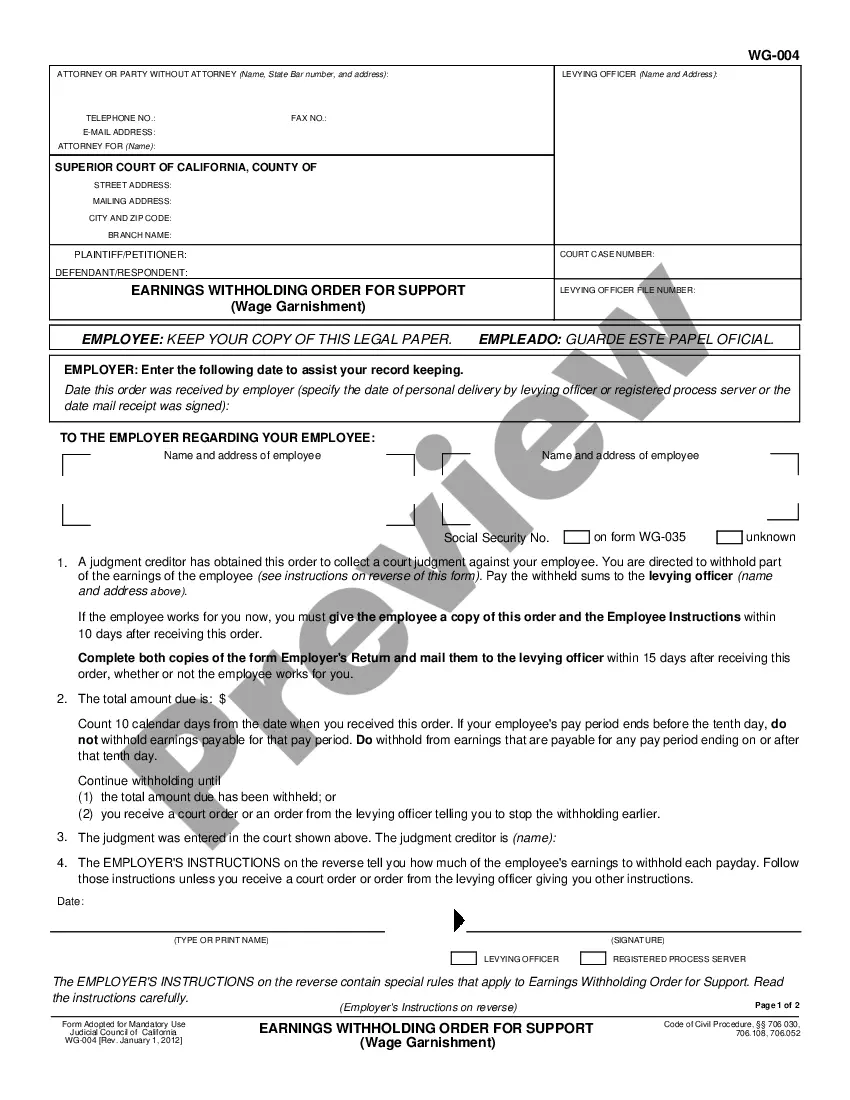

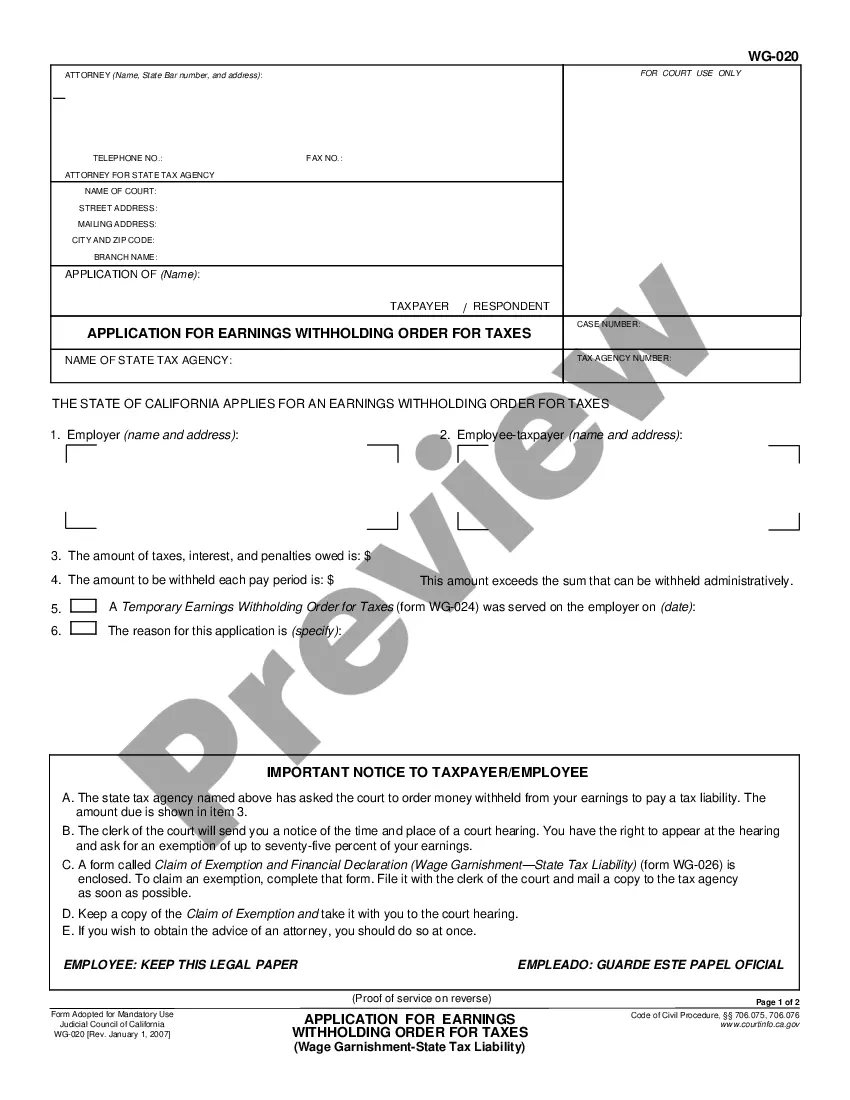

Application for Earnings Withholding Order: An Application for Earnings Withholding asks the Sheriff to garnish the wages of the Judgment Debtor. It states that he/she has not satisfied the judgment against him/her, and the Judgment Creditor wishes to recoup some of his/her losses.

Los Angeles California Application for Earnings Withholding Order - Wage Garnishment

Description

How to fill out California Application For Earnings Withholding Order - Wage Garnishment?

Utilize the US Legal Forms and gain instant access to any form template you desire.

Our user-friendly platform featuring thousands of templates streamlines the process of locating and obtaining nearly any document sample you need.

You can save, complete, and authorize the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment in just minutes instead of spending hours online searching for the appropriate template.

Using our collection is an outstanding method to enhance the security of your form submission. Our skilled legal experts routinely examine all documents to ensure that the forms are applicable to a specific state and adhere to the latest laws and regulations.

Access the page with the template you need. Ensure that it is the form you were looking for: confirm its title and description, and use the Preview option when available. Otherwise, use the Search bar to find the required document.

Initiate the saving process. Click Buy Now and select your preferred pricing plan. Then, register for an account and complete your purchase using a credit card or PayPal.

- How can you acquire the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment.

- If you have a subscription, simply Log In to your account. The Download feature will be activated on all documents you view. Furthermore, you can locate all the previously saved files in the My documents section.

- If you haven’t created an account yet, follow the steps outlined below.

Form popularity

FAQ

Wage garnishment rules in California include strict guidelines that protect consumers. Before garnishment can occur, a creditor must obtain a court judgment, and there are limits on how much can be taken from your wages. Additionally, you have the right to contest the garnishment and submit a claim of exemption if you qualify. Familiarizing yourself with these rules can help you take control of your financial situation, and resources like the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment can assist you in this process.

The maximum amount that can be garnished from your paycheck in California is 25% of your disposable earnings, unless you are supporting dependents, in which case the percentage may be lower. Your disposable earnings are calculated after mandatory deductions, like taxes and Social Security. Knowing your rights regarding garnishment limits will empower you when dealing with any wage garnishment scenario. The Los Angeles California Application for Earnings Withholding Order - Wage Garnishment provides clear information on these limits.

It is possible for someone to garnish your wages without your initial awareness. Creditors must obtain a court order to initiate the garnishment process, and they typically provide you with notice beforehand. However, if you miss this notification or do not respond, the garnishment can proceed without your consent. Staying informed about the implications of the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment is vital to protecting your rights.

In California, wage garnishment rules are strictly regulated. Generally, creditors can garnish up to 25% of your disposable earnings if you are not supporting dependents, or a lesser amount if you are. Additionally, you must receive proper notice of the garnishment before it takes effect. Understanding these regulations can help you navigate the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment effectively.

To file a claim of exemption wage garnishment in California, you need to complete the appropriate form, which is often a Claim of Exemption form. This document allows you to list your reasons for claiming the exemption and any relevant financial information. After filling out the form, you should submit it to the court that issued the earnings withholding order, along with any required documentation. Utilizing the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment can streamline this process.

A claim to exemption is a legal declaration that allows individuals to protect a portion of their earnings from being garnished. In California, this claim is typically filed by submitting the appropriate form to establish your financial circumstances. The process includes proving that your income meets specific guidelines for exemption. By using the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment, you can find resources to navigate this effectively.

To write a letter to stop wage garnishment, clearly state your request and include relevant details like your name, address, and case number. Provide a brief explanation of why you believe the garnishment should end, such as financial hardship or an exemption. Keep the communication respectful and concise, and send it to the appropriate creditor or court. The Los Angeles California Application for Earnings Withholding Order - Wage Garnishment provides guidance on addressing such matters effectively.

Filing a wage garnishment exemption in California involves submitting a Claim of Exemption form to the court. This form allows you to declare that certain financial circumstances shield your income from garnishment. Ensure to provide all necessary documentation to support your claim. Utilizing the Los Angeles California Application for Earnings Withholding Order - Wage Garnishment can help streamline this process.

To stop a wage garnishment immediately in California, you can file a motion with the court that issued the garnishment order. It's important to act quickly, as time is often limited. The Los Angeles California Application for Earnings Withholding Order - Wage Garnishment may also allow you to negotiate directly with your creditor to resolve the issue. Seeking legal assistance can provide you with the best options tailored to your situation.

To stop FTB wage garnishment in Los Angeles, California, you can start by submitting a request to cancel the Earnings Withholding Order. You may need to demonstrate changes in your financial situation or negotiate a payment plan that fits your budget. Additionally, using the US Legal Forms platform can streamline this process by providing you with ready-to-use legal forms designed for your needs. This way, you can ensure that your application for Earnings Withholding Order - Wage Garnishment is handled efficiently.