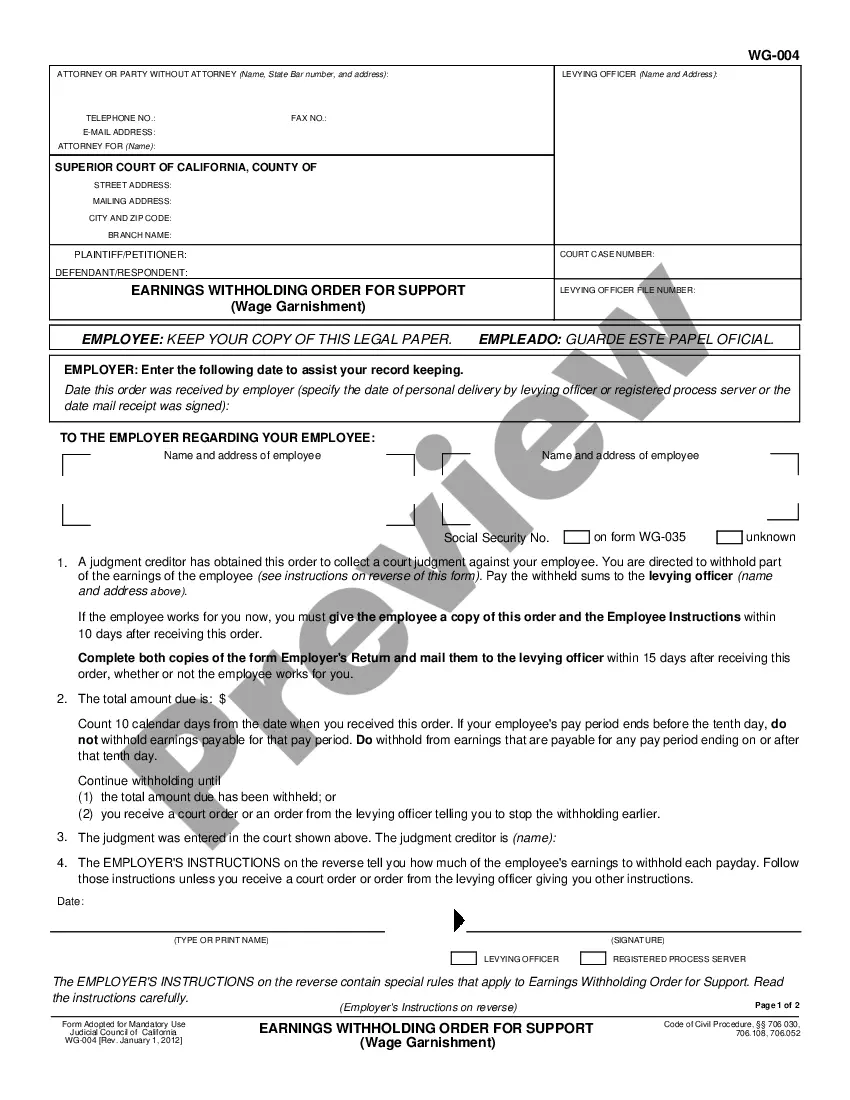

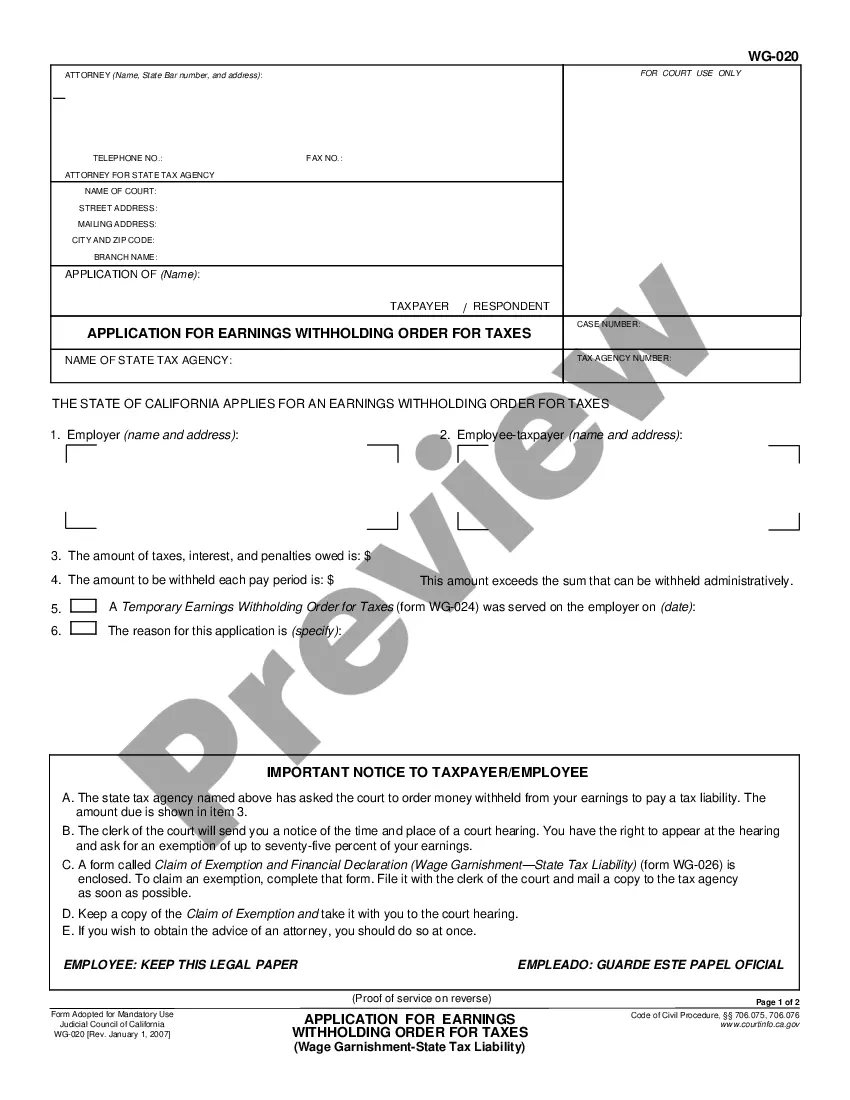

Application for Earnings Withholding Order: An Application for Earnings Withholding asks the Sheriff to garnish the wages of the Judgment Debtor. It states that he/she has not satisfied the judgment against him/her, and the Judgment Creditor wishes to recoup some of his/her losses.

Victorville California Application for Earnings Withholding Order - Wage Garnishment

Description

How to fill out California Application For Earnings Withholding Order - Wage Garnishment?

We consistently endeavor to alleviate or avert legal complications when handling intricate law-associated or financial issues.

To achieve this, we enroll in legal services that are typically quite costly.

However, not every legal concern is as intricate as it seems.

A majority of them can be managed by ourselves.

Utilize US Legal Forms whenever you need to locate and download the Victorville California Application for Earnings Withholding Order - Wage Garnishment or any other form quickly and securely. Just Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always re-download it from the My documents section. The procedure is equally simple if you are a newcomer to the website! You can set up your account within minutes. Ensure you verify whether the Victorville California Application for Earnings Withholding Order - Wage Garnishment complies with the laws and regulations of your state and locality. Additionally, it is crucial that you review the form’s outline (if available), and if you observe any inconsistencies with what you were initially seeking, look for an alternative template. Once you’ve confirmed that the Victorville California Application for Earnings Withholding Order - Wage Garnishment is suitable for your situation, you can select the subscription plan and move on to the payment. You can then download the document in any compatible format. For over 24 years of our existence in the market, we have assisted millions of individuals by providing ready-to-customize and current legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to take control of your situations without needing to hire a lawyer.

- We provide access to legal form templates that are not always readily available.

- Our templates are customized for specific states and regions, making the search process much easier.

Form popularity

FAQ

You can file an exemption for wage garnishment in California by completing the appropriate court form and submitting it along with any necessary evidence. There are specific grounds for exemption that you should review to see if they apply to your situation. Using uslegalforms can streamline your experience with the Victorville California Application for Earnings Withholding Order - Wage Garnishment.

To get out of a wage garnishment in California, you can file a claim of exemption or negotiate directly with the creditor. Documenting your financial situation and demonstrating hardship can be effective. Additionally, the uslegalforms platform provides resources to help you navigate the Victorville California Application for Earnings Withholding Order - Wage Garnishment.

An income withholding order is a legal directive requiring an employer to withhold a portion of an employee's earnings to satisfy a debt or obligation, such as child support or a judgment. This order is usually issued by a court and must be followed by the employer. If you are facing wage garnishment, understanding the Victorville California Application for Earnings Withholding Order - Wage Garnishment can clarify the process.

To file a claim of exemption for wage garnishment in California, you must complete a specific form and submit it to the court. This form allows you to outline why the garnishment should not apply in your case, such as financial hardship or other qualifying factors. Consider using the resources available on uslegalforms for guidance on filling out the Victorville California Application for Earnings Withholding Order - Wage Garnishment.

Yes, a creditor can garnish your wages through a legal process without your immediate knowledge. In many cases, you receive notice only after the order is issued. Understanding the Victorville California Application for Earnings Withholding Order - Wage Garnishment can help you understand your rights and responsibilities regarding wage garnishment.

A motion to dismiss garnishment is a legal request to terminate a garnishment order due to reasons such as improper procedures or changes in financial circumstances. This motion must be filed with the court and clearly state your reasons for dismissal. If accepted, it can provide immediate relief from garnishment. The Victorville California Application for Earnings Withholding Order - Wage Garnishment can assist you in preparing the necessary documentation for this motion.

Filling out a wage garnishment exemption requires you to complete the designated form accurately. You will need to detail your income, expenses, and any dependents relying on your income. Keep in mind the specific exemption laws in your state, as they can vary. The Victorville California Application for Earnings Withholding Order - Wage Garnishment can provide helpful templates and guidance for this process.

The best way to stop wage garnishment is to either negotiate a payment plan with your creditor or file a claim of exemption in court. If you can demonstrate financial hardship or if the debt is incorrect, the court may rule in your favor. It is crucial to act quickly, as garnishments can significantly affect your financial well-being. Explore options through the Victorville California Application for Earnings Withholding Order - Wage Garnishment for additional guidance.

To write a letter to stop a garnishment, start by addressing it to the garnishment's issuing court or creditor. Clearly state your request to stop the garnishment and provide compelling reasons, such as undue hardship or a claim of exemption. Be sure to include your contact information and any relevant case numbers for visibility. Reference the Victorville California Application for Earnings Withholding Order - Wage Garnishment to structure your letter effectively.

Writing a hardship letter for wage garnishment begins with clearly stating your financial situation and the specific reasons you cannot afford the garnishment. Detail your income, monthly expenses, and any unusual circumstances impacting your finances. Make sure to express your willingness to cooperate in finding a solution. The Victorville California Application for Earnings Withholding Order - Wage Garnishment can offer you essential templates for drafting this letter.