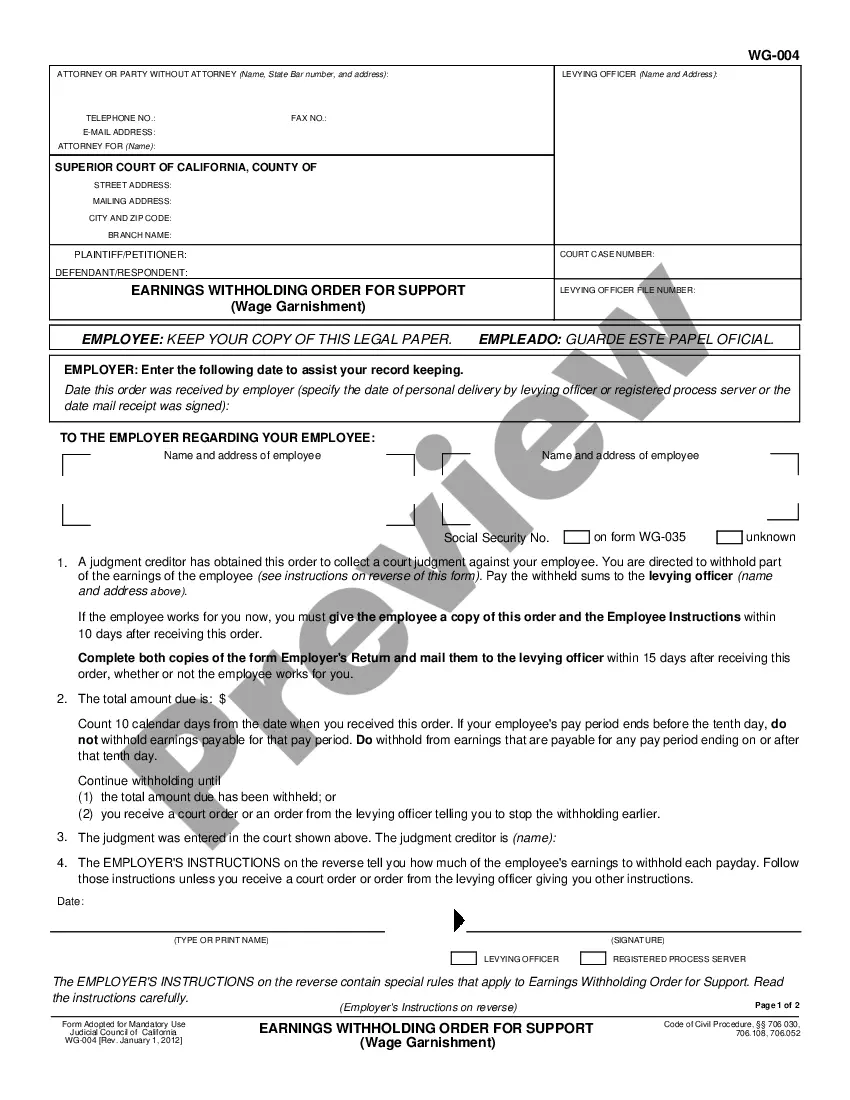

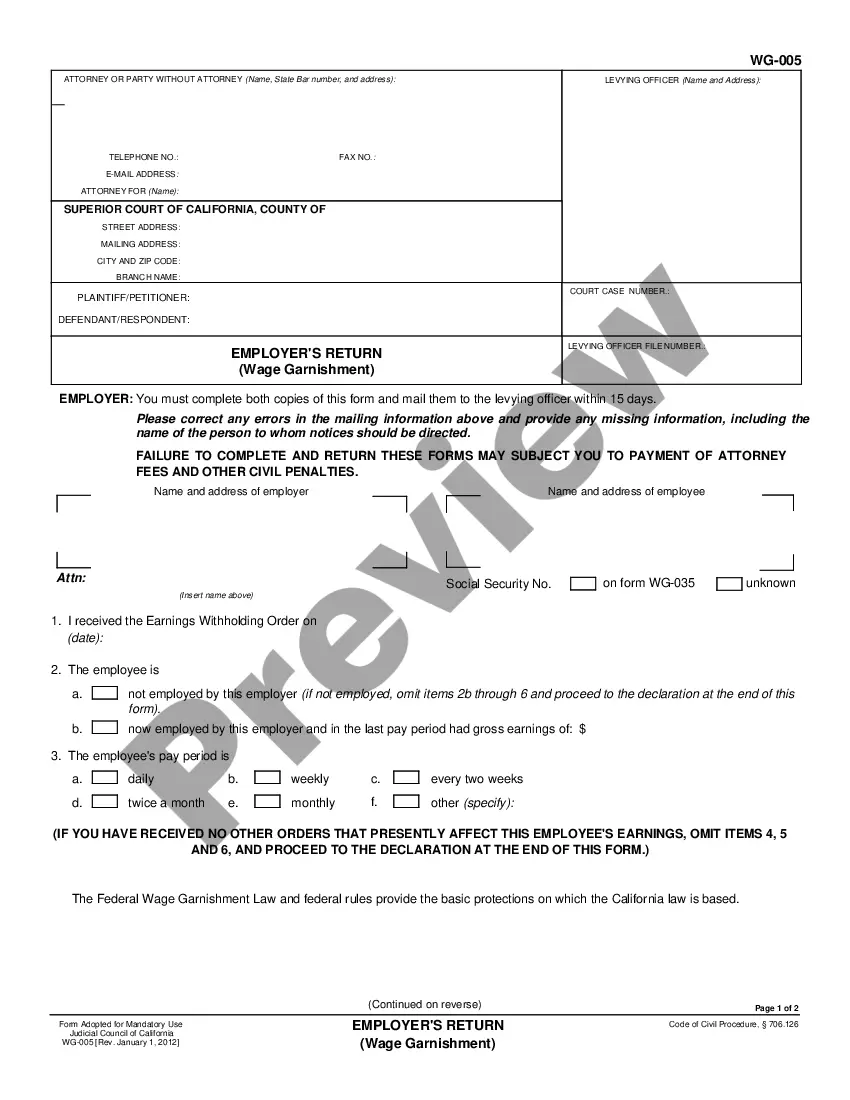

Earnings Withholding Order: An Earnings Withholding Order is issued by the Court, stating that the wages of the Judgment Debtor are to be garnished until he/she satifies the judgment against him/her.

Clovis California Earnings Withholding Order - Wage Garnishment

Description

How to fill out California Earnings Withholding Order - Wage Garnishment?

Locating validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All forms are appropriately categorized by their area of application and jurisdiction, making the search for the Clovis California Earnings Withholding Order - Wage Garnishment as easy as pie.

Maintaining organized paperwork that complies with legal standards is of utmost importance. Take advantage of the US Legal Forms library to consistently have vital document templates for any necessities right at your fingertips!

- For those already acquainted with our service and who have utilized it previously, acquiring the Clovis California Earnings Withholding Order - Wage Garnishment takes just a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- New users may need to follow a few more steps during this process.

- Adhere to the instructions below to commence with the most comprehensive online form catalogue.

- Review the Preview mode and form description. Ensure that you’ve chosen the correct document that fulfills your needs and aligns completely with your local legal requirements.

Form popularity

FAQ

You can find out who garnished your account by reviewing your bank statements for any unfamiliar transactions. A notice of garnishment, typically sent by the creditor or the court, will also indicate who initiated the Clovis California Earnings Withholding Order - Wage Garnishment. If you have not received any notifications, consider contacting your bank directly for more information.

To stop a wage garnishment quickly in California, you can file a motion with the court that issued the Clovis California Earnings Withholding Order - Wage Garnishment. You may need to show evidence of financial hardship or negotiate a new payment plan with the creditor. Additionally, utilizing uSlegalforms can provide the necessary legal documents and guidance needed to navigate this process effectively.

Yes, wage garnishments are generally considered public records. This means that anyone can access information regarding a Clovis California Earnings Withholding Order - Wage Garnishment through court records. However, the specifics of what is available can vary by jurisdiction, so it is advisable to check with your local courthouse for detailed information.

Identifying the source of a garnishment can often be done by examining your paystub, which may include a notation about the Clovis California Earnings Withholding Order - Wage Garnishment. Furthermore, you can reach out to your bank or financial institution for clarification on any deductions. If necessary, obtaining a credit report may also reveal any outstanding debts leading to garnishment.

To find the source of a wage garnishment, you should review any court documents or notices you've received. These documents typically provide detailed information regarding the Clovis California Earnings Withholding Order - Wage Garnishment. If you cannot locate these documents, consider contacting your employer’s payroll department or the issuing court for further assistance.

The right to claim exemptions allows individuals in Clovis to protect certain types of income from being garnished. This means you can retain essential resources to meet your basic needs. Understanding this right is critical during a Clovis California Earnings Withholding Order - Wage Garnishment. Resources on the uslegalforms platform can provide clarity on what constitutes an exemption and how to claim it.

To effectively write a letter to stop wage garnishment, start by addressing the creditor directly and stating your objective. Include details about your situation and any grounds for stopping the garnishment. It's beneficial to emphasize why you believe the garnishment is unjust, such as demonstrating undue hardship. Consult uslegalforms for templates that can guide you in writing a strong letter.

To fill out a challenge to garnishment form effectively, begin with accurate personal and case information. Clearly state your challenges, including any inaccuracies or financial hardships you face. Attach any necessary documentation that supports your claims. Utilizing resources from uslegalforms can simplify this process and increase your chances of a favorable outcome.

Certain incomes are exempt from garnishment in Clovis, including Social Security benefits, disability payments, and certain pension funds. The law protects income necessary for living expenses, so it’s crucial to identify what falls under this category. Understanding these exemptions can help you preserve your essential resources during a Clovis California Earnings Withholding Order - Wage Garnishment. Uslegalforms also offers guidance on what qualifies as exempt income.

Filling out a wage garnishment exemption in Clovis requires you to identify your exempt income and provide supporting documentation. Use the appropriate forms, and ensure you fill in all required fields accurately. It’s essential to explain why your income should be exempt from the Clovis California Earnings Withholding Order - Wage Garnishment. Uslegalforms can assist you with the necessary documents and instructions.