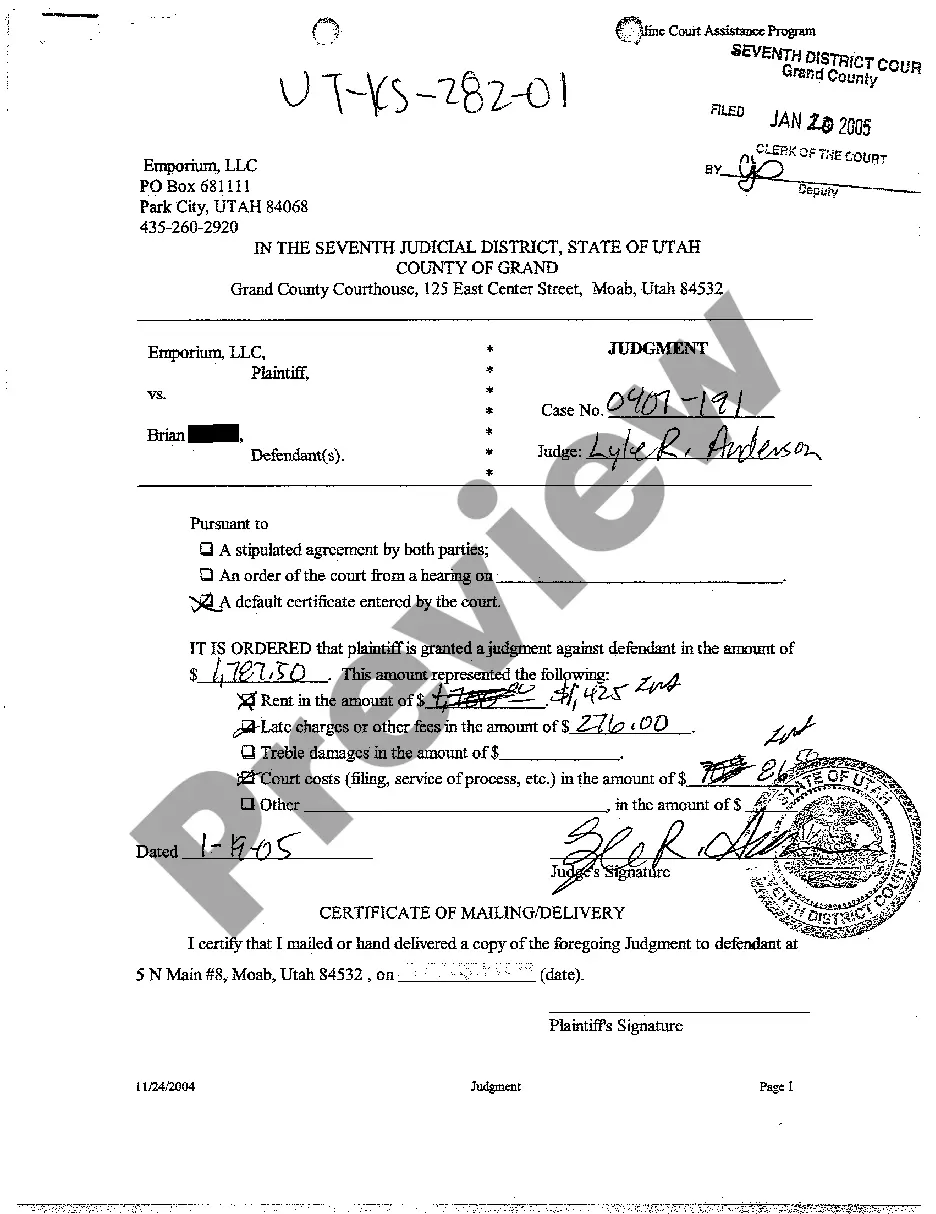

Earnings Withholding Order: An Earnings Withholding Order is issued by the Court, stating that the wages of the Judgment Debtor are to be garnished until he/she satifies the judgment against him/her.

Elk Grove, California Earnings Withholding Order — Wage Garnishment refers to a legal process through which a creditor can collect outstanding debts from a debtor's wages or salary. Also known as wage garnishment, this court-ordered method of debt collection allows a portion of the debtor's earnings to be withheld and directed towards repaying the owed amount. When it comes to Elk Grove, California, there are two main types of Earnings Withholding Orders — Wage Garnishment that commonly occur: 1. Basic Wage Garnishment: This type of wage garnishment allows a creditor to garnish a specific percentage of the debtor's earnings based on state legislation. In Elk Grove, California, the maximum amount that can be garnished from an employee's wages is typically 25% of their disposable earnings, or the amount exceeding 40 times the state minimum wage, whichever is less. This can apply to regular wages, as well as commissions, bonuses, and other forms of compensation. 2. Priority Wage Garnishment: Sometimes, certain debts are prioritized by law and take precedence over other debts. In Elk Grove, California, priority garnishments may occur for obligations such as child support, spousal support, and certain tax debts. These garnishments may result in a higher percentage of wages being withheld, up to 50% or more, depending on the specific circumstances. It is important to note that Elk Grove, California Earnings Withholding Order — Wage Garnishment is governed by specific state and federal laws, and the process must adhere to these regulations to maintain legality and protect the rights of both debtors and creditors. A court order is typically required to initiate wage garnishment, and the debtor must be given proper notice before any deductions can be made from their earnings. Wage garnishment can have a significant impact on an individual's financial situation, reducing their disposable income and potentially causing financial strain. However, it is a legally recognized method for creditors to recover debts when all other attempts at payment have been exhausted. It is advisable for debtors facing wage garnishment to consult with a legal professional or seek financial advice to understand their rights and explore potential alternatives or solutions.