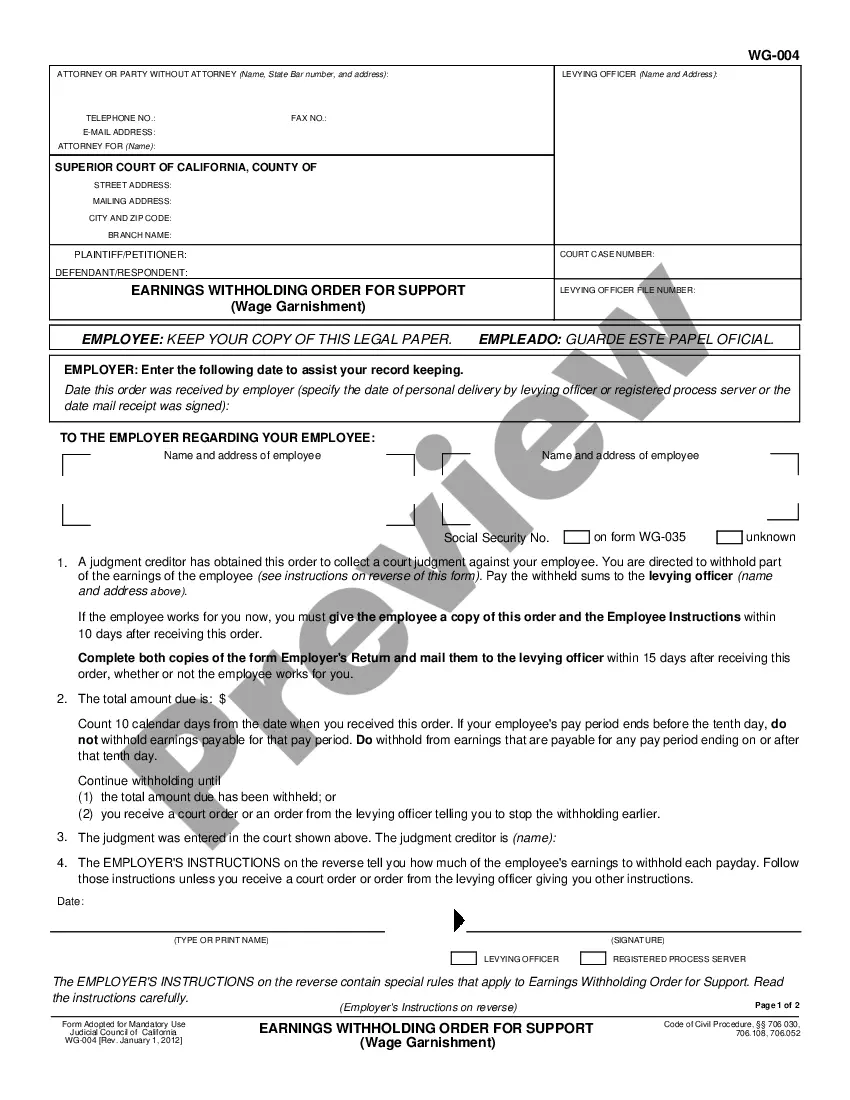

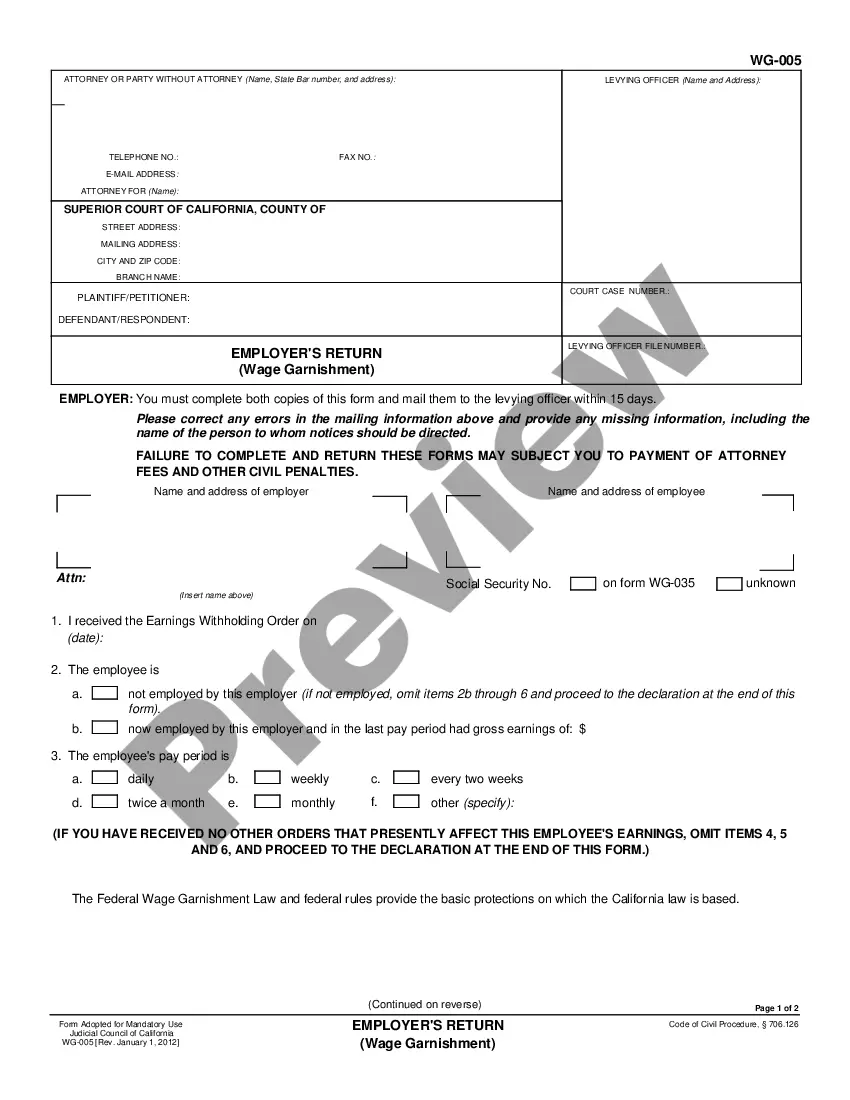

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Clara California Employee Instructions - Wage Garnishment

Description

How to fill out California Employee Instructions - Wage Garnishment?

If you are seeking a legitimate form template, it’s incredibly challenging to select a more user-friendly platform than the US Legal Forms website – one of the most comprehensive online repositories.

With this repository, you can discover a vast array of document samples for corporate and personal needs by categories and regions, or keywords.

With our top-notch search functionality, obtaining the latest Santa Clara California Employee Instructions - Wage Garnishment is as simple as 1-2-3.

Acquire the form. Choose the file format and save it to your device.

Make modifications. Complete, edit, print, and sign the acquired Santa Clara California Employee Instructions - Wage Garnishment. Every form you store in your user profile remains indefinitely and is yours permanently. You can easily retrieve them via the My documents menu, so if you wish to obtain an additional version for enhancement or to create a hard copy, feel free to return and export it again at any time. Utilize the US Legal Forms professional catalog to gain access to the Santa Clara California Employee Instructions - Wage Garnishment you were searching for and a multitude of other specialized and state-specific templates on one platform!

- If you are already familiar with our platform and possess an account, all you need to do to acquire the Santa Clara California Employee Instructions - Wage Garnishment is to Log In to your user profile and click the Download option.

- If you are utilizing US Legal Forms for the first time, just adhere to the guidelines below.

- Ensure you have selected the form you require. Review its description and utilize the Preview feature to examine its content. If it does not meet your requirements, use the Search option near the top of the screen to find the suitable document.

- Validate your choice. Click on the Buy now option. After that, select the desired pricing plan and provide the necessary information to create an account.

- Complete the financial transaction. Utilize your credit card or PayPal account to finish the registration process.

Form popularity

FAQ

In California, employers generally cannot refuse to comply with a lawful wage garnishment order. Once the court orders garnishment, your employer is legally obligated to withhold the specified amount from your paycheck. However, misunderstandings can arise. Accessing platforms like US Legal Forms can provide you with essential guidance on your garnishment rights and help clarify any misunderstandings with your employer.

Employers may feel compelled to terminate employees who face wage garnishments, especially if it disrupts business operations or morale. However, in California, firing someone solely due to garnishment may not be lawful. Understanding the Santa Clara California Employee Instructions - Wage Garnishment can empower you to address such concerns with your employer effectively.

Yes, your wages can be garnished without prior notice. In many cases, a court order is required, but creditors often act swiftly once they obtain this order. Consequently, it becomes crucial for you to stay informed and prepared for any potential legal actions. Utilizing US Legal Forms can simplify the process of understanding garnishment notices and your options.

Wage garnishment in California follows specific regulations designed to protect employees. Generally, creditors can garnish a portion of your wages, but there are limits set by the law. For instance, only up to 25% of your disposable earnings may be garnished. Familiarizing yourself with the Santa Clara California Employee Instructions - Wage Garnishment can help you understand your rights and obligations.

Quitting your job to escape wage garnishment may not be the best solution. In Santa Clara, California, creditors can still pursue the debt even after you leave. Additionally, a new employer could receive similar garnishment orders. It's vital to understand your legal rights and explore options through resources like US Legal Forms for guidance.

To write an objection letter for wage garnishment, clearly state your reasons for objecting, providing specific details about the garnishment amount or justification. Attach any relevant documentation that supports your case and ensure your letter is well-organized. Familiarizing yourself with Santa Clara California employee instructions on wage garnishment will help you craft a compelling objection.

A challenge to garnishment is a formal request to contest the legality or amount of a wage garnishment against you. This process allows individuals to argue that the garnishment is incorrect or unjustified. Understanding your rights under Santa Clara California employee instructions on wage garnishment can empower you to effectively pursue a challenge.

When handling an employee whose wages are garnished, it is crucial to remain supportive and informed. Explain the process to your employee, provide them with copies of the garnishment documents, and ensure that the correct amount is withheld from their paycheck as per Santa Clara California employee instructions on wage garnishment. Maintaining open communication will help alleviate any concerns they may have.

To fill out a challenge to garnishment form, collect relevant details about the garnishment and the basis for your challenge. Follow the instructions provided in the form carefully, and be sure to include all required information, such as your contact details and a statement explaining your reasons. Remember to refer to Santa Clara California employee instructions on wage garnishment for accurate completion.

To negotiate a garnishment, begin by contacting the creditor or their representative. Discuss your financial situation openly and propose a manageable repayment plan. You can also explore options for reducing the garnishment amount, referencing Santa Clara California employee instructions on wage garnishment to ensure you are within your rights during negotiations.