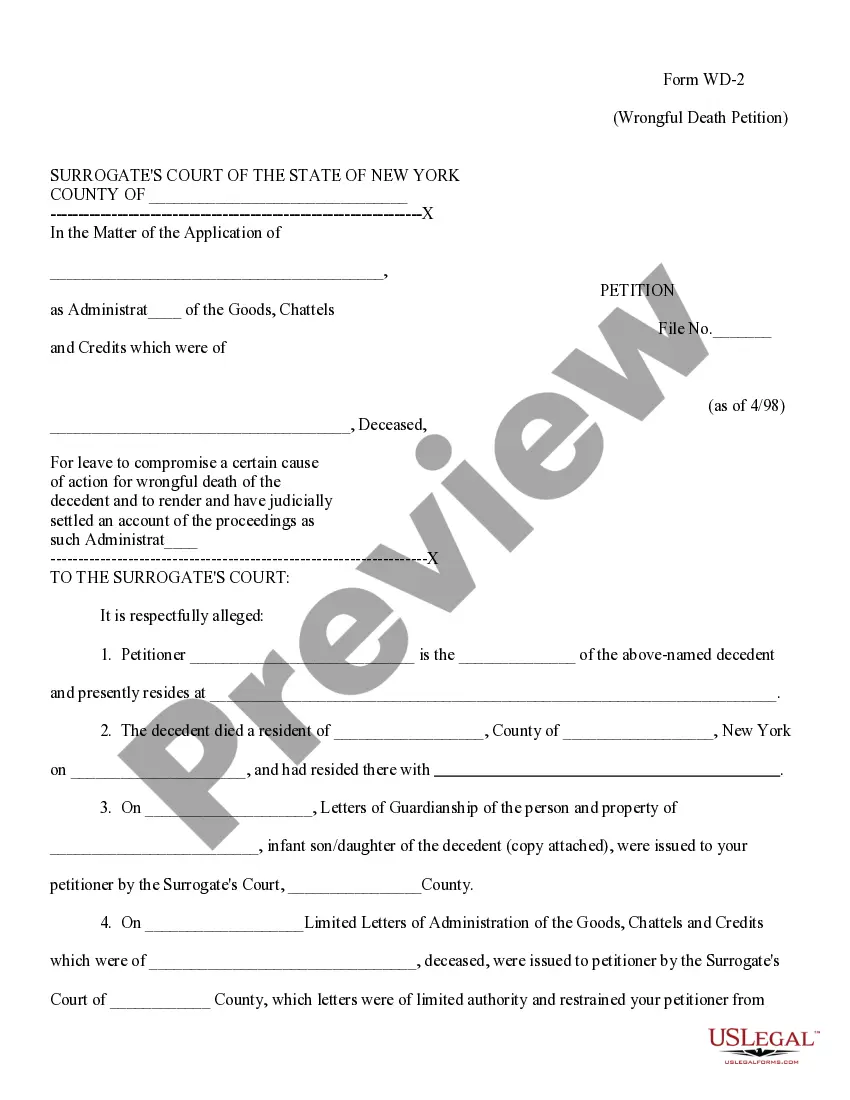

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Maria California Employee Instructions — Wage Garnishment: A Comprehensive Guide Introduction: If you are an employee in Santa Maria, California, and have encountered wage garnishment, it is crucial to understand the detailed instructions and procedures involved. This guide aims to provide comprehensive information on Santa Maria California Employee Instructions — Wage Garnishment, ensuring you grasp the key aspects of this process. Read on to learn about the various types of wage garnishment in Santa Maria and the essential steps you need to follow. Types of Wage Garnishment in Santa Maria, California: 1. Child Support Garnishment: In cases where you owe child support payments, your wages may be garnished by court order. The employer plays an essential role in implementing and processing this type of wage garnishment according to the specific instructions provided. 2. Tax Debt Garnishment: If you owe back taxes or have failed to satisfy your tax obligations, the federal or state government may impose wage garnishment. Employers are obligated to comply with the instructions received from the appropriate tax authorities and withhold a specific portion of your earnings. 3. Student Loan Garnishment: If you have defaulted on your student loan payments, your wages can be subject to garnishment. Student loan services or collection agencies can request employers to withhold a portion of your wages to satisfy the outstanding debt. Important Employee Instructions for Wage Garnishment in Santa Maria, California: 1. Notification: The first step involves receiving a legal notice regarding the wage garnishment. Employers are required to notify employees about the garnishment, including details such as the creditor's name, the amount to be garnished, and any applicable deadlines. 2. Complying with Withholding Orders: It is the employer's responsibility to comply with the withholding orders promptly. This entails deducting the specified amount from the employee's wages and remitting it to the appropriate creditor or agency. Failure to comply can result in legal consequences for the employer. 3. Maximum Garnishment Limits: It is essential for both employees and employers to be aware of the maximum amount that can be withheld from an employee's wages. Federal and state laws dictate these limits to protect employees and ensure they receive a reasonable portion of their earnings. 4. Timing of Garnishment Payments: Employers must accurately calculate and disburse the garnished amounts on time. Ensuring proper bookkeeping and separating these funds from general payroll is crucial. Timely and accurate record-keeping plays an important role throughout the wage garnishment process. 5. Employee Rights and Protection: Employees retain certain rights despite wage garnishment. Employers must provide employees with necessary information about their rights, which may include the ability to challenge the garnishment in court, seek exemptions for certain earnings, or request adjustments based on financial hardship. 6. Confidentiality and Privacy: Employers and payroll departments must adhere to strict confidentiality protocols when handling wage garnishment cases. Protecting employee privacy and ensuring sensitive financial information is secure is of utmost importance. Conclusion: Understanding Santa Maria California Employee Instructions — Wage Garnishment is crucial for employers and employees alike. By recognizing the various types of wage garnishment and following the instructions diligently, employees can navigate this process efficiently and protect their rights. Employers must also stay well-informed to ensure compliance and maintain a harmonious employer-employee relationship. Remember, seeking legal advice is advisable in complex situations to ensure complete adherence to the law.