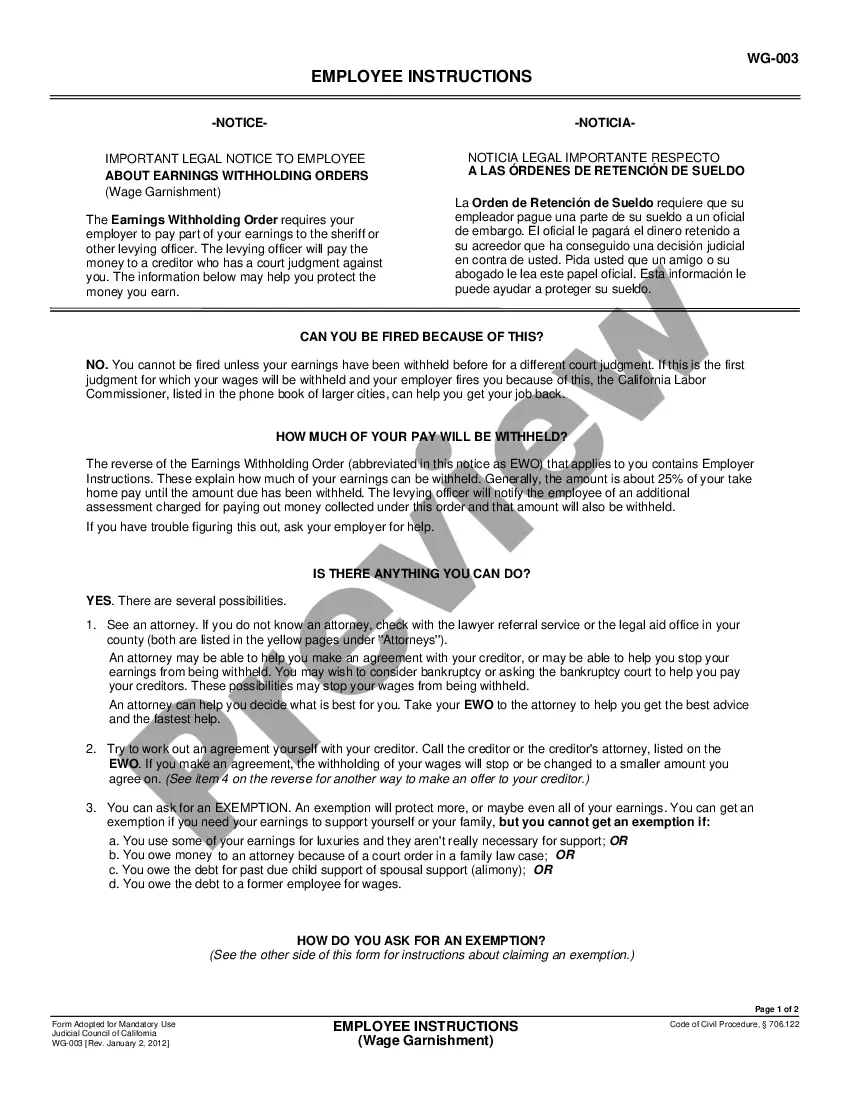

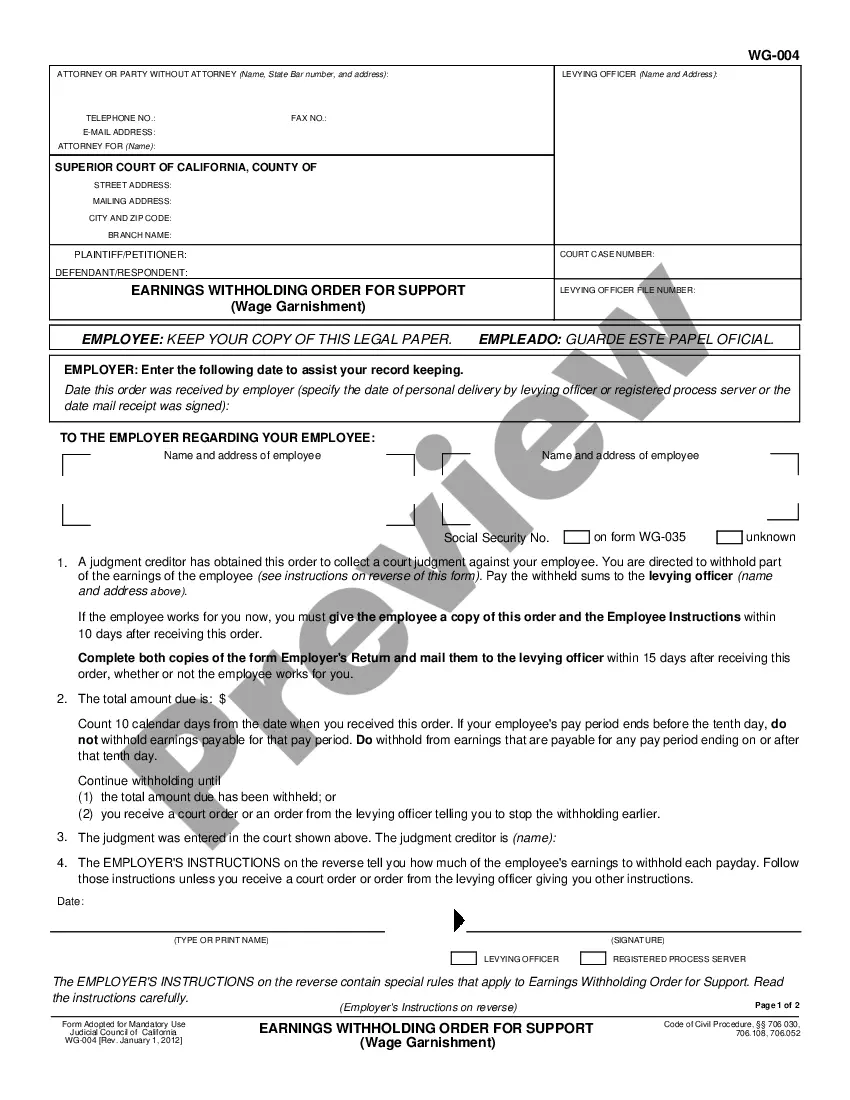

Employer's Return: An Employer's Return involves the wage garnishment of an Employee. This form is to be filled out and signed by the Employer, or risk fines from the court for non-compliance. It lists the Employee's name, address and wages, among other things.

Inglewood California Employer's Return - Wage Garnishment

Description

How to fill out California Employer's Return - Wage Garnishment?

Do you require a trustworthy and cost-effective legal documents provider to purchase the Inglewood California Employer's Return - Wage Garnishment? US Legal Forms is your primary option.

Regardless of whether you need a simple agreement to establish rules for living with your partner or a bundle of documents to facilitate your divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for individual and business use.

All templates that we provide access to aren’t generic and tailored according to the regulations of individual states and counties.

To obtain the form, you need to Log In to your account, find the necessary form, and click the Download button next to it. Please remember that you can download your previously acquired document templates any time from the My documents tab.

Now you can register your account. Select a subscription plan and complete the payment process. Once payment is finalized, download the Inglewood California Employer's Return - Wage Garnishment in any available format. You can revisit the website anytime and redownload the form at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending your precious time researching legal documents online once and for all.

- Are you unfamiliar with our platform? No problem.

- You can swiftly create an account, but before that, ensure to do the following.

- Verify if the Inglewood California Employer's Return - Wage Garnishment complies with your state and local regulations.

- Review the form’s specifics (if available) to understand its suitability.

- Reassess your search if the form does not fit your legal needs.

Form popularity

FAQ

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

An employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% × $580) may be garnished.

You can negotiate a wage garnishment, and your creditor may be open to that especially if you have less money coming in. Ideally, you should get in touch with them once you are served and try to negotiate a wage garnishment from there. They'll still garnish your wages, but at a lower negotiated rate.

Unfortunately a garnishee order can only be stopped by bringing an application to court to have the order stopped, or, if the judgment creditor informs the employer or garnishee that he no longer needs to deduct money from your salary.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

Stop Wage Garnishment in California Call the Creditor ? There is nothing lost in trying to talk to the creditor and work out a different arrangement to repay the debt back.File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.