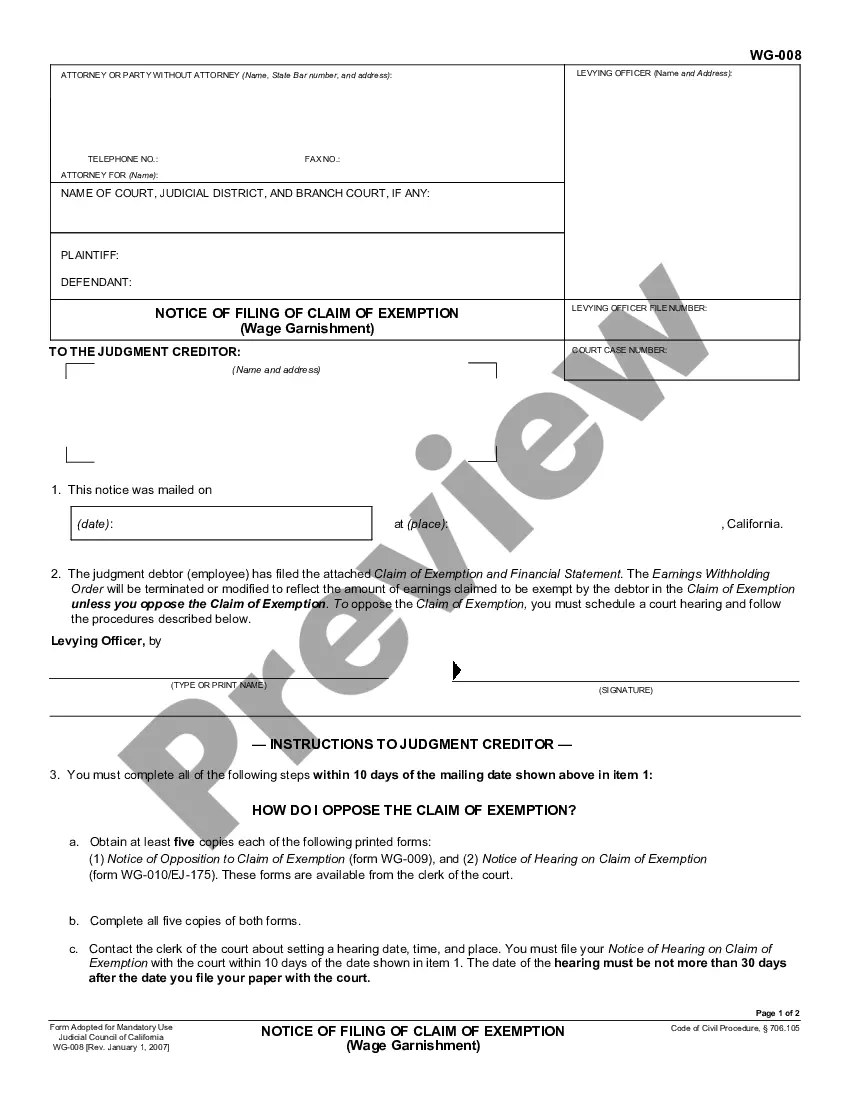

Claim of Exemption: A Claim of Exemption is completed and signed by the Employee. It states the wages he/she receives, as well as the cost for his/her needed expenditures.

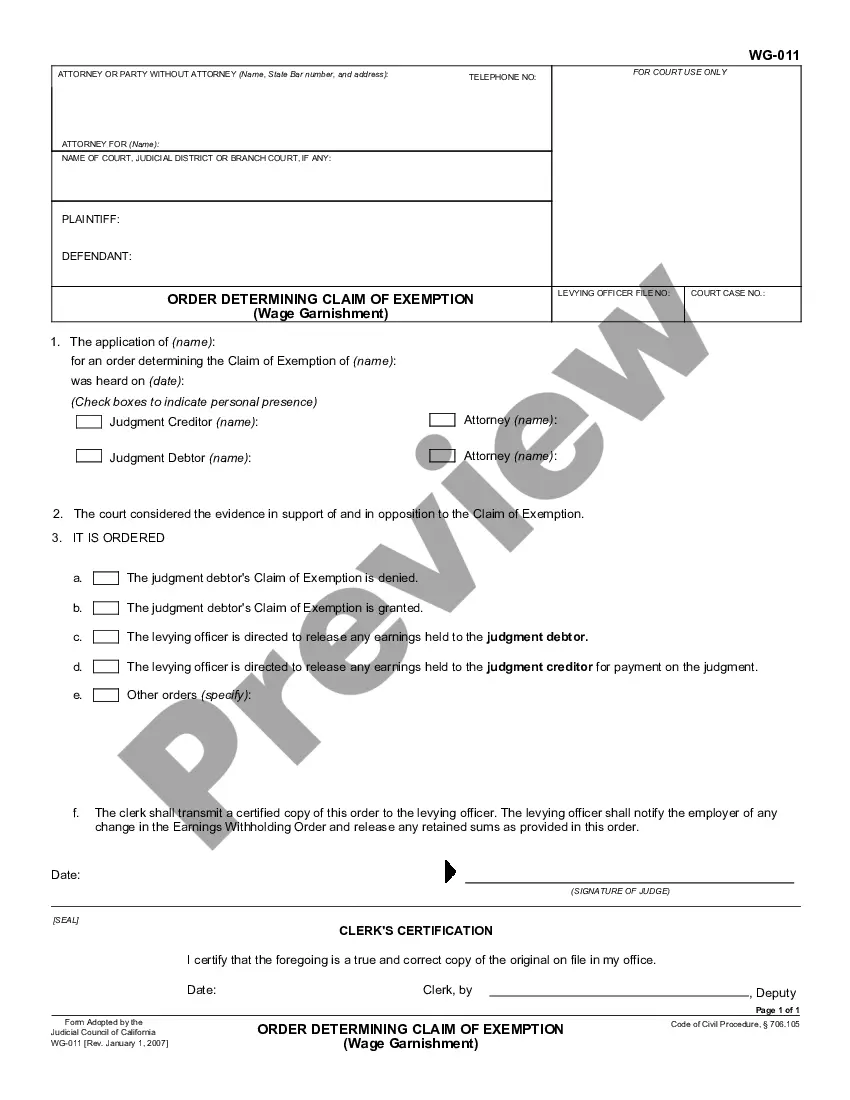

Pomona California Claim of Exemption is an important legal process that allows individuals to protect their assets from being seized by creditors or collection agencies. Primarily used in debt collection cases, a Claim of Exemption asserts that certain properties or income sources are exempt from collection attempts due to their protected status under California law. In Pomona, California, there are several types of Claim of Exemption that individuals can utilize, depending on their specific circumstances. These include: 1. Personal Property Exemption: One of the most common types of Claim of Exemption, this establishes that certain personal properties, such as household items, clothing, appliances, tools of trade, and vehicles up to a specific value, are exempt from being taken and sold to satisfy a debt. 2. Wage Exemption: This Claim of Exemption category safeguards a portion of an individual's wages from being garnished to repay debts. Under California law, only a certain percentage of a person's earnings can be taken, ensuring that they can still maintain their basic living expenses. 3. Retirement Account Exemption: This claim allows individuals to protect their retirement savings from being used to pay off creditors. California's law provides exemptions for various types of retirement accounts, including pensions, individual retirement accounts (IRAs), and 401(k)s, safeguarding these funds, so individuals can maintain their financial security in retirement. 4. Homestead Exemption: This claim aims to protect a primary residence from being sold to cover outstanding debts. Homeowners in Pomona, California, can assert a homestead exemption to shield a portion of the equity in their property, allowing them to retain their home and prevent it from being seized. 5. Public Benefits Exemption: This category of Claim of Exemption protects certain public benefits, such as unemployment compensation, workers' compensation, and disability benefits, from being used to satisfy debts owed to creditors. It is essential to note that each type of Claim of Exemption in Pomona, California, has specific requirements and limitations. It is recommended to consult with a qualified attorney who specializes in debt collection laws to ensure accurate filing and assert the appropriate exemptions for an individual's unique circumstances.