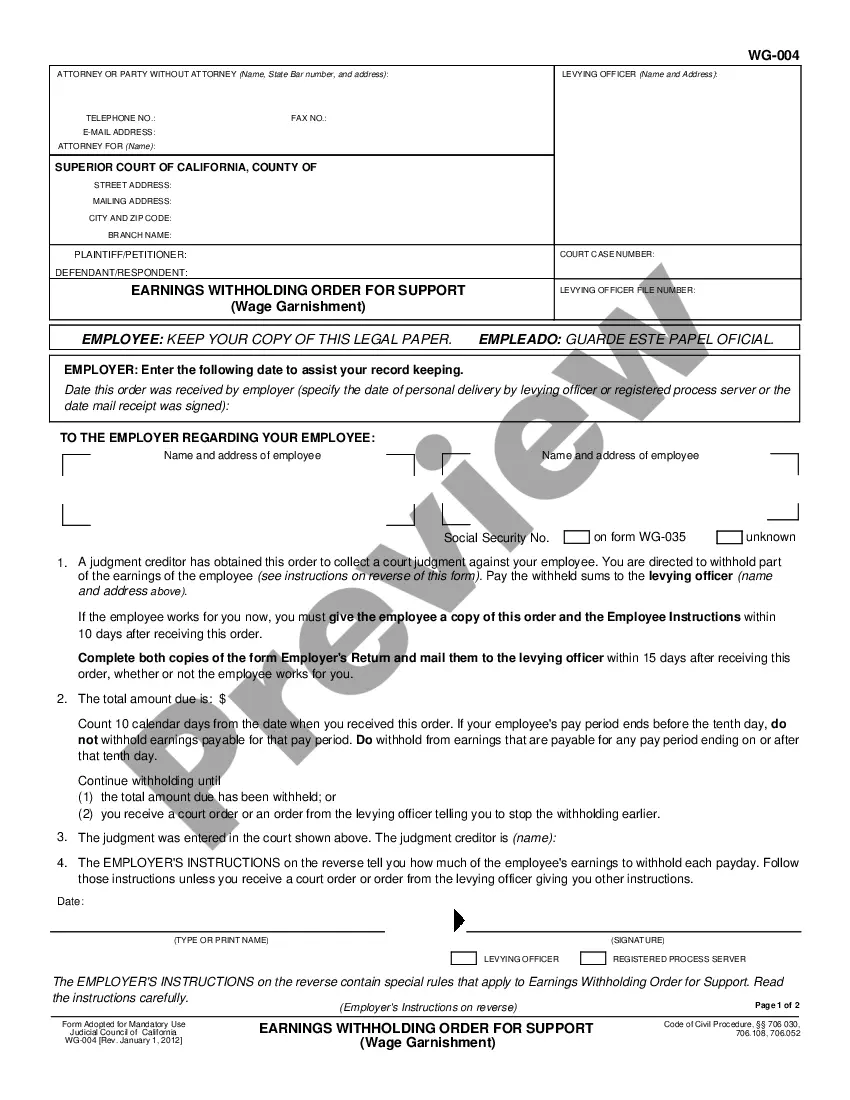

Application for Earnings Withholding Order for Taxes: An Application for Earnings Withholding asks the Sheriff to garnish the wages of the Judgment Debtor, in this case for taxes never paid. It states that he/she has not satisfied the judgment against him/her, and the Judgment Creditor wishes to recoup some of their losses.

The Oxnard California Application for Earnings Withholding Order for Taxes is a legal document used in Oxnard, California, to enforce the collection of unpaid taxes owed to the government. It conveniently allows the government to deduct money directly from a taxpayer's wages or other forms of income to satisfy their tax debt. The primary purpose of this application is to streamline the process of collecting taxes owed by individuals who have failed to meet their tax obligations. It provides a legal mechanism for the government to recover unpaid taxes by requesting an earnings withholding order from the taxpayer's employer or other income sources. There are three essential types of Oxnard California Application for Earnings Withholding Order for Taxes, each addressing distinct scenarios: 1. Individual Earnings Withholding Order: This type of application is used when an individual taxpayer has unpaid taxes. The application is filed by the government to request an earnings withholding order directly from the taxpayer's employer or income source, ensuring that a portion of their wages or income goes towards fulfilling their tax liabilities. 2. Business Earnings Withholding Order: In cases where a business entity has unpaid taxes, the government can file a specific application for a business earnings withholding order. This application enables the government to require the withholding of funds from the business' revenue, ensuring that the business' tax debt is satisfied from its income before other expenses are paid. 3. Joint Earnings Withholding Order: When spouses or domestic partners file taxes together and have unpaid taxes, the government can file a joint earnings withholding order application. This application allows the government to request the withholding of funds from both spouses' or domestic partners' wages or income to satisfy their combined tax debt. It's crucial for individuals and businesses to promptly address their tax obligations to avoid the need for an Oxnard California Application for Earnings Withholding Order for Taxes. By fulfilling tax responsibilities promptly, taxpayers can avoid potential legal actions and complications associated with the application process.The Oxnard California Application for Earnings Withholding Order for Taxes is a legal document used in Oxnard, California, to enforce the collection of unpaid taxes owed to the government. It conveniently allows the government to deduct money directly from a taxpayer's wages or other forms of income to satisfy their tax debt. The primary purpose of this application is to streamline the process of collecting taxes owed by individuals who have failed to meet their tax obligations. It provides a legal mechanism for the government to recover unpaid taxes by requesting an earnings withholding order from the taxpayer's employer or other income sources. There are three essential types of Oxnard California Application for Earnings Withholding Order for Taxes, each addressing distinct scenarios: 1. Individual Earnings Withholding Order: This type of application is used when an individual taxpayer has unpaid taxes. The application is filed by the government to request an earnings withholding order directly from the taxpayer's employer or income source, ensuring that a portion of their wages or income goes towards fulfilling their tax liabilities. 2. Business Earnings Withholding Order: In cases where a business entity has unpaid taxes, the government can file a specific application for a business earnings withholding order. This application enables the government to require the withholding of funds from the business' revenue, ensuring that the business' tax debt is satisfied from its income before other expenses are paid. 3. Joint Earnings Withholding Order: When spouses or domestic partners file taxes together and have unpaid taxes, the government can file a joint earnings withholding order application. This application allows the government to request the withholding of funds from both spouses' or domestic partners' wages or income to satisfy their combined tax debt. It's crucial for individuals and businesses to promptly address their tax obligations to avoid the need for an Oxnard California Application for Earnings Withholding Order for Taxes. By fulfilling tax responsibilities promptly, taxpayers can avoid potential legal actions and complications associated with the application process.