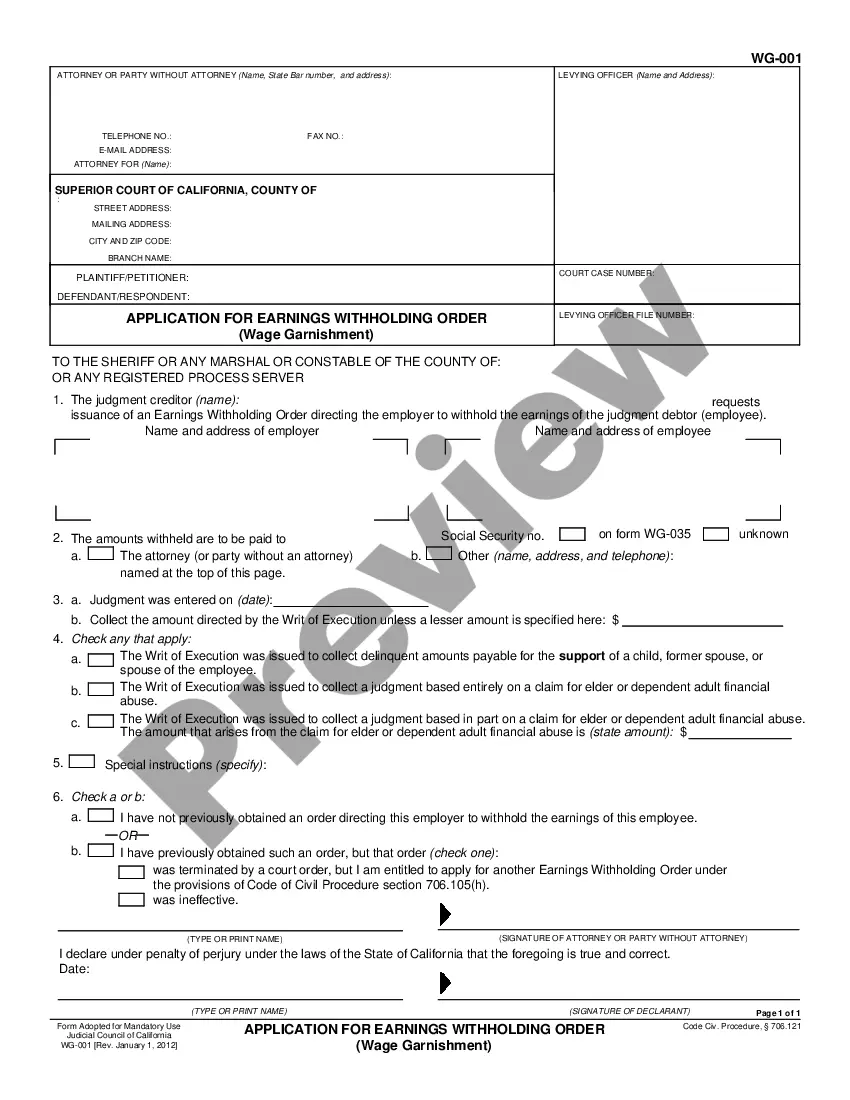

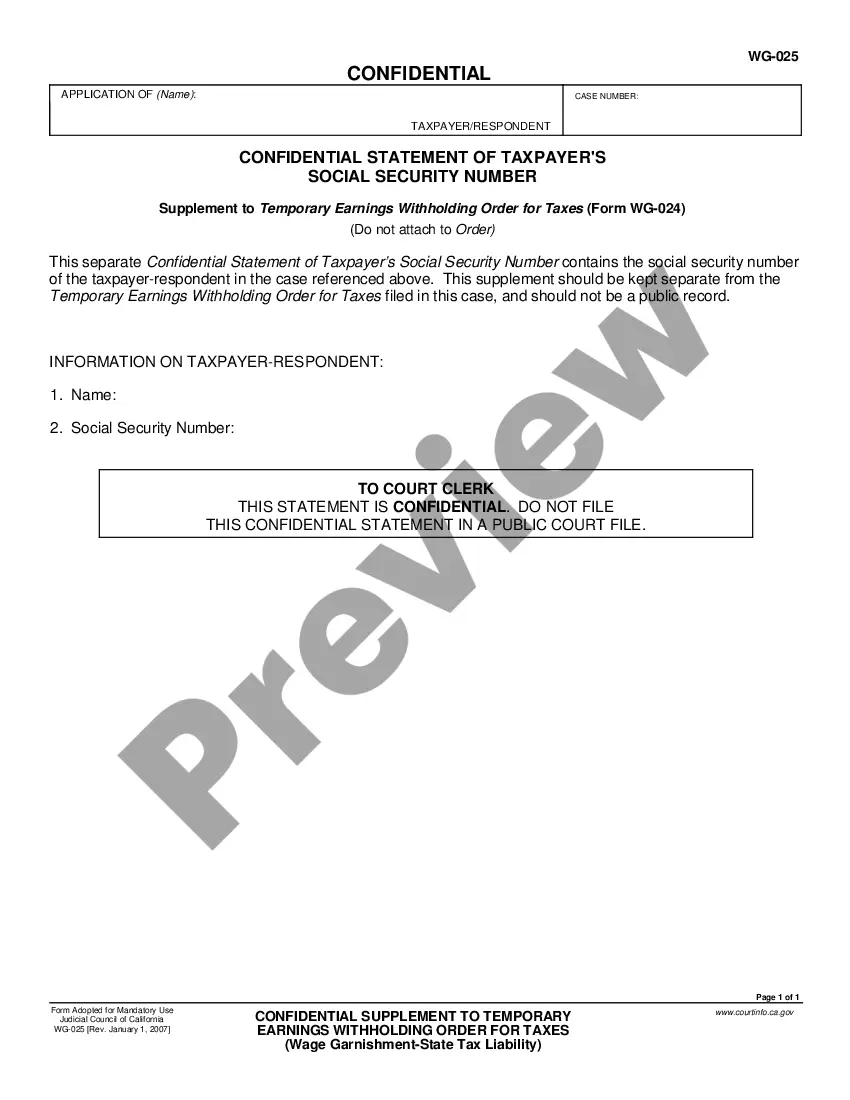

This is a California Judicial Council form that is used in Wage Garnishment - State Tax Liability proceedings. This form is a confidential supplement to the Application for Earnings Withholding Order for Taxes. It contains the social security number of the taxpayer and should be kept separate from the Application for Earnings Withholding Order for Taxes filed in the case.

Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes

Description

How to fill out California Confidential Supplement To Application For Earnings Withholding Order For Taxes?

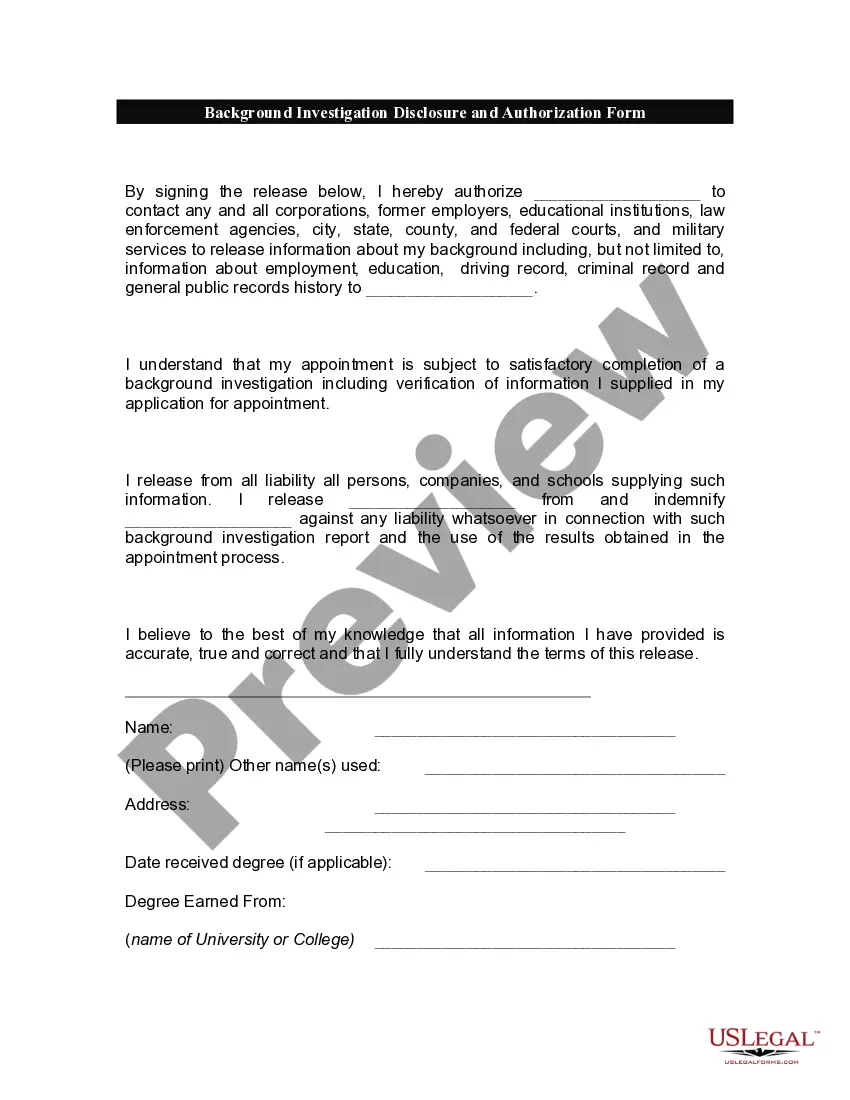

If you are in search of a legitimate document, it’s hard to find a more suitable place than the US Legal Forms site – one of the largest collections on the internet. Here you can obtain a vast array of form examples for business and personal use categorized by type and state, or keywords.

With our sophisticated search feature, locating the most recent Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes is as simple as 1-2-3. Moreover, the accuracy of each document is verified by a team of experienced attorneys who continually assess the templates on our site and refresh them in accordance with the latest state and county regulations.

If you are already familiar with our platform and possess a registered account, all you need to obtain the Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes is to Log In to your account and click the Download button.

Every document you add to your account has no expiration date and belongs to you indefinitely. You always retain access to them through the My documents tab, so if you require an additional copy for editing or producing a hard copy, you can return and download it again at any time.

Utilize the US Legal Forms expert library to find the Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes you were looking for and a multitude of other professional and state-specific templates all in one location!

- Ensure you have located the document you need. Review its description and utilize the Preview feature (if available) to check its contents. If it does not fulfill your needs, use the Search bar at the top of the page to find the required file.

- Verify your selection. Click the Buy now button. Following that, choose your desired subscription plan and enter your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Receive the document. Select the format and download it to your device.

- Make alterations. Fill out, modify, print, and sign the obtained Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes.

Form popularity

FAQ

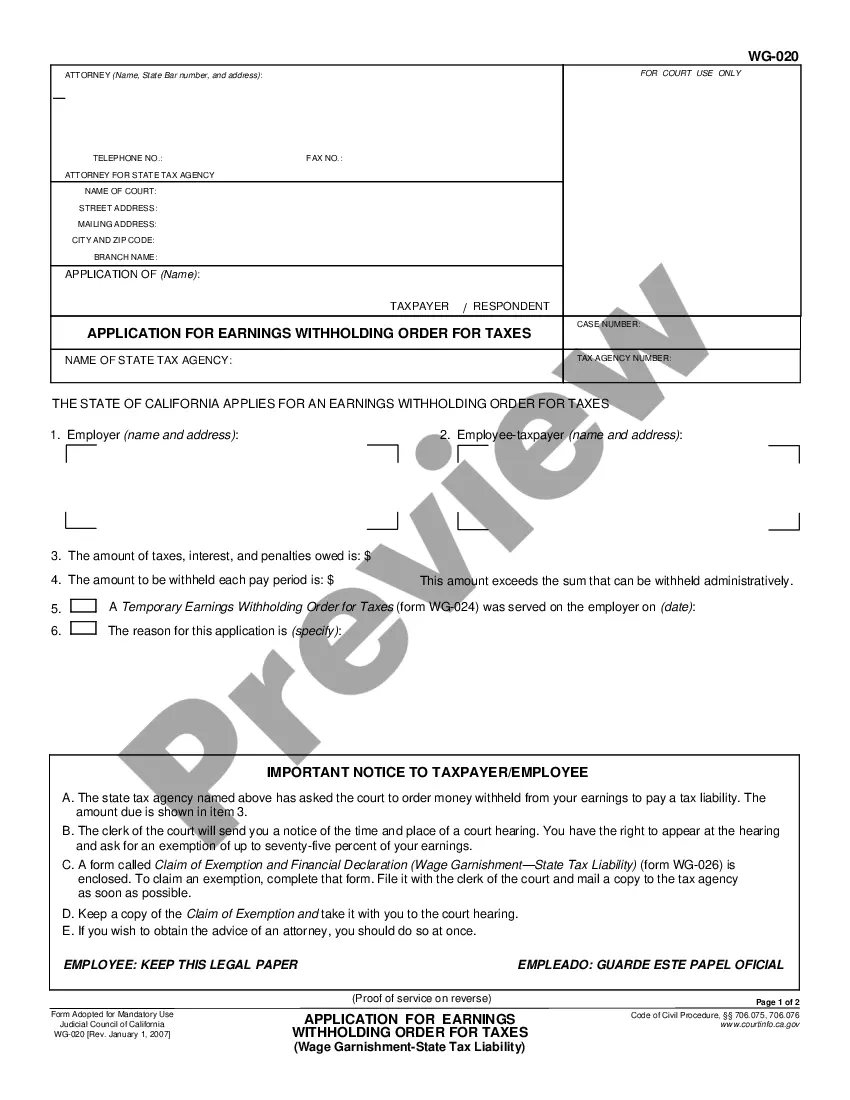

An earnings withholding order for taxes is a legal mechanism that allows the government to collect unpaid taxes directly from an individual’s wages. This order directs the employer to withhold a portion of the employee's earnings and send it directly to the tax authority. Understanding how this process works is essential, especially when considering the Bakersfield, California Confidential Supplement to Application for Earnings Withholding Order for Taxes. Our platform offers guidance on how to respond effectively to such orders.

To calculate disposable earnings for garnishment in California, begin by determining your gross income. Next, subtract mandatory withholdings including taxes and retirement contributions. The remaining amount is your disposable earnings, which can be subject to an earnings withholding order for taxes. If you are in Bakersfield, California, you can utilize our resources to assist you with this calculation through the Confidential Supplement to Application for Earnings Withholding Order for Taxes.

A withdrawal of a withholding order occurs when a court or agency cancels an existing earnings withholding order. This action allows the employer to stop deducting payments from an employee’s earnings. In Bakersfield, California, understanding the process for filing a withdrawal can be crucial, especially if you have submitted a Confidential Supplement to Application for Earnings Withholding Order for Taxes. You can find resources on our platform to help navigate this procedure.

A withdrawal of a withholding order in California means that the legal directive to withhold payments from your earnings has been officially canceled. This process may occur if you fulfill your obligation or reach an agreement on your debts. In Bakersfield, utilizing resources like the Confidential Supplement to Application for Earnings Withholding Order for Taxes can guide you in effectively managing this withdrawal.

The timeline for an income withholding order can vary based on several factors, including the type of order and the responsiveness of your employer. Typically, it starts taking effect shortly after the legal documents are submitted. If you're navigating this process in Bakersfield, California, using the Confidential Supplement to Application for Earnings Withholding Order for Taxes can help streamline your case.

An earnings order is a type of court-ordered directive that requires an employer to withhold a portion of an employee's wages for specific purposes, such as taxes or child support. In Bakersfield, California, this can involve submitting a Confidential Supplement to Application for Earnings Withholding Order for Taxes to initiate the process. It ensures that the owed amounts are collected systematically and efficiently.

The Termination of an order to withhold tax indicates that the tax withholding from your earnings has been officially canceled. This action usually occurs after all tax obligations have been settled. For assistance with understanding the implications of this termination, refer to the Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes.

A Termination of Iwo (Income Withholding Order) signifies the end of a previous income withholding for a specific obligation. This termination is important as it means your wages will no longer be subject to withholding for that particular order. To manage any related effects smoothly, you might want to consult the Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes.

You may receive an earnings withholding order due to unpaid taxes, child support, or other mandatory obligations. The order is issued to secure payment directly from your wages to the respective authority. If you're unsure about the details, the Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes can offer clarity and assistance.

A WG 002 earnings withholding order is a specific form used to withhold earnings for various obligations, including taxes and child support. It is crucial for ensuring that the appropriate funds are collected directly from your paycheck. For a deeper understanding and guidance through these orders, look into the Bakersfield California Confidential Supplement to Application for Earnings Withholding Order for Taxes.