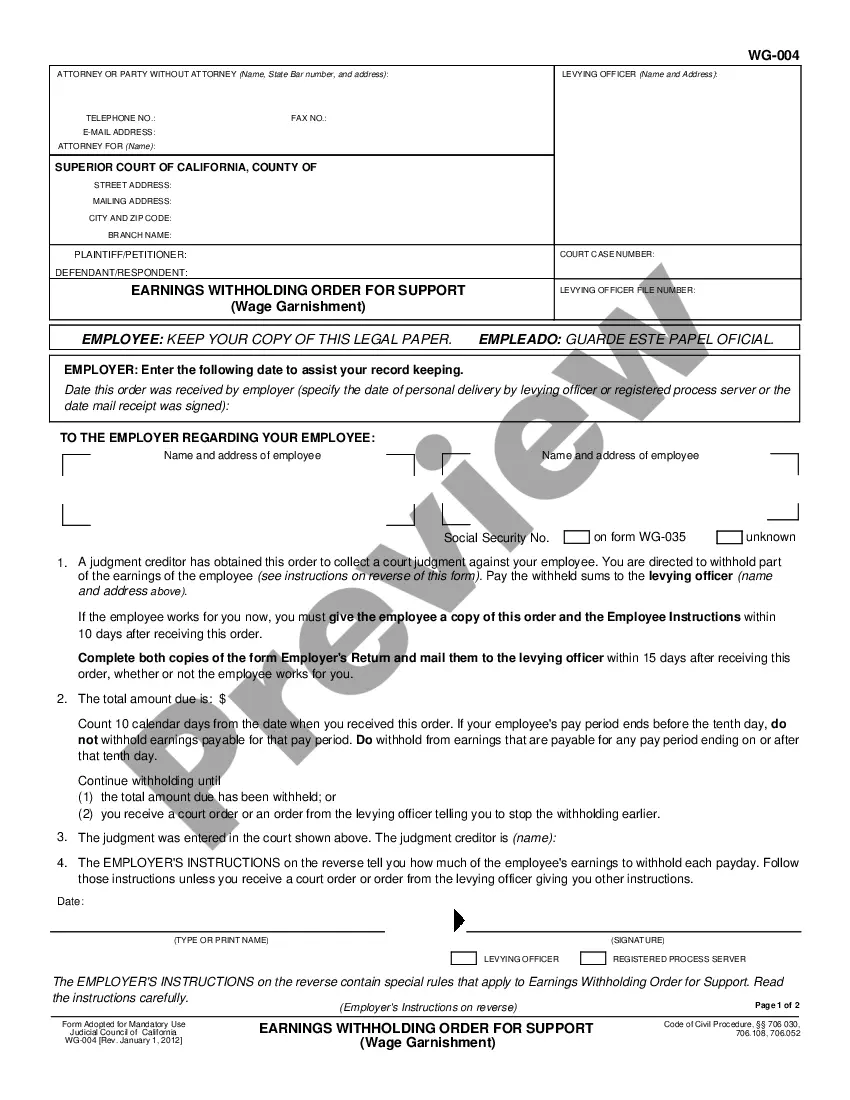

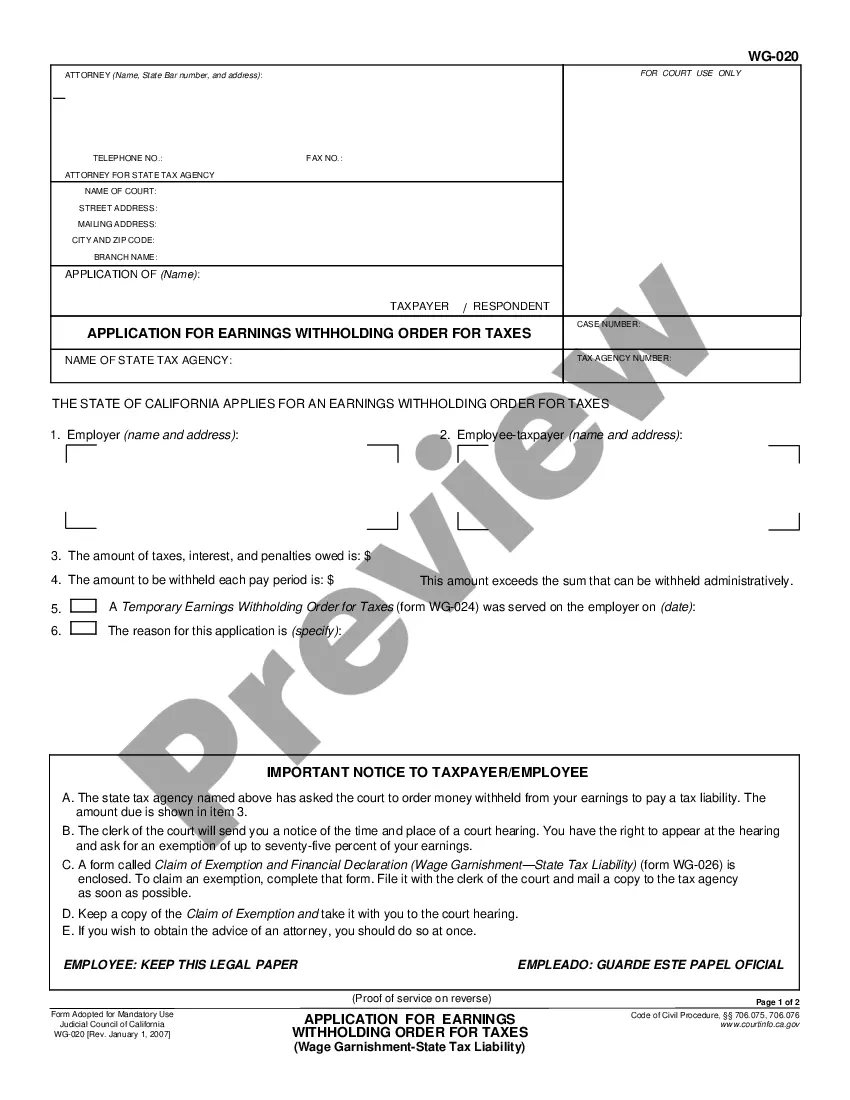

Earnings Withholding Order for Taxes: An Order for Earnings Withholding is issued by the Court, stating that the wages of the Judgment Debtor are to be garnished until he/she satisfies the judgment against him/her.

Concord California Earnings Withholding Order for Taxes

Description

How to fill out California Earnings Withholding Order For Taxes?

Regardless of your social or professional standing, completing legal paperwork is an unfortunate requirement in the current professional landscape.

Frequently, it’s nearly impossible for an individual without legal training to create these types of documents from the ground up, primarily due to the complicated terminology and legal nuances they entail.

This is where US Legal Forms proves to be useful.

Confirm the document you have selected is appropriate for your jurisdiction since the regulations of one state or county do not apply to others.

Review the document and examine a brief overview (if present) of the scenarios in which the document can be utilized.

- Our platform offers an extensive library of over 85,000 ready-to-use state-specific documents applicable to nearly any legal situation.

- US Legal Forms is also a fantastic asset for associates or legal advisors seeking to conserve time with our DIY papers.

- Whether you require the Concord California Earnings Withholding Order for Taxes or any other document relevant to your state or county, US Legal Forms has everything readily available.

- Here’s how to obtain the Concord California Earnings Withholding Order for Taxes in moments by utilizing our reliable platform.

- If you are already a member, you can simply Log In to your account to download the necessary form.

- If this is your first time using our library, ensure you follow these steps before downloading the Concord California Earnings Withholding Order for Taxes.

Form popularity

FAQ

To stop IRS garnishment, you must actively communicate with the IRS to resolve any outstanding tax liabilities. Presenting a detailed financial analysis may allow you to negotiate a payment plan or settle your debt, thereby addressing the Concord California Earnings Withholding Order for Taxes. Engaging with a tax advisor can significantly enhance your chances of a favorable outcome.

Filing a claim of exemption for wage garnishment in California involves submitting the appropriate forms to the court handling your case. The Concord California Earnings Withholding Order for Taxes mandates that you within a specific timeframe assert your exemption claim, demonstrating why you qualify. Legal assistance can simplify this process and ensure all requirements are met.

You may stop your tax refund from being garnished by addressing the root cause of the garnishment. The Concord California Earnings Withholding Order for Taxes may indicate that you should seek assistance from professionals or legal platforms like USLegalForms, which can help you file necessary exemptions or negotiations. Exploring your rights will be crucial in reclaiming your refund.

Stopping your tax refund from offset can be challenging, but it often involves understanding the basis for the offset. If the Concord California Earnings Withholding Order for Taxes is the reason for your offset, consider contacting the tax authority directly to discuss potential options or claims. You may also explore the possibility of filing for a hardship exemption to retain your refund.

To effectively stop a garnishment, you can take immediate action by filing a claim of exemption or negotiating directly with your creditor. If you qualify, the Concord California Earnings Withholding Order for Taxes might allow you to assert your financial hardship. Take advantage of legal resources and consult professionals if necessary to ensure your rights are protected.

Quitting your job to avoid wage garnishment is not recommended as a long-term solution and could lead to severe financial repercussions. Creditors can still pursue you for the debt, and your financial obligations remain. It's often better to explore lawful options for dealing with a Concord California Earnings Withholding Order for Taxes through negotiation or legal avenues provided by platforms like uslegalforms.

To stop wage garnishment for a credit card, explore options such as negotiating a settlement with your creditor or seeking legal advice. You might also consider filing for bankruptcy if your financial situation qualifies. Be aware that resolving the underlying debt and understanding your legal rights will help you navigate this challenging process effectively.

WG-002 is another reference to the earnings withholding order form that California uses. This form notifies your employer of their obligation to deduct funds from your paycheck for debt repayment. It's important to familiarize yourself with this form, especially if you're facing a Concord California Earnings Withholding Order for Taxes.

The WG 002 earnings withholding order is a specific court form used in California to implement a wage garnishment. This order mandates employers to withhold a certain portion of an employee's wages to satisfy a debt. If you receive a WG 002, it is critical to understand its implications and respond appropriately to safeguard your financial well-being.

To calculate disposable earnings for garnishment in California, start with your gross income. Subtract mandatory deductions, such as taxes and Social Security contributions, to determine your disposable earnings. The earnings withholding order will typically apply to a percentage of your disposable income, so knowing this calculation is crucial for accurate compliance.