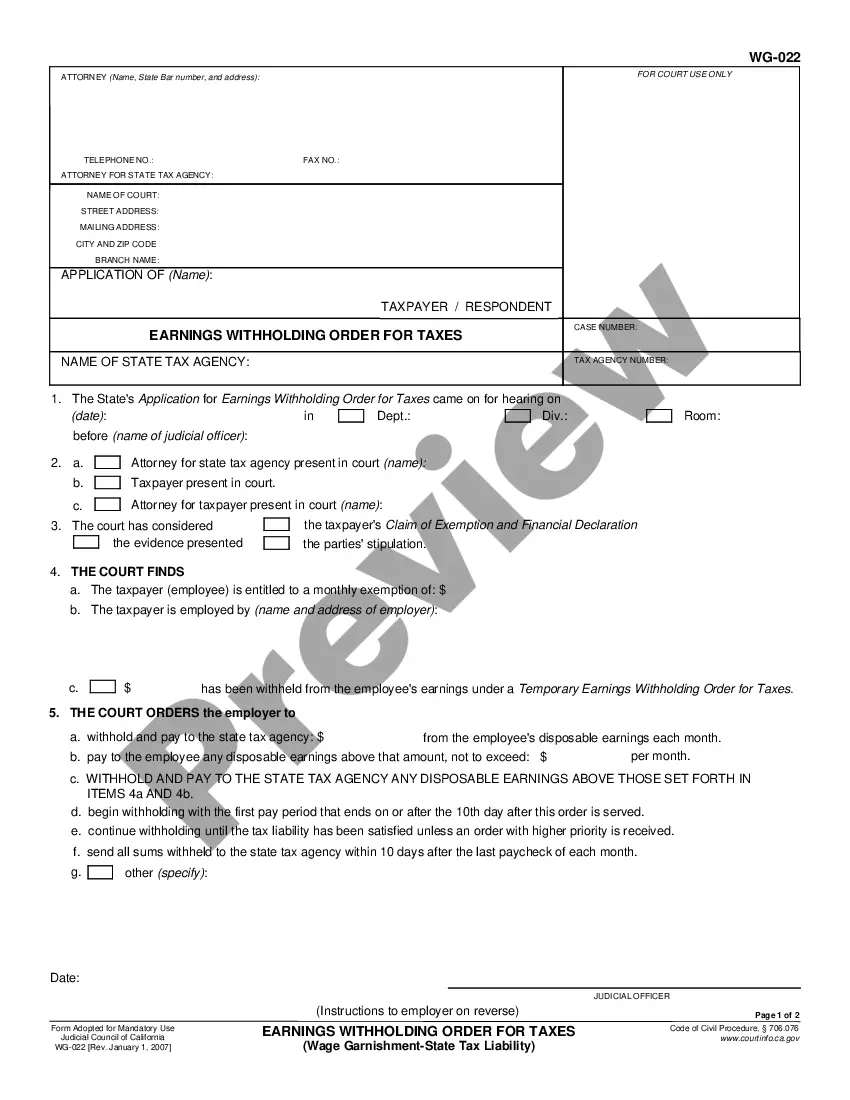

This form is a Temporary Earnings Withholding Order for Taxes. It directs an employer to retain a portion of an employee's earnings in order to satisfy a garnishment.

Elk Grove California Temporary Earnings Withholding Order for Taxes is a legal document issued by the state tax agency or support enforcement agency to enforce the collection of unpaid taxes or child support obligations. It allows them to withhold a portion of an individual's earnings or wages to satisfy their outstanding tax or support debt. The Temporary Earnings Withholding Order (TWO) in Elk Grove California is specifically designed to ensure compliance with state tax laws and child support obligations. It provides a temporary solution to collect the unpaid amounts until the debt is fully satisfied or a permanent withholding order is established. This type of order applies to individuals who have failed to meet their tax obligations or child support payments. It allows the designated agency to intercept a portion of the individual's earnings by instructing their employer to withhold a specific amount directly from their paycheck. The withheld amount is then forwarded to the appropriate agency for disbursement towards the outstanding debt. There are two main types of Elk Grove California Temporary Earnings Withholding Orders: 1. Temporary Earnings Withholding Order for Taxes: This type of order is issued by the state tax agency to collect unpaid state taxes. It ensures that the individual's earnings are appropriately withheld until the tax debt is repaid in full. The state tax agency works closely with the employer to ensure compliance and timely payment of the outstanding taxes. 2. Temporary Earnings Withholding Order for Child Support: This order is issued by the support enforcement agency to enforce outstanding child support payments. It allows the agency to intercept a portion of the individual's earnings to ensure regular and timely payment towards child support obligations. The withheld amounts are then disbursed to the custodial parent or a designated agency responsible for managing child support payments. Both types of Elk Grove California Temporary Earnings Withholding Orders play a crucial role in ensuring compliance with tax laws and child support obligations. The orders provide a legal mechanism to collect unpaid amounts, while still allowing the individual to meet their basic living expenses. Employers are obliged to withhold the specified amount and remit it to the appropriate agency on a regular basis until the debt is fully satisfied or a permanent withholding order is established. It is important for individuals to promptly address their tax obligations or child support payments to avoid the issuance of a Temporary Earnings Withholding Order in Elk Grove, California. Compliance with these orders is necessary to avoid legal consequences, penalties, and the potential loss of a portion of their earnings.Elk Grove California Temporary Earnings Withholding Order for Taxes is a legal document issued by the state tax agency or support enforcement agency to enforce the collection of unpaid taxes or child support obligations. It allows them to withhold a portion of an individual's earnings or wages to satisfy their outstanding tax or support debt. The Temporary Earnings Withholding Order (TWO) in Elk Grove California is specifically designed to ensure compliance with state tax laws and child support obligations. It provides a temporary solution to collect the unpaid amounts until the debt is fully satisfied or a permanent withholding order is established. This type of order applies to individuals who have failed to meet their tax obligations or child support payments. It allows the designated agency to intercept a portion of the individual's earnings by instructing their employer to withhold a specific amount directly from their paycheck. The withheld amount is then forwarded to the appropriate agency for disbursement towards the outstanding debt. There are two main types of Elk Grove California Temporary Earnings Withholding Orders: 1. Temporary Earnings Withholding Order for Taxes: This type of order is issued by the state tax agency to collect unpaid state taxes. It ensures that the individual's earnings are appropriately withheld until the tax debt is repaid in full. The state tax agency works closely with the employer to ensure compliance and timely payment of the outstanding taxes. 2. Temporary Earnings Withholding Order for Child Support: This order is issued by the support enforcement agency to enforce outstanding child support payments. It allows the agency to intercept a portion of the individual's earnings to ensure regular and timely payment towards child support obligations. The withheld amounts are then disbursed to the custodial parent or a designated agency responsible for managing child support payments. Both types of Elk Grove California Temporary Earnings Withholding Orders play a crucial role in ensuring compliance with tax laws and child support obligations. The orders provide a legal mechanism to collect unpaid amounts, while still allowing the individual to meet their basic living expenses. Employers are obliged to withhold the specified amount and remit it to the appropriate agency on a regular basis until the debt is fully satisfied or a permanent withholding order is established. It is important for individuals to promptly address their tax obligations or child support payments to avoid the issuance of a Temporary Earnings Withholding Order in Elk Grove, California. Compliance with these orders is necessary to avoid legal consequences, penalties, and the potential loss of a portion of their earnings.