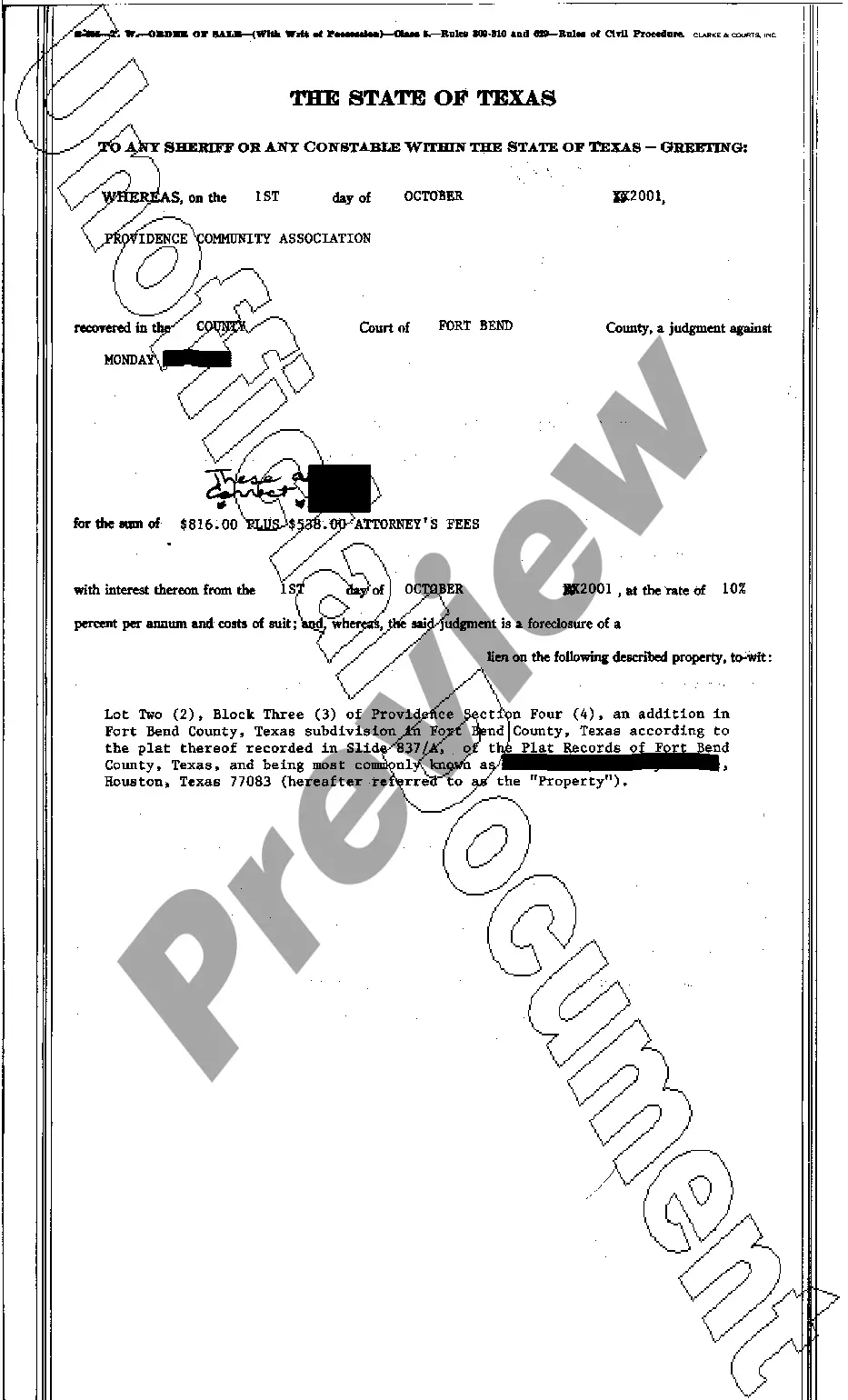

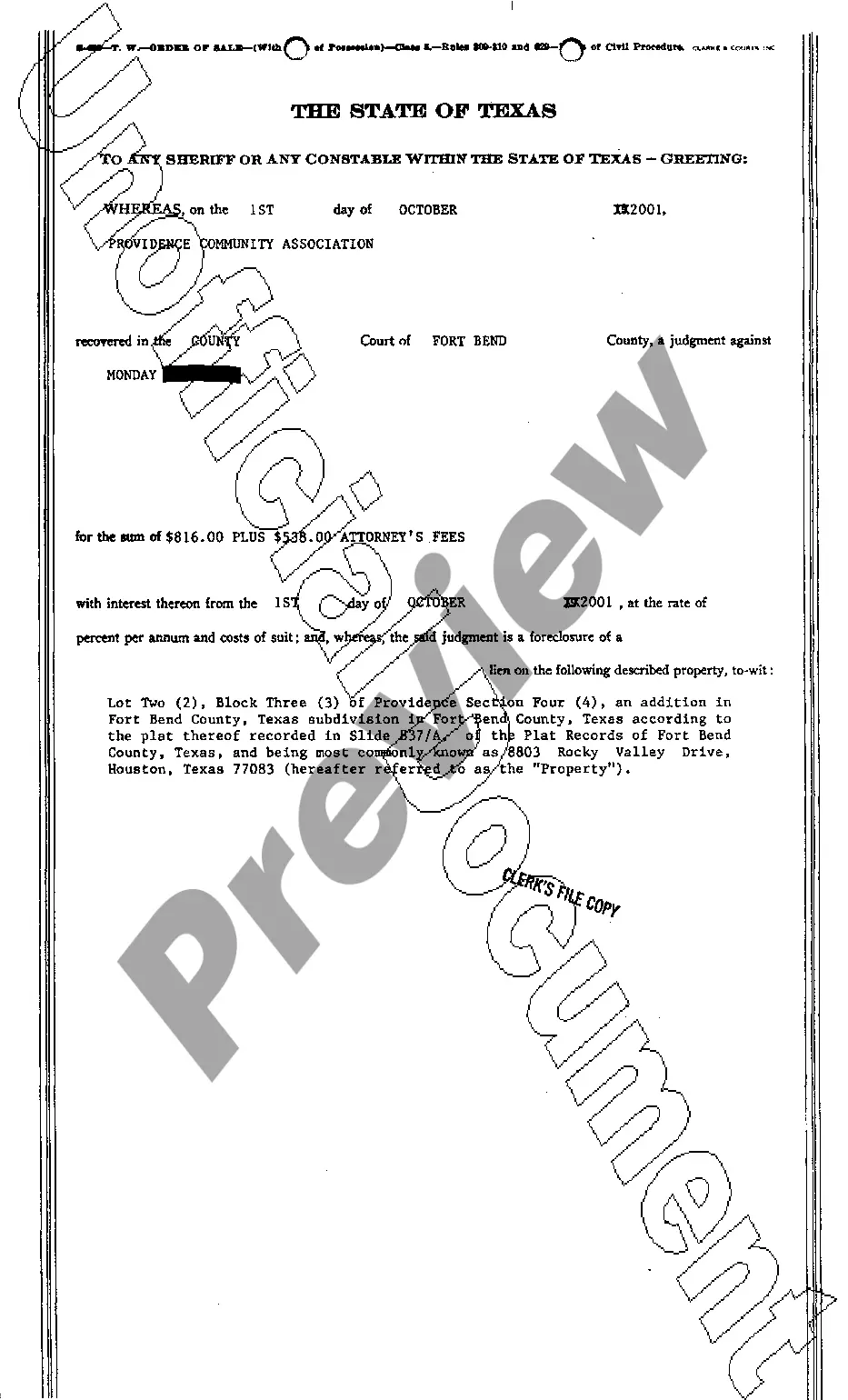

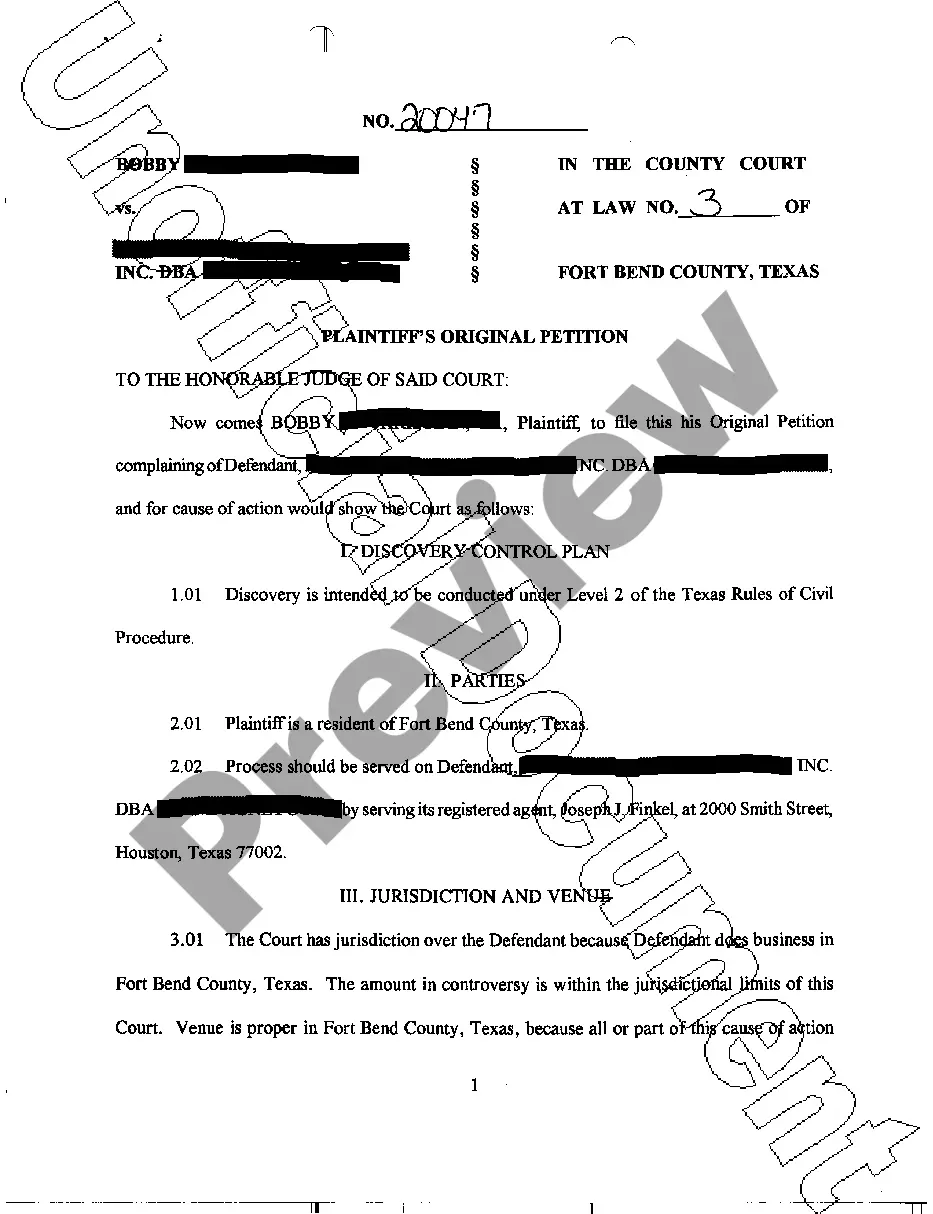

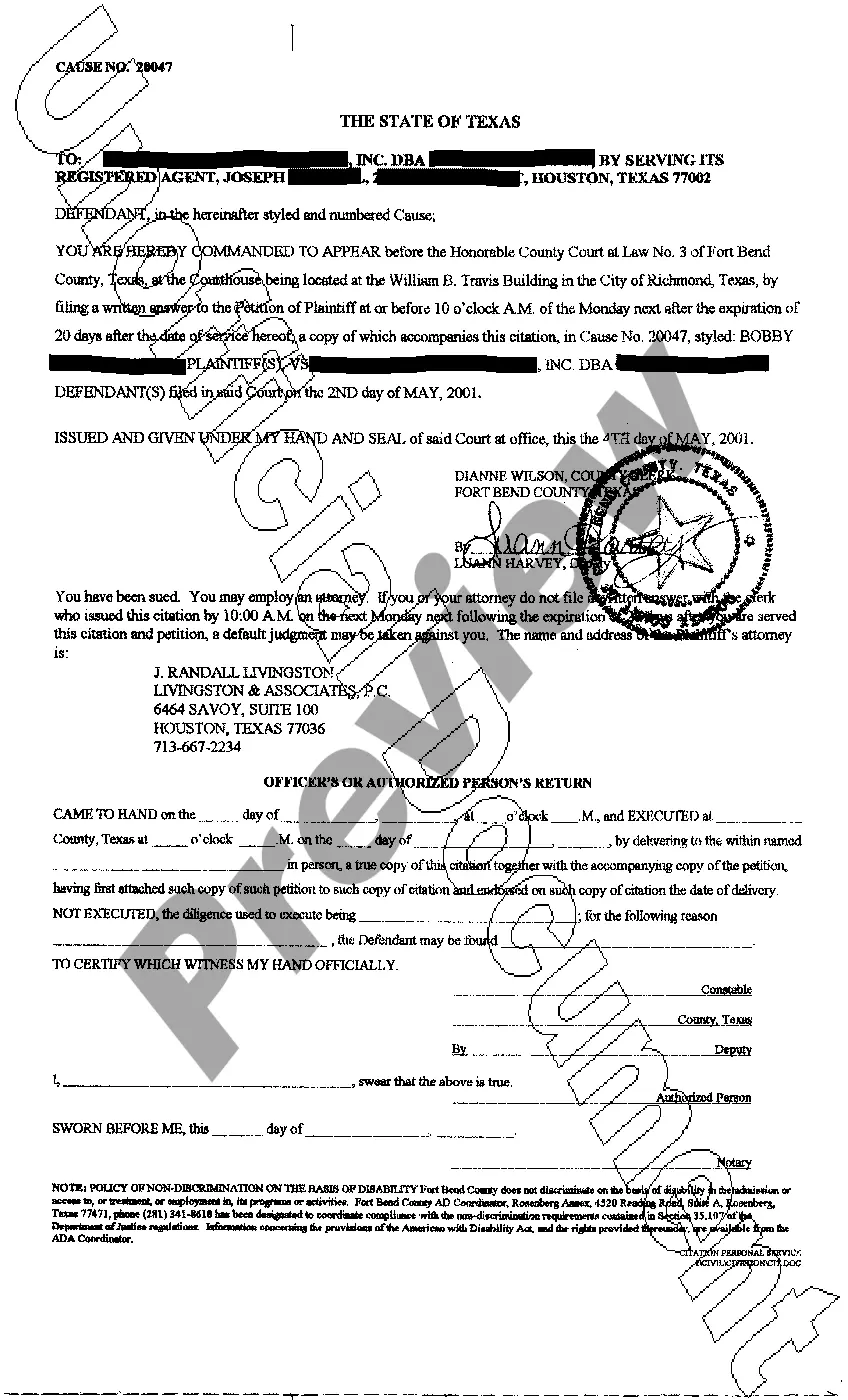

This form is a Temporary Earnings Withholding Order for Taxes. It directs an employer to retain a portion of an employee's earnings in order to satisfy a garnishment.

A Long Beach California Temporary Earnings Withholding Order for Taxes is a legal document used by the California Franchise Tax Board (FT) to direct an employer to deduct a specific amount from an employee's wages for the purpose of satisfying a tax debt owed to the state. This order is temporary and is typically initiated when an individual fails to pay their state income taxes. The Temporary Earnings Withholding Order for Taxes allows the FT to collect unpaid taxes directly from an individual's wages. It is commonly referred to as a wage garnishment or wage levy. This process ensures that the taxpayer's outstanding tax liabilities are addressed, helping them fulfill their tax obligations. There are different types of Temporary Earnings Withholding Orders for Taxes that may be issued in Long Beach, California, based on the specific circumstances of the taxpayer. Some of these variations include: 1. Prejudgment Order: This type of withholding order is typically issued before a court judgment is obtained, and it allows the FT to collect taxes owed without going through lengthy legal proceedings. 2. Post-judgment Order: A post-judgment withholding order is issued after a court judgment has been obtained against the taxpayer. It enables the FT to collect the tax debt through wage garnishment after the court's decision. 3. Lump Sum Order: In some cases, the FT may issue a lump sum withholding order, requiring the taxpayer's employer to deduct a substantial amount from their wages to satisfy a significant outstanding tax debt. This type of order is often used when the taxpayer owes a large sum and needs to repay it quickly. 4. Installment Order: An installment withholding order allows the taxpayer to repay their tax debt in multiple smaller payments deducted from their wages over a specified period. This type of order provides taxpayers with the flexibility to fulfill their tax obligations gradually. In Long Beach, California, the issuance of Temporary Earnings Withholding Orders for Taxes is governed by state laws and regulations. Employers are legally obligated to comply with these orders and withhold the specified amount from an employee's wages until the tax debt is fully satisfied. It is essential for individuals facing a Temporary Earnings Withholding Order for Taxes to understand their rights and seek professional assistance when dealing with wage garnishments. Consulting a tax professional or seeking legal advice can help taxpayers navigate this process and explore any available options for resolution or negotiation with the FT.