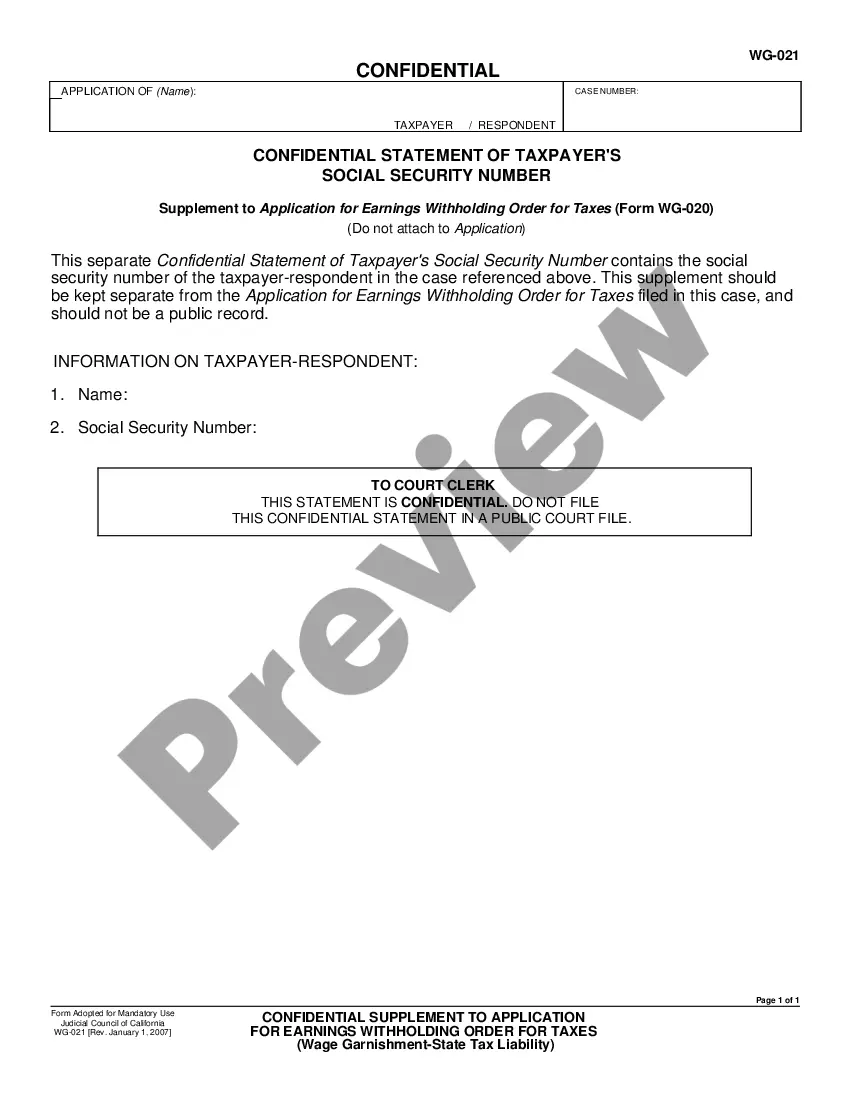

This is a California Judicial Council form that is used in Wage Garnishment proceedings. This form is a confidential supplement to the Temporary Withholding Order for Taxes. It contains the social security number of the taxpayer and should be kept separate from the Temporary Withholding Order for Taxes filed in the case.

Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes

Description

How to fill out California Confidential Supplement To Temporary Earnings Withholding Order For Taxes?

Utilize the US Legal Forms and gain instant access to any form template you desire.

Our advantageous platform featuring thousands of documents simplifies the process of locating and acquiring nearly any document sample you require.

You can save, complete, and authorize the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes in just a few minutes instead of spending hours searching online for the appropriate template.

Leveraging our library is an excellent method to enhance the security of your document submission.

If you do not have an account yet, follow the steps outlined below.

Locate the form you need. Ensure that it is the template you wish to find: check its title and description, and take advantage of the Preview option when available. Otherwise, use the Search field to look for the required one.

- Our experienced legal experts routinely evaluate all documents to guarantee that the templates adhere to specific regional requirements and comply with current laws and regulations.

- How can you obtain the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes.

- If you already possess an account, simply Log In to your profile.

- The Download button will become visible on all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

A Termination of an Income Withholding Order (IWO) indicates that the obligation to withhold funds from an individual's income has been officially ended. This action often results from a payment completion or modification of the initial court order. This topic is particularly relevant for individuals handling wage garnishments in Clovis, California. For assistance with the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes, consider utilizing the resources available on the US Legal Forms platform.

Termination of an order to withhold tax refers to the official cancellation of a notice that instructs an employer to deduct a certain amount from an employee's paycheck for tax purposes. This change can occur when a tax obligation is fulfilled or if circumstances change. Understanding the termination process is crucial for ensuring compliance with tax laws in Clovis, California. You can find resources related to the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes to help navigate through this situation.

To elect to withhold taxes means that an individual chooses to have a portion of their income withheld for tax purposes. This decision helps to meet tax obligations throughout the year, rather than in a lump sum at tax time. In Clovis, California, understanding the options provided by the Confidential Supplement to Temporary Earnings Withholding Order for Taxes will ensure you make informed choices regarding tax withholdings.

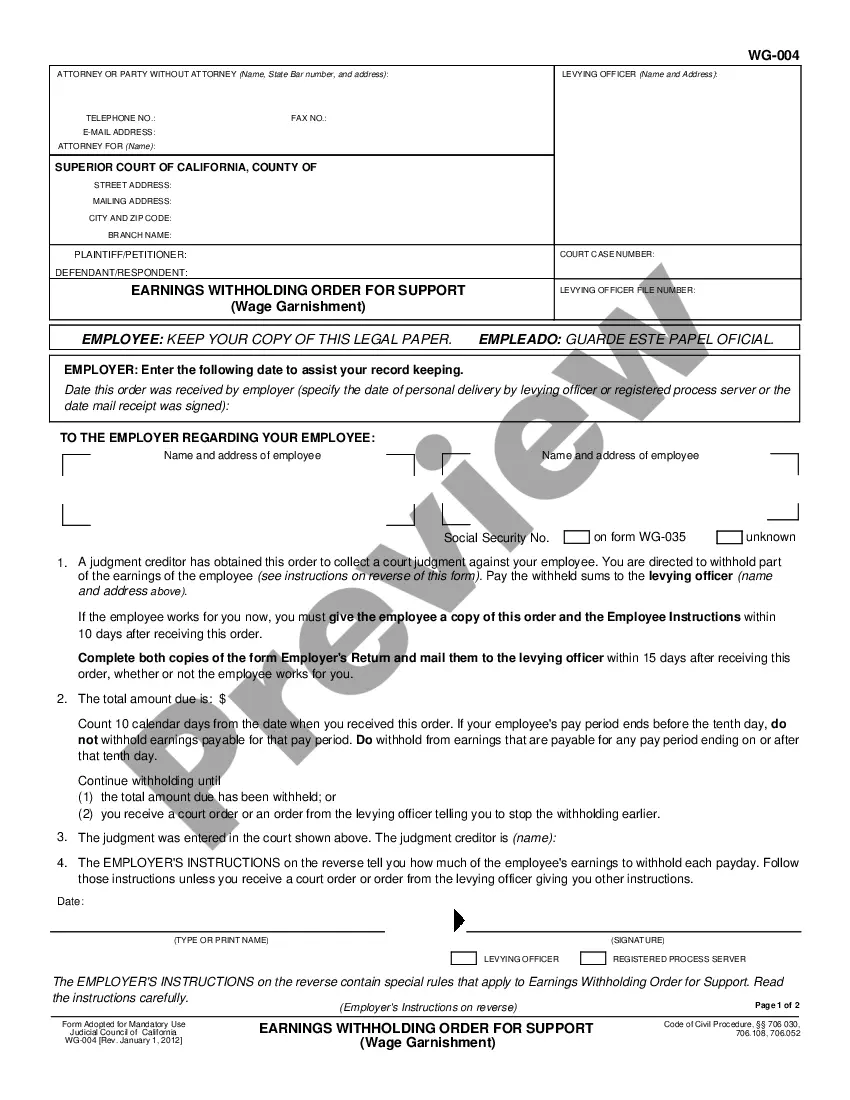

An earnings withholding order in California is a directive issued by a court that requires an employer to deduct a specific amount from an employee's wages to satisfy a debt or obligation. This order is critical for managing payment responsibilities for obligations such as child support or tax liabilities. Utilizing the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes can provide clarity in these situations.

A withholding order is a legal requirement that directs an employer to withhold a specified amount of an employee’s wages for tax obligations or other court-ordered payments. This form of income management helps ensure that necessary deductions occur promptly. For individuals in Clovis, California, utilizing a Confidential Supplement to Temporary Earnings Withholding Order for Taxes can aid in accurately implementing these orders.

Disposable income in California refers to the amount of income that remains after all mandatory deductions have been made, such as taxes and Social Security. It is the income available for an individual to spend, save, or invest. Understanding disposable income is essential when working through obligations like the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes.

An order to withhold taxes is a legal directive that requires an employer to deduct a specified amount from an employee's earnings. This process ensures that funds are withheld for various obligations, including tax liabilities. In Clovis, California, a Confidential Supplement to Temporary Earnings Withholding Order for Taxes can help streamline this process, ensuring compliance with local regulations.

To stop a wage garnishment immediately in California, you must act quickly by filing a claim of exemption with the court. This claim must detail why the garnishment should not apply to your current financial situation. Engaging with resources like the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes can equip you with the information needed to present a strong case.

To calculate disposable earnings for garnishment in California, first, determine your gross income, then deduct mandatory taxes and other withholdings. The remaining amount is considered disposable earnings, which is subject to garnishment. Understanding these calculations is vital, and the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes may provide necessary guidance for your calculations.

An earnings withholding order for taxes is a court order requiring an employer to withhold a specific amount of an employee’s earnings to satisfy unpaid taxes. This process ensures that tax obligations are met while allowing the employee to retain some disposable income. If you face this situation, the Clovis California Confidential Supplement to Temporary Earnings Withholding Order for Taxes can help you manage the details effectively.