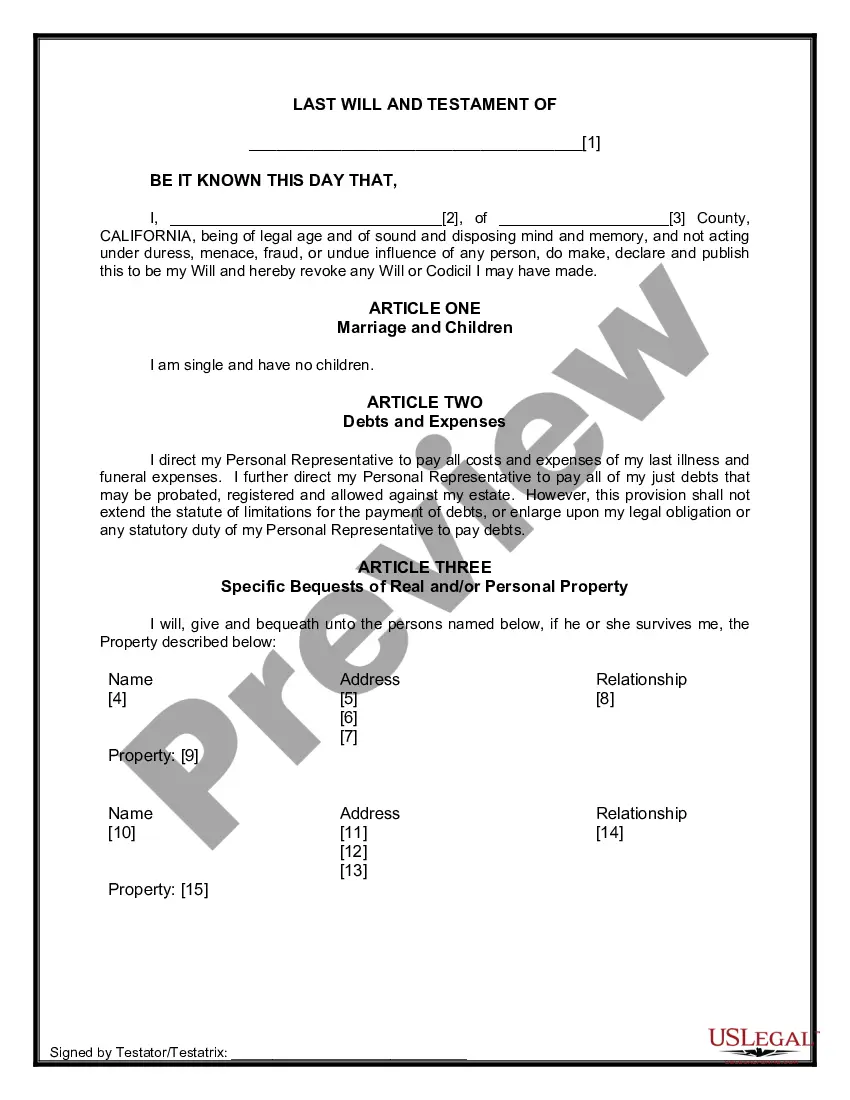

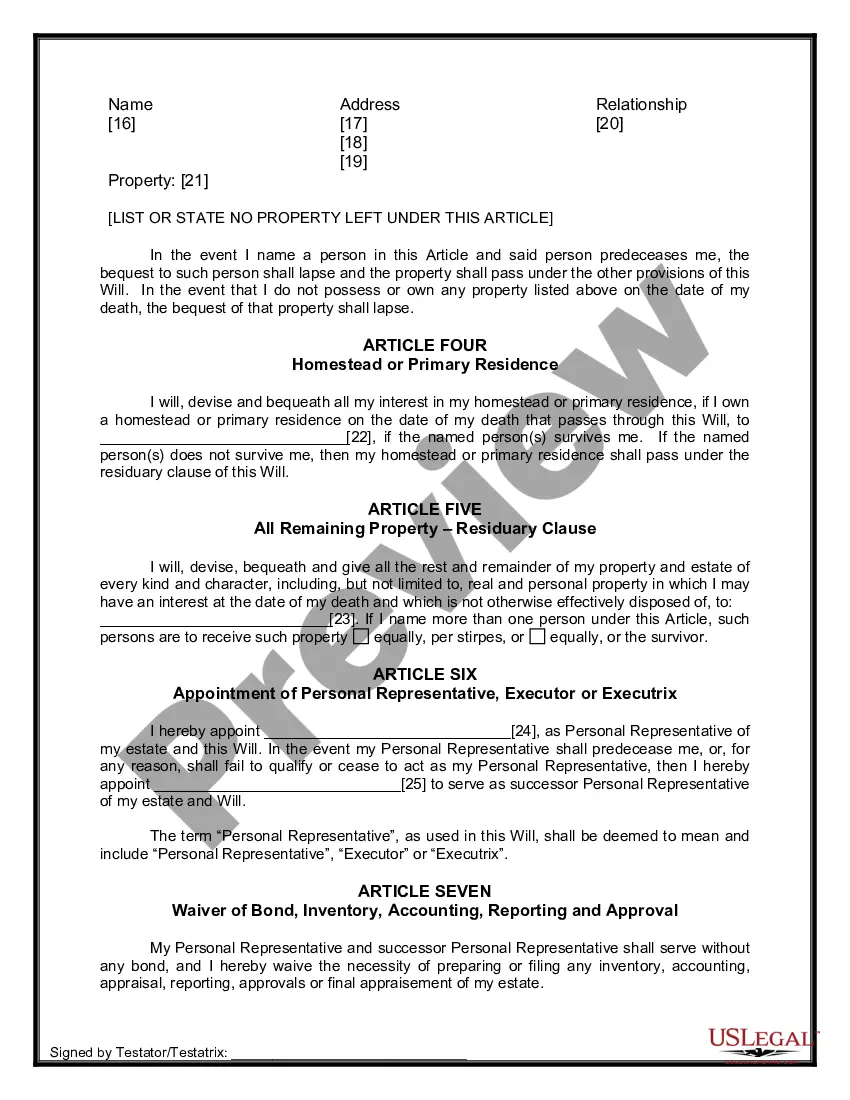

The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

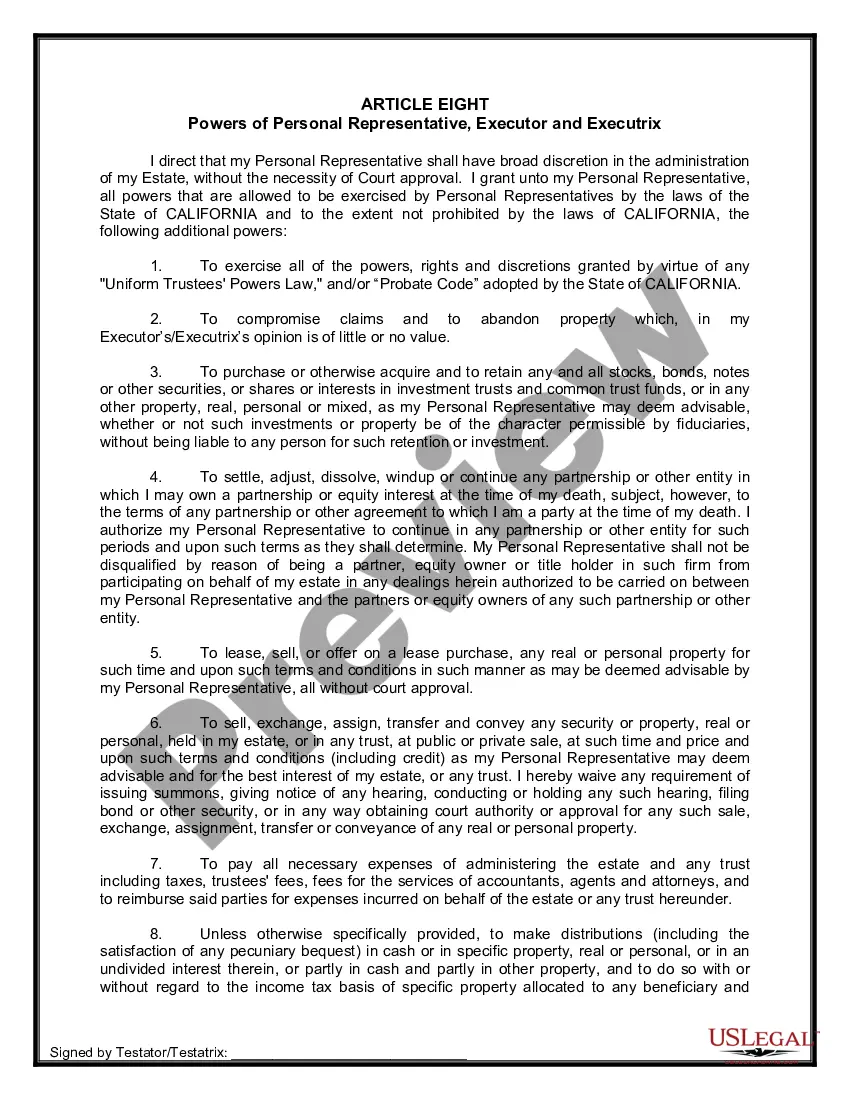

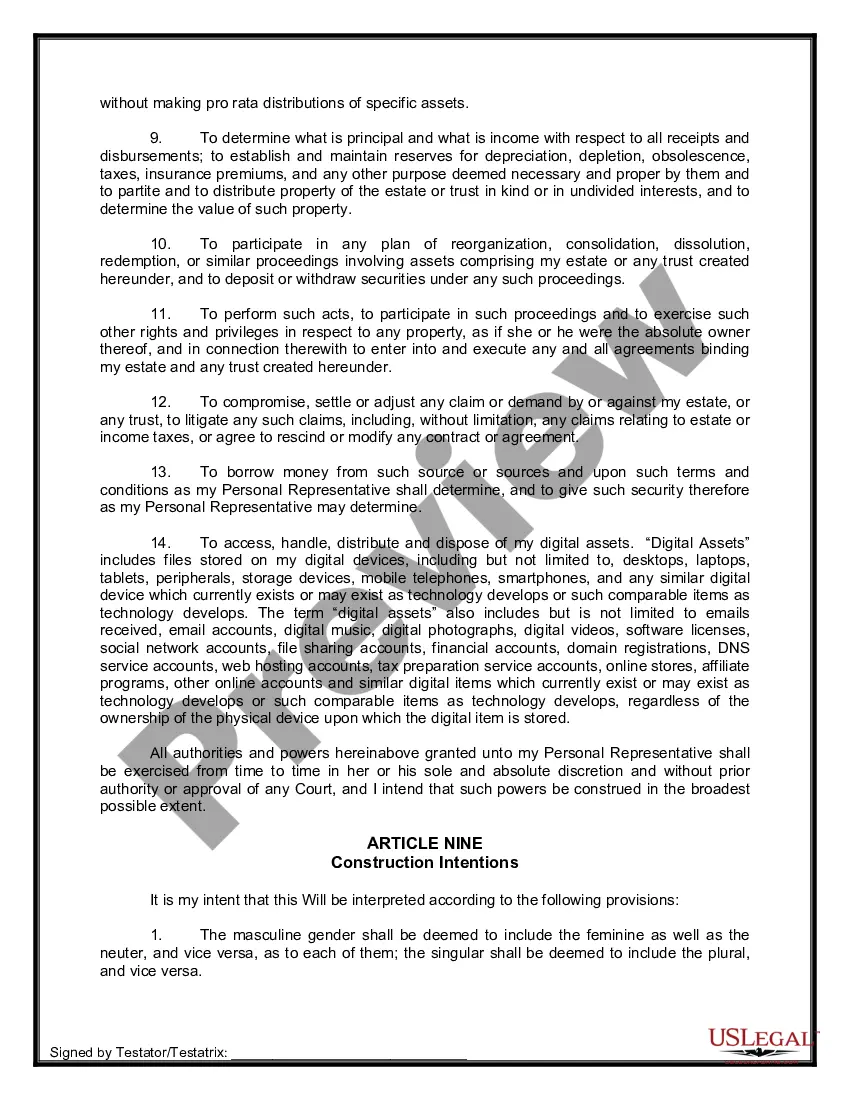

A Santa Clara California Legal Last Will and Testament Form for Single Person with No Children is a legally binding document that allows individuals without children to outline their final wishes regarding the distribution of their assets, appoint executors, and designate beneficiaries. This form ensures that the individual's estate is handled according to their specific instructions after their death. The Santa Clara California Legal Last Will and Testament Form for Single Person with No Children typically includes the following key elements: 1. Personal Information: The form starts by capturing the personal details of the individual, such as their full legal name, address, and contact information. 2. Appointment of Executor: This section allows the individual to designate an executor, who will be responsible for managing and distributing the estate as per the individual's instructions. 3. Asset Distribution: The form provides a comprehensive section where the individual can specify how their assets should be distributed among beneficiaries, such as family members, friends, or charitable organizations. This can include cash, property, investments, personal belongings, and any other relevant assets. 4. Guardianship: In case the single person has any dependents, such as pets or disabled family members, they can use this section to appoint a guardian who will take care of them. 5. Alternate Beneficiaries: It is recommended to name alternate beneficiaries in case the primary beneficiaries are unable to receive their designated share of the estate. 6. Digital Assets: In the digital age, individuals may possess valuable online assets or accounts, such as social media accounts, email accounts, cryptocurrency, or digital content. The form may include a section to address the management and distribution of these digital assets. 7. Debts and Taxes: This part allows the individual to specify how they would like their debts to be settled and if they want their estate to cover any remaining taxes. 8. Signatures and Witnesses: A Santa Clara California Legal Last Will and Testament Form for Single Person with No Children must be signed by the individual, along with at least two adult witnesses. It is crucial to follow the legal requirements for signatures and witnesses to ensure its validity. There may be variations of the Santa Clara California Legal Last Will and Testament Form for Single Person with No Children, but the general purpose and key elements remain consistent. It is important to consult an attorney or legal professional to ensure that the form complies with the specific laws and regulations of Santa Clara County, California.A Santa Clara California Legal Last Will and Testament Form for Single Person with No Children is a legally binding document that allows individuals without children to outline their final wishes regarding the distribution of their assets, appoint executors, and designate beneficiaries. This form ensures that the individual's estate is handled according to their specific instructions after their death. The Santa Clara California Legal Last Will and Testament Form for Single Person with No Children typically includes the following key elements: 1. Personal Information: The form starts by capturing the personal details of the individual, such as their full legal name, address, and contact information. 2. Appointment of Executor: This section allows the individual to designate an executor, who will be responsible for managing and distributing the estate as per the individual's instructions. 3. Asset Distribution: The form provides a comprehensive section where the individual can specify how their assets should be distributed among beneficiaries, such as family members, friends, or charitable organizations. This can include cash, property, investments, personal belongings, and any other relevant assets. 4. Guardianship: In case the single person has any dependents, such as pets or disabled family members, they can use this section to appoint a guardian who will take care of them. 5. Alternate Beneficiaries: It is recommended to name alternate beneficiaries in case the primary beneficiaries are unable to receive their designated share of the estate. 6. Digital Assets: In the digital age, individuals may possess valuable online assets or accounts, such as social media accounts, email accounts, cryptocurrency, or digital content. The form may include a section to address the management and distribution of these digital assets. 7. Debts and Taxes: This part allows the individual to specify how they would like their debts to be settled and if they want their estate to cover any remaining taxes. 8. Signatures and Witnesses: A Santa Clara California Legal Last Will and Testament Form for Single Person with No Children must be signed by the individual, along with at least two adult witnesses. It is crucial to follow the legal requirements for signatures and witnesses to ensure its validity. There may be variations of the Santa Clara California Legal Last Will and Testament Form for Single Person with No Children, but the general purpose and key elements remain consistent. It is important to consult an attorney or legal professional to ensure that the form complies with the specific laws and regulations of Santa Clara County, California.