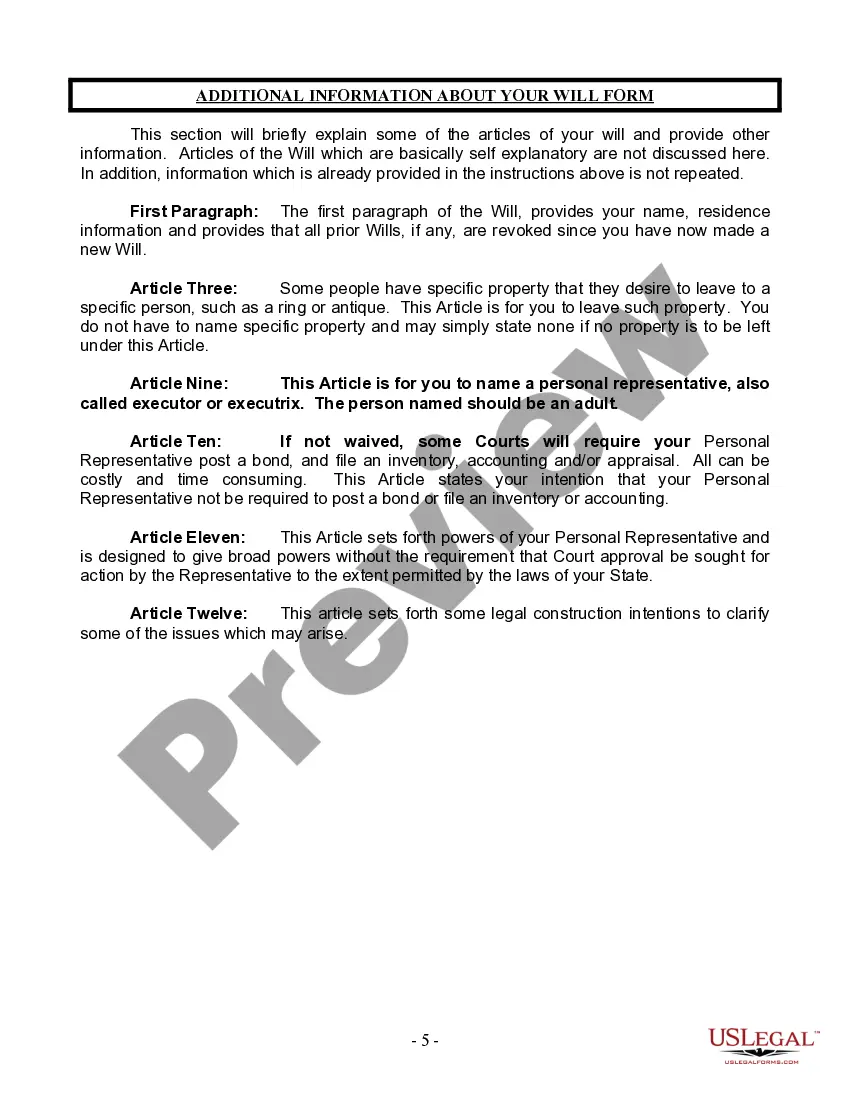

The Legal Last Will and Testament you have found, is for a single person with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your children. It also includes provisions for the appointment of a trustee for the estate of the minor children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

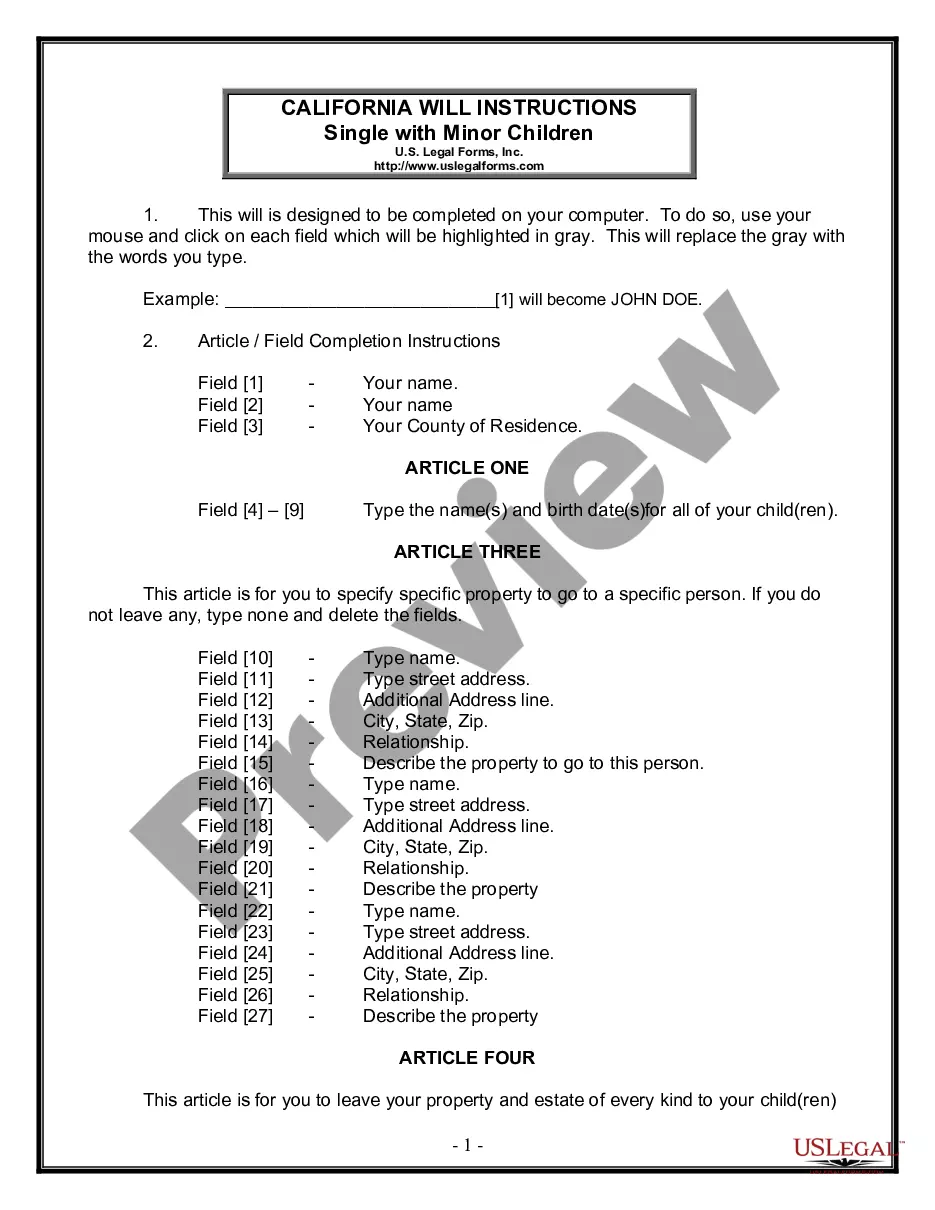

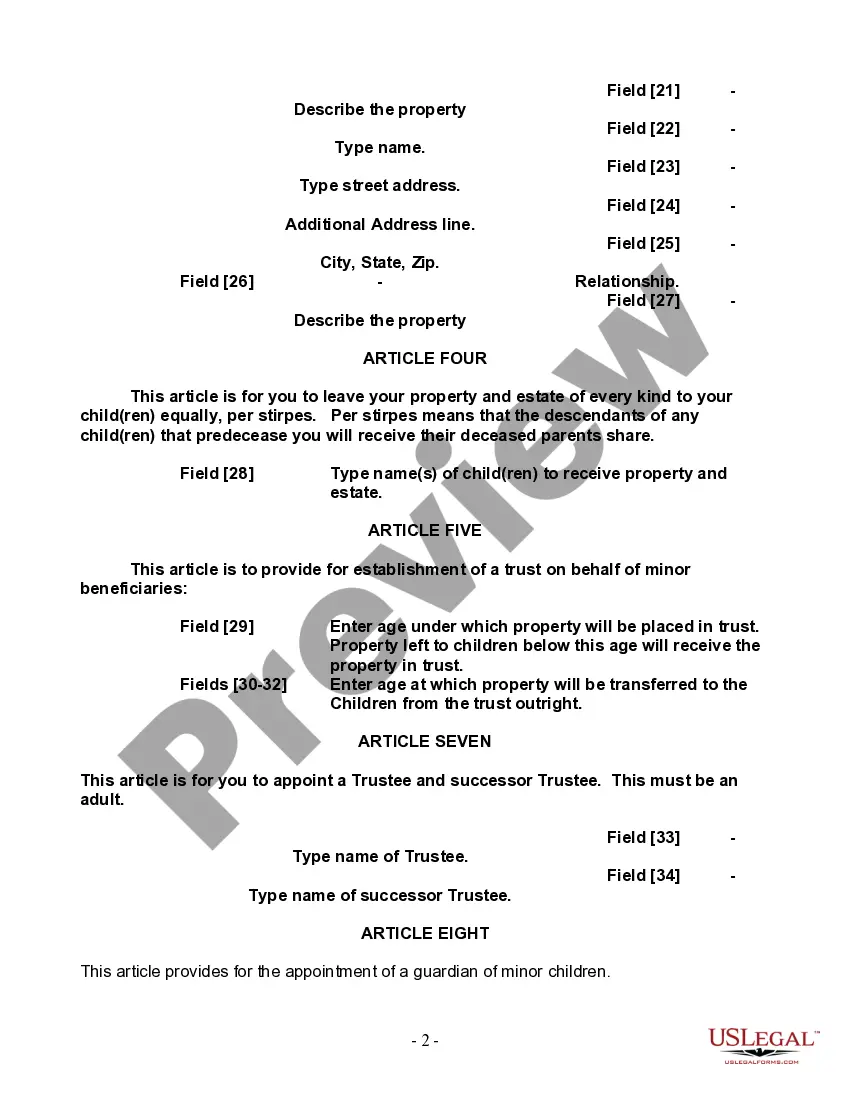

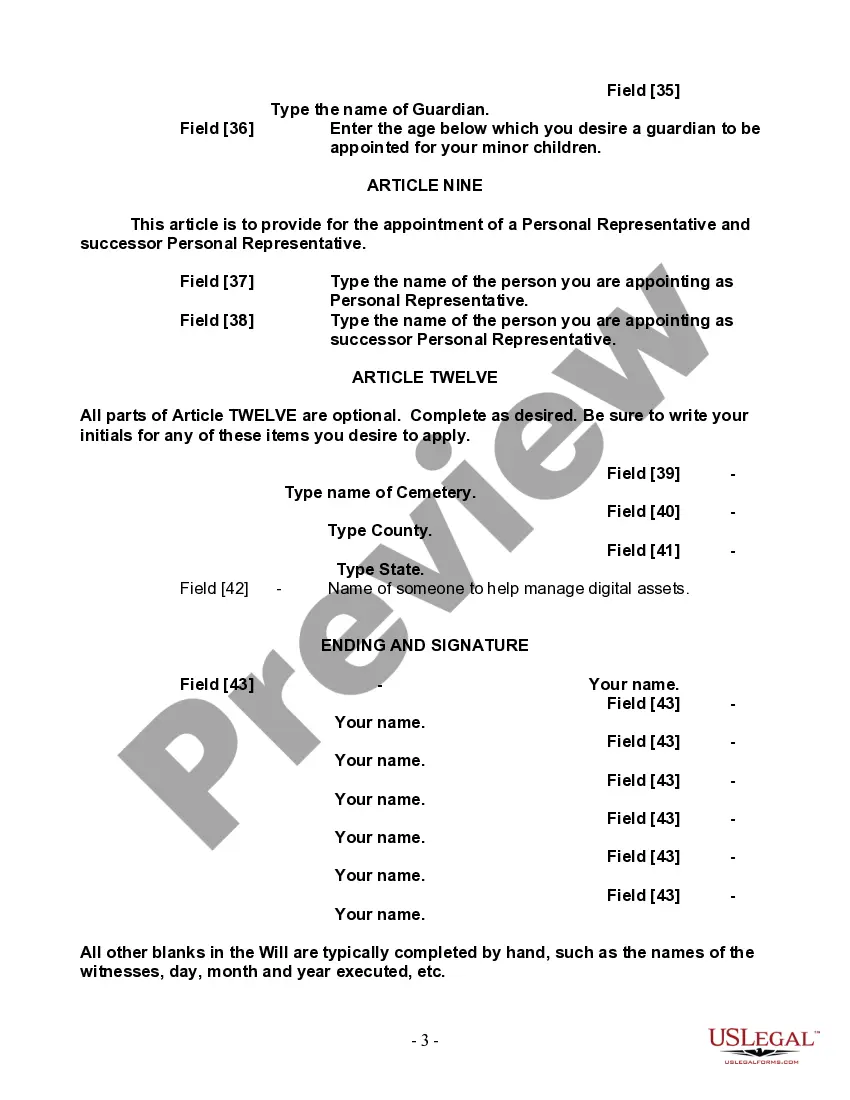

The Oxnard California Legal Last Will and Testament Form for a Single Person with Minor Children is a legally binding document specifically designed for individuals residing in Oxnard, California, who wish to outline their preferences for the distribution of their assets and guardianship of their minor children after their passing. This comprehensive form serves as a vital tool for ensuring that your final wishes are adhered to and that your children are well taken care of in case of unforeseen circumstances. Key requirements to consider while completing the Oxnard California Legal Last Will and Testament Form for a Single Person with Minor Children include: 1. Personal Information: You will be required to provide your personal details, including your full name, address, and contact information. 2. Appointment of Guardian: This section allows you to designate a trusted individual as the legal guardian of your minor children. Carefully consider someone who would be capable of providing the necessary care, support, and nurturing environment for your children. 3. Asset Distribution: The form allows you to specify how your assets, such as property, bank accounts, investments, and personal possessions, should be distributed. You can name specific beneficiaries, specify percentages, or leave instructions for an executor to handle the distribution according to your preferences. 4. Executor Selection: An executor will be responsible for managing your estate, ensuring that your debts and taxes are paid, and overseeing the distribution of your assets as per your wishes. Choose someone reliable, organized, and familiar with your financial affairs. 5. Contingency Plans: In the event that your designated beneficiaries or executor are unable or unwilling to fulfill their roles, it is crucial to outline alternative choices to ensure your wishes are still carried out effectively. Different types of Oxnard California Legal Last Will and Testament Forms for Single Persons with Minor Children may include variations based on individual circumstances or specific preferences. Some possible versions may include: 1. Last Will and Testament Form with Trust Provisions: This form enables you to set up a trust to manage and distribute your assets on behalf of your minor children until they reach a certain age or milestone. 2. Complex Will Form with Tax Planning: This type of form is tailored for individuals with extensive assets and aims to minimize tax liabilities while distributing their wealth to beneficiaries, including minor children. 3. Holographic Will Form: In certain cases, individuals may choose to handwrite their will without the typical formalities required. However, it is important to consult with a legal professional in such instances to ensure its validity and compliance with California laws. Remember, to ensure accuracy and adherence to relevant laws, it is strongly recommended seeking advice from a qualified attorney or legal expert while completing any Last Will and Testament Form, especially when it involves minor children and complex asset distribution.The Oxnard California Legal Last Will and Testament Form for a Single Person with Minor Children is a legally binding document specifically designed for individuals residing in Oxnard, California, who wish to outline their preferences for the distribution of their assets and guardianship of their minor children after their passing. This comprehensive form serves as a vital tool for ensuring that your final wishes are adhered to and that your children are well taken care of in case of unforeseen circumstances. Key requirements to consider while completing the Oxnard California Legal Last Will and Testament Form for a Single Person with Minor Children include: 1. Personal Information: You will be required to provide your personal details, including your full name, address, and contact information. 2. Appointment of Guardian: This section allows you to designate a trusted individual as the legal guardian of your minor children. Carefully consider someone who would be capable of providing the necessary care, support, and nurturing environment for your children. 3. Asset Distribution: The form allows you to specify how your assets, such as property, bank accounts, investments, and personal possessions, should be distributed. You can name specific beneficiaries, specify percentages, or leave instructions for an executor to handle the distribution according to your preferences. 4. Executor Selection: An executor will be responsible for managing your estate, ensuring that your debts and taxes are paid, and overseeing the distribution of your assets as per your wishes. Choose someone reliable, organized, and familiar with your financial affairs. 5. Contingency Plans: In the event that your designated beneficiaries or executor are unable or unwilling to fulfill their roles, it is crucial to outline alternative choices to ensure your wishes are still carried out effectively. Different types of Oxnard California Legal Last Will and Testament Forms for Single Persons with Minor Children may include variations based on individual circumstances or specific preferences. Some possible versions may include: 1. Last Will and Testament Form with Trust Provisions: This form enables you to set up a trust to manage and distribute your assets on behalf of your minor children until they reach a certain age or milestone. 2. Complex Will Form with Tax Planning: This type of form is tailored for individuals with extensive assets and aims to minimize tax liabilities while distributing their wealth to beneficiaries, including minor children. 3. Holographic Will Form: In certain cases, individuals may choose to handwrite their will without the typical formalities required. However, it is important to consult with a legal professional in such instances to ensure its validity and compliance with California laws. Remember, to ensure accuracy and adherence to relevant laws, it is strongly recommended seeking advice from a qualified attorney or legal expert while completing any Last Will and Testament Form, especially when it involves minor children and complex asset distribution.