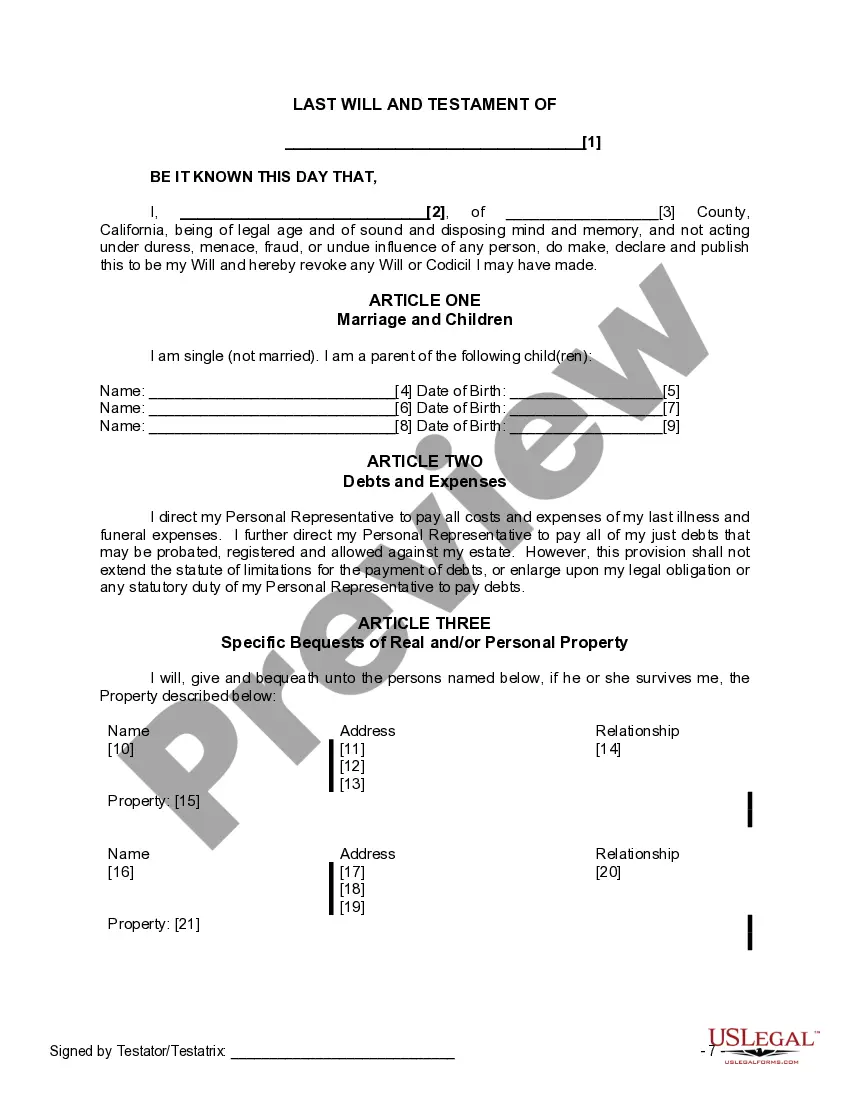

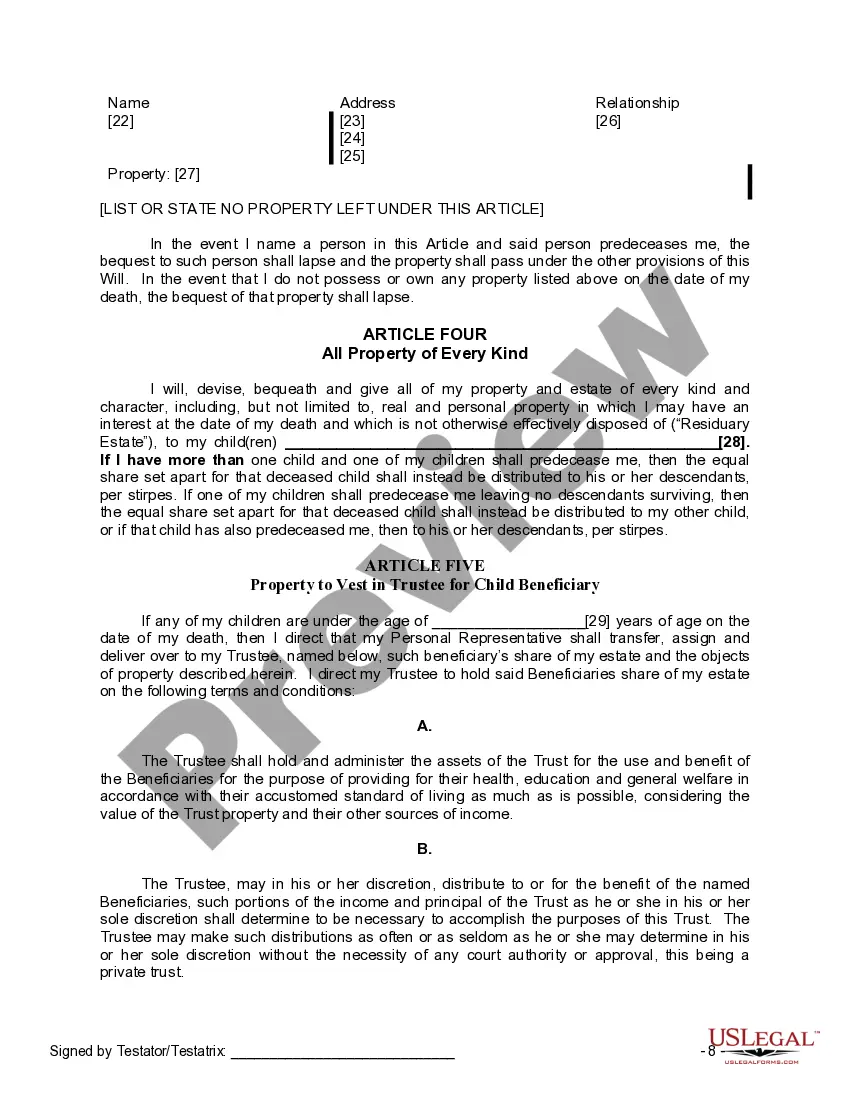

The Legal Last Will and Testament you have found, is for a single person with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your children. It also includes provisions for the appointment of a trustee for the estate of the minor children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

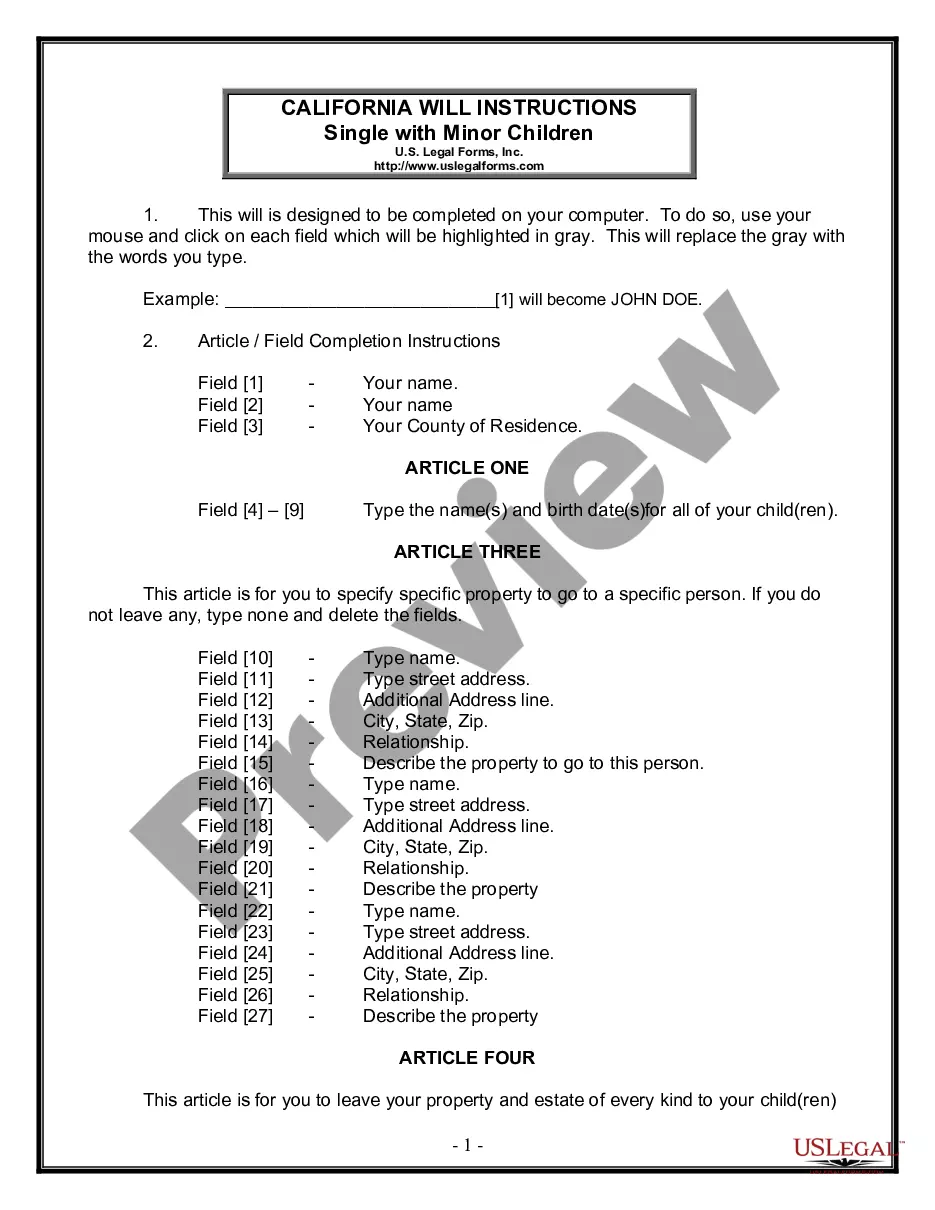

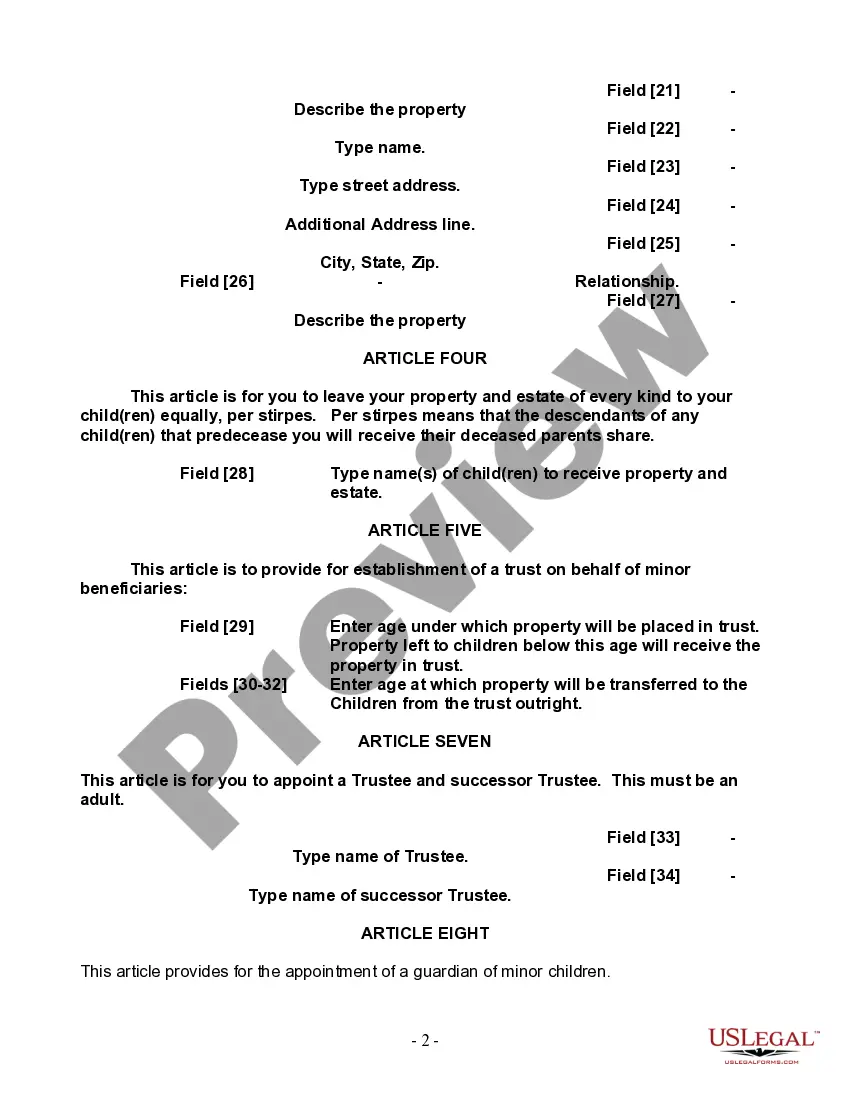

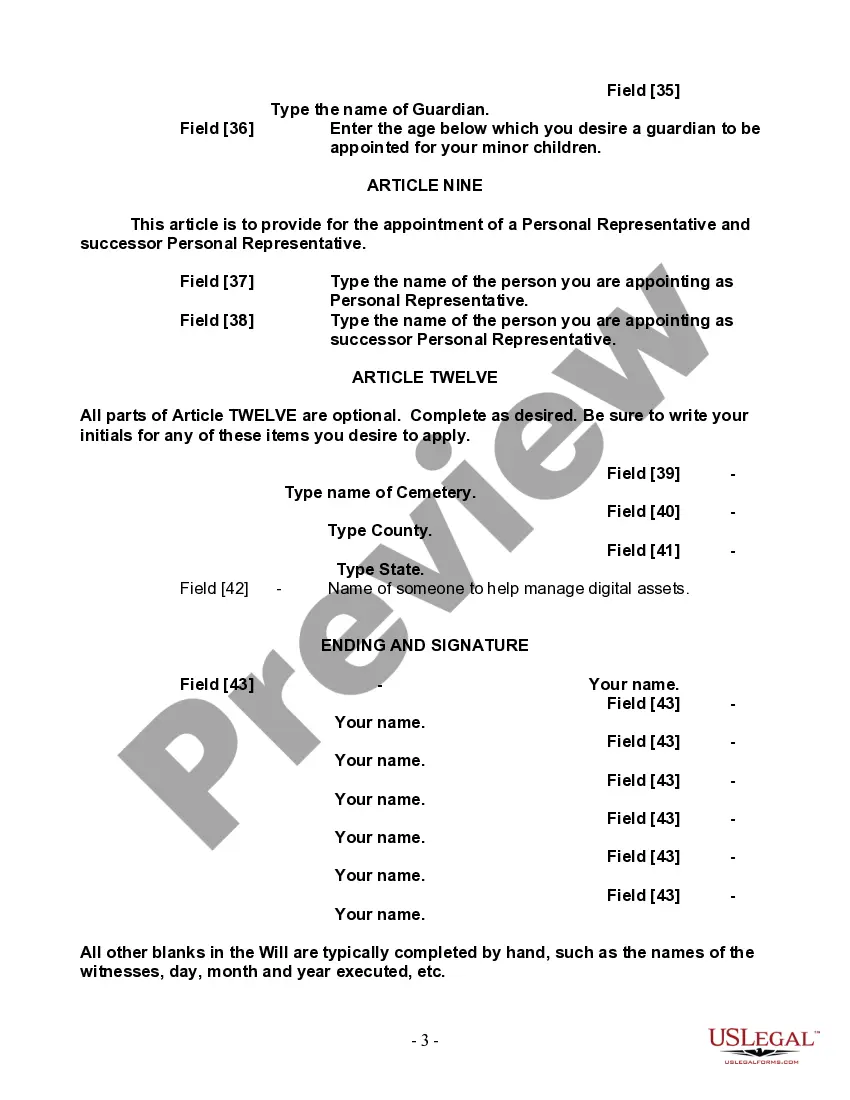

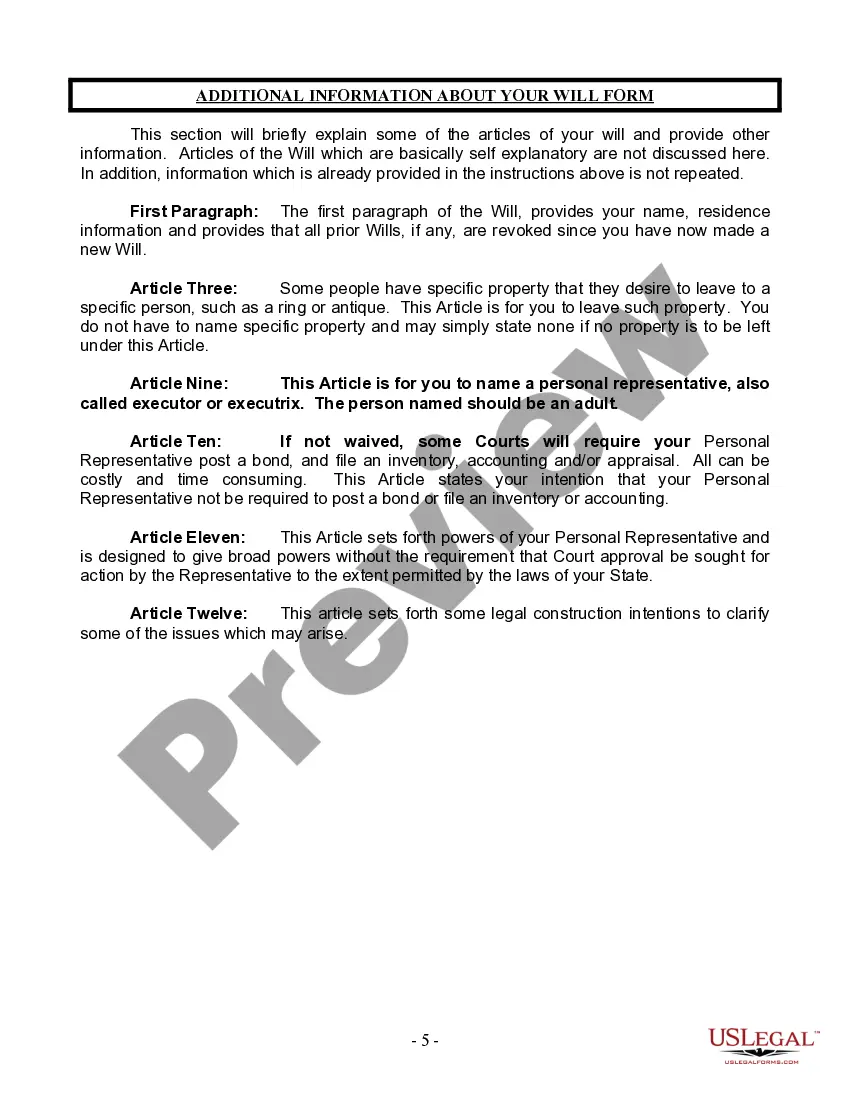

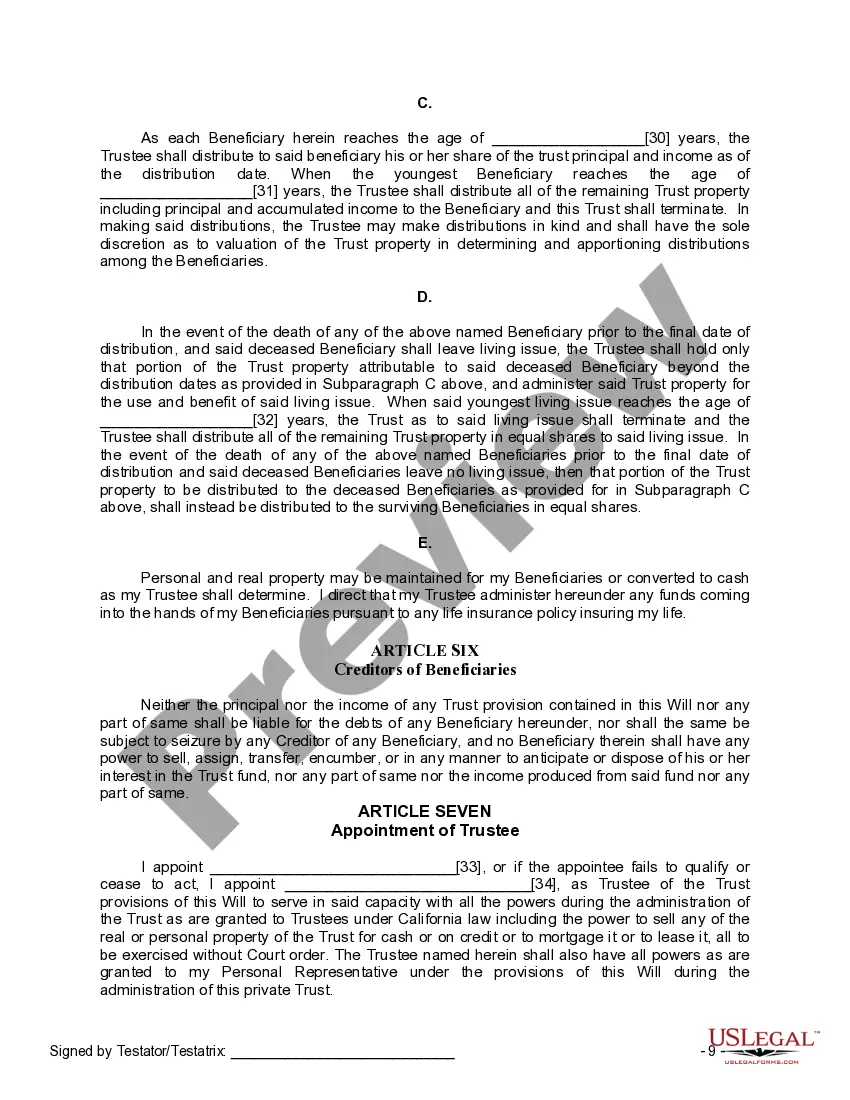

The Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children is a legally binding document that outlines how a person's assets, property, and care for their minor children will be handled upon their passing. This form is specifically designed for residents of Santa Clara County, California, and serves as an important tool to ensure the protection and care of both the individual's children and their assets. Key elements of the Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children include: 1. Appointment of a Personal Representative: This form allows the individual to name a trusted person, known as a personal representative or executor, who will be responsible for overseeing the distribution of assets, paying debts, and handling other legal matters after the individual's death. 2. Guardianship Appointment: One of the most crucial aspects of this form is the ability to name a guardian for any minor children. This ensures that the individual's children are placed in the care of someone they trust and who will provide for their welfare, education, and general well-being. 3. Asset Distribution: This form provides details on how the individual's assets, such as bank accounts, real estate, investments, and personal belongings, will be distributed among their beneficiaries. The individual can allocate specific amounts or percentages to various individuals, organizations, or charities. 4. Care and Management of Minor Children's Inheritance: Since minor children cannot directly inherit large sums of money or assets, this form allows for the establishment of a trust to manage and distribute the children's inheritance until they reach a certain age or milestone, such as turning 18 or completing their education. 5. Alternate Beneficiaries: In case any named beneficiaries or guardians are unable or unwilling to fulfill their roles, this form includes provisions to appoint alternate beneficiaries or guardians. It is important to note that while this description provides a general overview of the Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children, it is highly recommended consulting with an attorney familiar with California estate law to ensure all legal requirements are met and that the form is tailored to the individual's specific circumstances. Different variations or amendments of the Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children may exist, depending on the individual's unique situation and preferences. Some specific versions might include provisions specific to blended families, special needs children, or individuals with significant assets or complex financial situations.

The Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children is a legally binding document that outlines how a person's assets, property, and care for their minor children will be handled upon their passing. This form is specifically designed for residents of Santa Clara County, California, and serves as an important tool to ensure the protection and care of both the individual's children and their assets. Key elements of the Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children include: 1. Appointment of a Personal Representative: This form allows the individual to name a trusted person, known as a personal representative or executor, who will be responsible for overseeing the distribution of assets, paying debts, and handling other legal matters after the individual's death. 2. Guardianship Appointment: One of the most crucial aspects of this form is the ability to name a guardian for any minor children. This ensures that the individual's children are placed in the care of someone they trust and who will provide for their welfare, education, and general well-being. 3. Asset Distribution: This form provides details on how the individual's assets, such as bank accounts, real estate, investments, and personal belongings, will be distributed among their beneficiaries. The individual can allocate specific amounts or percentages to various individuals, organizations, or charities. 4. Care and Management of Minor Children's Inheritance: Since minor children cannot directly inherit large sums of money or assets, this form allows for the establishment of a trust to manage and distribute the children's inheritance until they reach a certain age or milestone, such as turning 18 or completing their education. 5. Alternate Beneficiaries: In case any named beneficiaries or guardians are unable or unwilling to fulfill their roles, this form includes provisions to appoint alternate beneficiaries or guardians. It is important to note that while this description provides a general overview of the Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children, it is highly recommended consulting with an attorney familiar with California estate law to ensure all legal requirements are met and that the form is tailored to the individual's specific circumstances. Different variations or amendments of the Santa Clara California Legal Last Will and Testament Form for a Single Person with Minor Children may exist, depending on the individual's unique situation and preferences. Some specific versions might include provisions specific to blended families, special needs children, or individuals with significant assets or complex financial situations.