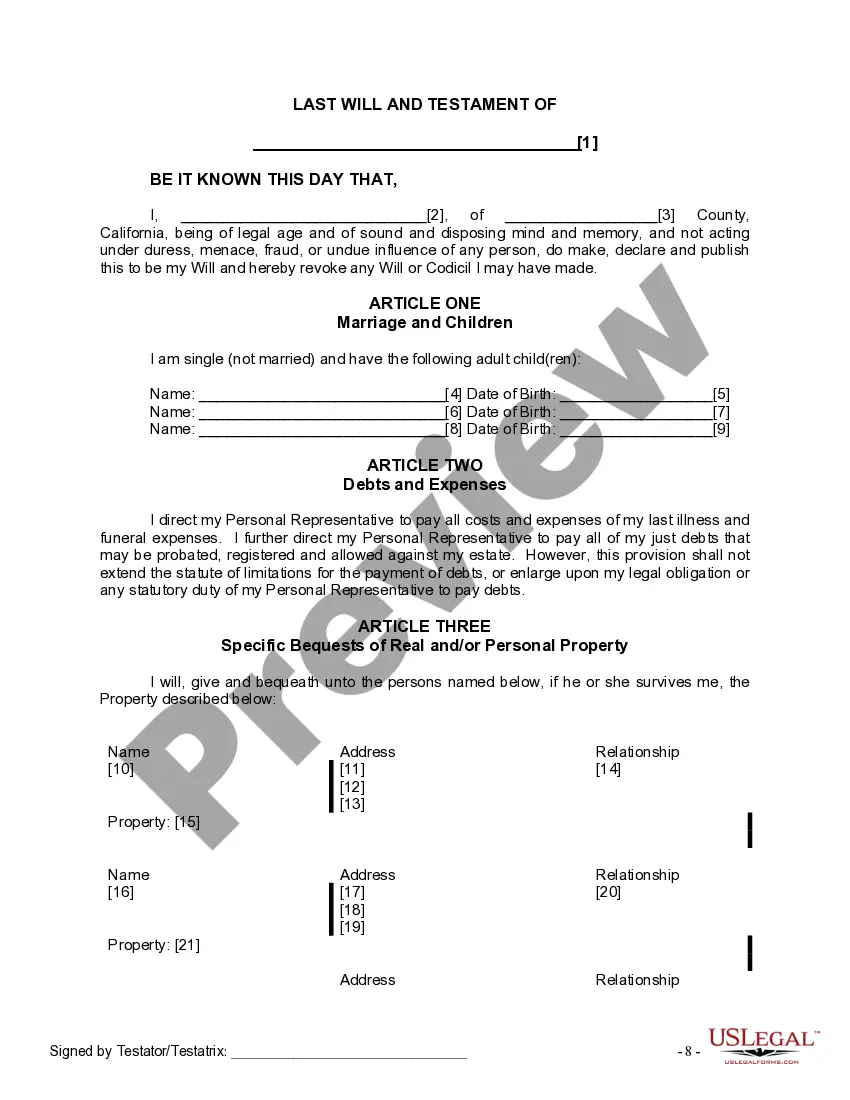

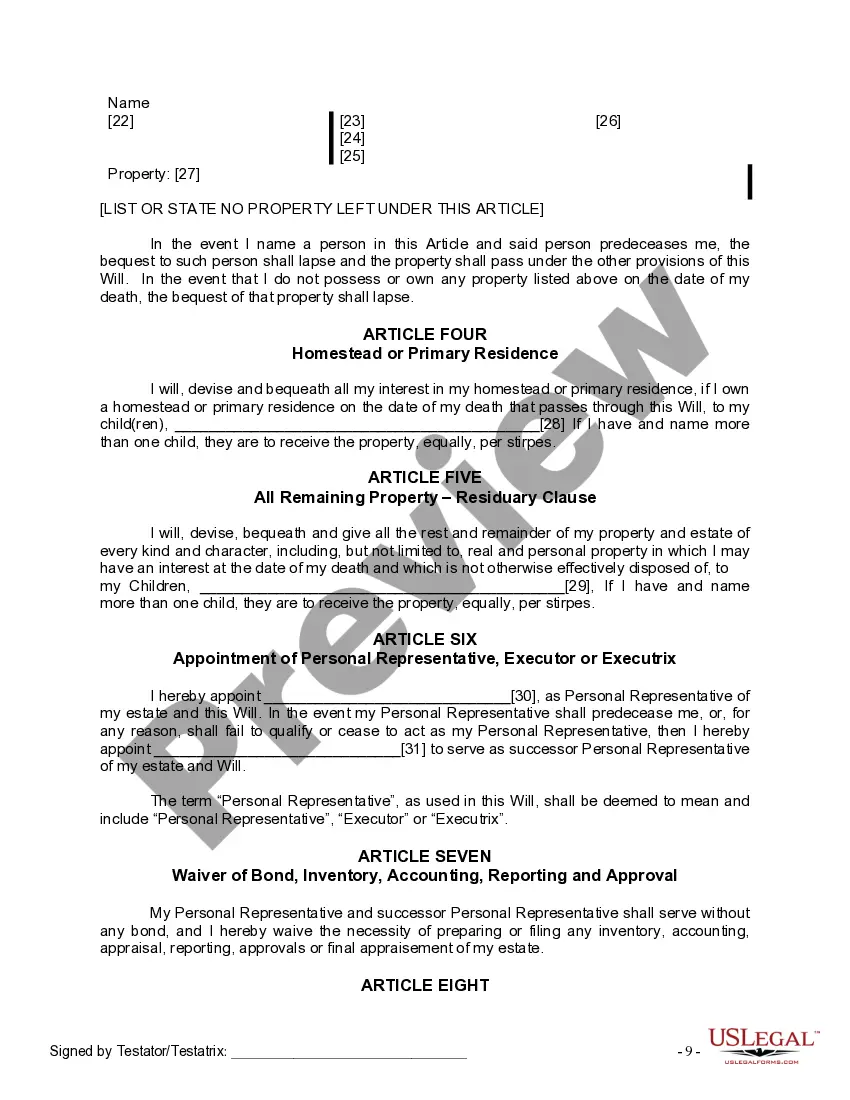

The Legal Last Will and Testament Form with Instructions you have found, is for a single person (never married) with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

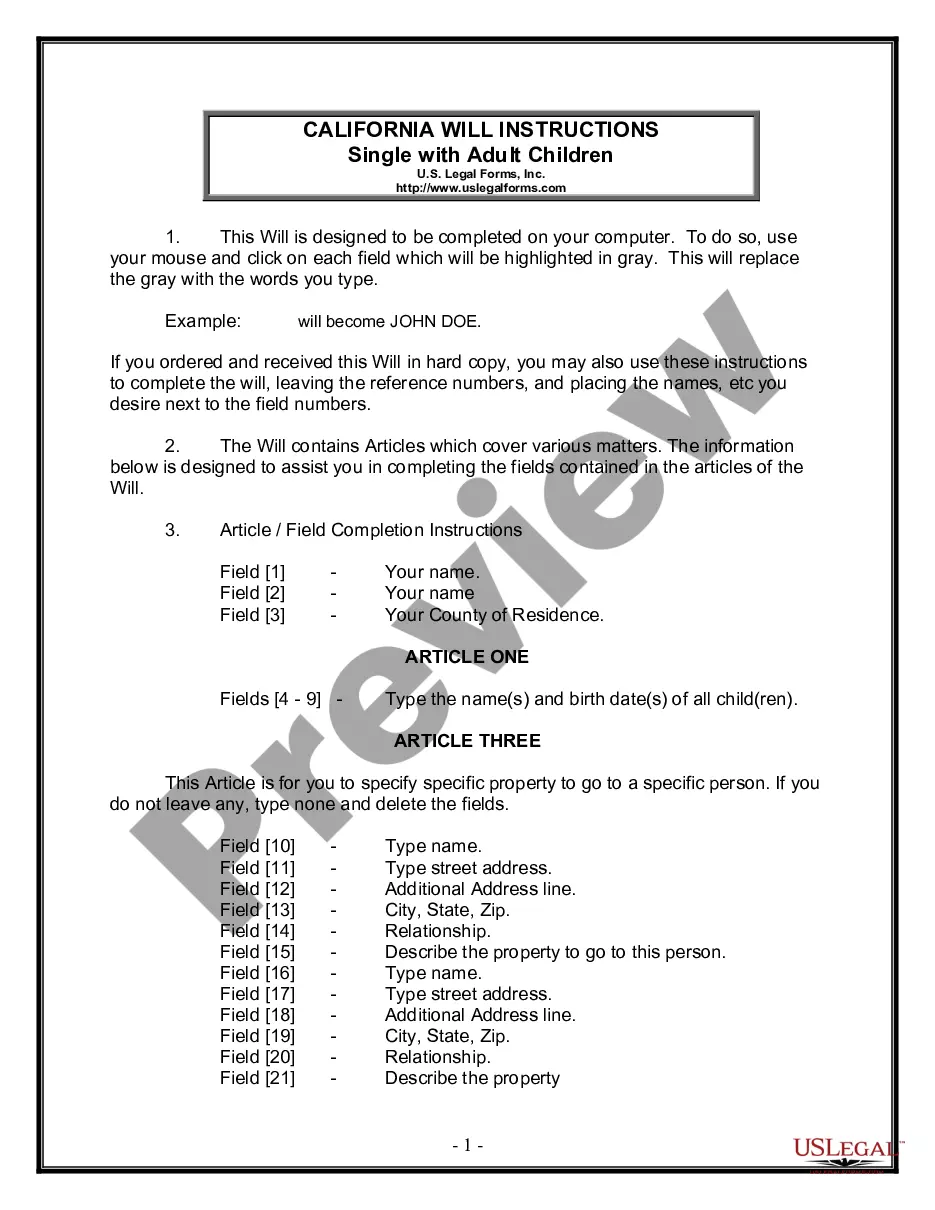

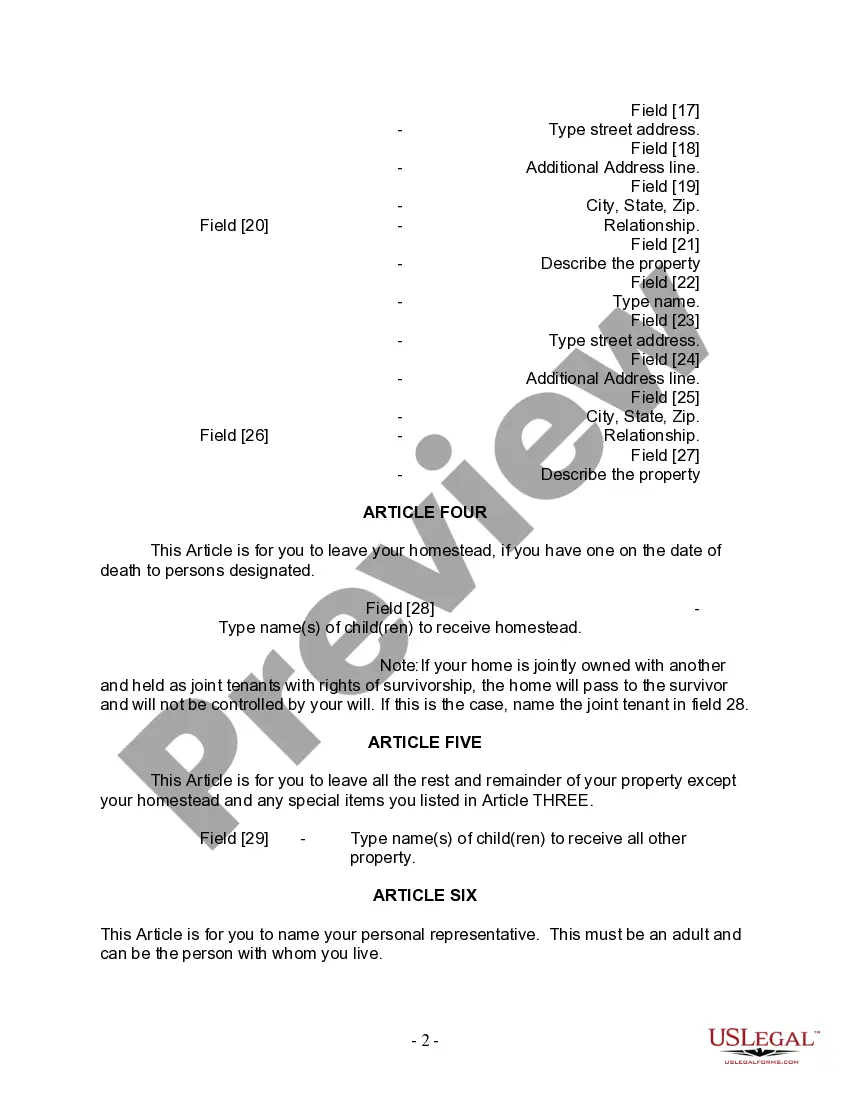

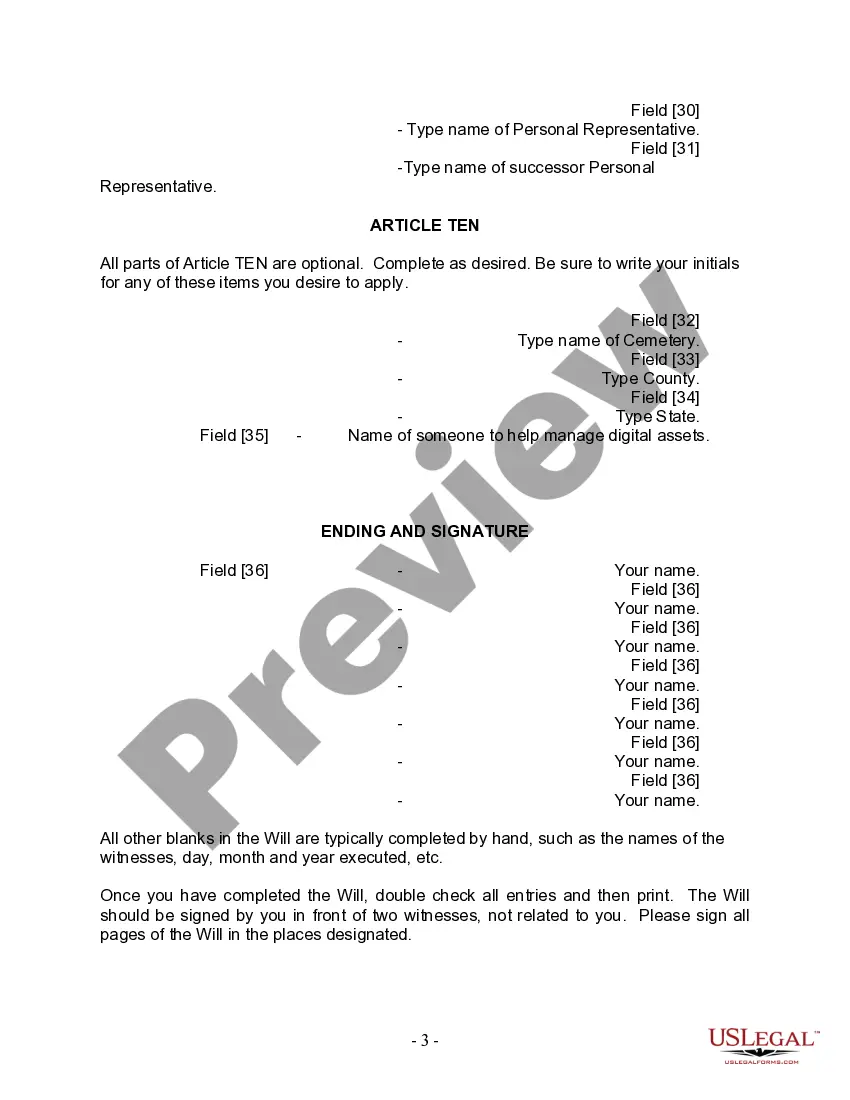

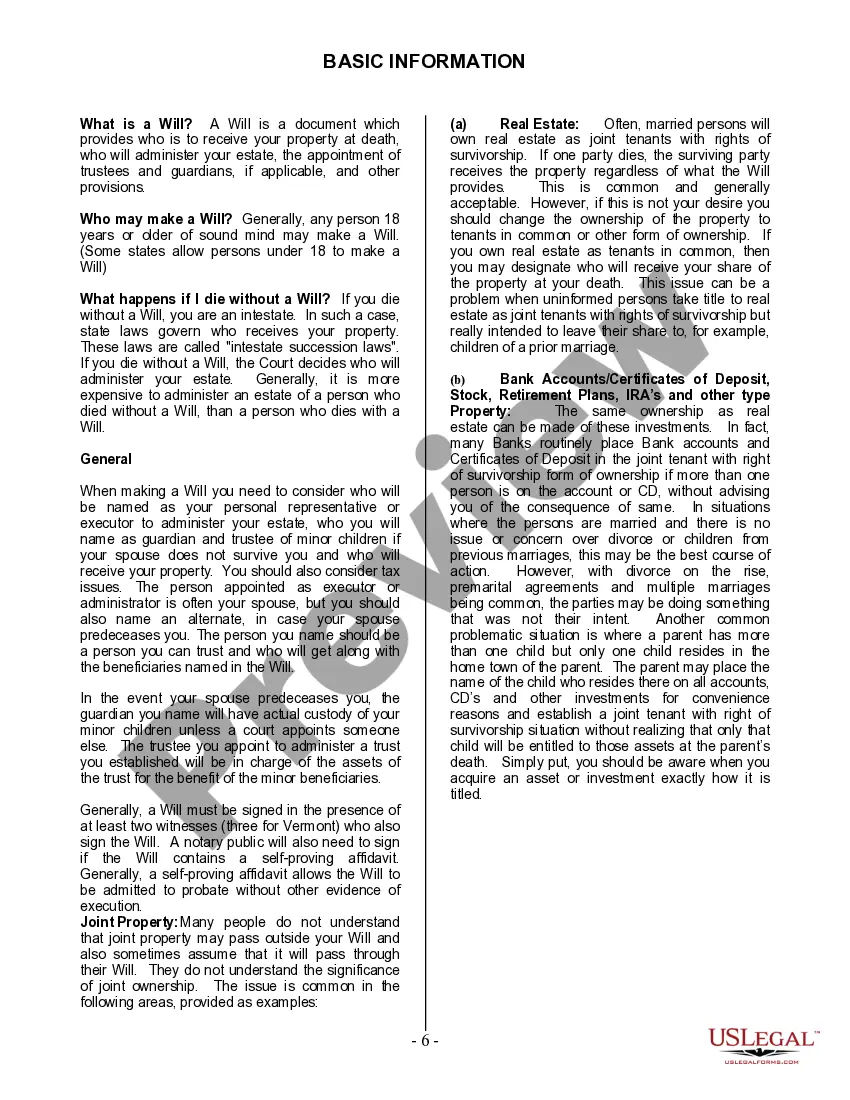

Title: Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children: An In-Depth Overview Introduction: An Inglewood California Legal Last Will and Testament Form serves as a vital legal document that ensures a single person's wishes regarding the distribution of their estate are honored after their demise. Specifically designed for individuals residing in Inglewood, California, who are single and have adult children, this comprehensive form offers a straightforward approach to estate planning. In case there are variations or specialized versions of this form, they are referred to as "Inglewood California Legal Last Will and Testament Forms for Single Persons with Adult Children." Key Elements of Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children: 1. Testator Information: The form collects important details about the testator, including their full legal name, residential address in Inglewood, California, and any identifications or relevant numbers required for authentication purposes. 2. Appointment of Executor(s): The testator has the privilege to designate an executor or multiple executors who will be responsible for handling the distribution of the estate as per the instructions outlined in the will. 3. Bequeathed of Assets: This section allows the testator to outline how their assets, such as real estate, finances, personal belongings, and investments, should be distributed among their adult children after their passing. 4. Appointment of Legal Guardianship: If the single person has dependent children, this section permits the testator to designate a legal guardian(s) to ensure the well-being and care of their minor children in the event of the testator's death. 5. Allocation of Debts and Taxes: The form also provides an opportunity for the testator to allocate the responsibility of any existing debts, outstanding taxes, or expenses, ensuring that their heirs will not face undue burdens. 6. Residual Clause: This clause enables the testator to specify how any remaining assets not explicitly mentioned in the will should be distributed among their adult children, miscellaneous beneficiaries, or charitable causes. 7. Alternate Beneficiaries: In the event that any named beneficiaries cannot inherit due to unforeseen circumstances, the form allows the testator to designate alternate beneficiaries as a backup plan. Variations or Specialized Versions: While the Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children primarily serves the specific needs mentioned above, there might be some variations or specialized versions available to account for additional circumstances, such as: 1. Inglewood California Legal Last Will and Testament Form for Single Person with Special Needs Dependent: Designed for testators who have an adult child with special needs, this specialized version provides additional provisions and instructions to ensure the continuous care and financial support of the dependent child. 2. Inglewood California Legal Last Will and Testament Form for Single Person with Complex Financial Assets: Tailored for individuals with intricate financial portfolios, this version caters to the specific requirements of distributing diverse assets like multiple properties, offshore investments, or business holdings among adult children. Conclusion: By utilizing the Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children, single individuals in Inglewood, California, can establish a legally binding document that protects their final wishes and safeguards their adult children's financial future. Whether it's the standard version or specialized variations, these forms provide peace of mind by ensuring that their assets are distributed according to their desires in a seamless and legally sound manner.Title: Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children: An In-Depth Overview Introduction: An Inglewood California Legal Last Will and Testament Form serves as a vital legal document that ensures a single person's wishes regarding the distribution of their estate are honored after their demise. Specifically designed for individuals residing in Inglewood, California, who are single and have adult children, this comprehensive form offers a straightforward approach to estate planning. In case there are variations or specialized versions of this form, they are referred to as "Inglewood California Legal Last Will and Testament Forms for Single Persons with Adult Children." Key Elements of Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children: 1. Testator Information: The form collects important details about the testator, including their full legal name, residential address in Inglewood, California, and any identifications or relevant numbers required for authentication purposes. 2. Appointment of Executor(s): The testator has the privilege to designate an executor or multiple executors who will be responsible for handling the distribution of the estate as per the instructions outlined in the will. 3. Bequeathed of Assets: This section allows the testator to outline how their assets, such as real estate, finances, personal belongings, and investments, should be distributed among their adult children after their passing. 4. Appointment of Legal Guardianship: If the single person has dependent children, this section permits the testator to designate a legal guardian(s) to ensure the well-being and care of their minor children in the event of the testator's death. 5. Allocation of Debts and Taxes: The form also provides an opportunity for the testator to allocate the responsibility of any existing debts, outstanding taxes, or expenses, ensuring that their heirs will not face undue burdens. 6. Residual Clause: This clause enables the testator to specify how any remaining assets not explicitly mentioned in the will should be distributed among their adult children, miscellaneous beneficiaries, or charitable causes. 7. Alternate Beneficiaries: In the event that any named beneficiaries cannot inherit due to unforeseen circumstances, the form allows the testator to designate alternate beneficiaries as a backup plan. Variations or Specialized Versions: While the Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children primarily serves the specific needs mentioned above, there might be some variations or specialized versions available to account for additional circumstances, such as: 1. Inglewood California Legal Last Will and Testament Form for Single Person with Special Needs Dependent: Designed for testators who have an adult child with special needs, this specialized version provides additional provisions and instructions to ensure the continuous care and financial support of the dependent child. 2. Inglewood California Legal Last Will and Testament Form for Single Person with Complex Financial Assets: Tailored for individuals with intricate financial portfolios, this version caters to the specific requirements of distributing diverse assets like multiple properties, offshore investments, or business holdings among adult children. Conclusion: By utilizing the Inglewood California Legal Last Will and Testament Form for Single Person with Adult Children, single individuals in Inglewood, California, can establish a legally binding document that protects their final wishes and safeguards their adult children's financial future. Whether it's the standard version or specialized variations, these forms provide peace of mind by ensuring that their assets are distributed according to their desires in a seamless and legally sound manner.