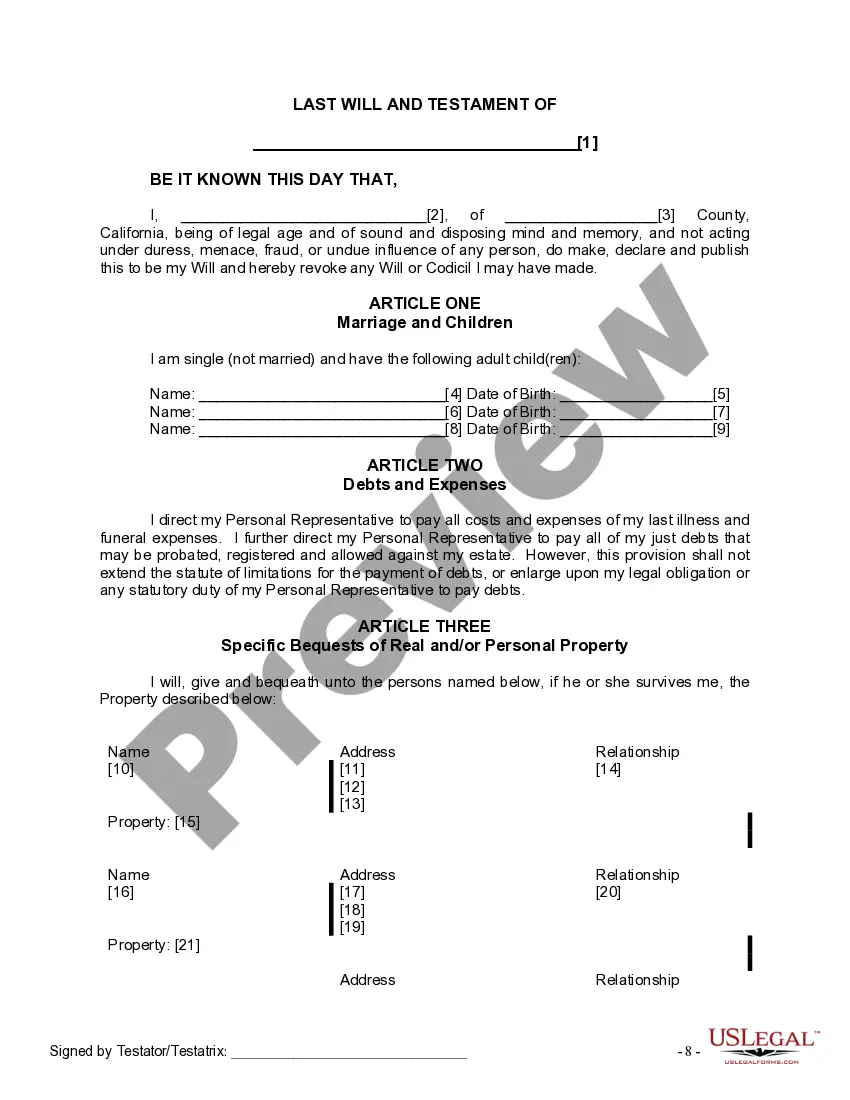

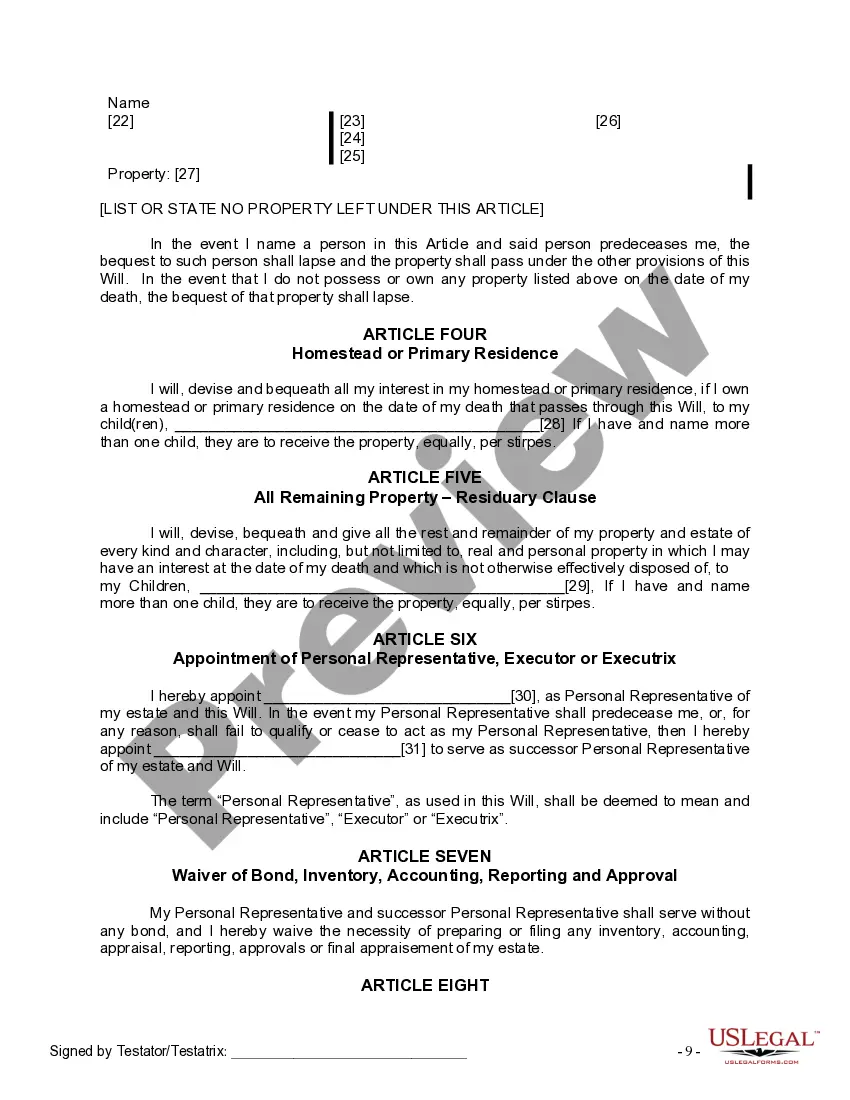

The Legal Last Will and Testament Form with Instructions you have found, is for a single person (never married) with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

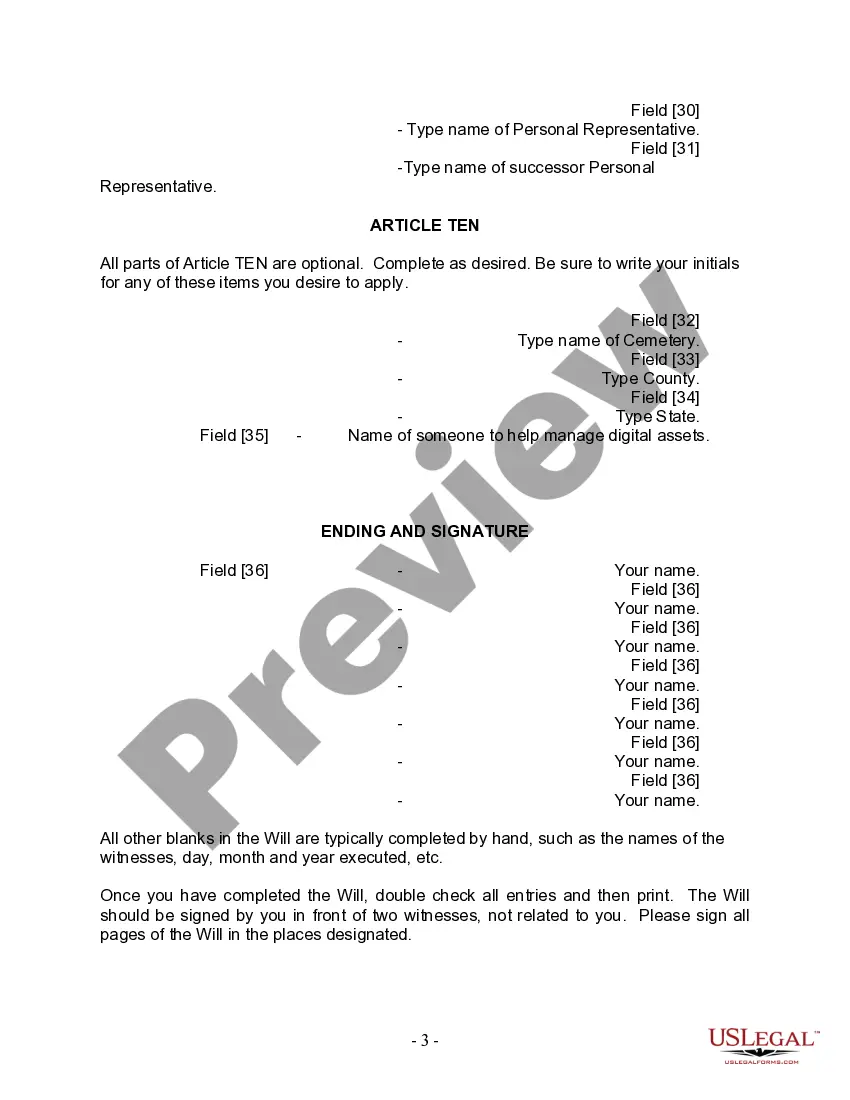

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

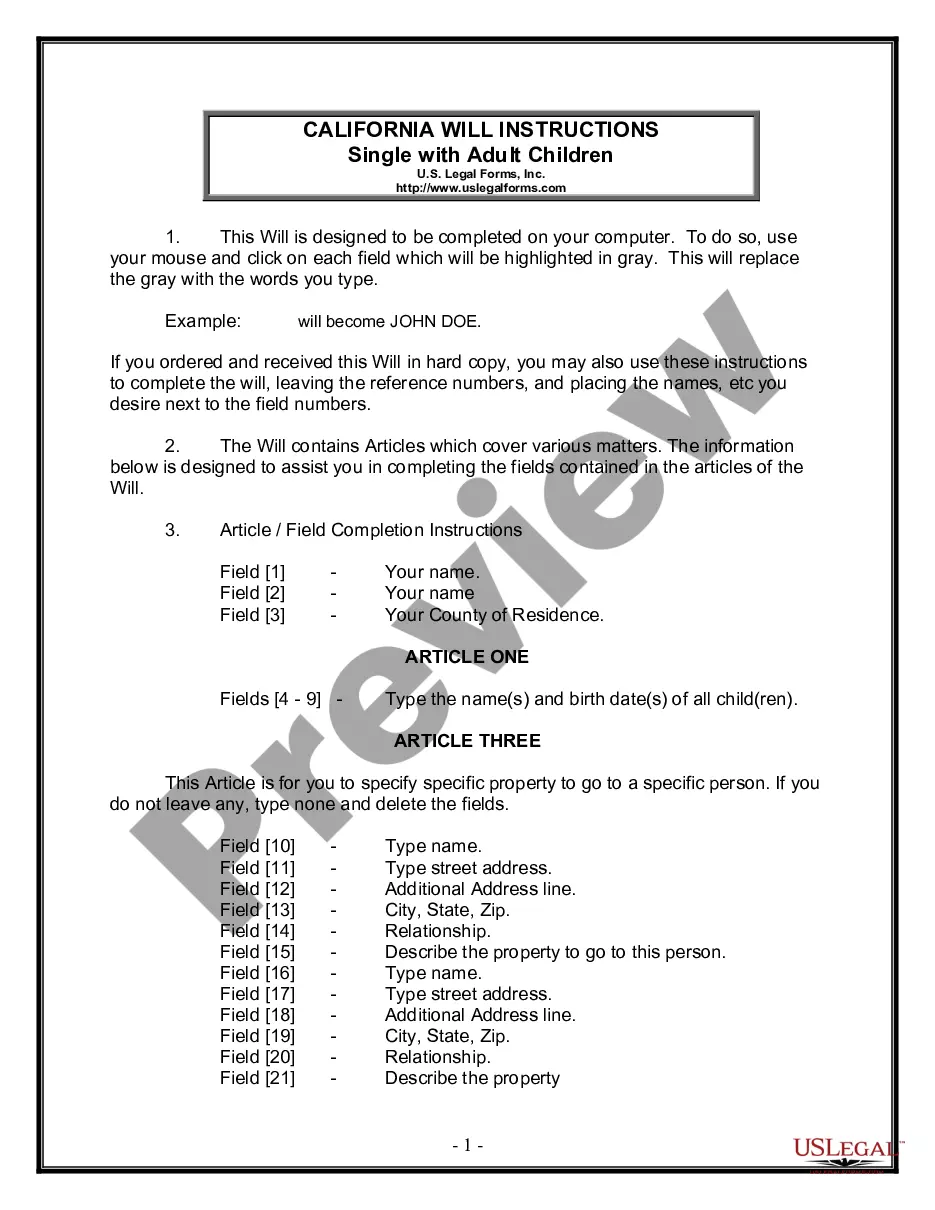

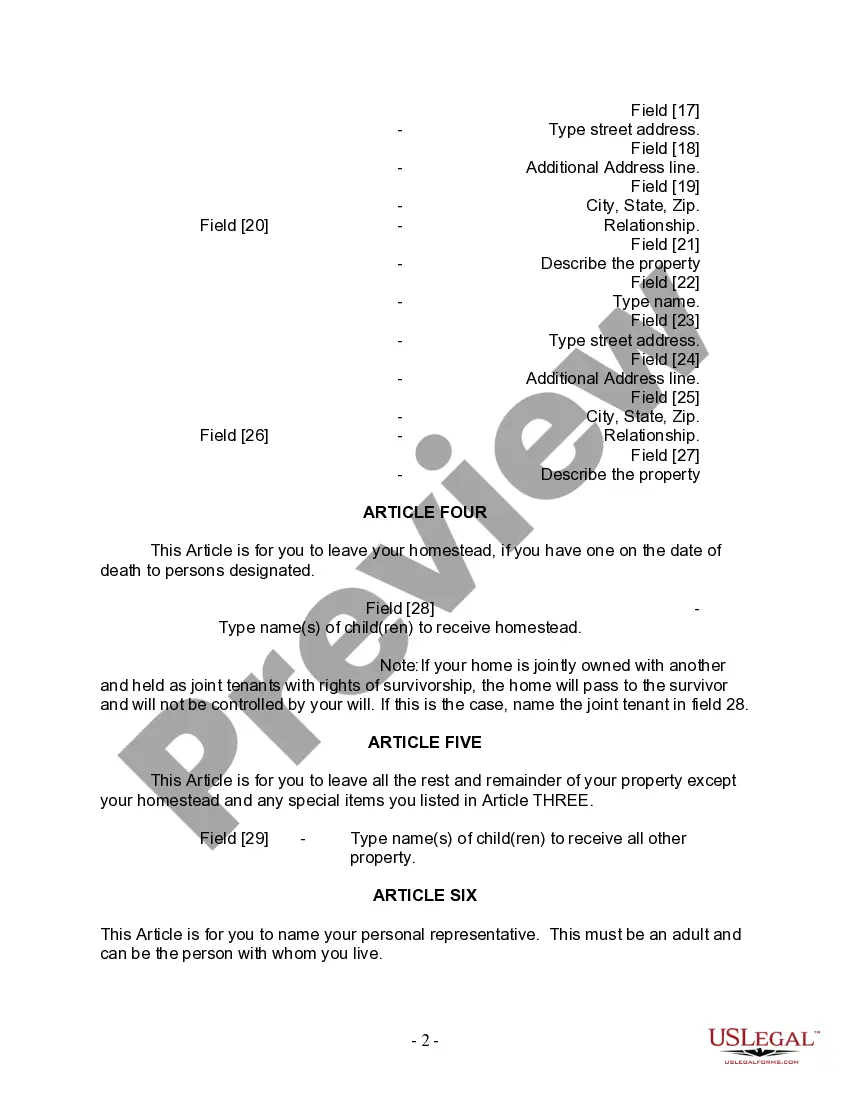

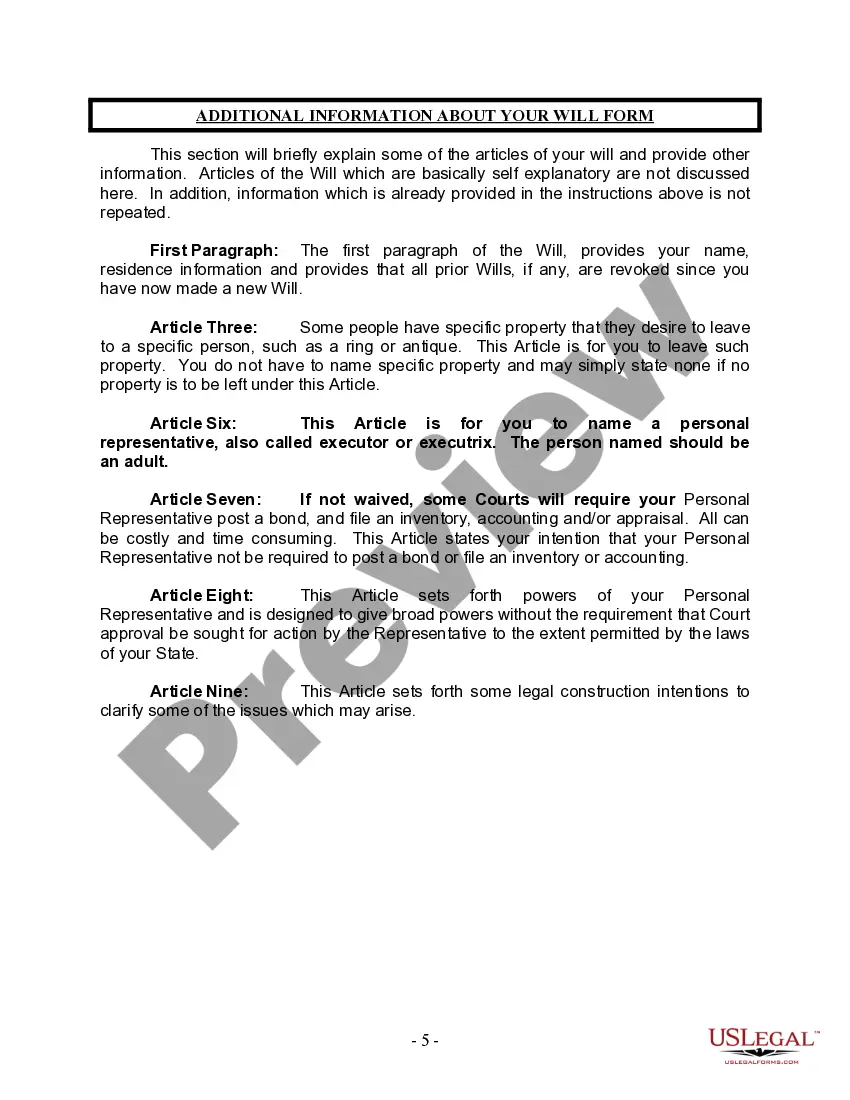

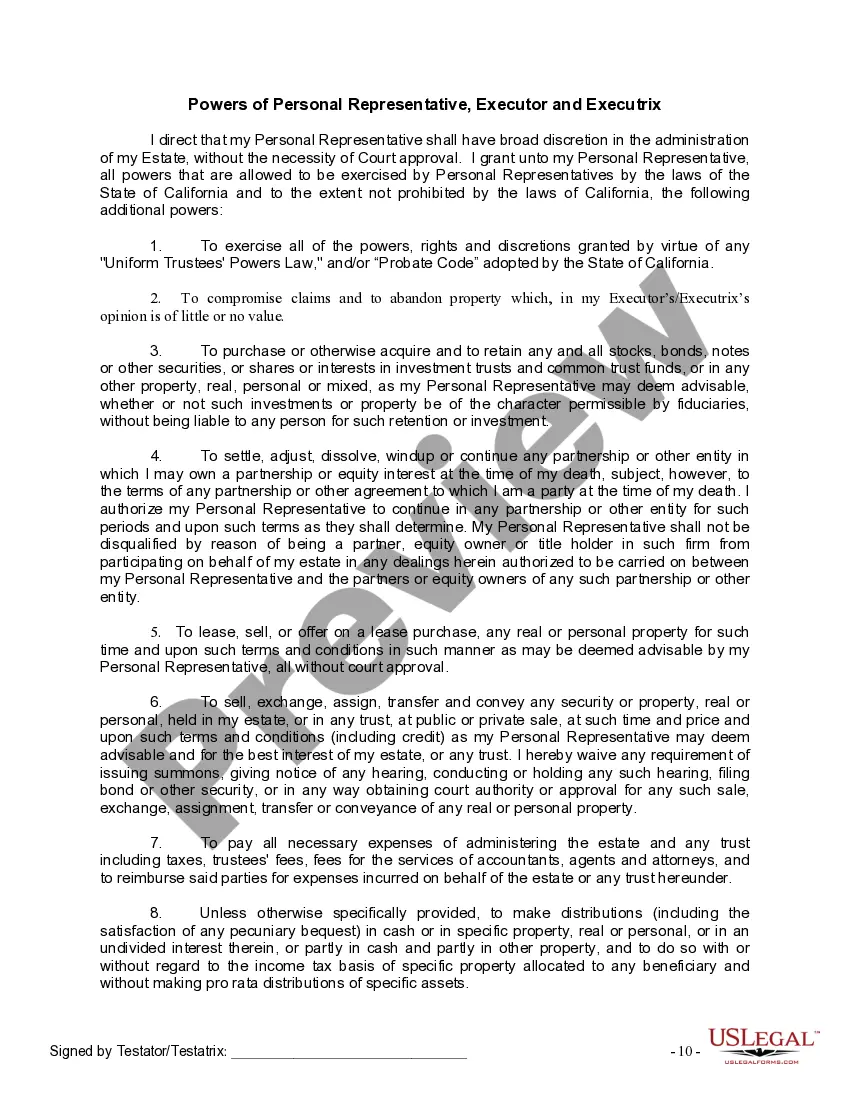

A Norwalk California Legal Last Will and Testament Form for Single Person with Adult Children is a legally binding document that allows individuals residing in Norwalk, California, to outline their final wishes regarding the distribution of their assets and the guardianship of their children upon their passing. This form is custom-tailored for individuals who are not married and have adult children. The Norwalk California Legal Last Will and Testament Form for Single Person with Adult Children serves as a comprehensive estate planning tool, ensuring that your assets are passed down according to your preferences while minimizing potential conflicts among your adult children. By clearly expressing your intentions, you can help prevent any legal disputes that may arise after your death. Key elements usually included in this form are: 1. Introduction: This section provides an overview of the document, stating that it is your official last will and testament and that it revokes any previous wills or codicils. 2. Appointment of Executor: You can name a trusted person, known as the executor, to carry out the instructions outlined in the will. The executor is responsible for managing your estate, paying off debts, and distributing assets to your beneficiaries. 3. Beneficiaries: List the names of your adult children who will inherit your assets. You can allocate specific amounts or assets to each child individually or equally. 4. Guardianship: If you have minor children or dependent adults, you can specify who you would like to appoint as their legal guardians, ensuring their care and well-being. 5. Funeral Arrangements: Although not legally binding, you can include instructions about your preferred funeral or burial arrangements to guide your family members during an emotional time. 6. Debts and Taxes: This section clarifies that your estate's debts and taxes should be settled using your assets before distributing them to the beneficiaries. 7. Residual Estate: If there are any remaining assets after settling debts and distributing specific gifts, you can specify how these residual assets should be allocated, such as charity donations or distributing them equally among your adult children. It is important to note that there may be variations of the Norwalk California Legal Last Will and Testament Forms for Single Person with Adult Children that are specific to different law firms or estate planning services. However, the content and purpose of these forms will generally remain consistent, serving as the foundation for outlining your final instructions and ensuring a smooth transition of your estate to your loved ones.A Norwalk California Legal Last Will and Testament Form for Single Person with Adult Children is a legally binding document that allows individuals residing in Norwalk, California, to outline their final wishes regarding the distribution of their assets and the guardianship of their children upon their passing. This form is custom-tailored for individuals who are not married and have adult children. The Norwalk California Legal Last Will and Testament Form for Single Person with Adult Children serves as a comprehensive estate planning tool, ensuring that your assets are passed down according to your preferences while minimizing potential conflicts among your adult children. By clearly expressing your intentions, you can help prevent any legal disputes that may arise after your death. Key elements usually included in this form are: 1. Introduction: This section provides an overview of the document, stating that it is your official last will and testament and that it revokes any previous wills or codicils. 2. Appointment of Executor: You can name a trusted person, known as the executor, to carry out the instructions outlined in the will. The executor is responsible for managing your estate, paying off debts, and distributing assets to your beneficiaries. 3. Beneficiaries: List the names of your adult children who will inherit your assets. You can allocate specific amounts or assets to each child individually or equally. 4. Guardianship: If you have minor children or dependent adults, you can specify who you would like to appoint as their legal guardians, ensuring their care and well-being. 5. Funeral Arrangements: Although not legally binding, you can include instructions about your preferred funeral or burial arrangements to guide your family members during an emotional time. 6. Debts and Taxes: This section clarifies that your estate's debts and taxes should be settled using your assets before distributing them to the beneficiaries. 7. Residual Estate: If there are any remaining assets after settling debts and distributing specific gifts, you can specify how these residual assets should be allocated, such as charity donations or distributing them equally among your adult children. It is important to note that there may be variations of the Norwalk California Legal Last Will and Testament Forms for Single Person with Adult Children that are specific to different law firms or estate planning services. However, the content and purpose of these forms will generally remain consistent, serving as the foundation for outlining your final instructions and ensuring a smooth transition of your estate to your loved ones.