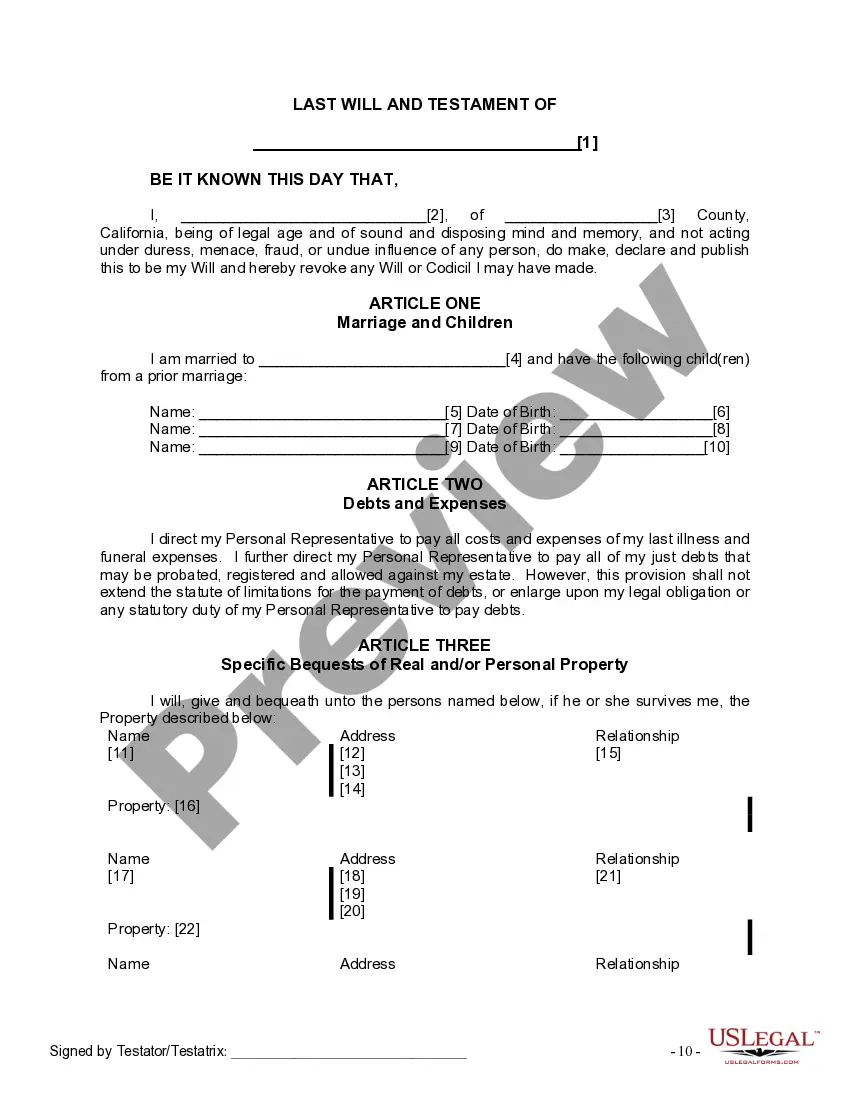

The Will you have found is for a married person with minor children from a prior marriage. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Thousand Oaks California Legal Last Will and Testament for Married person with Minor Children from Prior Marriage is a legal document that helps married individuals with minor children from a previous marriage ensure their assets and the well-being of their children are protected after their passing. This type of will is crucial for individuals residing in Thousand Oaks, California, who want to tailor their estate plan to meet their specific needs and address the complexities that arise from blended families. Here are some common components and considerations found in a Thousand Oaks California Legal Last Will and Testament for Married person with Minor Children from Prior Marriage: 1. Asset Distribution: This will outlines how the assets, including real estate, bank accounts, investments, and personal belongings, will be distributed among the surviving spouse and the children from the prior marriage. 2. Guardianship of Minor Children: The will allows you to appoint a guardian to take care of the minor children if both parents pass away. It is essential to consider the relationship between the new spouse, the children, and potential guardians to ensure the children's best interests are met. 3. Trusts and Trustee: In cases where minor children inherit significant assets, establishing trusts can protect the assets until they reach a certain age or milestone. The will allows the appointment of a trustee who will manage the trust and make financial decisions on behalf of the minor children. 4. Health Care Proxies: This document allows you to designate someone to make medical decisions on your behalf if you become incapacitated. It is crucial to update these proxies to reflect your current spouse and ensure they understand your wishes. 5. Power of Attorney: A power of attorney designates someone to handle financial and legal matters on your behalf if you become incapacitated. Appointing the appropriate person can help ensure the well-being of your children and the efficient management of your assets. Different variations or subtypes of Thousand Oaks California Legal Last Will and Testament for Married person with Minor Children from Prior Marriage may include: 1. Joint Will: This type of will is created and executed by a married couple as a single document. It outlines the distribution of assets and guardianship of minor children, typically in favor of the surviving spouse. 2. Mirror Will: A mirror will refer to when a married couple creates separate wills but includes almost identical terms, respecting mutual agreements regarding asset distribution and child guardianship. 3. Testamentary Trust Will: A testamentary trust will often is used in cases of substantial assets or complex family dynamics. It establishes separate trusts within the will itself, ensuring proper management and distribution of assets for the minor children from the prior marriage. By consulting with an experienced estate planning attorney in Thousand Oaks, California, you can customize your Last Will and Testament to meet your specific requirements. Legal professionals can help navigate the intricacies involved in blending families, ensuring your wishes are accurately documented, and providing peace of mind for both you and your loved ones.Thousand Oaks California Legal Last Will and Testament for Married person with Minor Children from Prior Marriage is a legal document that helps married individuals with minor children from a previous marriage ensure their assets and the well-being of their children are protected after their passing. This type of will is crucial for individuals residing in Thousand Oaks, California, who want to tailor their estate plan to meet their specific needs and address the complexities that arise from blended families. Here are some common components and considerations found in a Thousand Oaks California Legal Last Will and Testament for Married person with Minor Children from Prior Marriage: 1. Asset Distribution: This will outlines how the assets, including real estate, bank accounts, investments, and personal belongings, will be distributed among the surviving spouse and the children from the prior marriage. 2. Guardianship of Minor Children: The will allows you to appoint a guardian to take care of the minor children if both parents pass away. It is essential to consider the relationship between the new spouse, the children, and potential guardians to ensure the children's best interests are met. 3. Trusts and Trustee: In cases where minor children inherit significant assets, establishing trusts can protect the assets until they reach a certain age or milestone. The will allows the appointment of a trustee who will manage the trust and make financial decisions on behalf of the minor children. 4. Health Care Proxies: This document allows you to designate someone to make medical decisions on your behalf if you become incapacitated. It is crucial to update these proxies to reflect your current spouse and ensure they understand your wishes. 5. Power of Attorney: A power of attorney designates someone to handle financial and legal matters on your behalf if you become incapacitated. Appointing the appropriate person can help ensure the well-being of your children and the efficient management of your assets. Different variations or subtypes of Thousand Oaks California Legal Last Will and Testament for Married person with Minor Children from Prior Marriage may include: 1. Joint Will: This type of will is created and executed by a married couple as a single document. It outlines the distribution of assets and guardianship of minor children, typically in favor of the surviving spouse. 2. Mirror Will: A mirror will refer to when a married couple creates separate wills but includes almost identical terms, respecting mutual agreements regarding asset distribution and child guardianship. 3. Testamentary Trust Will: A testamentary trust will often is used in cases of substantial assets or complex family dynamics. It establishes separate trusts within the will itself, ensuring proper management and distribution of assets for the minor children from the prior marriage. By consulting with an experienced estate planning attorney in Thousand Oaks, California, you can customize your Last Will and Testament to meet your specific requirements. Legal professionals can help navigate the intricacies involved in blending families, ensuring your wishes are accurately documented, and providing peace of mind for both you and your loved ones.