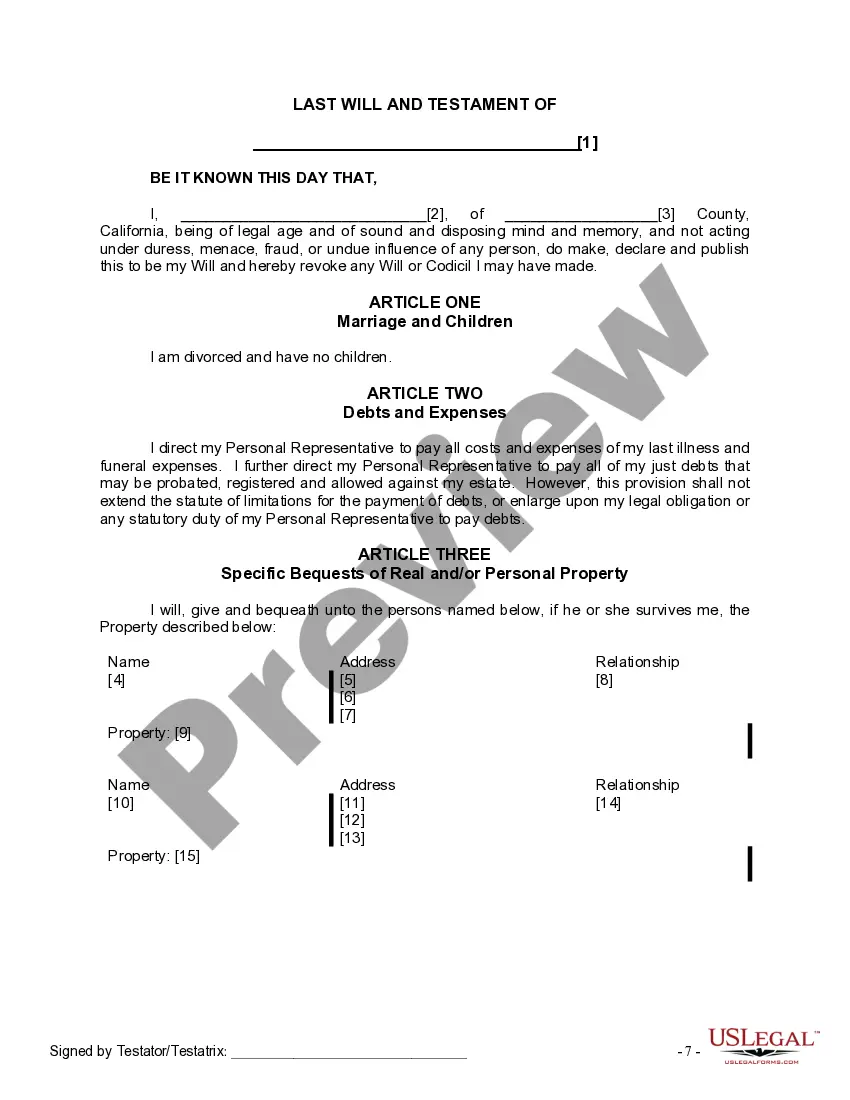

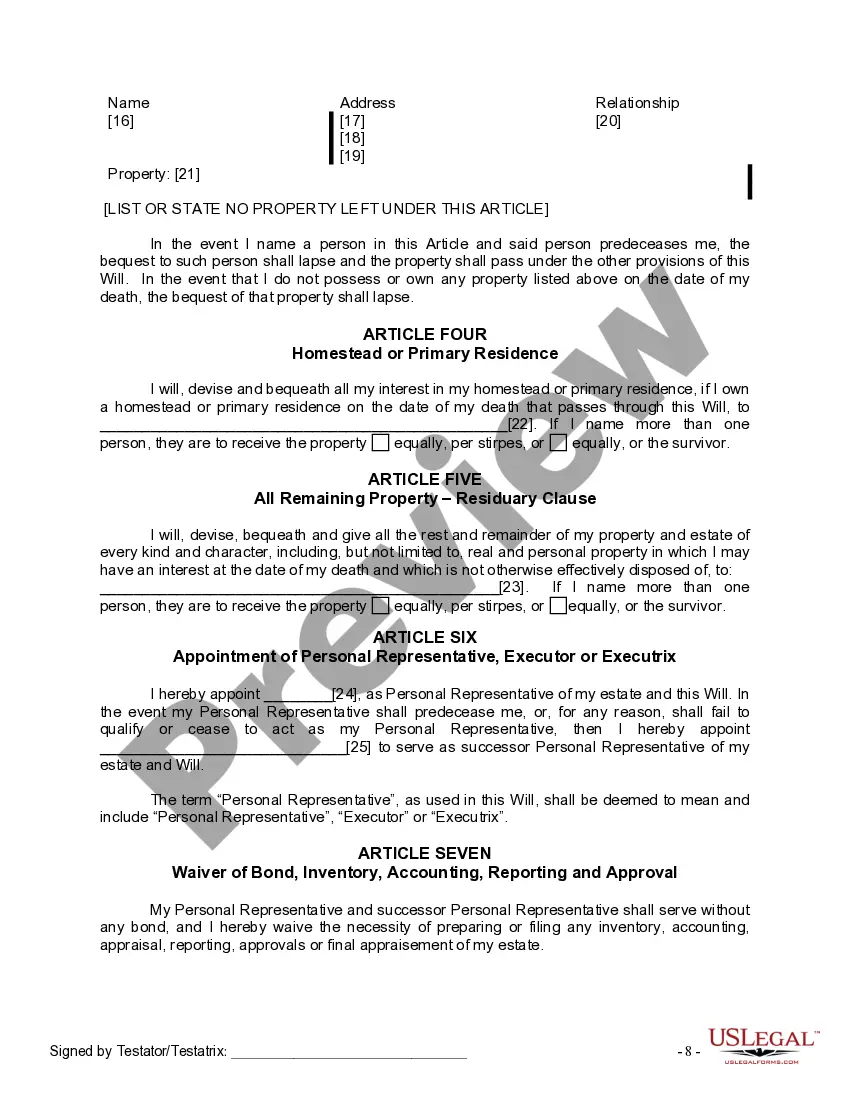

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

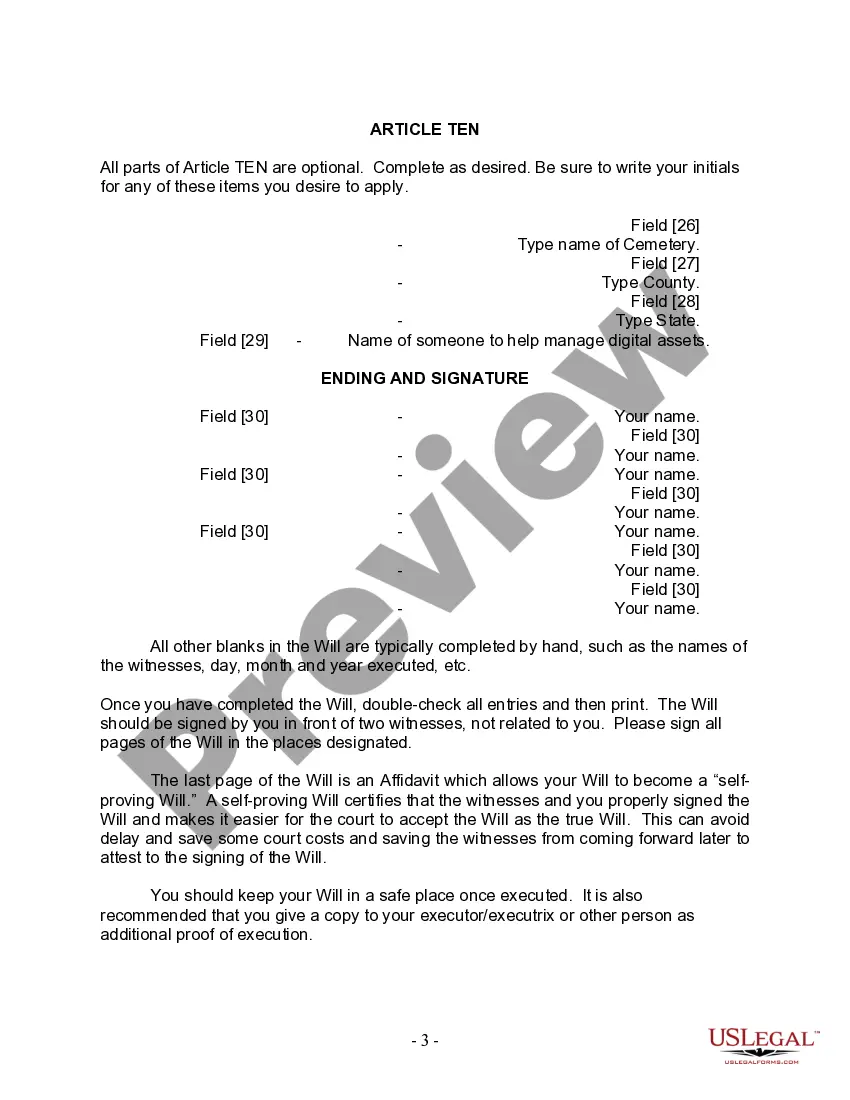

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

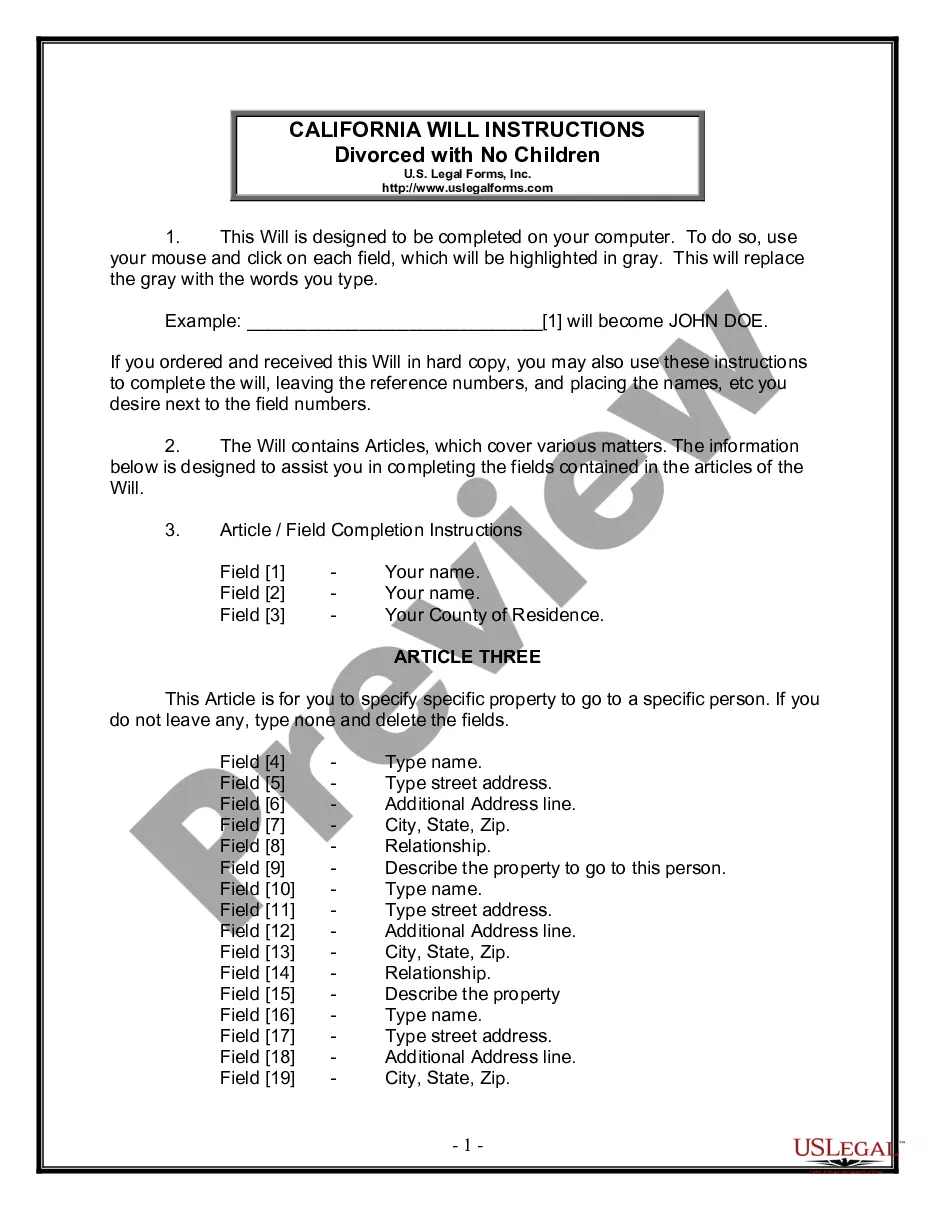

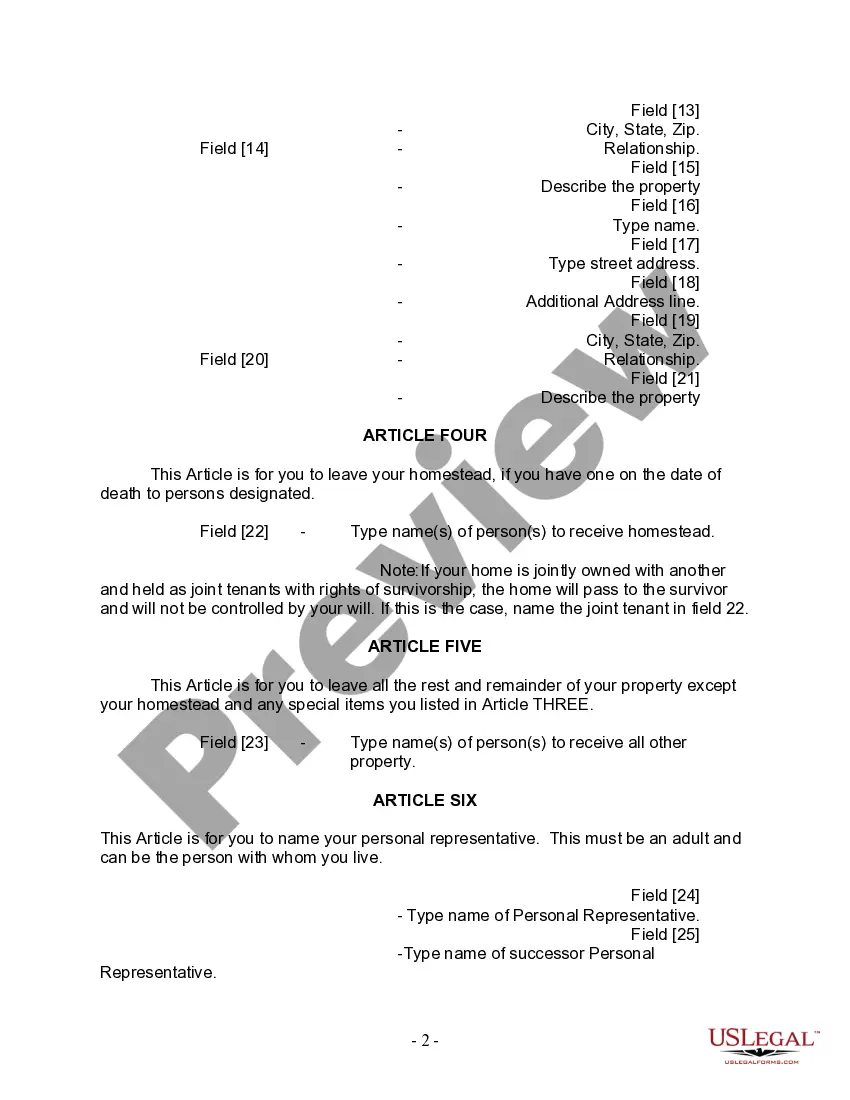

Escondido California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced, not remarried, and have no children to outline their wishes regarding the distribution of their assets and property after their demise. This specific form caters to the unique circumstances of this demographic, ensuring that their desires are clearly defined and legally enforceable. By utilizing the Escondido California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, individuals can exercise control over their estate and avoid potential disputes that may arise among family members or other interested parties. This document is designed to accommodate the specific needs and preferences of divorced individuals who have not remarried and do not have any children. Some key components that may be covered in this form include: 1. Appointment of an Executor: The form allows individuals to name an executor who will be responsible for administering the estate. This person should be trustworthy and capable of handling the necessary legal and financial matters after the individual's death. 2. Distribution of Assets: This form enables the individual to specify how their assets, such as real estate, bank accounts, investments, personal belongings, and any other property they own, should be distributed after their passing. Detailed instructions can be included to ensure that the named beneficiaries receive the intended shares or items. 3. Charitable Bequests: The form also provides an opportunity for the individual to allocate a portion of their estate or specific assets to charitable organizations, causes, or foundations close to their heart. 4. Alternate Beneficiaries: In case the primary beneficiaries mentioned in the will are unable to inherit the assets for any reason, this form allows for the appointment of alternative beneficiaries. This ensures that the estate is assigned to intended recipients in all possible scenarios. It is important to note that while this description focuses on the Escondido California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, there may be additional variations or alternatives available to cater to different circumstances or legal preferences. Individuals are advised to consult with an attorney or seek professional guidance to determine the most suitable legal form for their specific situation.Escondido California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced, not remarried, and have no children to outline their wishes regarding the distribution of their assets and property after their demise. This specific form caters to the unique circumstances of this demographic, ensuring that their desires are clearly defined and legally enforceable. By utilizing the Escondido California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, individuals can exercise control over their estate and avoid potential disputes that may arise among family members or other interested parties. This document is designed to accommodate the specific needs and preferences of divorced individuals who have not remarried and do not have any children. Some key components that may be covered in this form include: 1. Appointment of an Executor: The form allows individuals to name an executor who will be responsible for administering the estate. This person should be trustworthy and capable of handling the necessary legal and financial matters after the individual's death. 2. Distribution of Assets: This form enables the individual to specify how their assets, such as real estate, bank accounts, investments, personal belongings, and any other property they own, should be distributed after their passing. Detailed instructions can be included to ensure that the named beneficiaries receive the intended shares or items. 3. Charitable Bequests: The form also provides an opportunity for the individual to allocate a portion of their estate or specific assets to charitable organizations, causes, or foundations close to their heart. 4. Alternate Beneficiaries: In case the primary beneficiaries mentioned in the will are unable to inherit the assets for any reason, this form allows for the appointment of alternative beneficiaries. This ensures that the estate is assigned to intended recipients in all possible scenarios. It is important to note that while this description focuses on the Escondido California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, there may be additional variations or alternatives available to cater to different circumstances or legal preferences. Individuals are advised to consult with an attorney or seek professional guidance to determine the most suitable legal form for their specific situation.