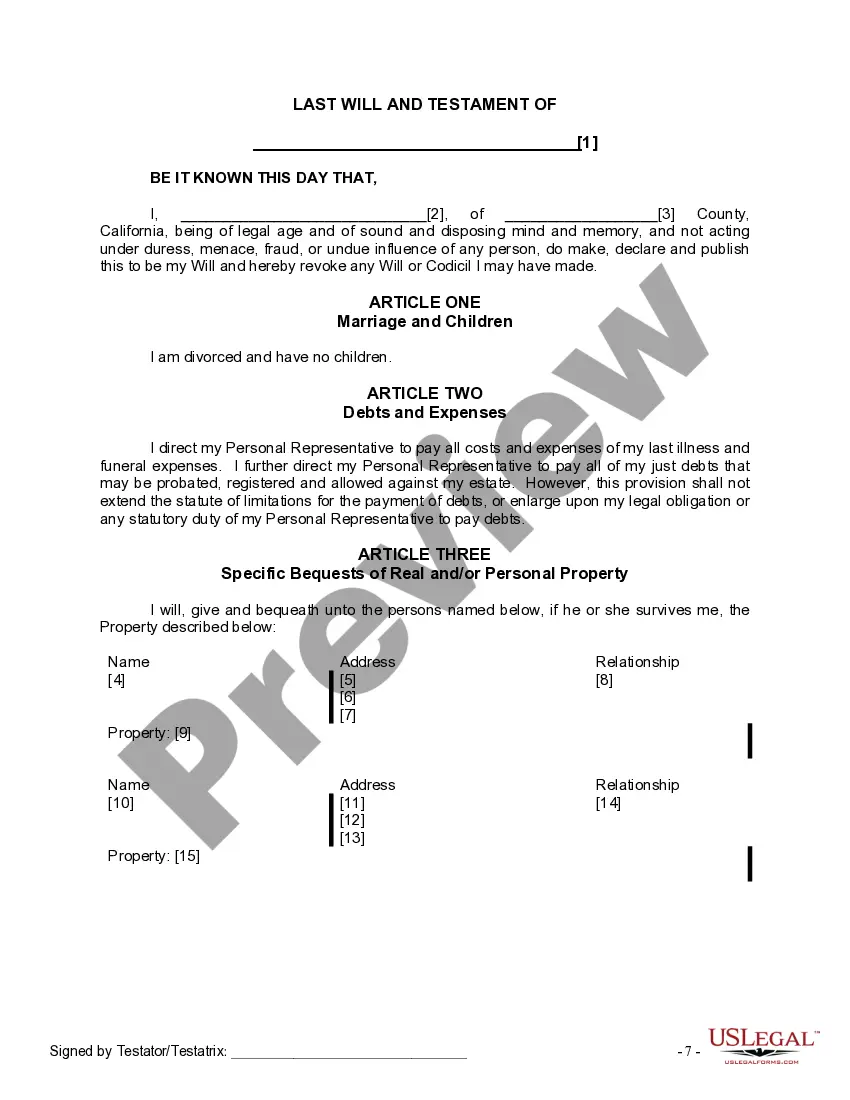

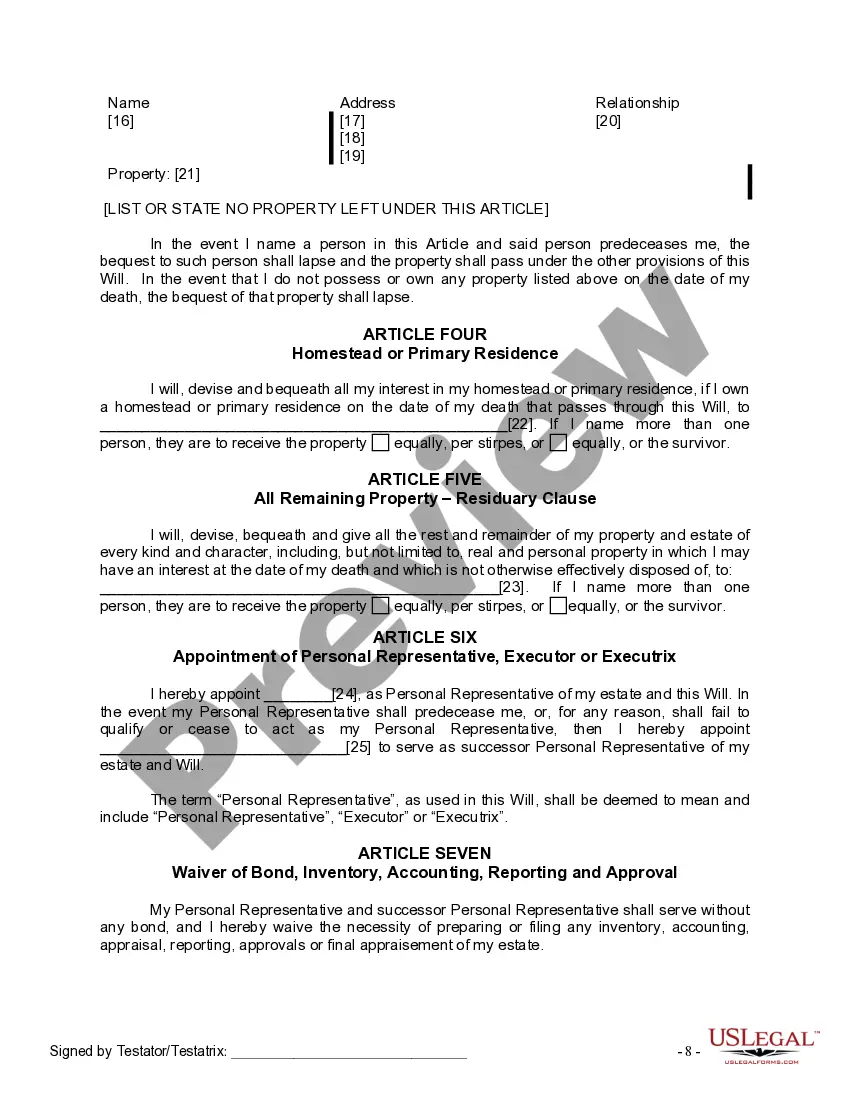

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

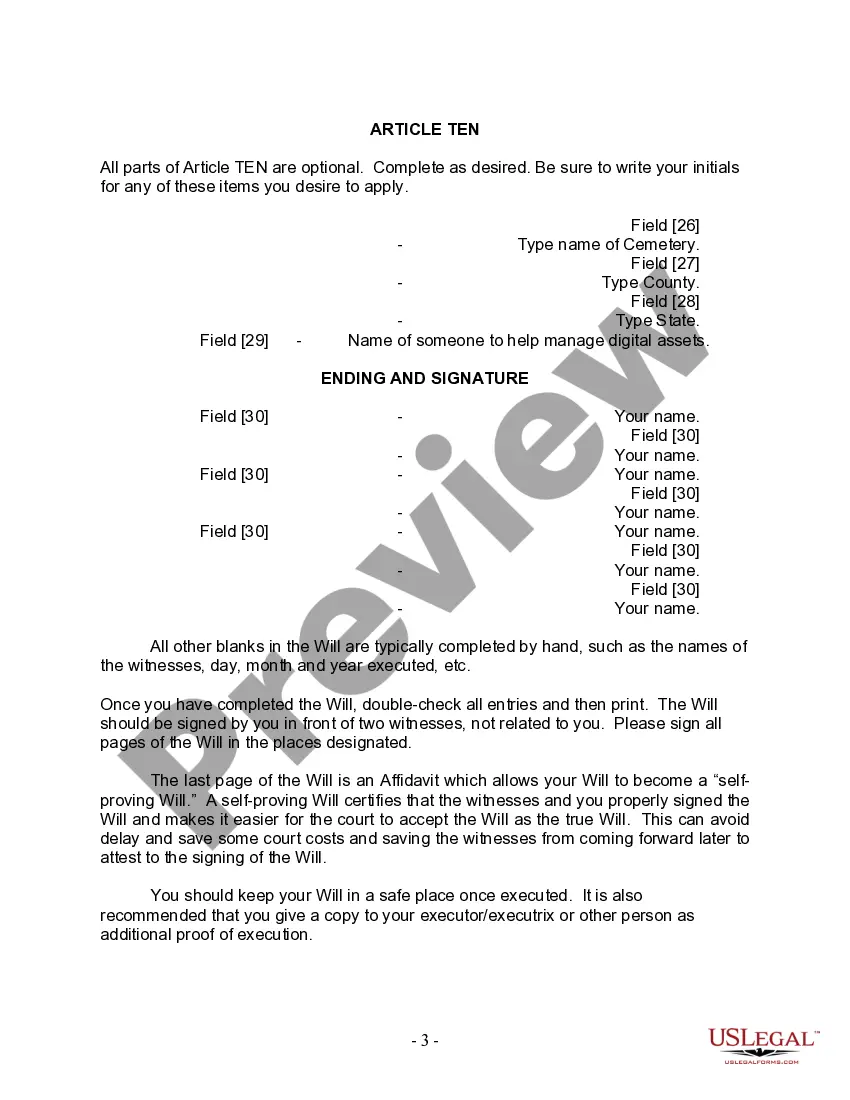

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

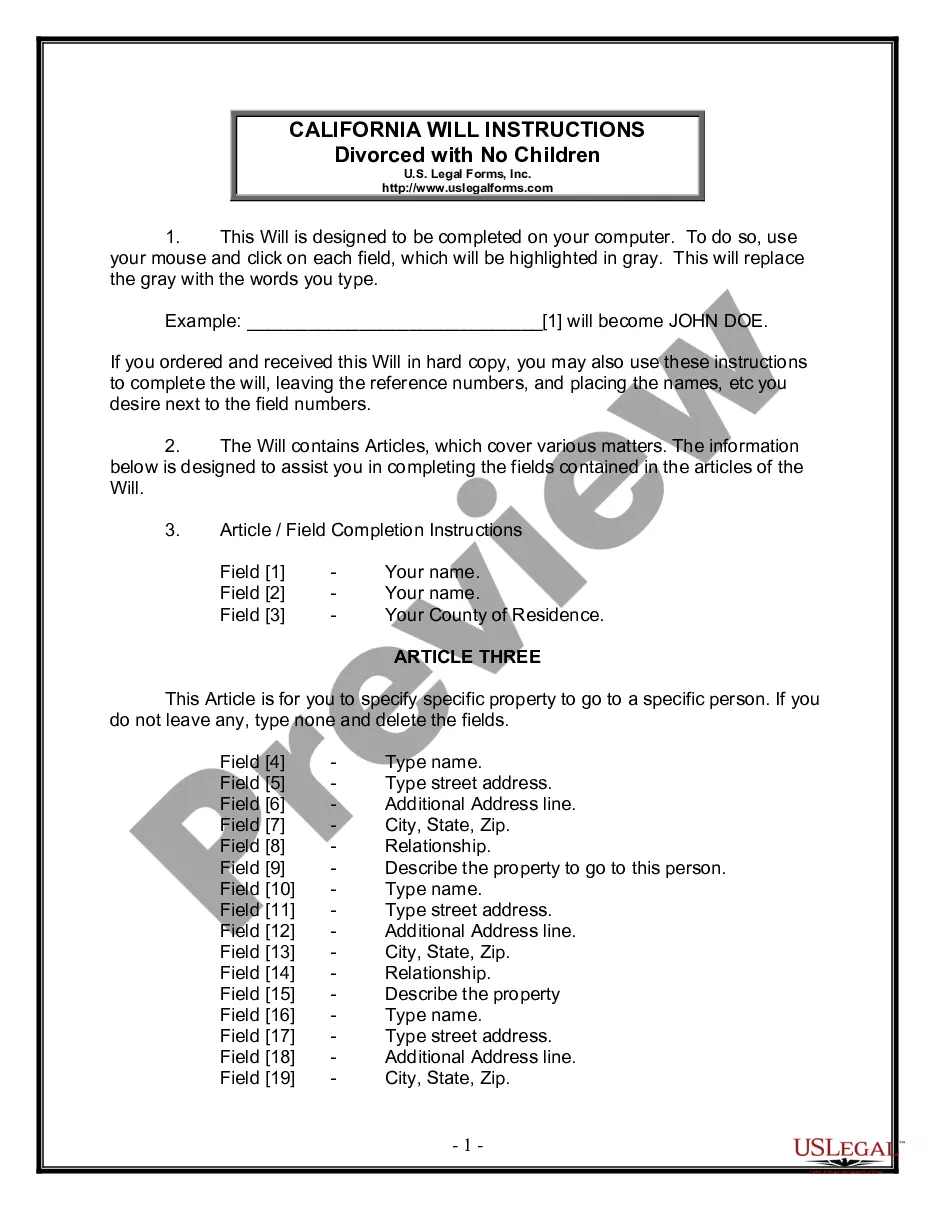

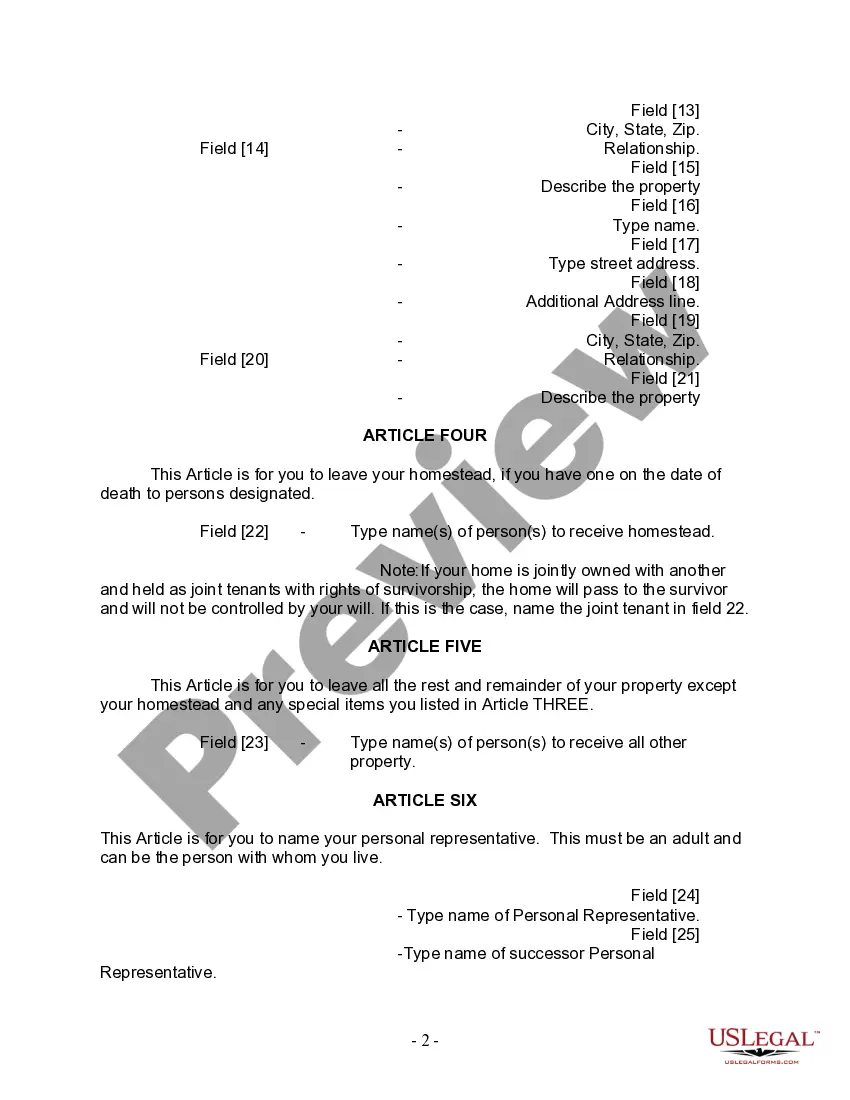

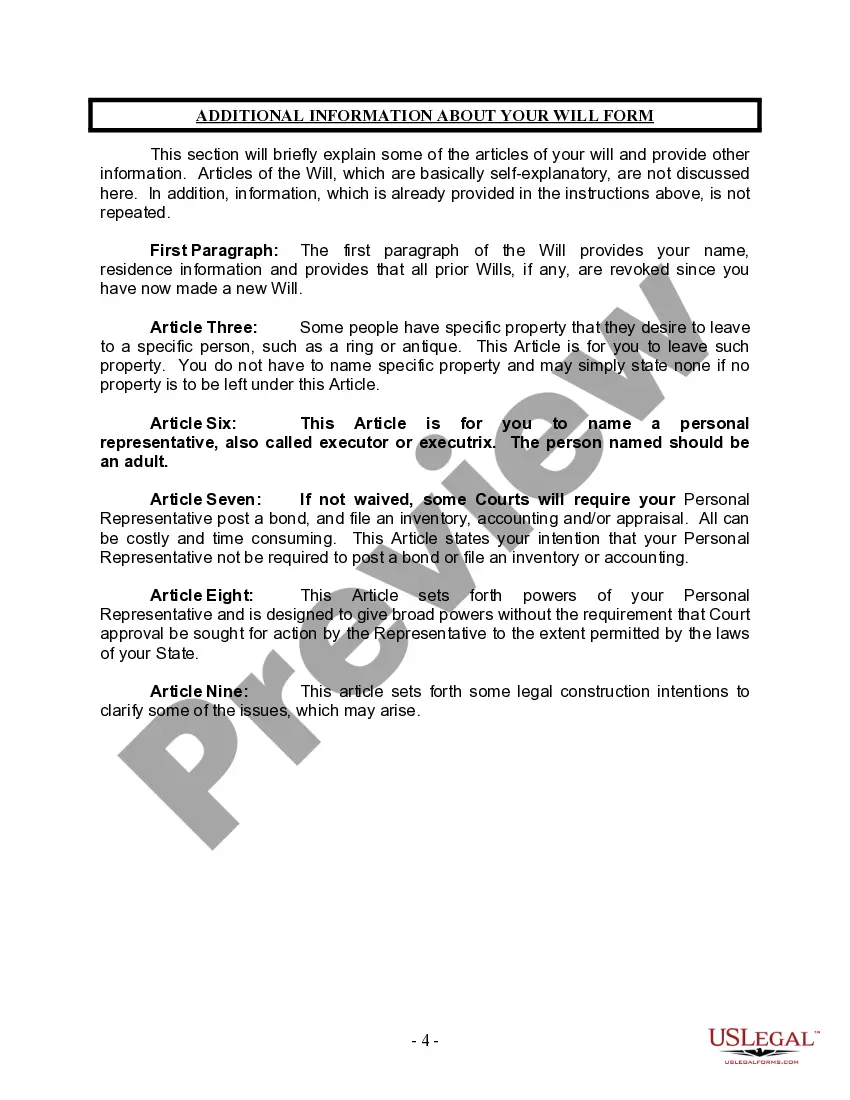

The Fullerton California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced and not remarried, and have no children, to specify how they want their assets and property distributed after their death. This will ensure that their wishes are fulfilled and minimize any potential conflicts or issues that may arise regarding the distribution of their estate. This particular type of will is specifically designed for individuals in Fullerton, California, who are divorced and have no children. It takes into consideration the unique circumstances of individuals without children, providing a tailored solution to their estate planning needs. The form provides a clear outline for the individual to divide their assets, name beneficiaries, and appoint an executor to oversee the distribution of their estate. Some important details that should be included in the Fullerton California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children are: 1. Identifying Information: This includes the individual's full name, address, and contact information. 2. Executor Appointment: The form allows the individual to appoint an executor, who will be responsible for carrying out the instructions in the will. The executor should be someone trusted and reliable. 3. Asset Distribution: The individual can specify how they want their assets, including real estate, bank accounts, investments, and personal belongings, to be distributed among their chosen beneficiaries or charities. 4. Debts and Taxes: The form should address any outstanding debts, mortgages, or taxes to be settled from the individual's estate before distribution to beneficiaries. 5. Alternate Beneficiary: In case the named beneficiaries predecease the individual or refuse their inheritance, the will form should include provisions for alternate beneficiaries. 6. Witnesses and Notarization: To ensure the will's validity, it is important to have at least two witnesses sign the document, and to have it notarized by a public notary. Different types of Fullerton California Legal Last Will and Testament Forms may exist depending on specific circumstances. For example, there may be separate templates for divorced individuals who eventually remarried or have children from a previous marriage. These variations address the unique considerations and complexities associated with different family arrangements, ensuring that individuals can create a will that accurately reflects their intentions. Creating a Fullerton California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is essential for anyone in this situation to ensure their assets are distributed according to their wishes. Consulting an attorney or using online legal services can provide guidance and assistance in completing the appropriate form accurately.The Fullerton California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced and not remarried, and have no children, to specify how they want their assets and property distributed after their death. This will ensure that their wishes are fulfilled and minimize any potential conflicts or issues that may arise regarding the distribution of their estate. This particular type of will is specifically designed for individuals in Fullerton, California, who are divorced and have no children. It takes into consideration the unique circumstances of individuals without children, providing a tailored solution to their estate planning needs. The form provides a clear outline for the individual to divide their assets, name beneficiaries, and appoint an executor to oversee the distribution of their estate. Some important details that should be included in the Fullerton California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children are: 1. Identifying Information: This includes the individual's full name, address, and contact information. 2. Executor Appointment: The form allows the individual to appoint an executor, who will be responsible for carrying out the instructions in the will. The executor should be someone trusted and reliable. 3. Asset Distribution: The individual can specify how they want their assets, including real estate, bank accounts, investments, and personal belongings, to be distributed among their chosen beneficiaries or charities. 4. Debts and Taxes: The form should address any outstanding debts, mortgages, or taxes to be settled from the individual's estate before distribution to beneficiaries. 5. Alternate Beneficiary: In case the named beneficiaries predecease the individual or refuse their inheritance, the will form should include provisions for alternate beneficiaries. 6. Witnesses and Notarization: To ensure the will's validity, it is important to have at least two witnesses sign the document, and to have it notarized by a public notary. Different types of Fullerton California Legal Last Will and Testament Forms may exist depending on specific circumstances. For example, there may be separate templates for divorced individuals who eventually remarried or have children from a previous marriage. These variations address the unique considerations and complexities associated with different family arrangements, ensuring that individuals can create a will that accurately reflects their intentions. Creating a Fullerton California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is essential for anyone in this situation to ensure their assets are distributed according to their wishes. Consulting an attorney or using online legal services can provide guidance and assistance in completing the appropriate form accurately.