The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

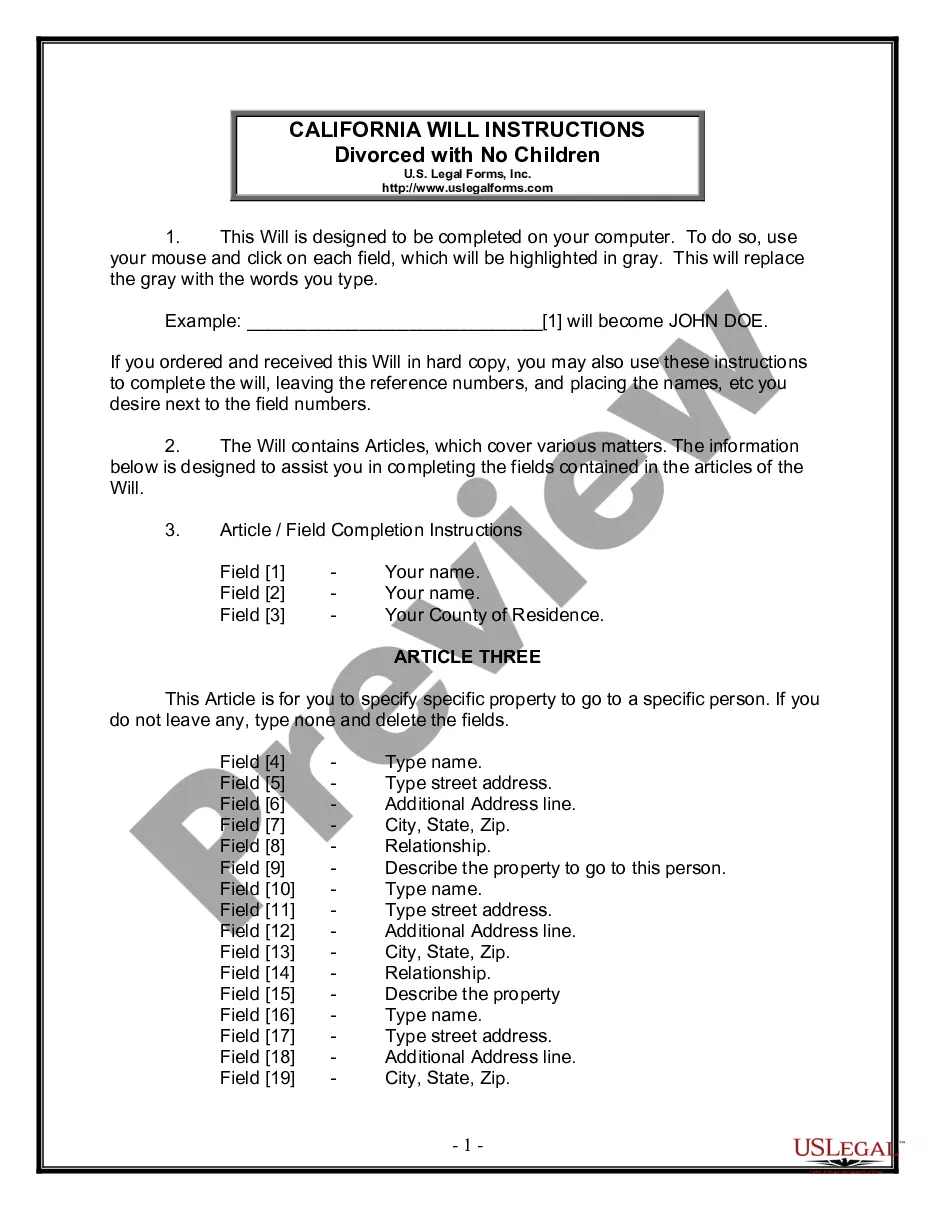

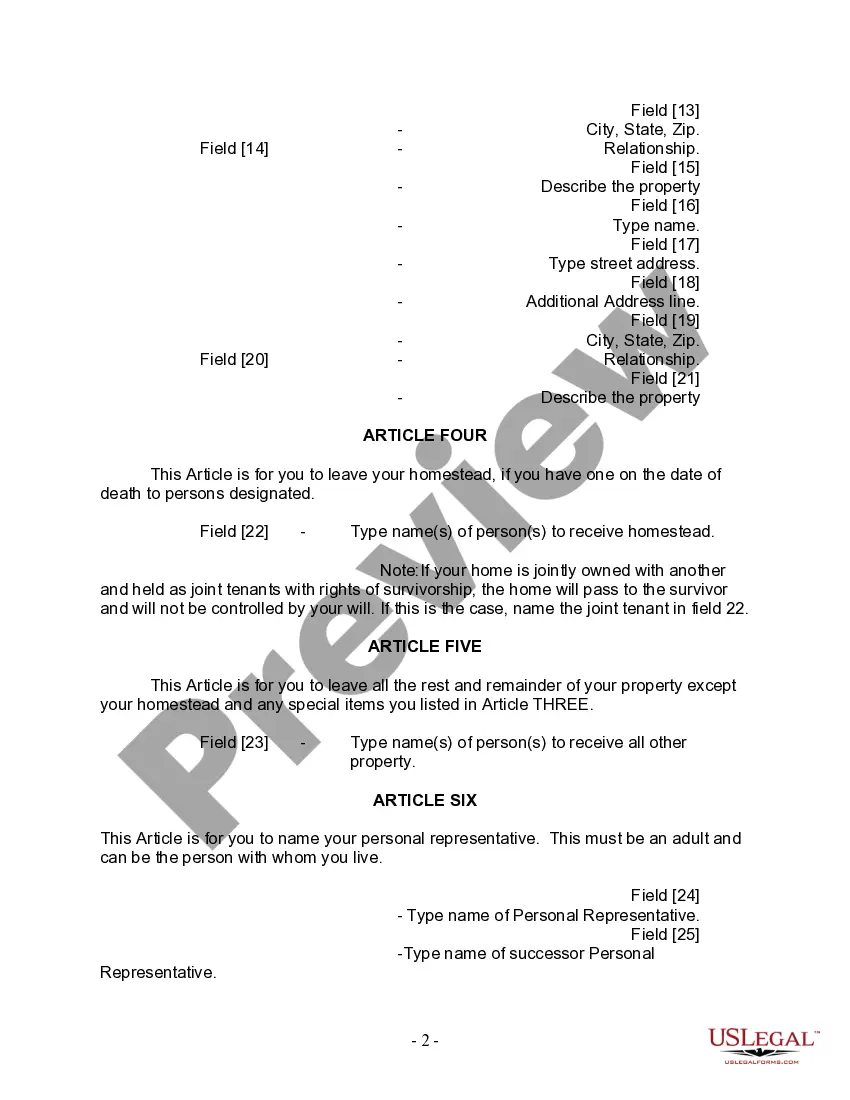

The Sacramento California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows you to outline your final wishes and distribute your assets after your death. This form is specifically designed for individuals who have gone through a divorce, are not currently remarried, and do not have any children. By creating a valid last will and testament, you can ensure that your estate is managed and distributed according to your preferences. This particular form may vary slightly depending on the specific requirements of Sacramento, California, but it typically includes key sections such as: 1. Identification: The form starts by asking you to provide your full legal name, date of birth, and address. This information is necessary to accurately identify you as the testator (the person making the will). 2. Appointment of Executor: The next section allows you to designate an executor, also known as a personal representative or administrator. This individual will be responsible for carrying out your wishes and handling the legal matters associated with your estate after your passing. 3. Asset Distribution: It is important to clearly state how you want your assets to be distributed among your beneficiaries. In this section, you can specify the beneficiaries' names and the portion of your estate they should receive. You may also include any specific instructions, such as dividing certain assets equally or providing for specific bequests. 4. Debts and Taxes: This section addresses how your debts and taxes should be handled. You can indicate whether you prefer your estate's debts to be paid before distribution or if you want specific assets to cover the debts. It is crucial to consider any outstanding obligations to ensure the smooth handling of your estate. 5. Residual Estate: The residual estate refers to any remaining assets after specific bequests and debts have been settled. You have the option to designate who should receive these leftover assets or allocate them among other beneficiaries. 6. Guardian and Conservatorships (if applicable): Since this particular form is intended for individuals without children, the section on guardianship and conservatorship may not be applicable. However, it is essential to review the form to confirm if any additional sections or clauses need to be considered. Overall, the Sacramento California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children ensures that your assets are distributed and managed according to your preferences. It is vital to consult with an experienced attorney to ensure the form is correctly completed and complies with Sacramento's specific legal requirements. Note: While there may not be multiple variations of the form for this specific circumstance, there might be other types of last will and testament forms each tailored to different situations, such as those with dependents or without a previous divorce.The Sacramento California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows you to outline your final wishes and distribute your assets after your death. This form is specifically designed for individuals who have gone through a divorce, are not currently remarried, and do not have any children. By creating a valid last will and testament, you can ensure that your estate is managed and distributed according to your preferences. This particular form may vary slightly depending on the specific requirements of Sacramento, California, but it typically includes key sections such as: 1. Identification: The form starts by asking you to provide your full legal name, date of birth, and address. This information is necessary to accurately identify you as the testator (the person making the will). 2. Appointment of Executor: The next section allows you to designate an executor, also known as a personal representative or administrator. This individual will be responsible for carrying out your wishes and handling the legal matters associated with your estate after your passing. 3. Asset Distribution: It is important to clearly state how you want your assets to be distributed among your beneficiaries. In this section, you can specify the beneficiaries' names and the portion of your estate they should receive. You may also include any specific instructions, such as dividing certain assets equally or providing for specific bequests. 4. Debts and Taxes: This section addresses how your debts and taxes should be handled. You can indicate whether you prefer your estate's debts to be paid before distribution or if you want specific assets to cover the debts. It is crucial to consider any outstanding obligations to ensure the smooth handling of your estate. 5. Residual Estate: The residual estate refers to any remaining assets after specific bequests and debts have been settled. You have the option to designate who should receive these leftover assets or allocate them among other beneficiaries. 6. Guardian and Conservatorships (if applicable): Since this particular form is intended for individuals without children, the section on guardianship and conservatorship may not be applicable. However, it is essential to review the form to confirm if any additional sections or clauses need to be considered. Overall, the Sacramento California Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children ensures that your assets are distributed and managed according to your preferences. It is vital to consult with an experienced attorney to ensure the form is correctly completed and complies with Sacramento's specific legal requirements. Note: While there may not be multiple variations of the form for this specific circumstance, there might be other types of last will and testament forms each tailored to different situations, such as those with dependents or without a previous divorce.