The Will you have found is for a divorced person, not remarried with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

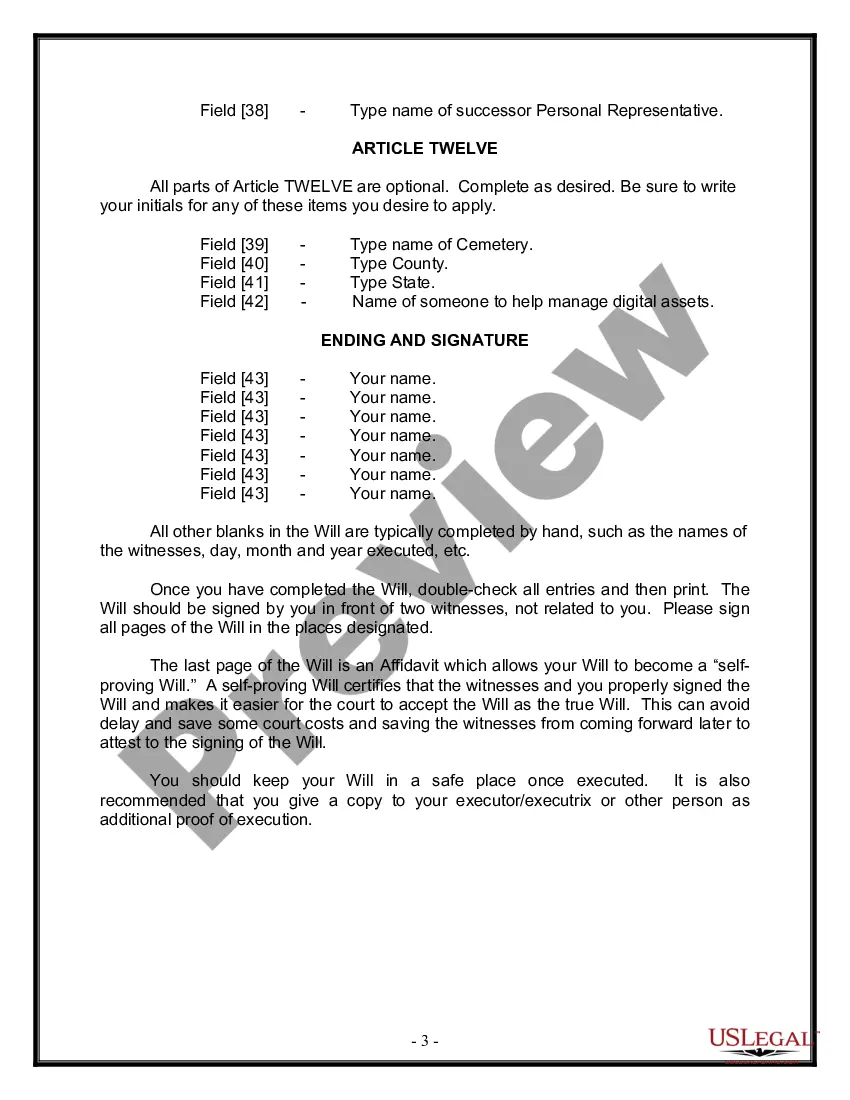

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

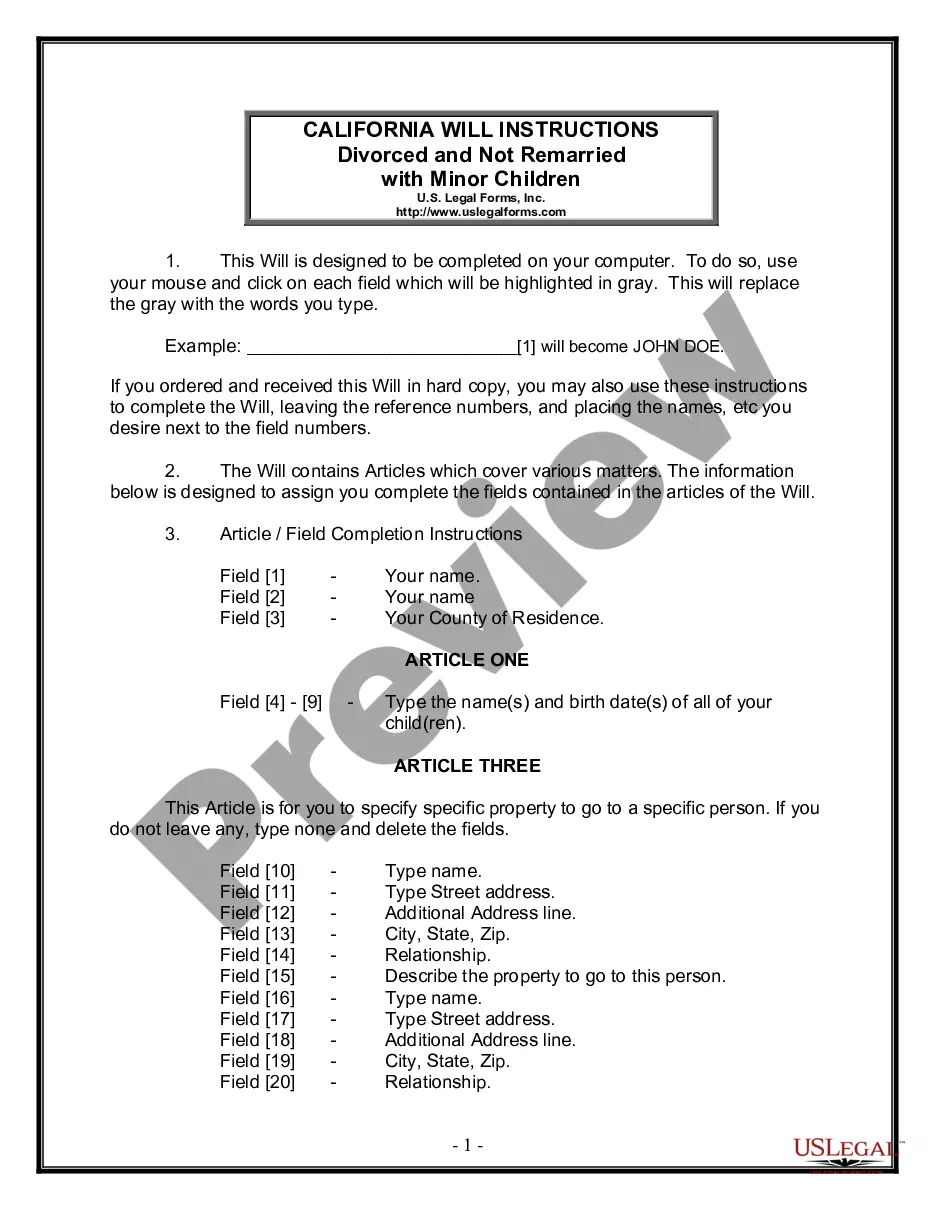

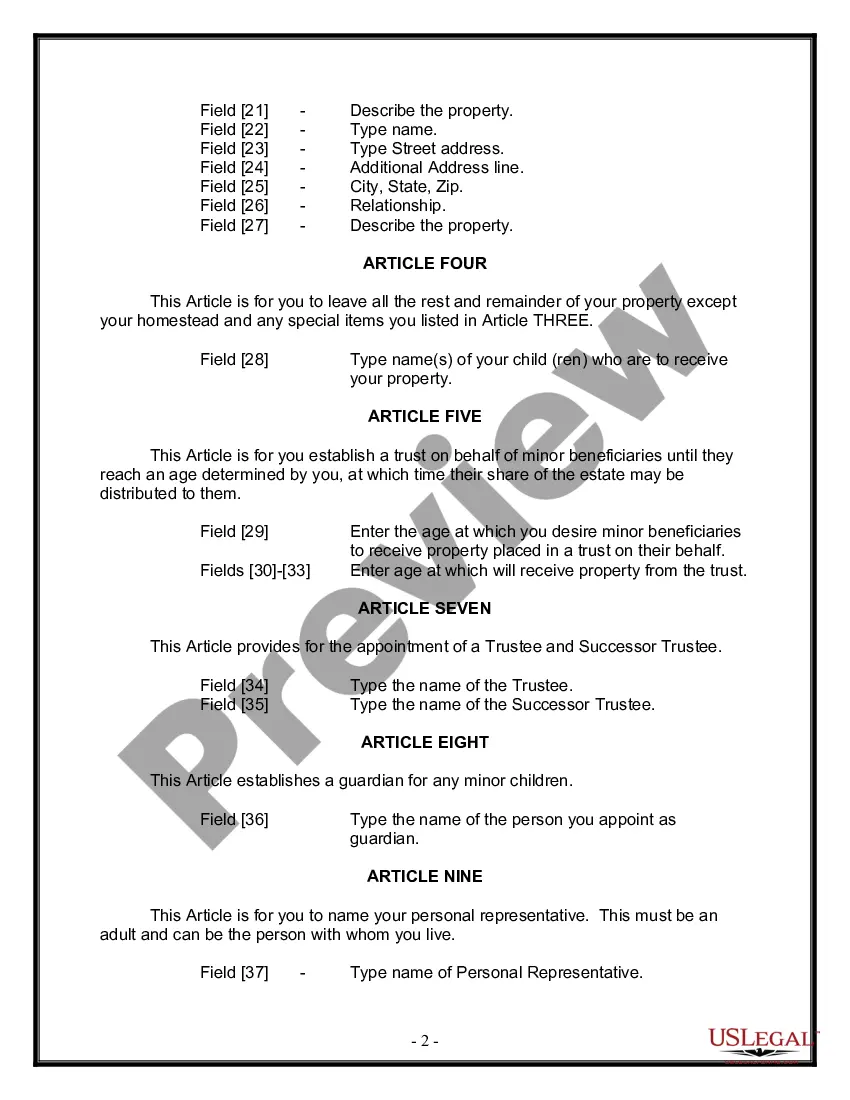

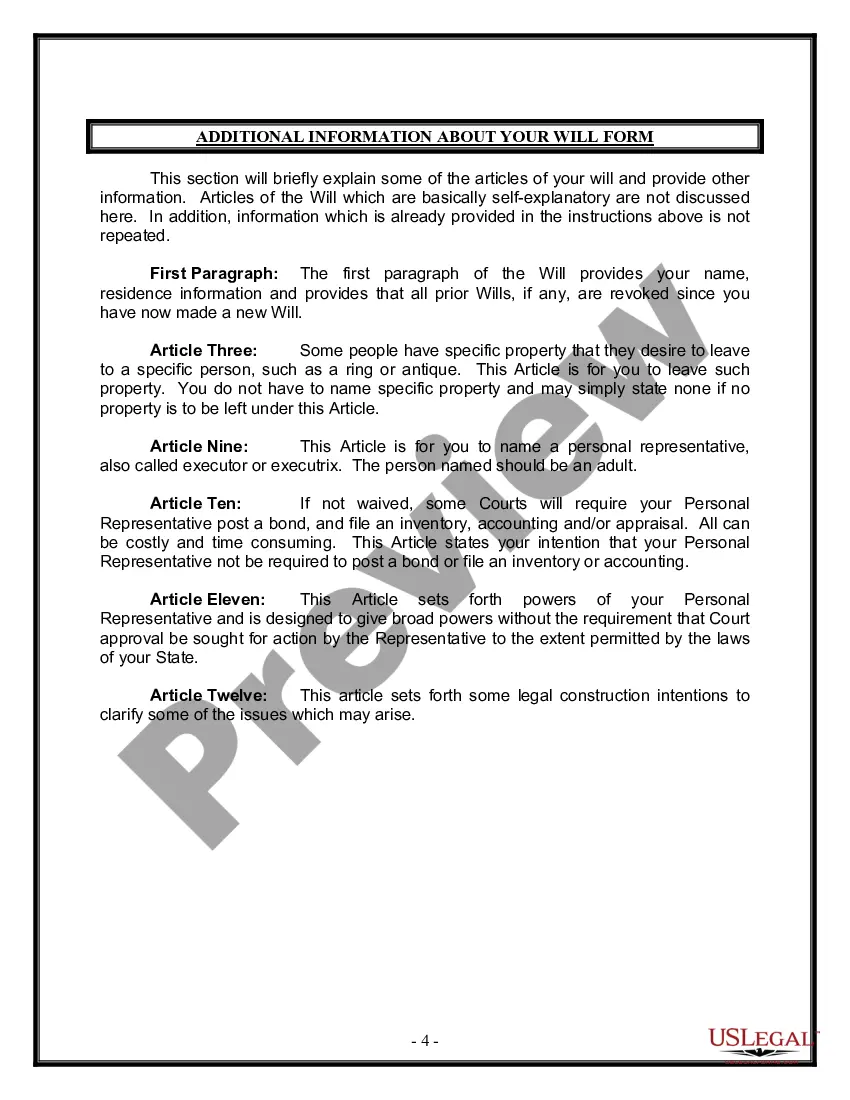

Description: A Chula Vista California Legal Last Will and Testament Form for a Divorced person not Remarried with Minor Children is a legally binding document that allows individuals who have gone through a divorce and have minor children to outline their final wishes regarding their assets, properties, and the custody and care of their children in the event of their demise. This document ensures that the individual's wishes are respected and followed, providing peace of mind that their children, assets, and personal belongings will be distributed and managed as desired. The Chula Vista California Legal Last Will and Testament Form for a Divorced person not Remarried with Minor Children generally includes the following key elements: 1. Personal Information: It starts with the personal details of the individual, including their full legal name, address, and contact information. 2. Revocation of Previous Will: If the individual had previously created a will, this section revokes any prior wills or codicils to ensure the validity and enforceability of the current will. 3. Appointment of Executor: The will allows the individual to appoint an executor who will be responsible for administering the estate, including the distribution of assets and handling financial matters after their passing. 4. Distribution of Assets: In this section, the individual can specify how their assets, such as property, investments, bank accounts, and personal belongings, should be distributed among their minor children after their demise. It may also include any specific instructions regarding charitable donations or bequests to other individuals. 5. Nomination of Guardian: This section is crucial for individuals with minor children. Here, the individual can nominate a guardian who will have legal custody and be responsible for the care and upbringing of their children if both parents are deceased. It is important to consider a guardian who can provide a suitable environment for the child's physical, emotional, and financial well-being. 6. Creation of Testamentary Trust: To protect the financial interests of the minor children, the individual can establish a testamentary trust within the will, appointing a trustee who will manage any inheritance or assets designated for the children until they reach a specified age or milestone, such as turning 18 or completing higher education. Different types of Chula Vista California Legal Last Will and Testament Forms for Divorced persons not Remarried with Minor Children may include variations depending on the preferences and specific circumstances of the individual. Some may includes additional provisions for special needs children, business interests, or unique considerations in the division of assets. However, the fundamental purpose remains the same: to ensure the individual's intentions are legally recognized and implemented after their passing.Description: A Chula Vista California Legal Last Will and Testament Form for a Divorced person not Remarried with Minor Children is a legally binding document that allows individuals who have gone through a divorce and have minor children to outline their final wishes regarding their assets, properties, and the custody and care of their children in the event of their demise. This document ensures that the individual's wishes are respected and followed, providing peace of mind that their children, assets, and personal belongings will be distributed and managed as desired. The Chula Vista California Legal Last Will and Testament Form for a Divorced person not Remarried with Minor Children generally includes the following key elements: 1. Personal Information: It starts with the personal details of the individual, including their full legal name, address, and contact information. 2. Revocation of Previous Will: If the individual had previously created a will, this section revokes any prior wills or codicils to ensure the validity and enforceability of the current will. 3. Appointment of Executor: The will allows the individual to appoint an executor who will be responsible for administering the estate, including the distribution of assets and handling financial matters after their passing. 4. Distribution of Assets: In this section, the individual can specify how their assets, such as property, investments, bank accounts, and personal belongings, should be distributed among their minor children after their demise. It may also include any specific instructions regarding charitable donations or bequests to other individuals. 5. Nomination of Guardian: This section is crucial for individuals with minor children. Here, the individual can nominate a guardian who will have legal custody and be responsible for the care and upbringing of their children if both parents are deceased. It is important to consider a guardian who can provide a suitable environment for the child's physical, emotional, and financial well-being. 6. Creation of Testamentary Trust: To protect the financial interests of the minor children, the individual can establish a testamentary trust within the will, appointing a trustee who will manage any inheritance or assets designated for the children until they reach a specified age or milestone, such as turning 18 or completing higher education. Different types of Chula Vista California Legal Last Will and Testament Forms for Divorced persons not Remarried with Minor Children may include variations depending on the preferences and specific circumstances of the individual. Some may includes additional provisions for special needs children, business interests, or unique considerations in the division of assets. However, the fundamental purpose remains the same: to ensure the individual's intentions are legally recognized and implemented after their passing.