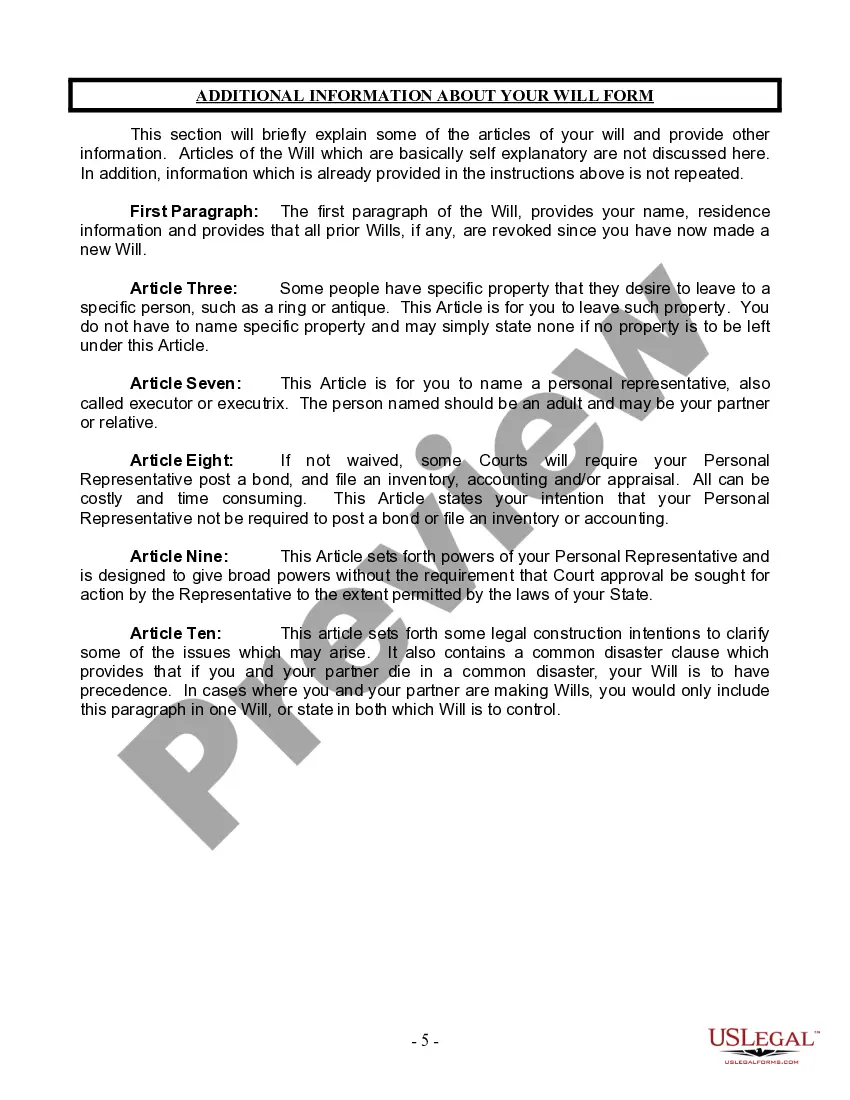

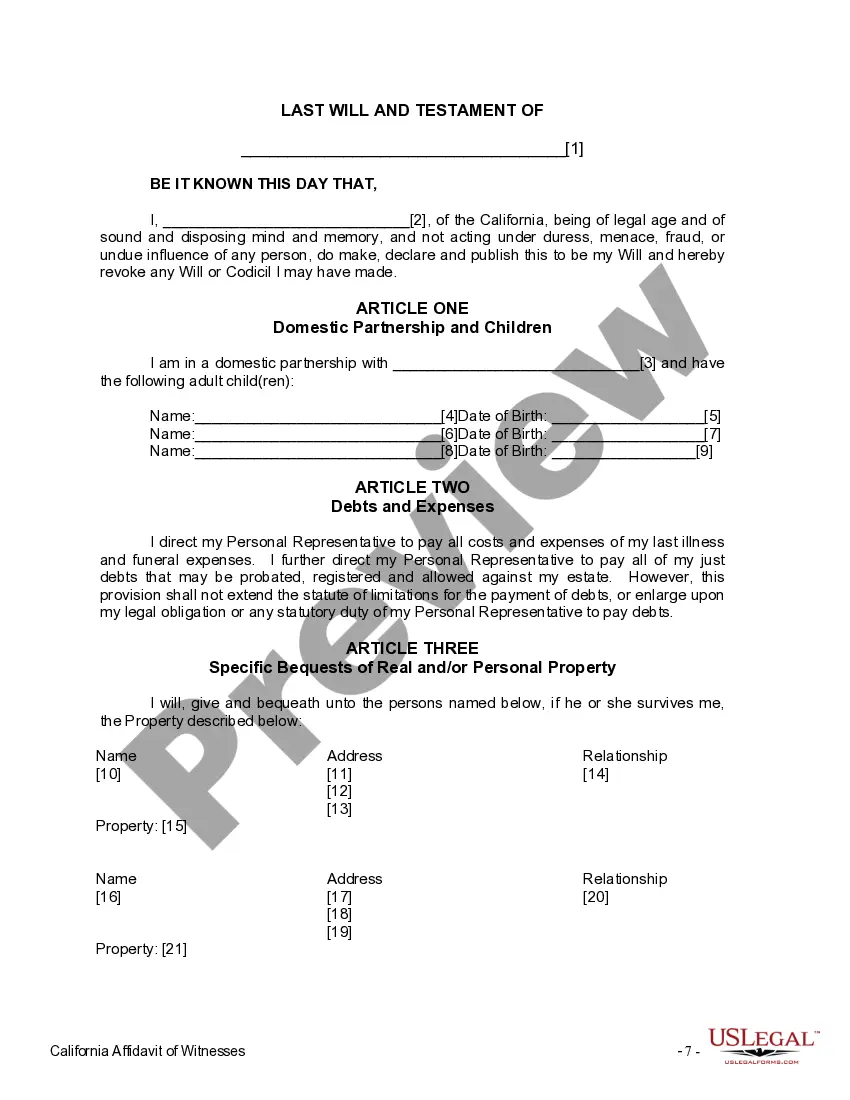

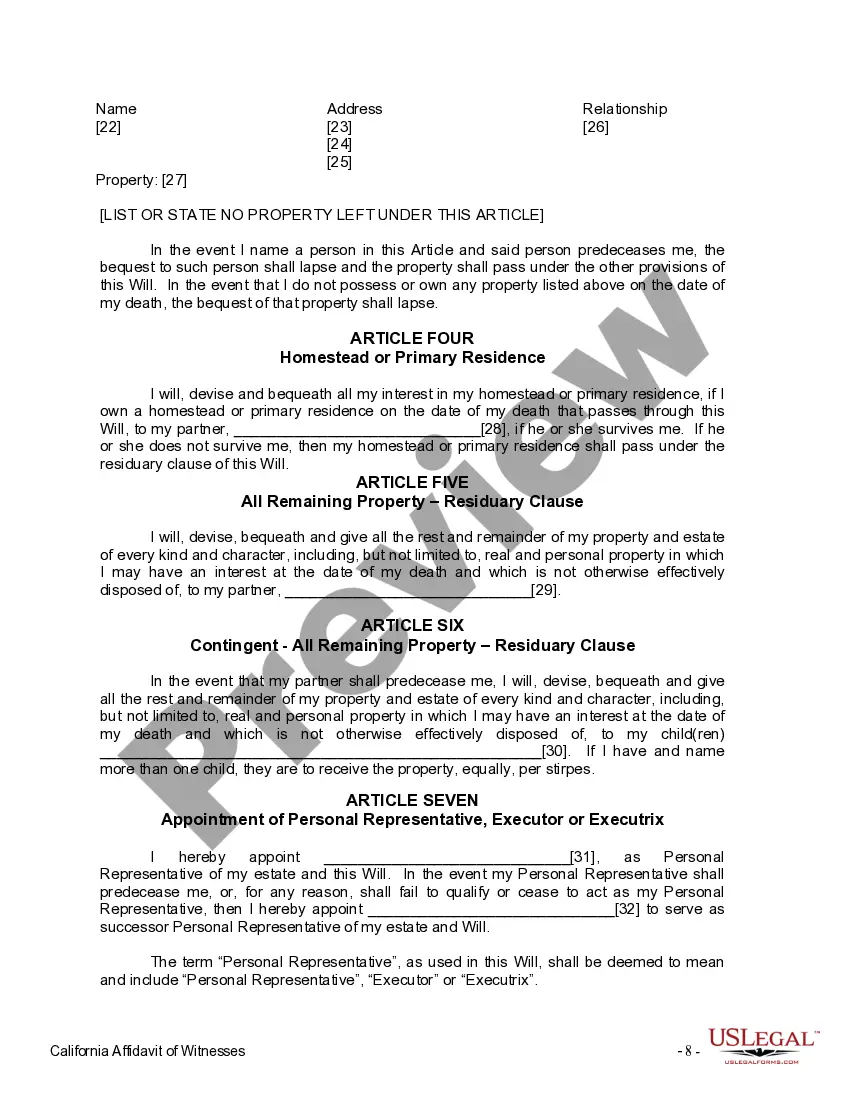

The Will you have found is for a domestic partner with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for provisions for the adult children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

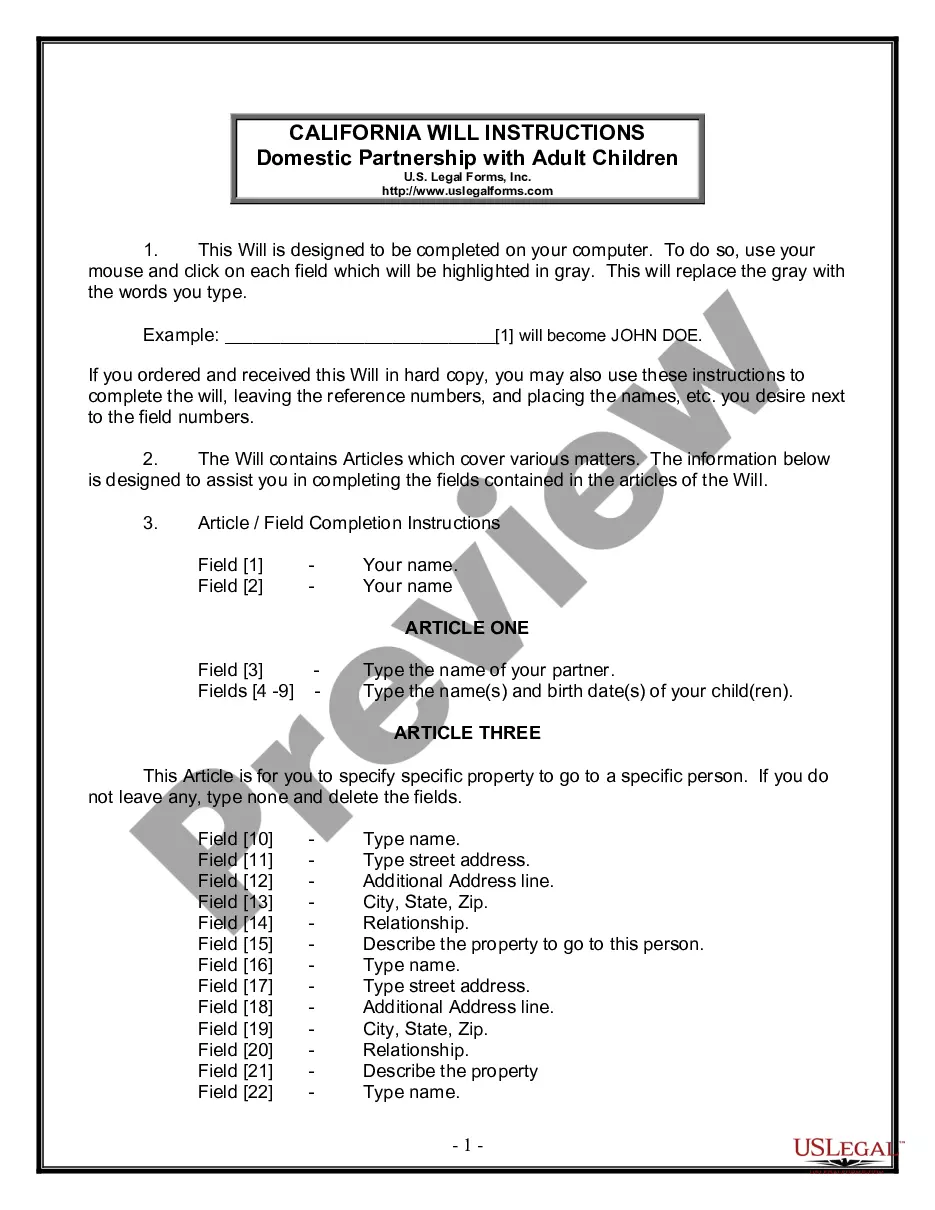

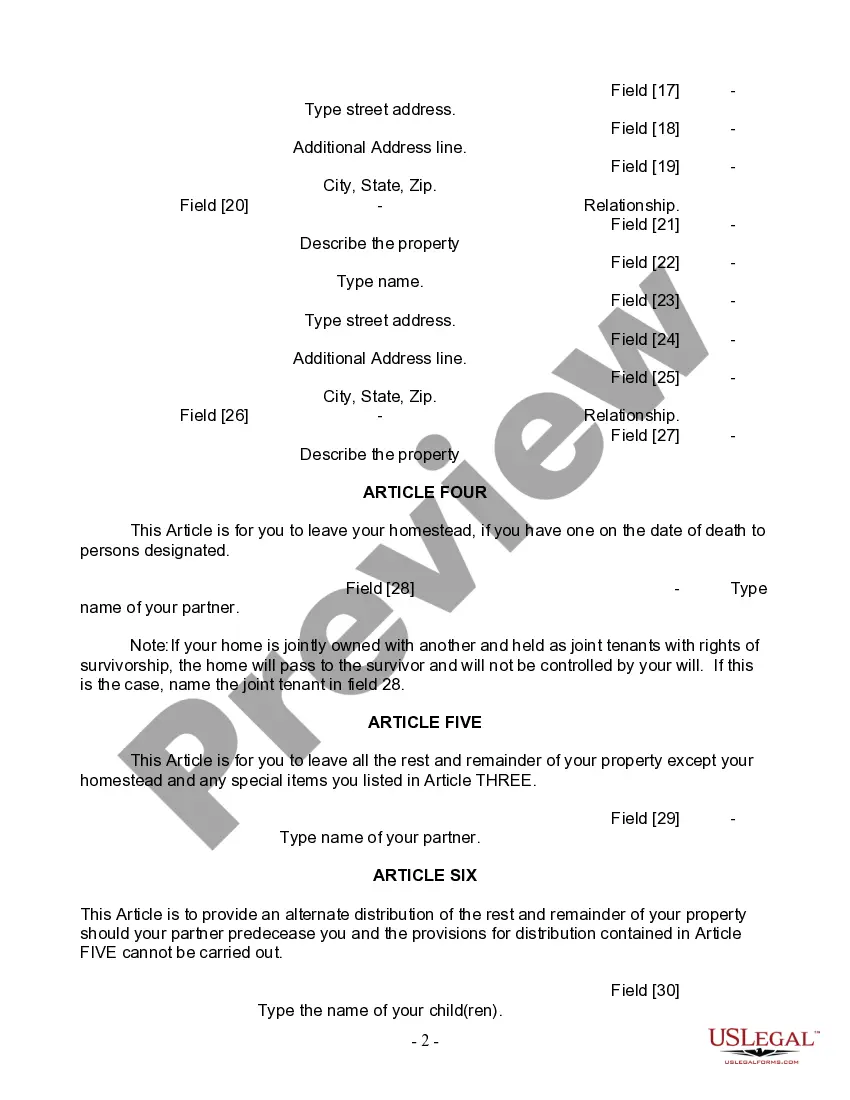

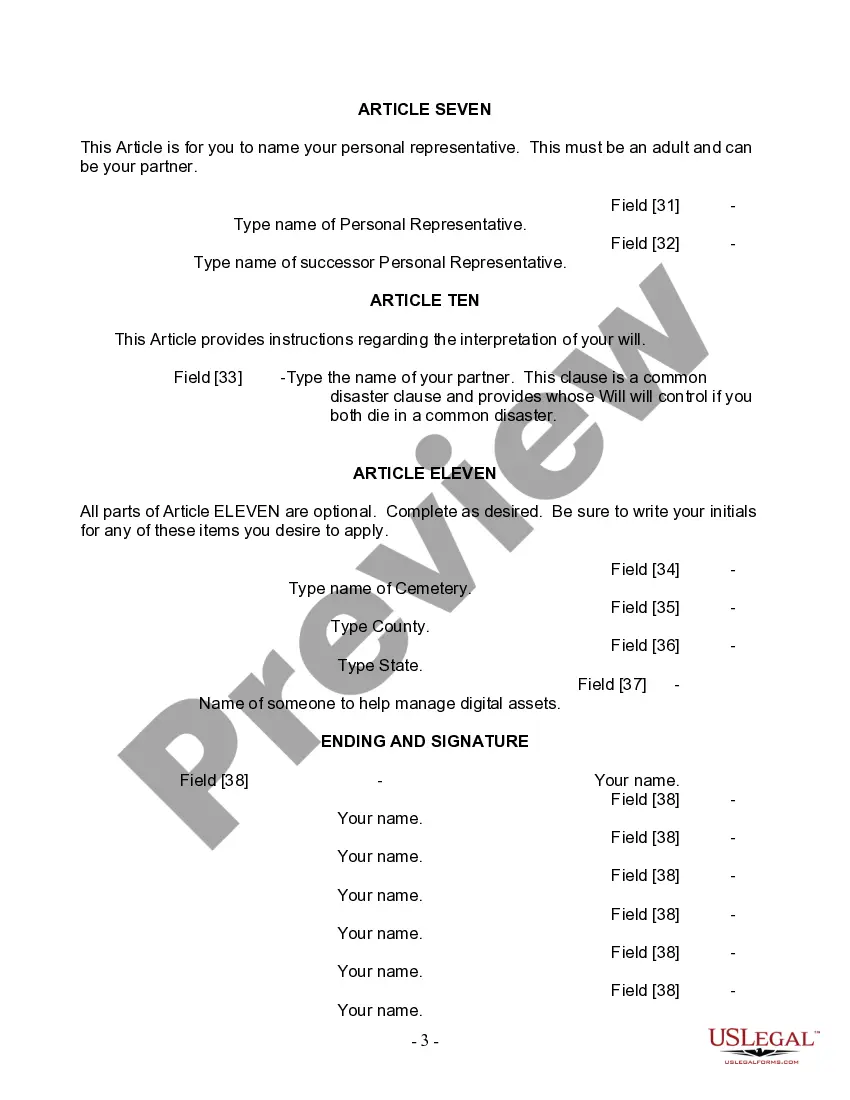

Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children is a legal document that outlines the final wishes and distribution of assets of an individual who is in a domestic partnership and has adult children. This form is specifically designed to comply with the laws and regulations of Fontana, California. The Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children ensures that the wishes of the individual are followed even after their demise. It allows the domestic partner to appoint a trusted individual as the executor of the will, who will be responsible for handling the distribution of assets and the administration of the estate. This legal document addresses various important aspects, including the allocation of assets to the adult children, the appointment of guardians for any minor children, and provisions for the care of any dependent disabled adult children. It also enables the individual to name beneficiaries for specific assets, designate alternative beneficiaries, and specify any specific instructions regarding the distribution of their estate. In Fontana, California, there might be different variations of the Legal Last Will and Testament Form for Domestic Partner with Adult Children, such as: 1. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Basic Version: This is a simplified version of the form, suitable for individuals with simple estate plans and straightforward distribution of assets. 2. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Comprehensive Version: This version of the form is more detailed and comprehensive, suitable for individuals with complex estate plans and specific provisions for asset distribution. 3. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Living Will Addition: This version of the form includes a living will component, which allows the individual to express their preferences regarding medical treatment and end-of-life decisions. 4. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Trusts and Estate Planning: This form incorporates provisions for setting up trusts and engaging in comprehensive estate planning strategies to maximize asset protection and minimize tax liabilities. Overall, the Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children serves as a crucial legal document that ensures one's final wishes are respected and their estate is distributed according to their preferences among their adult children and other beneficiaries. It is recommended to consult with a legal professional or estate planning attorney to ensure the form is properly completed and meets all legal requirements.Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children is a legal document that outlines the final wishes and distribution of assets of an individual who is in a domestic partnership and has adult children. This form is specifically designed to comply with the laws and regulations of Fontana, California. The Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children ensures that the wishes of the individual are followed even after their demise. It allows the domestic partner to appoint a trusted individual as the executor of the will, who will be responsible for handling the distribution of assets and the administration of the estate. This legal document addresses various important aspects, including the allocation of assets to the adult children, the appointment of guardians for any minor children, and provisions for the care of any dependent disabled adult children. It also enables the individual to name beneficiaries for specific assets, designate alternative beneficiaries, and specify any specific instructions regarding the distribution of their estate. In Fontana, California, there might be different variations of the Legal Last Will and Testament Form for Domestic Partner with Adult Children, such as: 1. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Basic Version: This is a simplified version of the form, suitable for individuals with simple estate plans and straightforward distribution of assets. 2. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Comprehensive Version: This version of the form is more detailed and comprehensive, suitable for individuals with complex estate plans and specific provisions for asset distribution. 3. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Living Will Addition: This version of the form includes a living will component, which allows the individual to express their preferences regarding medical treatment and end-of-life decisions. 4. Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children — Trusts and Estate Planning: This form incorporates provisions for setting up trusts and engaging in comprehensive estate planning strategies to maximize asset protection and minimize tax liabilities. Overall, the Fontana California Legal Last Will and Testament Form for Domestic Partner with Adult Children serves as a crucial legal document that ensures one's final wishes are respected and their estate is distributed according to their preferences among their adult children and other beneficiaries. It is recommended to consult with a legal professional or estate planning attorney to ensure the form is properly completed and meets all legal requirements.