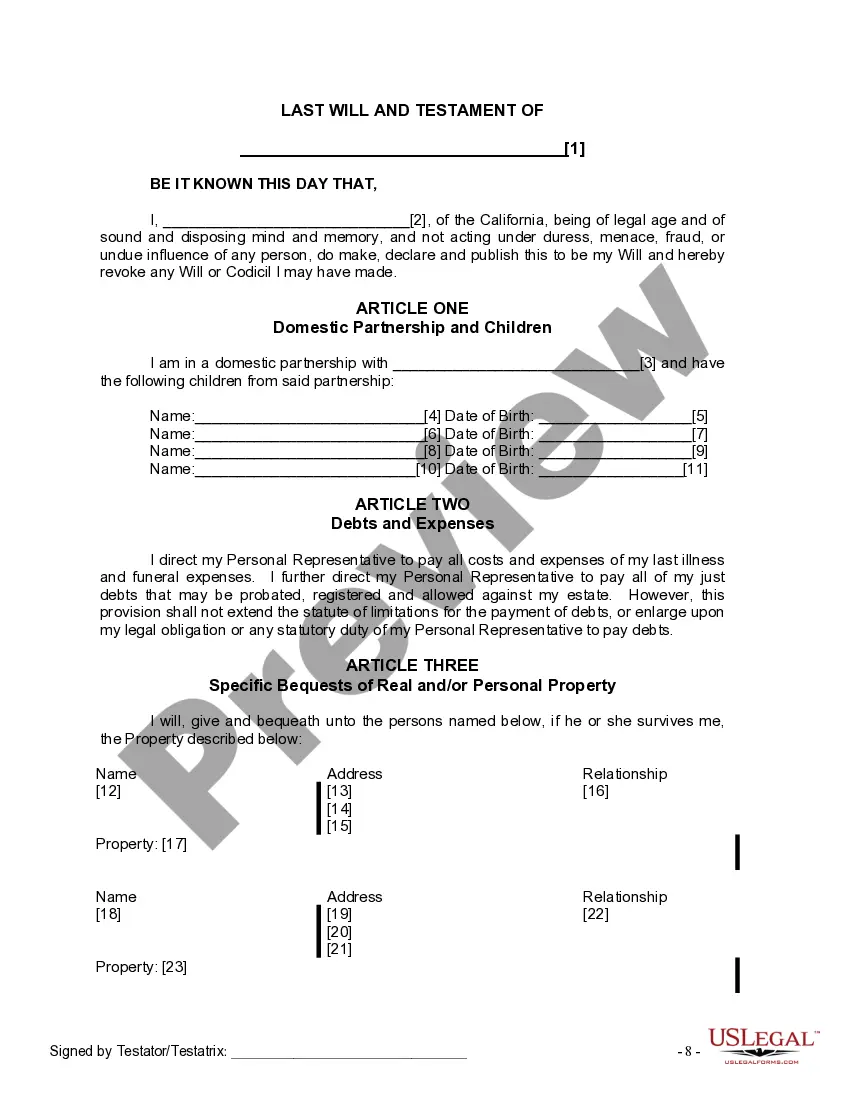

The Will you have found is for a domestic partner with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for provisions for the adult children.

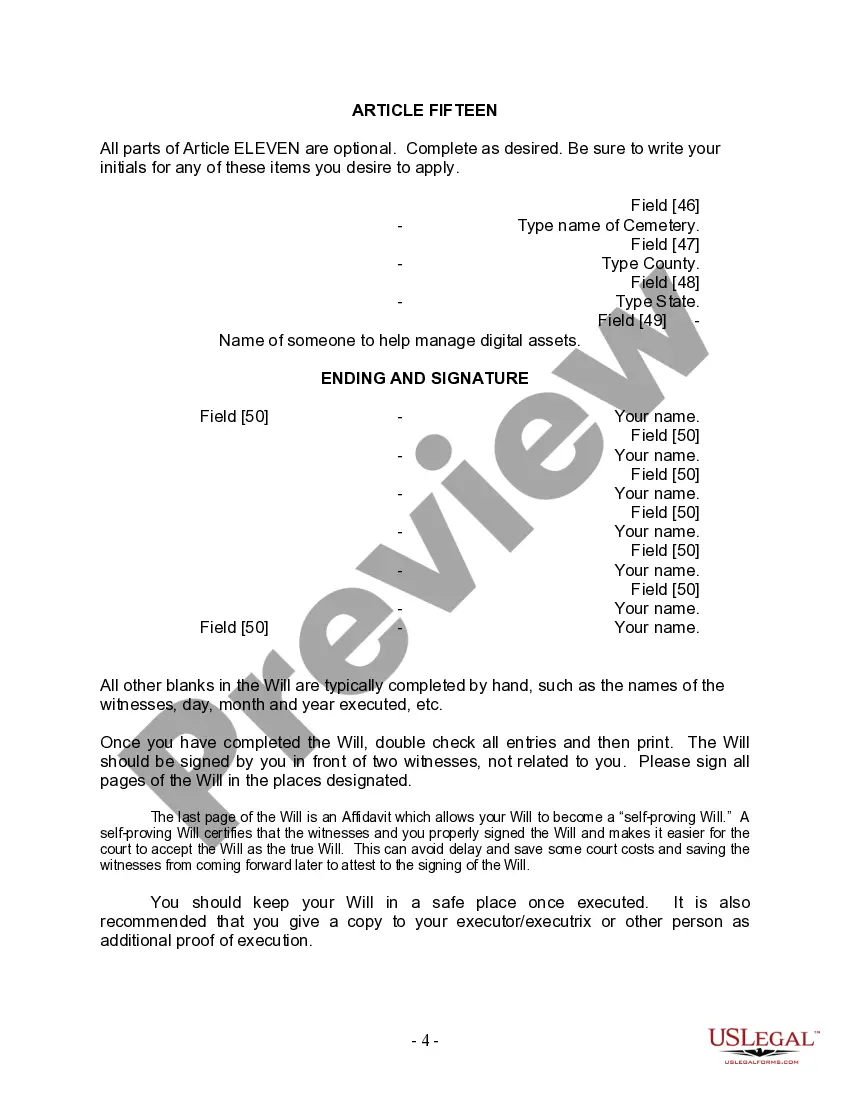

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

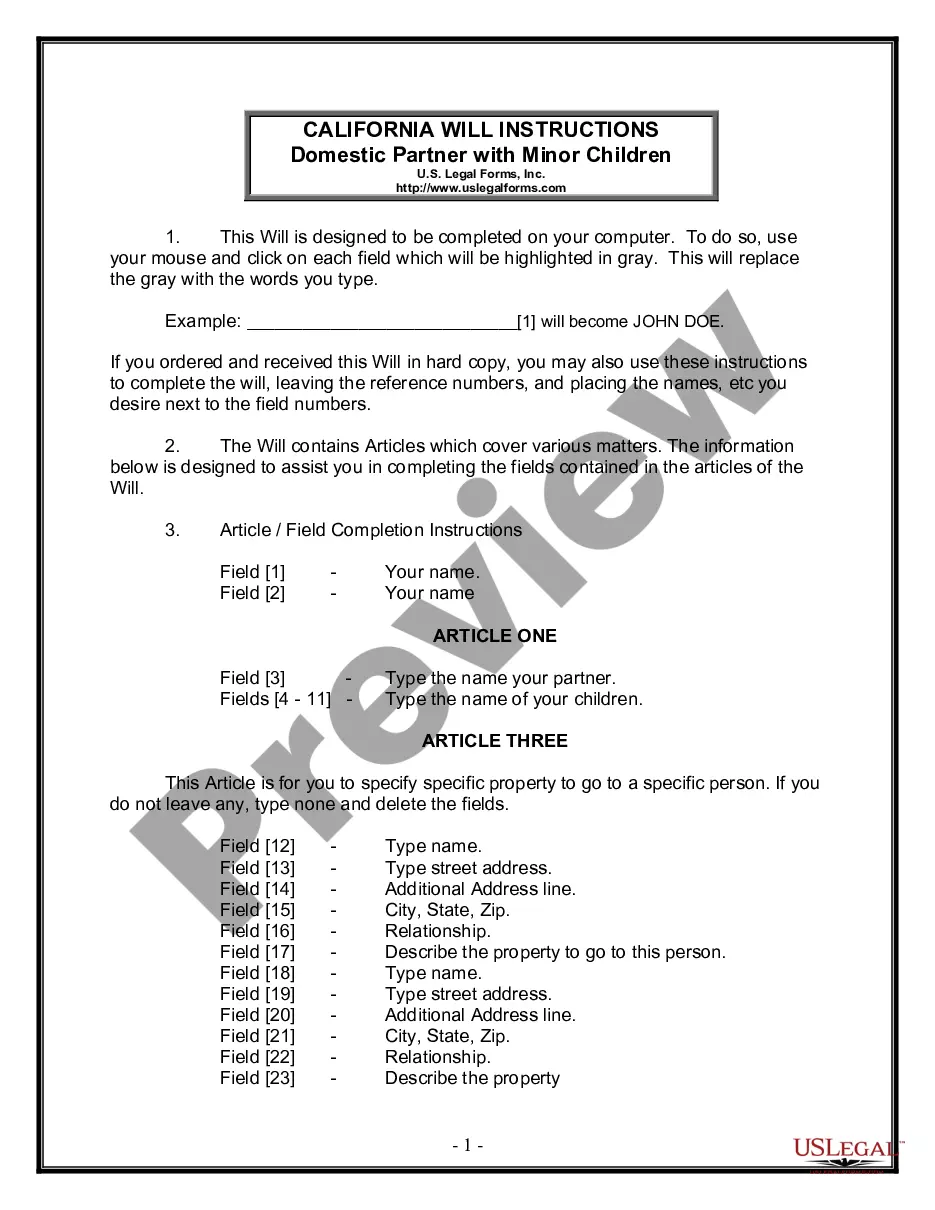

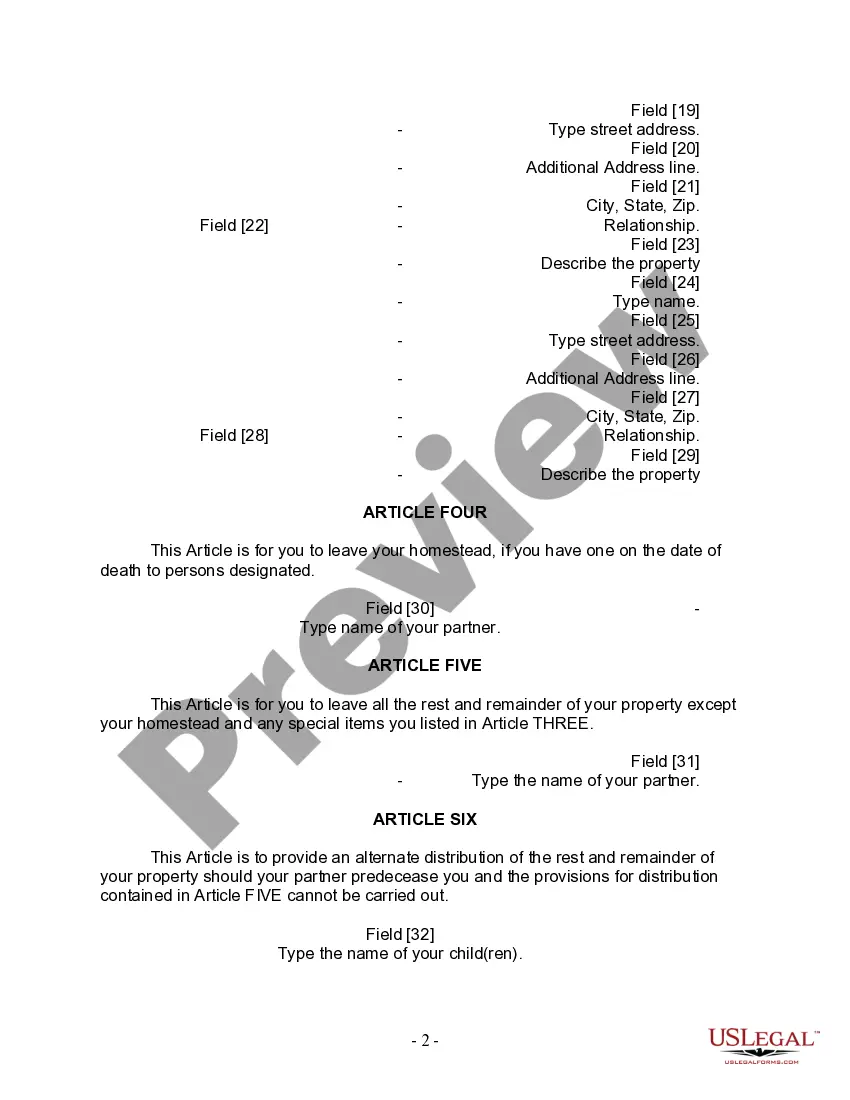

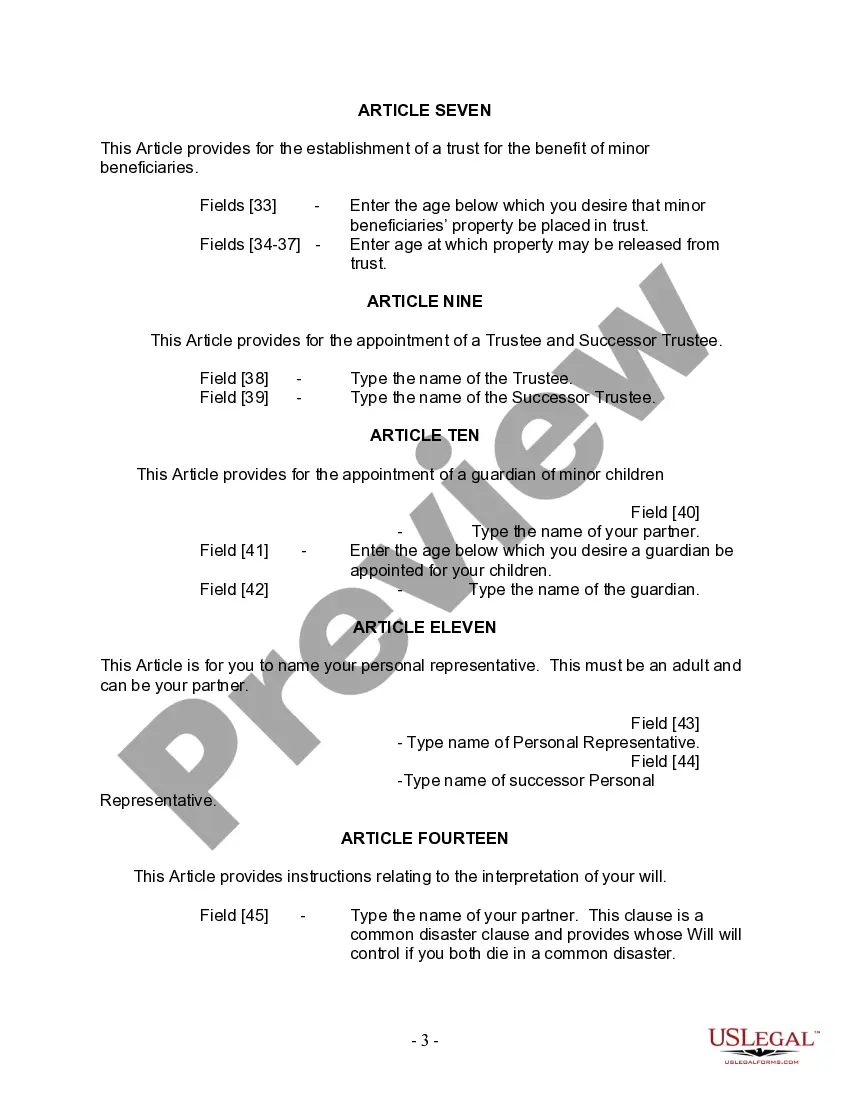

Title: Alameda California Legal Last Will and Testament Form for Domestic Partner with No Children Keywords: Alameda California, legal, last will and testament, form, domestic partner, no children Description: 1. Alameda California Legal Last Will and Testament Form Overview: The Alameda California Legal Last Will and Testament Form for Domestic Partner with No Children is a legal document that allows unmarried couples to outline their final wishes and distribute their assets upon their passing. This form provides individuals the opportunity to tailor their will to their specific circumstances, ensuring that their domestic partner is considered as their primary beneficiary. 2. Importance of Having a Last Will and Testament in Alameda California: Creating a last will and testament is vital to ensure that your assets are distributed according to your wishes. Without a valid will, the state's intestacy laws will determine how your estate is distributed, potentially neglecting your domestic partner. By utilizing the Alameda California Legal Last Will and Testament Form, individuals can protect their loved ones and ensure their assets are managed in the desired manner. 3. Key Components of the Alameda California Legal Last Will and Testament Form: — Identification: The form requires personal details of the testator and domestic partner, such as full names, addresses, and contact information. — Appointment of Executor: The testator can name an executor, who will oversee the distribution of the estate and handle administrative tasks. — Asset Distribution: This section allows the testator to specify how their assets, including real estate, bank accounts, investments, and personal belongings, will be distributed among beneficiaries. In the absence of children, the domestic partner is typically the primary beneficiary. — Contingent Beneficiaries: The form also provides provisions for alternative beneficiaries if the primary beneficiary predeceases the testator. — Special Instructions: Testators can include specific instructions regarding funeral arrangements, charitable contributions, guardianship of pets, or any other unique considerations. — Witnesses and Notary: To ensure the legality of the will, the form must be signed by the testator in the presence of two witnesses and a notary public. Note: While there may not be different types of Alameda California Legal Last Will and Testament Forms specifically for domestic partners without children, the provided form can be customized based on individual preferences and requirements. In conclusion, the Alameda California Legal Last Will and Testament Form for Domestic Partner with No Children is an essential legal document that enables unmarried couples to protect their interests and designate the distribution of their assets. By preparing this comprehensive document, individuals can ensure their domestic partners are duly recognized and protected in the event of their passing.Title: Alameda California Legal Last Will and Testament Form for Domestic Partner with No Children Keywords: Alameda California, legal, last will and testament, form, domestic partner, no children Description: 1. Alameda California Legal Last Will and Testament Form Overview: The Alameda California Legal Last Will and Testament Form for Domestic Partner with No Children is a legal document that allows unmarried couples to outline their final wishes and distribute their assets upon their passing. This form provides individuals the opportunity to tailor their will to their specific circumstances, ensuring that their domestic partner is considered as their primary beneficiary. 2. Importance of Having a Last Will and Testament in Alameda California: Creating a last will and testament is vital to ensure that your assets are distributed according to your wishes. Without a valid will, the state's intestacy laws will determine how your estate is distributed, potentially neglecting your domestic partner. By utilizing the Alameda California Legal Last Will and Testament Form, individuals can protect their loved ones and ensure their assets are managed in the desired manner. 3. Key Components of the Alameda California Legal Last Will and Testament Form: — Identification: The form requires personal details of the testator and domestic partner, such as full names, addresses, and contact information. — Appointment of Executor: The testator can name an executor, who will oversee the distribution of the estate and handle administrative tasks. — Asset Distribution: This section allows the testator to specify how their assets, including real estate, bank accounts, investments, and personal belongings, will be distributed among beneficiaries. In the absence of children, the domestic partner is typically the primary beneficiary. — Contingent Beneficiaries: The form also provides provisions for alternative beneficiaries if the primary beneficiary predeceases the testator. — Special Instructions: Testators can include specific instructions regarding funeral arrangements, charitable contributions, guardianship of pets, or any other unique considerations. — Witnesses and Notary: To ensure the legality of the will, the form must be signed by the testator in the presence of two witnesses and a notary public. Note: While there may not be different types of Alameda California Legal Last Will and Testament Forms specifically for domestic partners without children, the provided form can be customized based on individual preferences and requirements. In conclusion, the Alameda California Legal Last Will and Testament Form for Domestic Partner with No Children is an essential legal document that enables unmarried couples to protect their interests and designate the distribution of their assets. By preparing this comprehensive document, individuals can ensure their domestic partners are duly recognized and protected in the event of their passing.