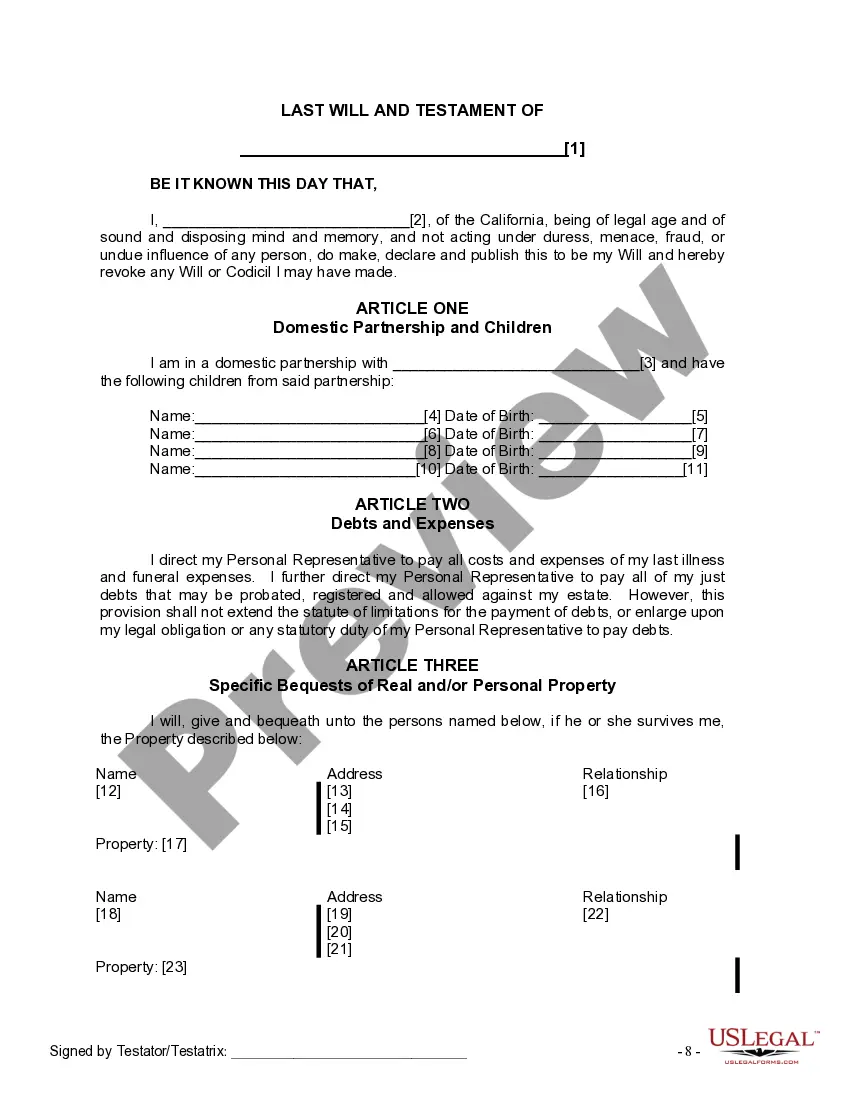

The Will you have found is for a domestic partner with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for provisions for the adult children.

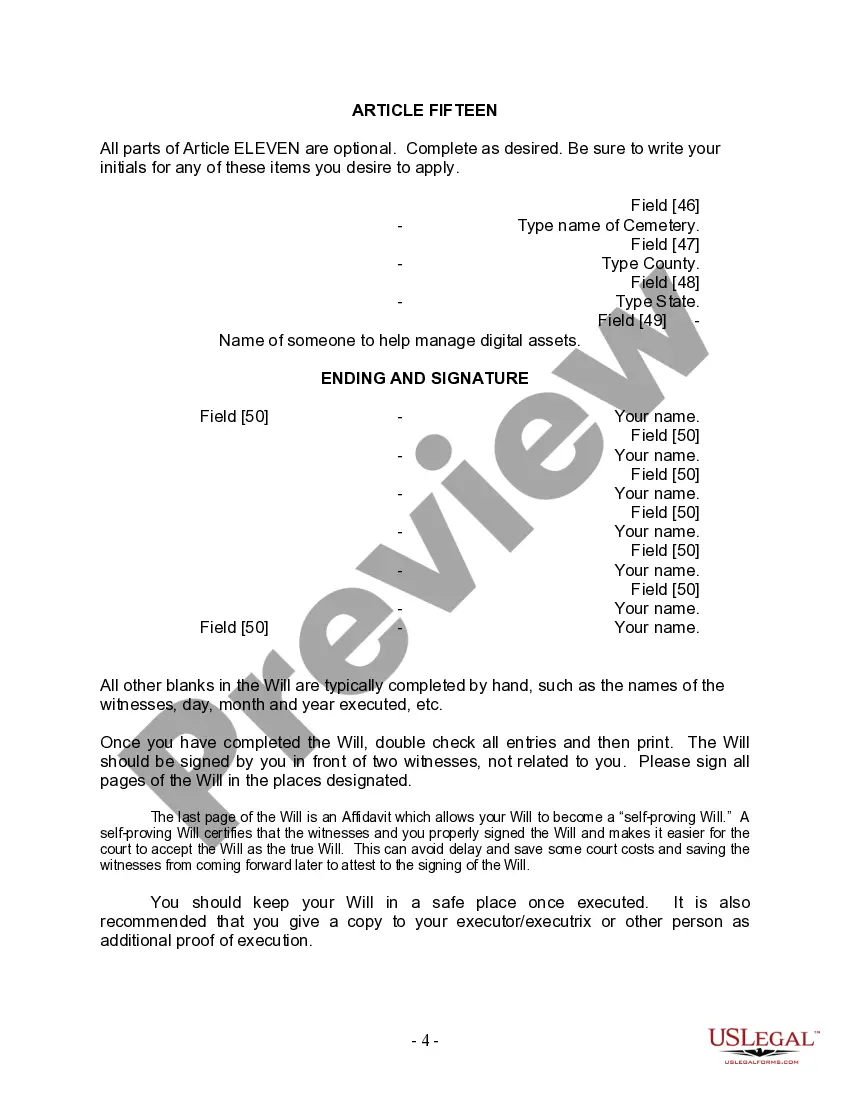

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

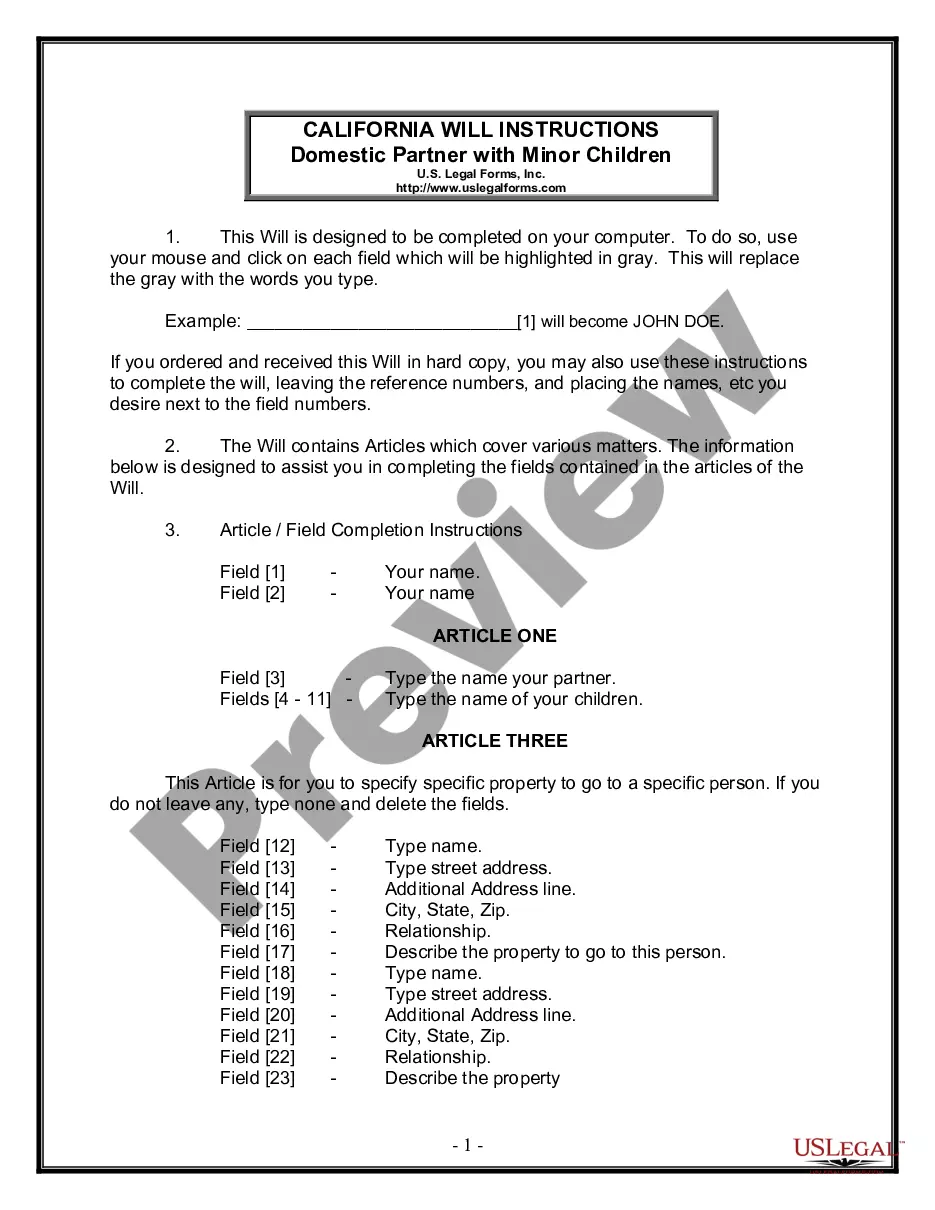

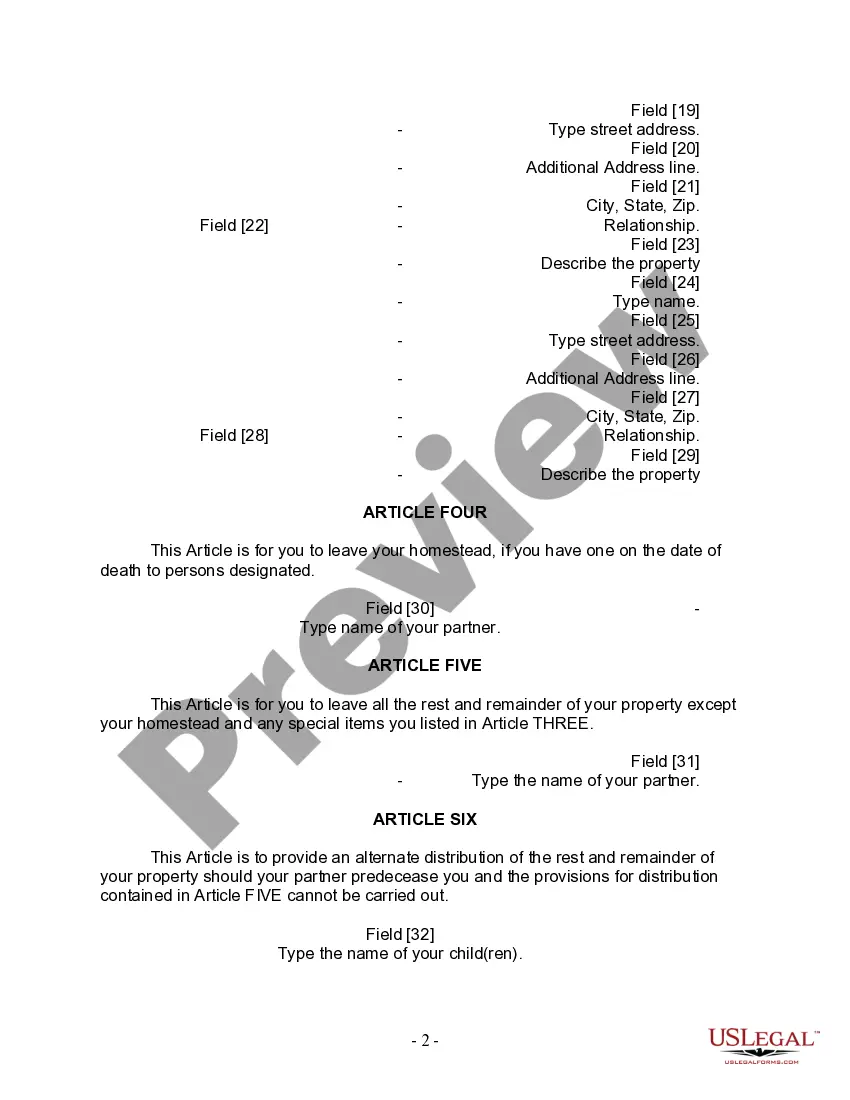

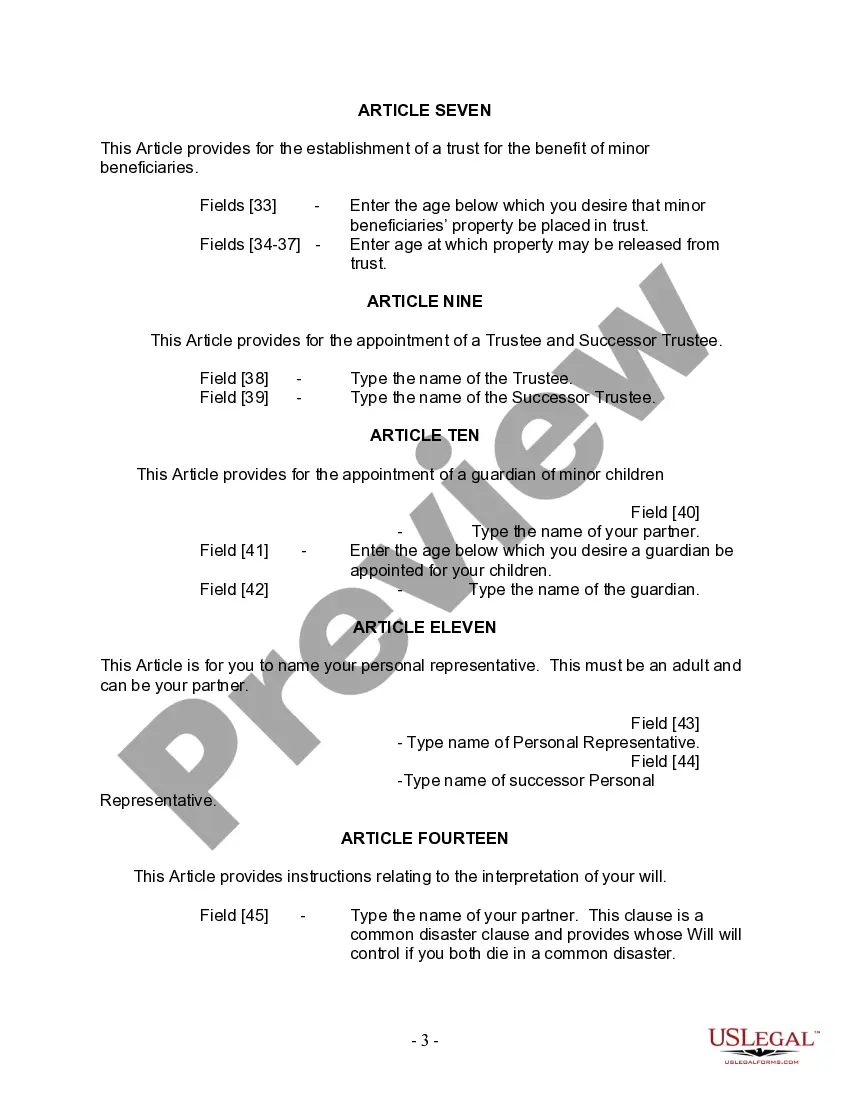

The El Monte California Legal Last Will and Testament Form for a Domestic Partner with No Children is a legally binding document that allows individuals who have a domestic partnership in El Monte, California, to determine the distribution of their assets and care for their loved ones after their passing. This form is specifically designed for domestic partners who do not have any children. By completing this legal document, domestic partners can ensure that their wishes regarding their estate, property, and other assets are properly addressed and executed. This form includes important sections such as: 1. Personal Information: This section requires the full names, addresses, and contact information of the domestic partners. 2. Appointment of Executor: In this section, the domestic partners can name an executor who will be responsible for managing the distribution of their assets and carrying out their wishes as specified in the will. 3. Distribution of Property and Assets: Domestic partners can detail the specific distribution of their property, assets, and possessions. This includes real estate, financial accounts, personal belongings, investments, and any other valuable assets. 4. Appointment of Guardians: If the domestic partners have any dependents, such as pets, they can appoint guardians who will be responsible for the care and well-being of these dependents after their passing. 5. Funeral and Burial Instructions: This section allows the domestic partners to specify their wishes regarding funeral arrangements, whether they prefer burial or cremation, and any specific instructions related to their final resting place. 6. Residue and Contingent Beneficiaries: Domestic partners can designate any individuals or organizations as the beneficiaries of the residual assets after all specific bequests have been fulfilled. Additionally, they can name contingent beneficiaries in case the primary beneficiaries pass away before the testator. It is important to note that there may be variations or additional forms available for specific circumstances or requirements. Some possible variations of the El Monte California Legal Last Will and Testament Form for a Domestic Partner with No Children may include: 1. Joint Will: Some domestic partners may choose to create a joint will, where both partners' wishes are combined into a single document. 2. Living Will or Advance Healthcare Directive: This form allows individuals to outline their medical treatment preferences and appoint a healthcare agent to make decisions on their behalf in case of incapacitation. 3. Power of Attorney: A Power of Attorney form grants a designated person the legal authority to make financial, legal, or medical decisions on behalf of the domestic partner if they become unable to do so themselves. It is advisable to consult with a legal professional or estate planning attorney to ensure that the appropriate and accurate form is selected, based on the specific needs and circumstances of the domestic partners.The El Monte California Legal Last Will and Testament Form for a Domestic Partner with No Children is a legally binding document that allows individuals who have a domestic partnership in El Monte, California, to determine the distribution of their assets and care for their loved ones after their passing. This form is specifically designed for domestic partners who do not have any children. By completing this legal document, domestic partners can ensure that their wishes regarding their estate, property, and other assets are properly addressed and executed. This form includes important sections such as: 1. Personal Information: This section requires the full names, addresses, and contact information of the domestic partners. 2. Appointment of Executor: In this section, the domestic partners can name an executor who will be responsible for managing the distribution of their assets and carrying out their wishes as specified in the will. 3. Distribution of Property and Assets: Domestic partners can detail the specific distribution of their property, assets, and possessions. This includes real estate, financial accounts, personal belongings, investments, and any other valuable assets. 4. Appointment of Guardians: If the domestic partners have any dependents, such as pets, they can appoint guardians who will be responsible for the care and well-being of these dependents after their passing. 5. Funeral and Burial Instructions: This section allows the domestic partners to specify their wishes regarding funeral arrangements, whether they prefer burial or cremation, and any specific instructions related to their final resting place. 6. Residue and Contingent Beneficiaries: Domestic partners can designate any individuals or organizations as the beneficiaries of the residual assets after all specific bequests have been fulfilled. Additionally, they can name contingent beneficiaries in case the primary beneficiaries pass away before the testator. It is important to note that there may be variations or additional forms available for specific circumstances or requirements. Some possible variations of the El Monte California Legal Last Will and Testament Form for a Domestic Partner with No Children may include: 1. Joint Will: Some domestic partners may choose to create a joint will, where both partners' wishes are combined into a single document. 2. Living Will or Advance Healthcare Directive: This form allows individuals to outline their medical treatment preferences and appoint a healthcare agent to make decisions on their behalf in case of incapacitation. 3. Power of Attorney: A Power of Attorney form grants a designated person the legal authority to make financial, legal, or medical decisions on behalf of the domestic partner if they become unable to do so themselves. It is advisable to consult with a legal professional or estate planning attorney to ensure that the appropriate and accurate form is selected, based on the specific needs and circumstances of the domestic partners.