The Will you have found is for a domestic partner with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for provisions for the adult children.

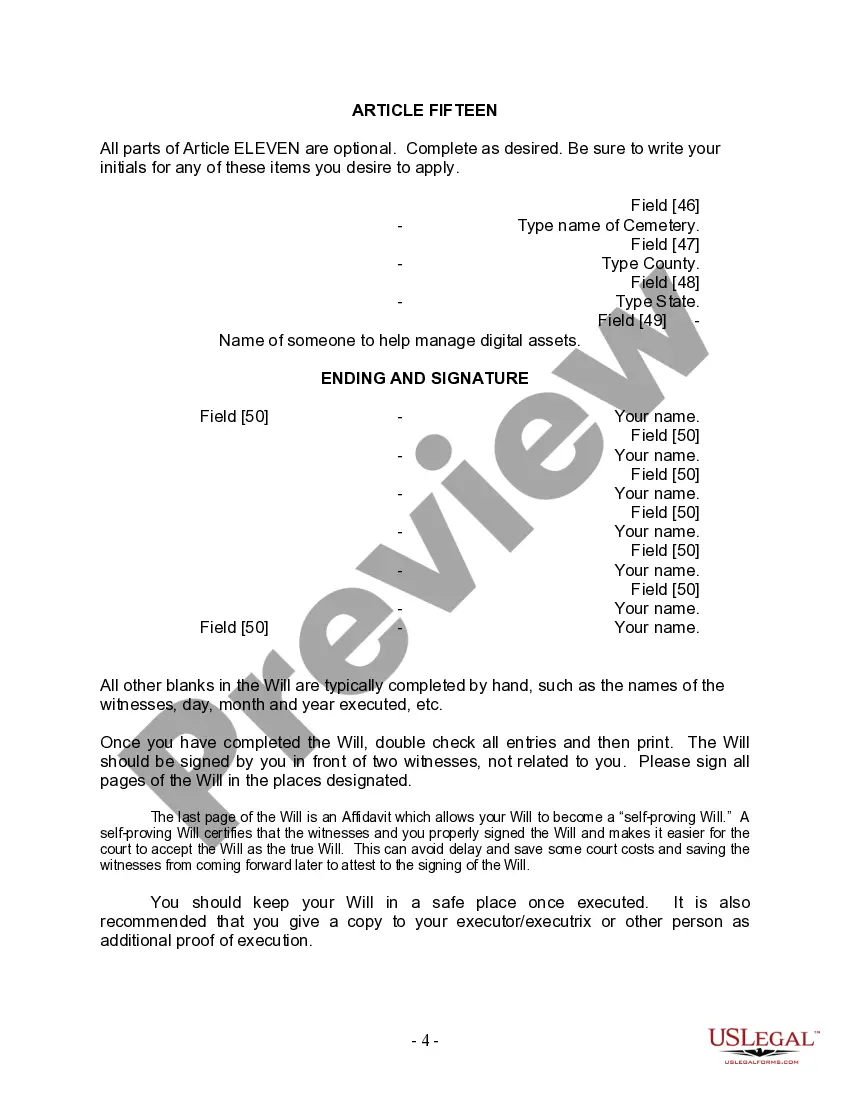

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

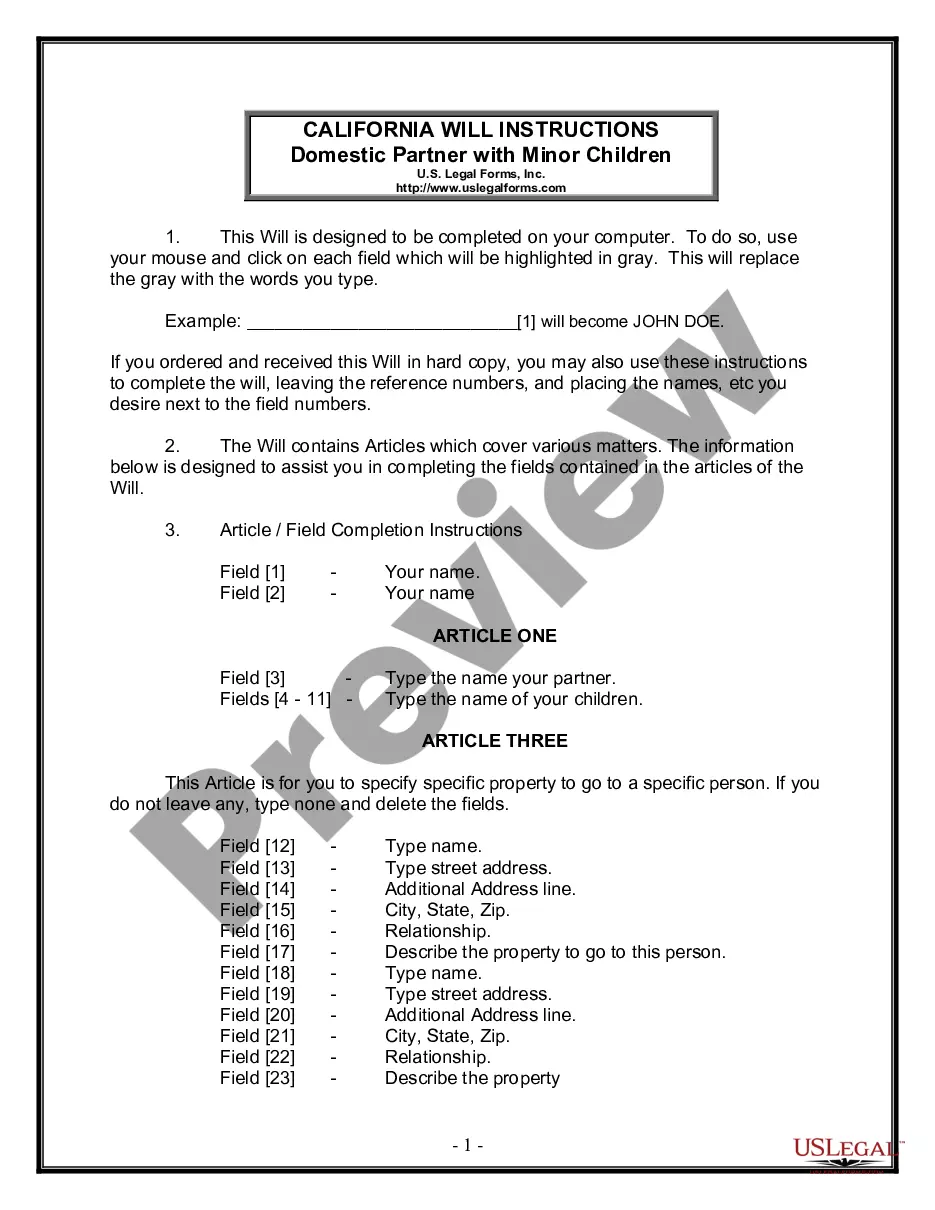

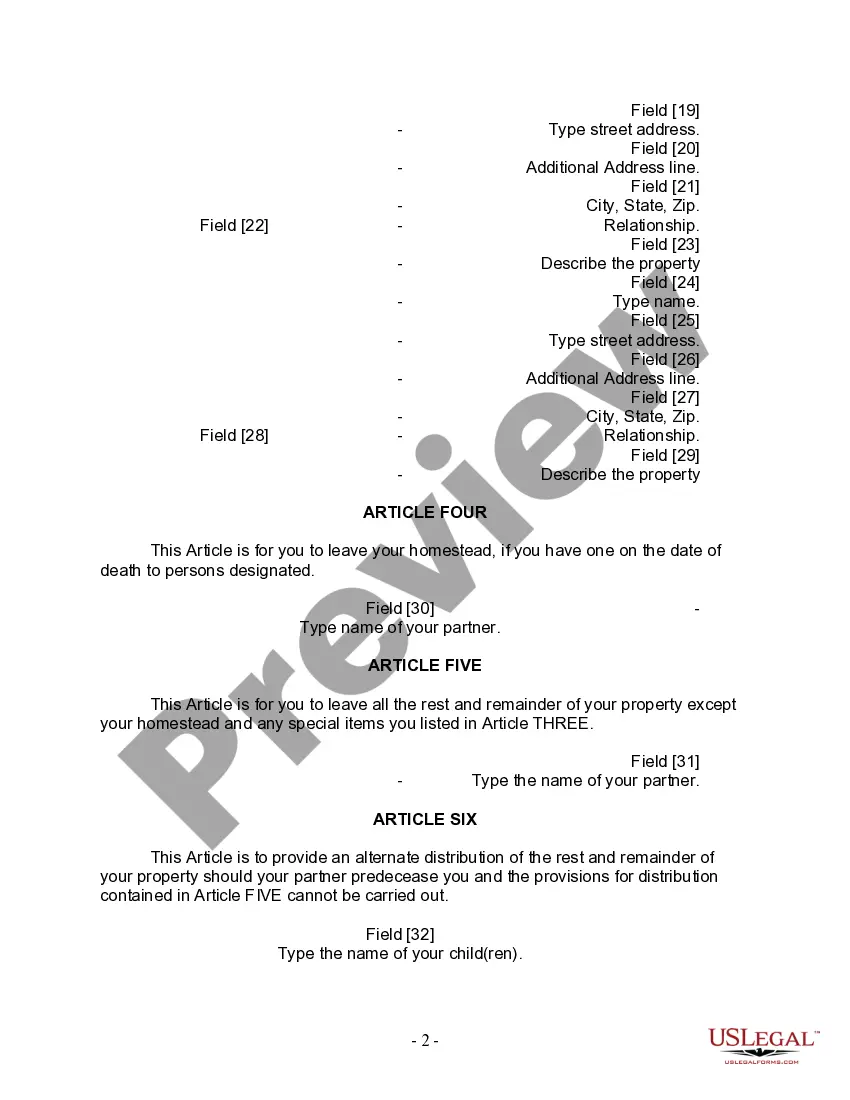

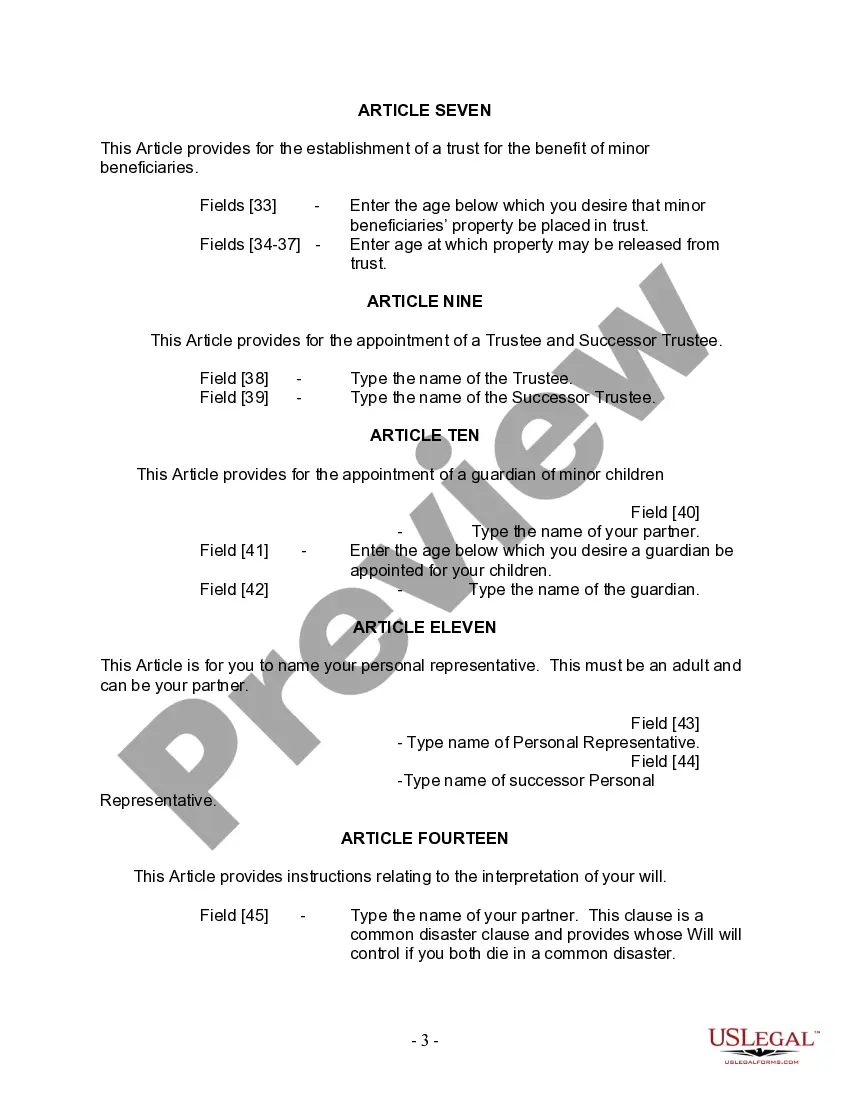

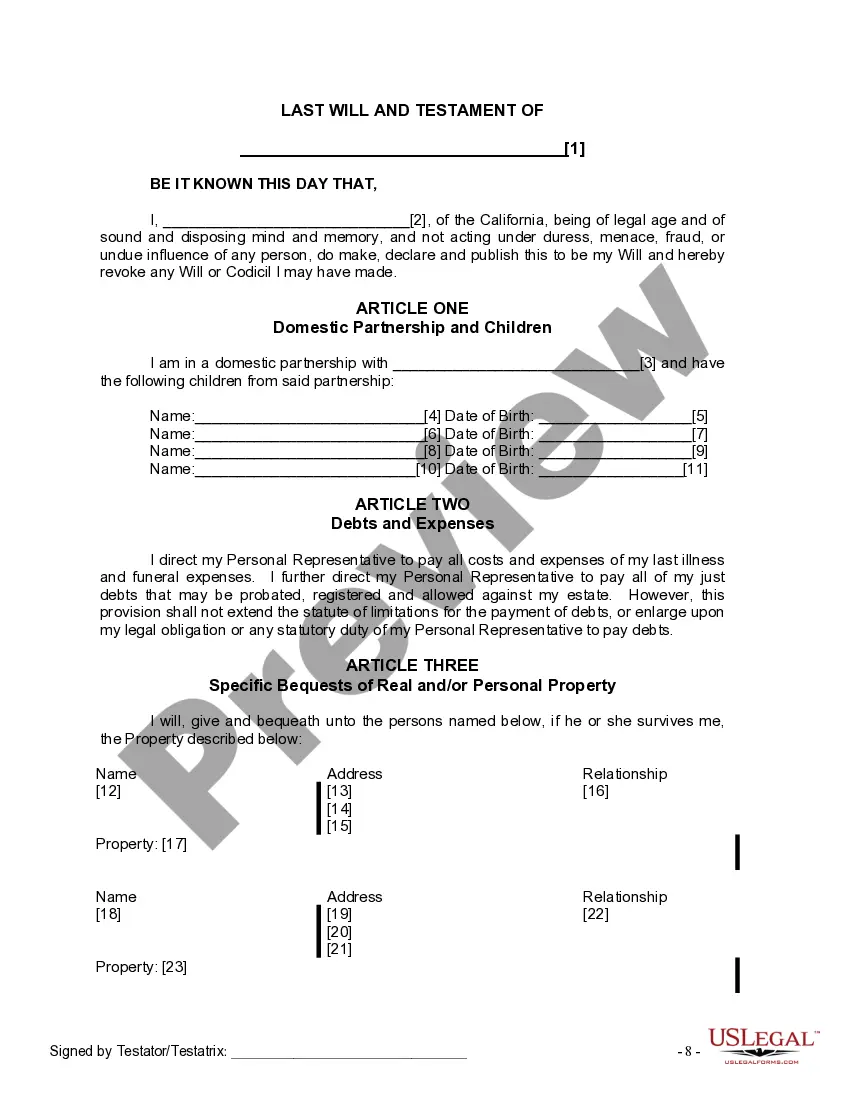

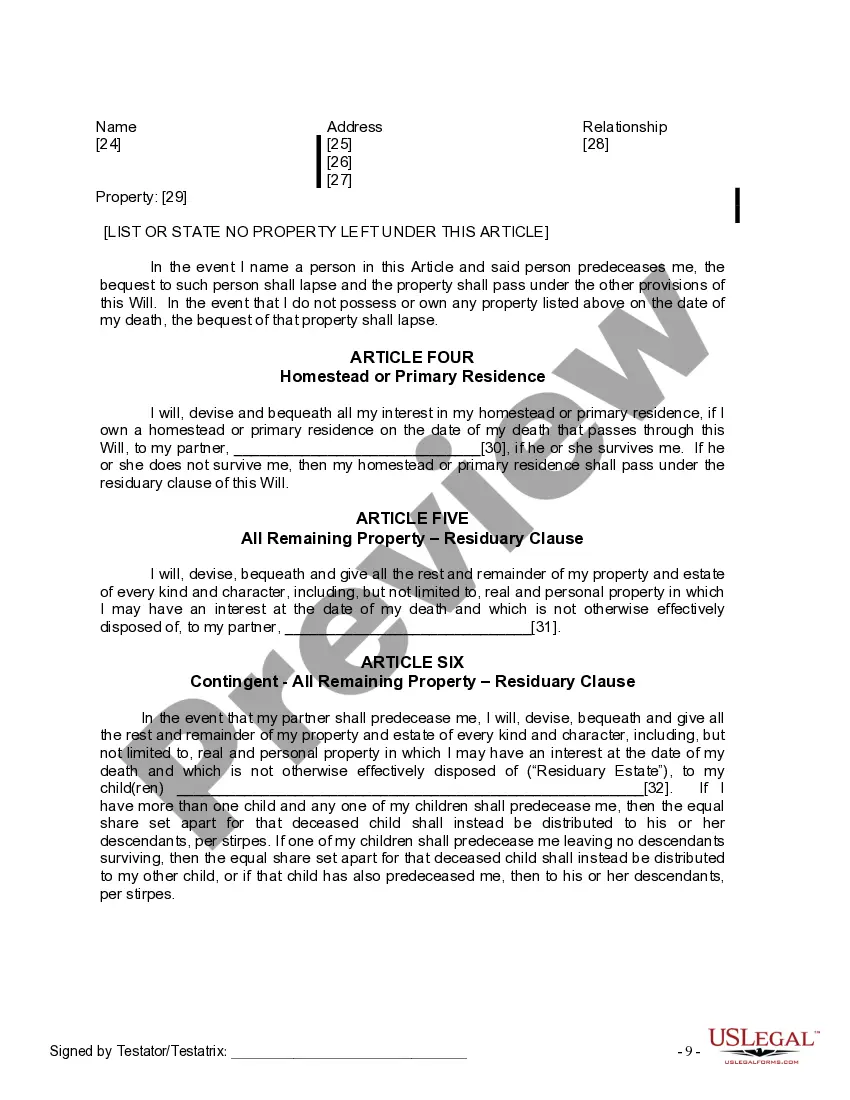

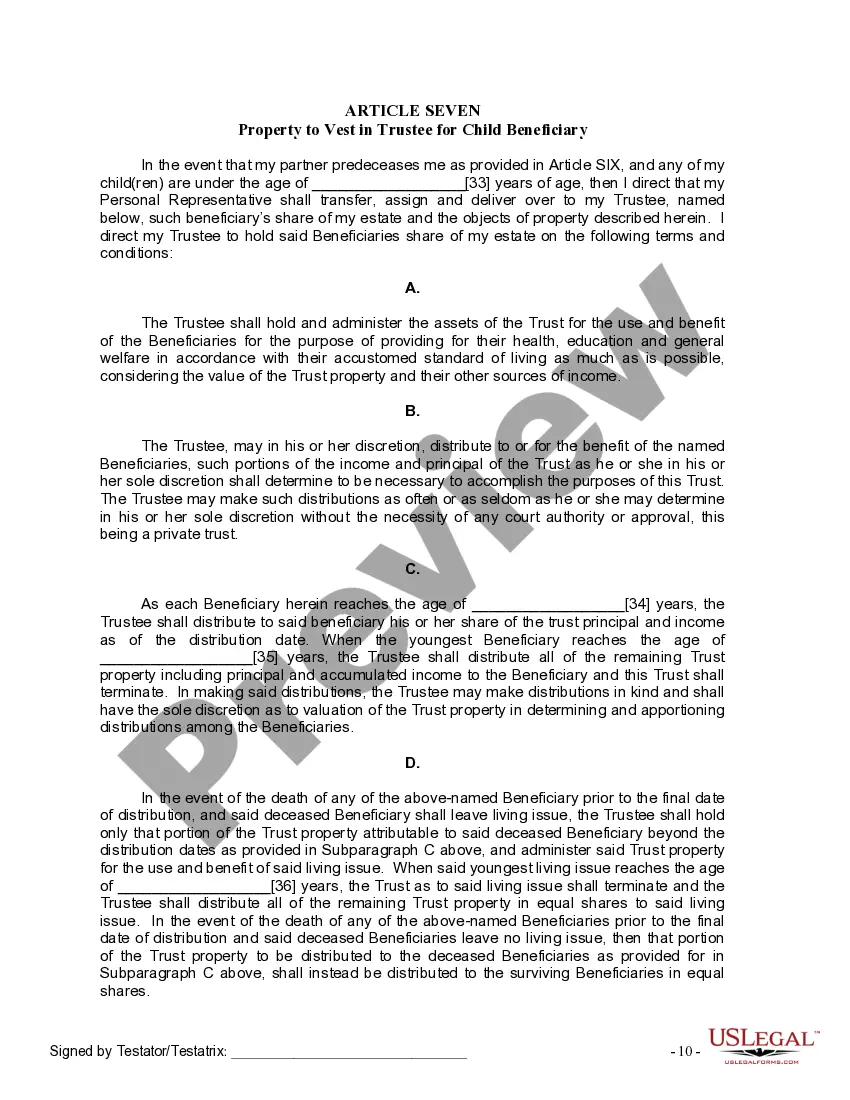

A Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children is a legally binding document that allows individuals in a domestic partnership to outline their wishes regarding the distribution of their assets, appointment of an executor, and other important matters after their death. This form is specifically designed for individuals who are in a domestic partnership and do not have any children. By completing this legal form, domestic partners can ensure that their assets are distributed according to their wishes and that their partner is taken care of in the event of their passing. It is important to note that without a valid will, the state's laws of intestacy will determine how assets are distributed, which may not align with the individual's intentions. The Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children typically includes the following sections: 1. Identification: This section requires the individual's personal information, such as their full name, address, and date of birth. 2. Appointment of Executor: The form provides a space for the individual to name the person they want to be appointed as the executor of their estate. The executor is responsible for carrying out the instructions in the will and managing the estate's affairs. 3. Distribution of Assets: This is the most crucial section of the form, where individuals can outline how they want their assets, including real estate, bank accounts, investments, and personal belongings, to be distributed among their domestic partner and other beneficiaries. They can specify percentages or specific assets to be bequeathed. 4. Alternate Beneficiaries: In case the domestic partner predeceases the individual or is unable to inherit, this section allows individuals to name alternate beneficiaries who will receive the assets. 5. Residual Estate: This refers to the portion of the estate that remains after all specific bequests have been made. Individuals can specify how they want the residual estate to be distributed, whether to their domestic partner, other family members, or charities. It is important to consult an attorney while completing the Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children to ensure that it complies with the state's laws and accurately reflects the individual's wishes. Different types or versions of the Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children may include variations in format, design, or specific prompts. However, the underlying purpose and elements of the form remain similar across versions. It is advisable to use an up-to-date and state-specific form to meet legal requirements and ensure the validity of the will.A Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children is a legally binding document that allows individuals in a domestic partnership to outline their wishes regarding the distribution of their assets, appointment of an executor, and other important matters after their death. This form is specifically designed for individuals who are in a domestic partnership and do not have any children. By completing this legal form, domestic partners can ensure that their assets are distributed according to their wishes and that their partner is taken care of in the event of their passing. It is important to note that without a valid will, the state's laws of intestacy will determine how assets are distributed, which may not align with the individual's intentions. The Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children typically includes the following sections: 1. Identification: This section requires the individual's personal information, such as their full name, address, and date of birth. 2. Appointment of Executor: The form provides a space for the individual to name the person they want to be appointed as the executor of their estate. The executor is responsible for carrying out the instructions in the will and managing the estate's affairs. 3. Distribution of Assets: This is the most crucial section of the form, where individuals can outline how they want their assets, including real estate, bank accounts, investments, and personal belongings, to be distributed among their domestic partner and other beneficiaries. They can specify percentages or specific assets to be bequeathed. 4. Alternate Beneficiaries: In case the domestic partner predeceases the individual or is unable to inherit, this section allows individuals to name alternate beneficiaries who will receive the assets. 5. Residual Estate: This refers to the portion of the estate that remains after all specific bequests have been made. Individuals can specify how they want the residual estate to be distributed, whether to their domestic partner, other family members, or charities. It is important to consult an attorney while completing the Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children to ensure that it complies with the state's laws and accurately reflects the individual's wishes. Different types or versions of the Temecula California Legal Last Will and Testament Form for a Domestic Partner with No Children may include variations in format, design, or specific prompts. However, the underlying purpose and elements of the form remain similar across versions. It is advisable to use an up-to-date and state-specific form to meet legal requirements and ensure the validity of the will.