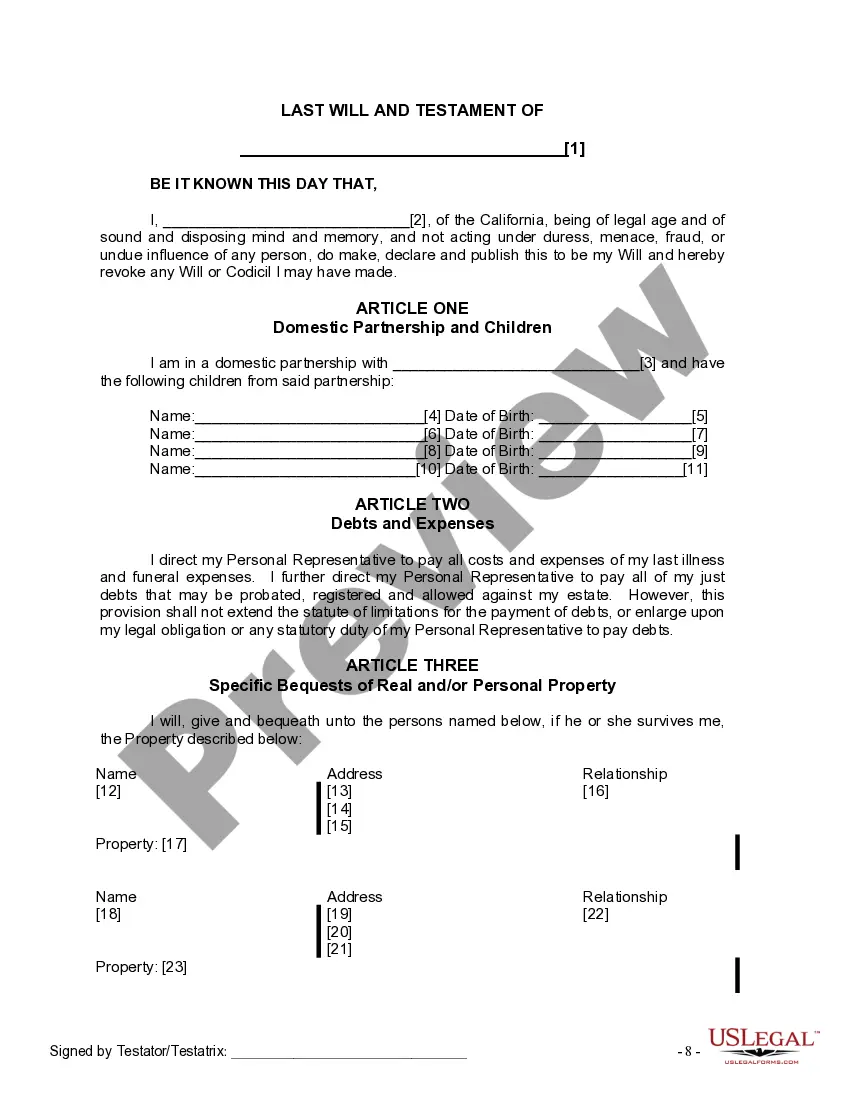

The Will you have found is for a domestic partner with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for provisions for the adult children.

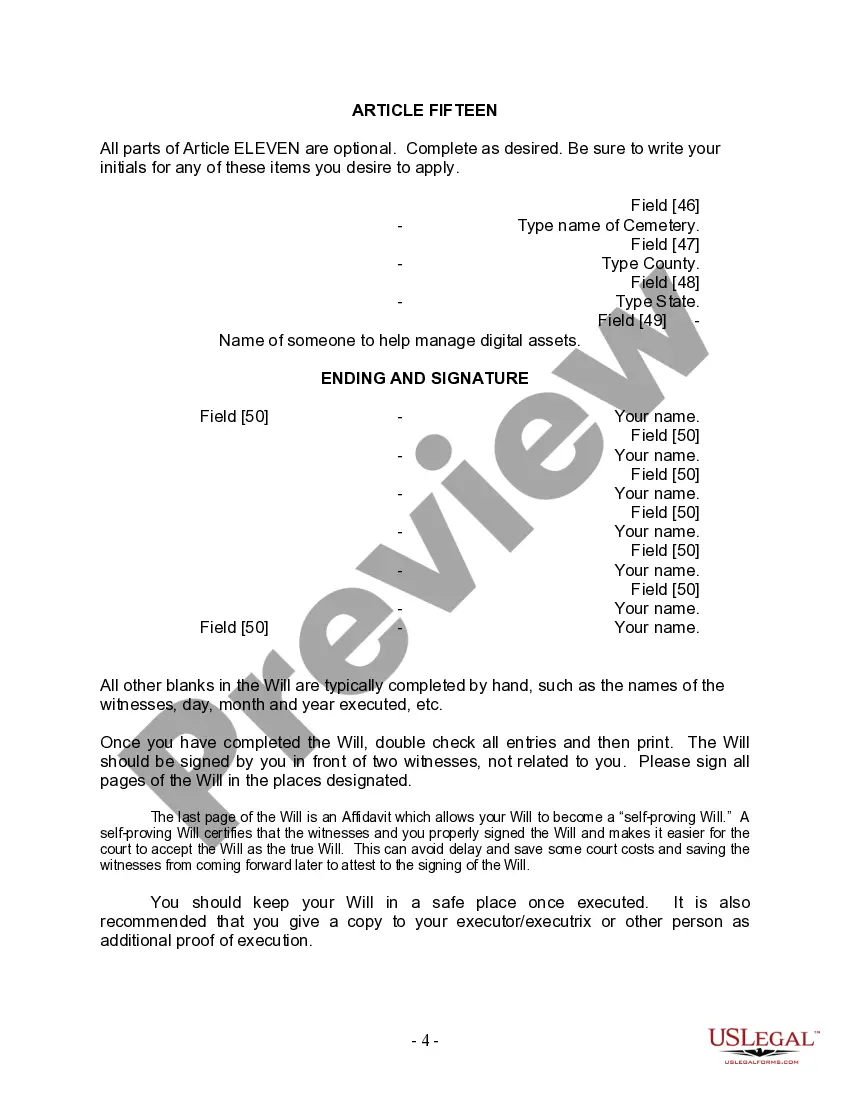

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

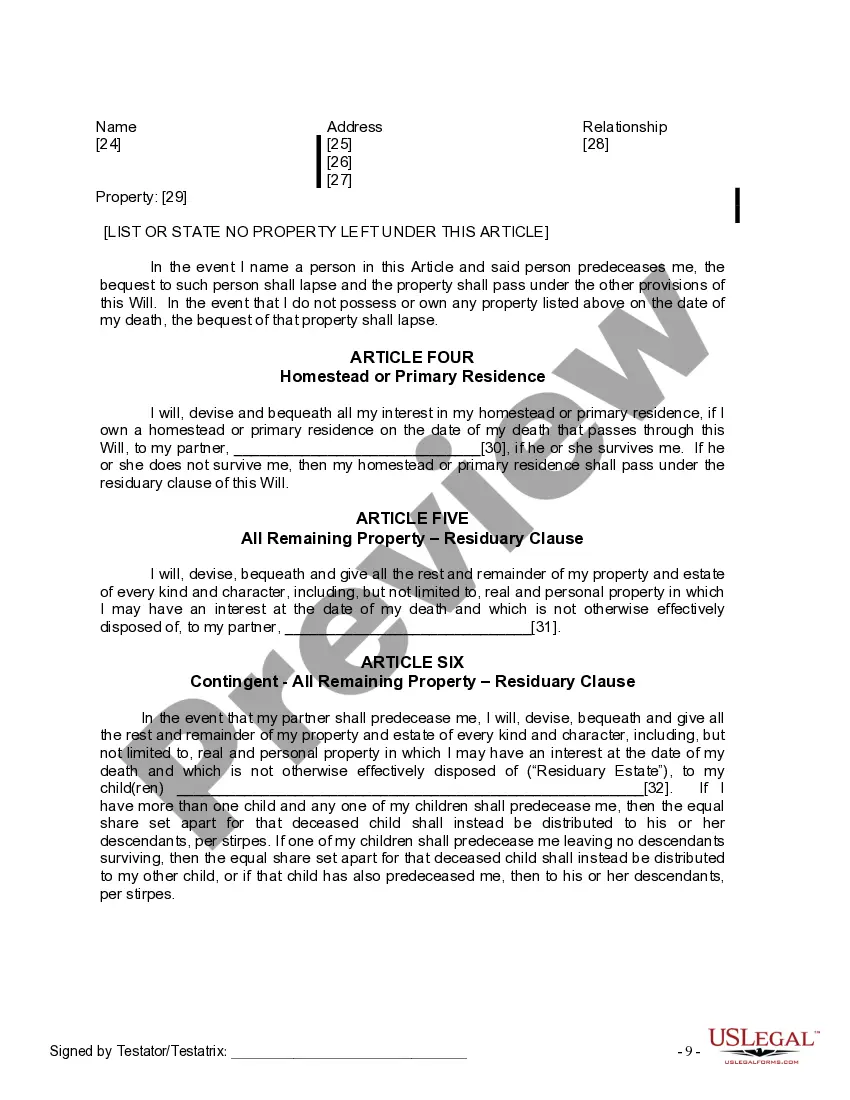

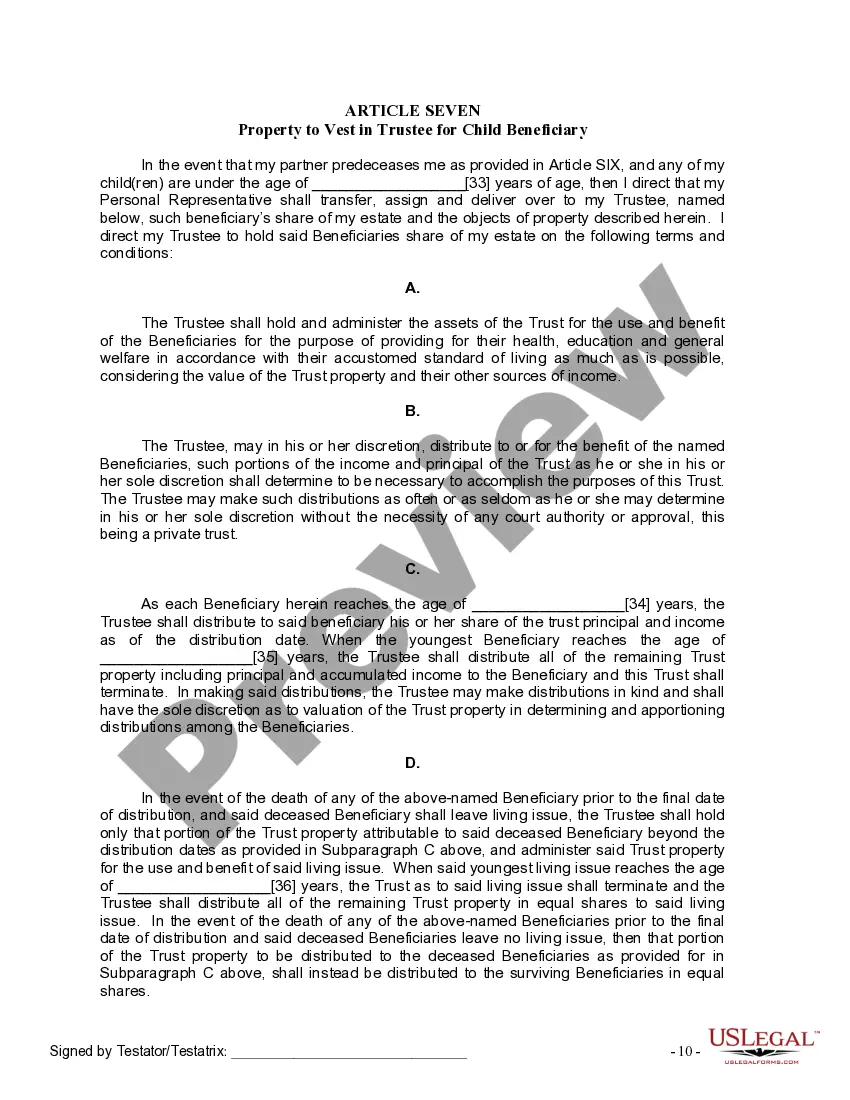

A Victorville California Legal Last Will and Testament Form for a Domestic Partner with No Children is a legally binding document that allows domestic partners in Victorville, California, to outline their final wishes and directions for the distribution of their assets and possessions upon their passing. This form ensures that the domestic partner's estate is distributed according to their preferences, providing peace of mind and clarity for their loved ones during an emotional time. The Victorville California Legal Last Will and Testament Form for a Domestic Partner with No Children is specifically designed for individuals who are in a domestic partnership and do not have any children. It is a customized document that reflects the unique circumstances of domestic partners who wish to designate their beneficiaries and decide how their assets will be distributed after their death. This legal form typically includes various sections and provisions to create a comprehensive and detailed plan. Some keywords relevant to the content of this form may include: 1. Domestic Partner: This form is specifically tailored for individuals who are in a domestic partnership, providing them with the legal means to ensure their partner is taken care of after their passing. 2. Last Will and Testament: The document is a last will and testament, meaning it outlines the testator's final desires and wishes regarding their estate after death. 3. No Children: This form is designed for individuals who do not have any children. This distinction is crucial as it affects the distribution of assets and ensures the domestic partner is the primary beneficiary. 4. Assets and Possessions: The form allows the domestic partner to specify various assets and possessions they own, such as real estate, vehicles, bank accounts, investments, personal belongings, and any other valuable items they wish to allocate to specific beneficiaries or charities. 5. Beneficiaries and Bequests: The form provides a section allowing the testator (the person creating the will) to name specific beneficiaries and the portion of their estate that each beneficiary will receive. It also allows for the designation of secondary beneficiaries or contingent beneficiaries if the primary beneficiaries are unable to receive their allocation. It is important to consult an attorney or utilize reputable online legal platforms to ensure accuracy and compliance with Victorville, California, laws when creating a Last Will and Testament Form for a Domestic Partner with No Children. Different variations or templates of this form may exist to accommodate specific needs or preferences, but ultimately, the content should align with the legal requirements and the testator's intentions.A Victorville California Legal Last Will and Testament Form for a Domestic Partner with No Children is a legally binding document that allows domestic partners in Victorville, California, to outline their final wishes and directions for the distribution of their assets and possessions upon their passing. This form ensures that the domestic partner's estate is distributed according to their preferences, providing peace of mind and clarity for their loved ones during an emotional time. The Victorville California Legal Last Will and Testament Form for a Domestic Partner with No Children is specifically designed for individuals who are in a domestic partnership and do not have any children. It is a customized document that reflects the unique circumstances of domestic partners who wish to designate their beneficiaries and decide how their assets will be distributed after their death. This legal form typically includes various sections and provisions to create a comprehensive and detailed plan. Some keywords relevant to the content of this form may include: 1. Domestic Partner: This form is specifically tailored for individuals who are in a domestic partnership, providing them with the legal means to ensure their partner is taken care of after their passing. 2. Last Will and Testament: The document is a last will and testament, meaning it outlines the testator's final desires and wishes regarding their estate after death. 3. No Children: This form is designed for individuals who do not have any children. This distinction is crucial as it affects the distribution of assets and ensures the domestic partner is the primary beneficiary. 4. Assets and Possessions: The form allows the domestic partner to specify various assets and possessions they own, such as real estate, vehicles, bank accounts, investments, personal belongings, and any other valuable items they wish to allocate to specific beneficiaries or charities. 5. Beneficiaries and Bequests: The form provides a section allowing the testator (the person creating the will) to name specific beneficiaries and the portion of their estate that each beneficiary will receive. It also allows for the designation of secondary beneficiaries or contingent beneficiaries if the primary beneficiaries are unable to receive their allocation. It is important to consult an attorney or utilize reputable online legal platforms to ensure accuracy and compliance with Victorville, California, laws when creating a Last Will and Testament Form for a Domestic Partner with No Children. Different variations or templates of this form may exist to accommodate specific needs or preferences, but ultimately, the content should align with the legal requirements and the testator's intentions.