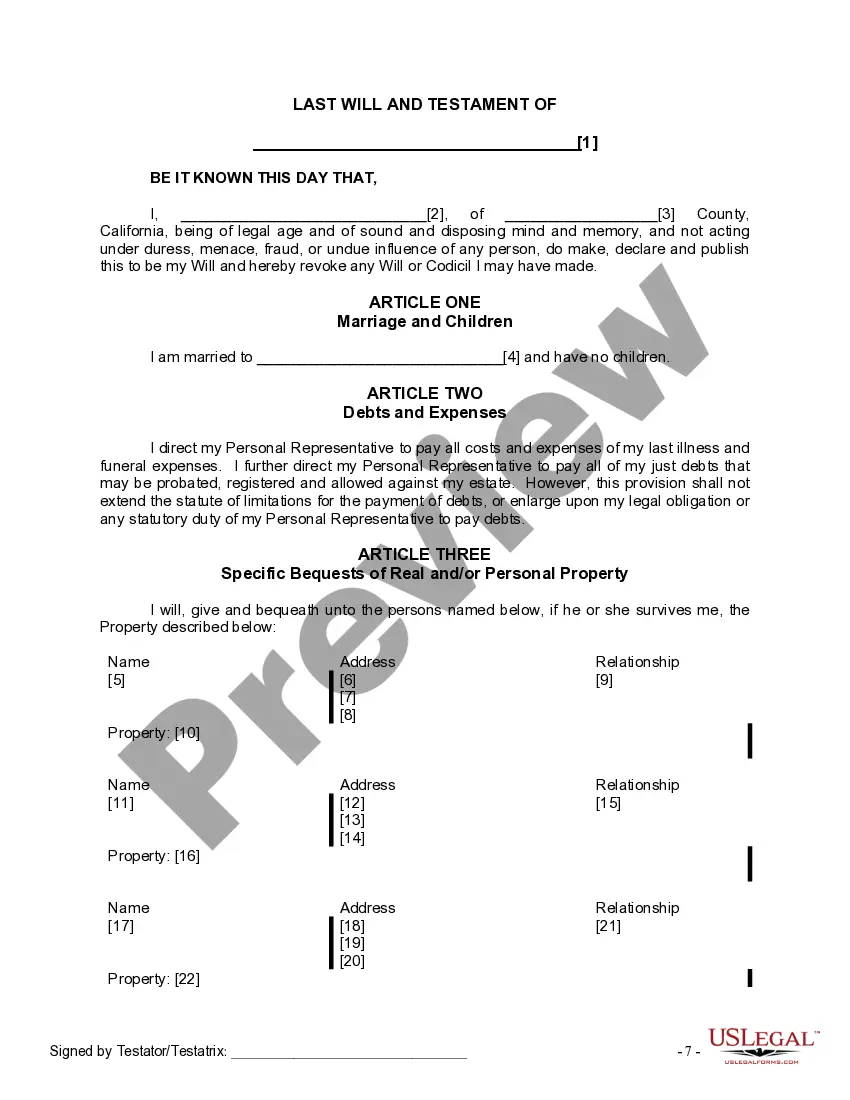

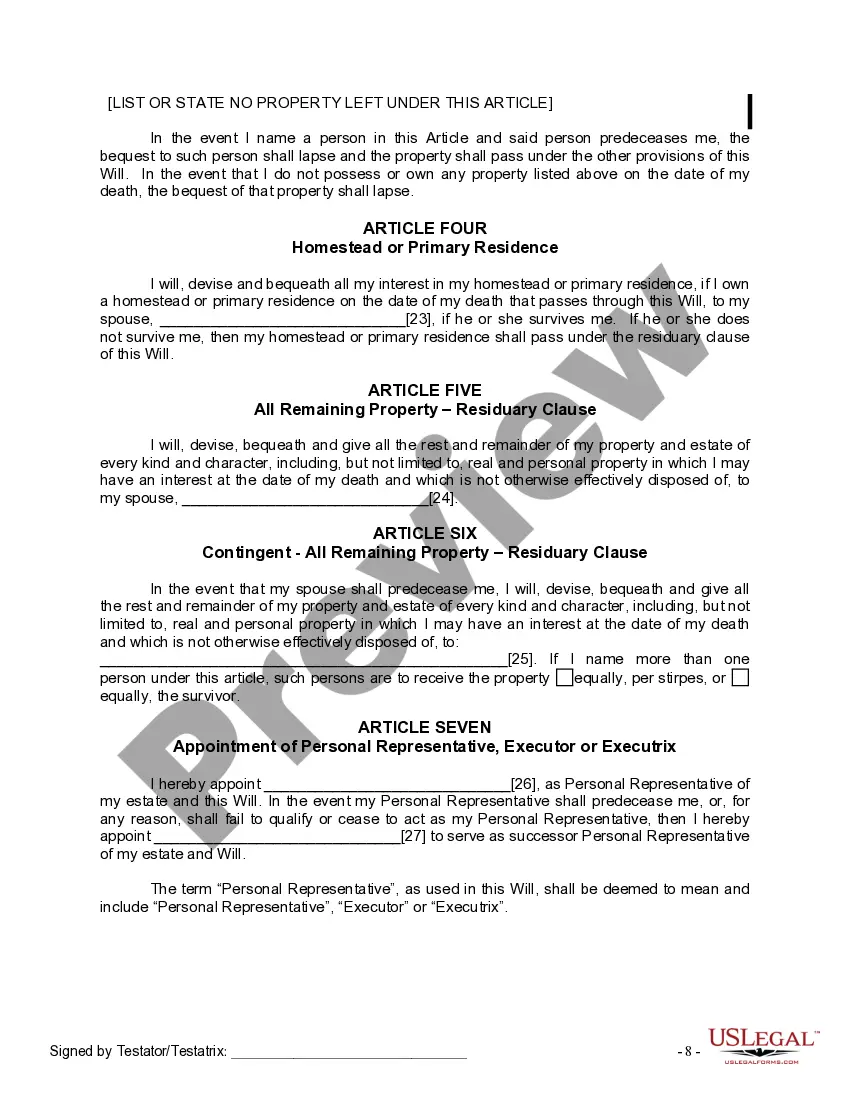

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

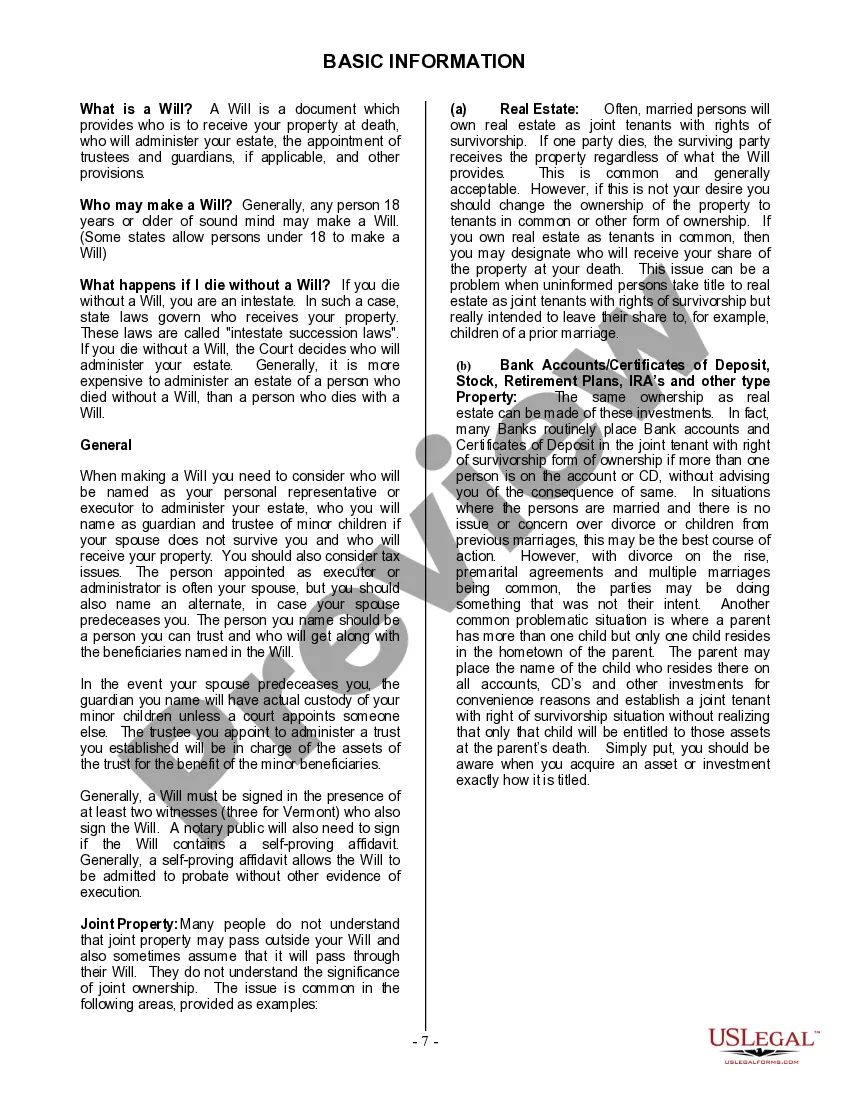

The Elk Grove California Legal Last Will and Testament Form for a Married Person with No Children is a crucial document that allows individuals who are married and have no children to outline their final wishes and distribute their assets after their passing. This legally binding document ensures that your assets and property are distributed according to your desires, and it helps to avoid potential conflicts among family members or other parties. The Elk Grove California Legal Last Will and Testament Form for a Married Person with No Children includes specific sections that must be filled out accurately. It typically begins with a personal information section, where you provide your full name, address, and other identifying details. This section also allows you to specify your marital status and state that you have no children. Next, you will designate an executor who will be responsible for executing the instructions outlined in your will. The executor plays a crucial role in managing your estate, settling any outstanding debts, and ensuring that your assets are distributed according to your wishes. They will form also includes sections to allocate your assets. This includes specifying who will inherit your property, investments, savings, real estate, and personal belongings. If you have any specific requests or conditions for asset distribution, such as charitable donations or certain individuals receiving particular items, it is essential to clearly state these in your will. Additionally, the Elk Grove California Legal Last Will and Testament Form should include provisions for any digital assets or online accounts you may have. In today's digital age, it is crucial to address the management or transfer of your online accounts, social media profiles, or other digital possessions, ensuring they are handled appropriately. It is important to note that there may be different types of Elk Grove California Legal Last Will and Testament Forms for a Married Person with No Children, each tailored to different scenarios or preferences. For instance, individuals with complex financial situations or specific estate planning needs might opt for more comprehensive or customized will form. Moreover, variations may exist based on the specific legal requirements or updates within the state of California. Therefore, it is recommended to consult with an attorney or legal professional to determine the most suitable will form for your specific circumstances. In conclusion, the Elk Grove California Legal Last Will and Testament Form is a critical document that ensures your final wishes are honored. By properly completing this form, individuals who are married with no children can have peace of mind knowing that their assets will be distributed according to their desires, thus providing security for their surviving spouse and ensuring their estate is handled effectively.The Elk Grove California Legal Last Will and Testament Form for a Married Person with No Children is a crucial document that allows individuals who are married and have no children to outline their final wishes and distribute their assets after their passing. This legally binding document ensures that your assets and property are distributed according to your desires, and it helps to avoid potential conflicts among family members or other parties. The Elk Grove California Legal Last Will and Testament Form for a Married Person with No Children includes specific sections that must be filled out accurately. It typically begins with a personal information section, where you provide your full name, address, and other identifying details. This section also allows you to specify your marital status and state that you have no children. Next, you will designate an executor who will be responsible for executing the instructions outlined in your will. The executor plays a crucial role in managing your estate, settling any outstanding debts, and ensuring that your assets are distributed according to your wishes. They will form also includes sections to allocate your assets. This includes specifying who will inherit your property, investments, savings, real estate, and personal belongings. If you have any specific requests or conditions for asset distribution, such as charitable donations or certain individuals receiving particular items, it is essential to clearly state these in your will. Additionally, the Elk Grove California Legal Last Will and Testament Form should include provisions for any digital assets or online accounts you may have. In today's digital age, it is crucial to address the management or transfer of your online accounts, social media profiles, or other digital possessions, ensuring they are handled appropriately. It is important to note that there may be different types of Elk Grove California Legal Last Will and Testament Forms for a Married Person with No Children, each tailored to different scenarios or preferences. For instance, individuals with complex financial situations or specific estate planning needs might opt for more comprehensive or customized will form. Moreover, variations may exist based on the specific legal requirements or updates within the state of California. Therefore, it is recommended to consult with an attorney or legal professional to determine the most suitable will form for your specific circumstances. In conclusion, the Elk Grove California Legal Last Will and Testament Form is a critical document that ensures your final wishes are honored. By properly completing this form, individuals who are married with no children can have peace of mind knowing that their assets will be distributed according to their desires, thus providing security for their surviving spouse and ensuring their estate is handled effectively.