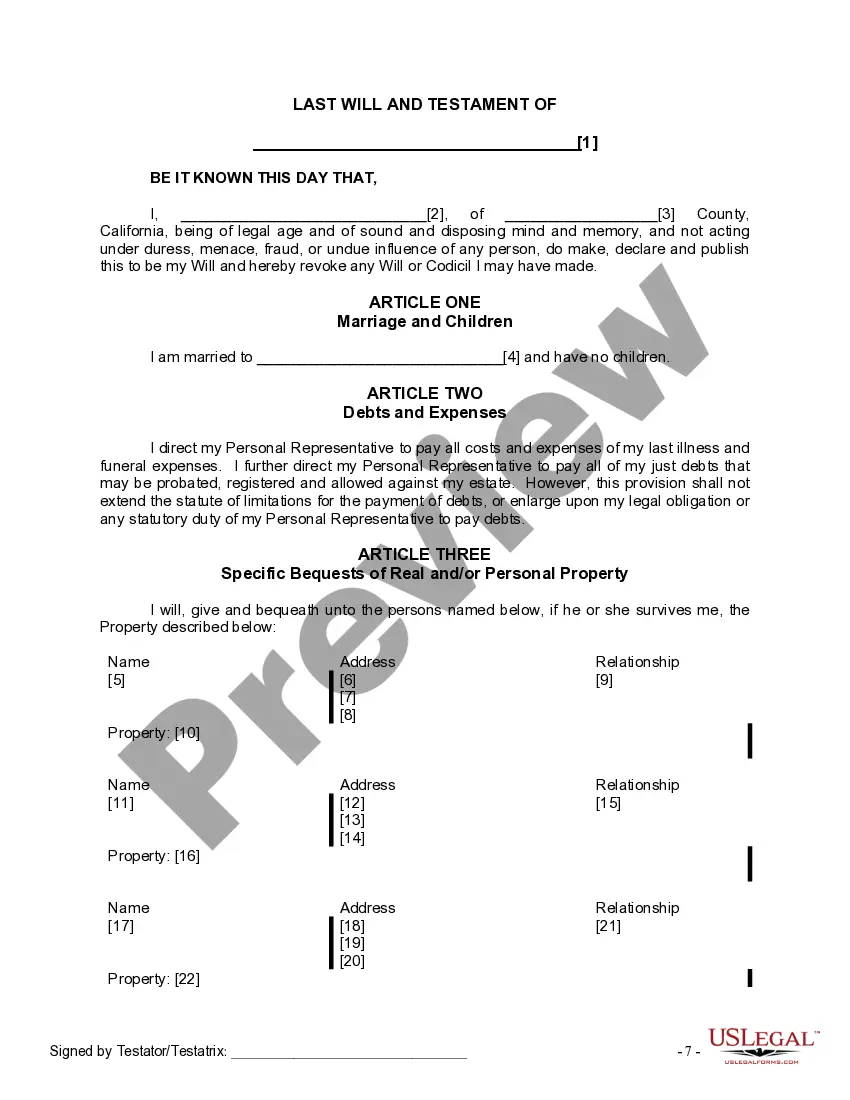

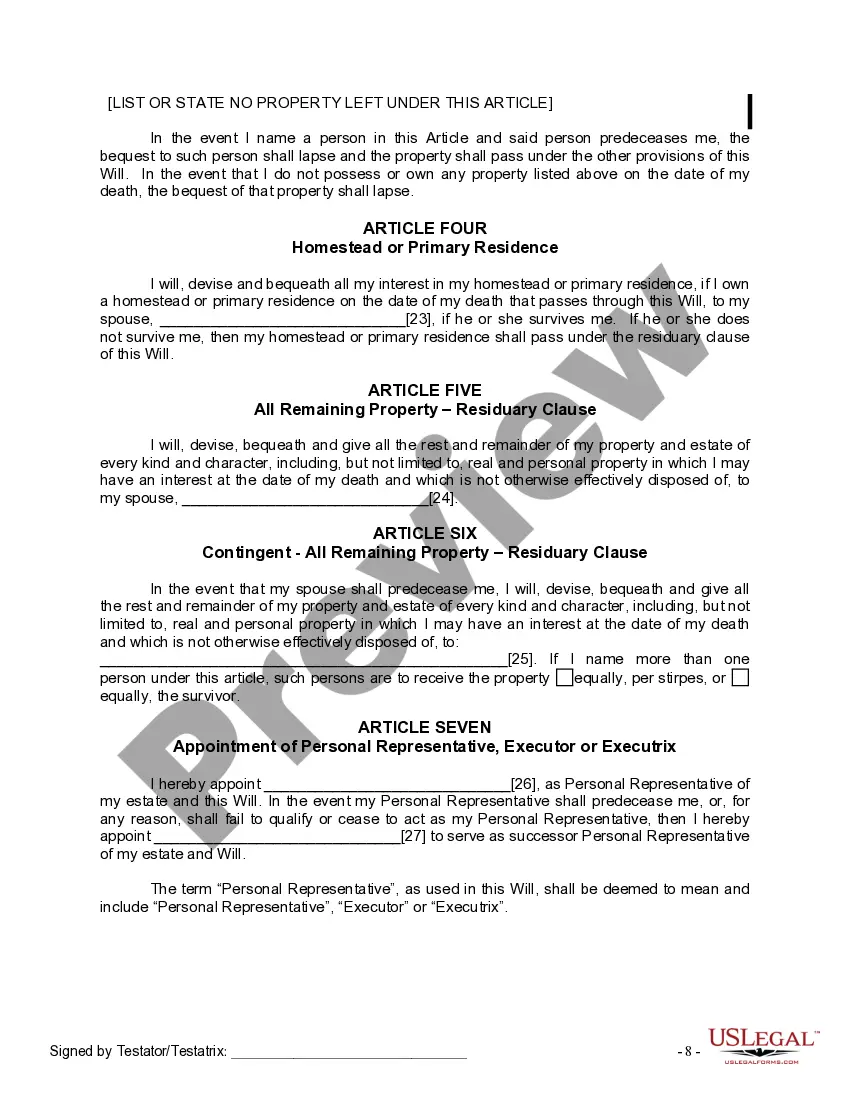

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

A Riverside California Legal Last Will and Testament Form for a Married Person with No Children is a legal document that outlines the specific wishes of a married individual who does not have any children regarding the distribution of their assets, debts, and other matters upon their passing. It is essential to have a legally binding will in place to ensure that your estate is handled according to your wishes, l as well as to minimize potential conflicts among loved ones. The Riverside California Legal Last Will and Testament Form for a Married Person with No Children allows individuals to name an executor or personal representative who will be responsible for carrying out the instructions laid out in the will. This person will be tasked with overseeing the probate process, including identifying and valuing assets, paying debts and taxes, and distributing the remaining property to the designated beneficiaries. When drafting a Riverside California Legal Last Will and Testament Form for a Married Person with No Children, it is important to include key elements such as: 1. Identification: The will should begin with the full legal names, current addresses, and contact information of the testator (the person creating the will) and their spouse. 2. Executor Designation: The form should include the name of the individual appointed as the executor. This person should be someone the testator trusts to handle their affairs and carry out the instructions without bias. 3. Asset Distribution: The testator must specify their desired distribution of assets, including bank accounts, investments, real estate, personal possessions, and any other property or valuables. This may include bequests to family members, friends, or charitable organizations. 4. Debts and Taxes: The will should address the payment of any outstanding debts or taxes owed by the testator. This may involve selling certain assets to cover these obligations. 5. Alternative Beneficiaries: In case the primary beneficiary predeceases the testator or is unable to inherit, it is advisable to name alternative beneficiaries to ensure that the assets are distributed as intended. 6. Guardianship: If applicable, the will should identify a guardian or guardians to care for any minor children or dependents in the event both spouses pass away simultaneously. Some variations of the Riverside California Legal Last Will and Testament Form for a Married Person with No Children may include specific provisions for unique circumstances, such as: — Testamentary Trust: This form may include the creation of a trust to manage and distribute the assets of the deceased if certain conditions or criteria are met. — Charitable Bequests: Individuals may opt to include provisions for charitable donations or endowments to organizations or causes close to their hearts. — Digital Assets: Some individuals may wish to address the management and distribution of digital assets, including online accounts, passwords, and files. By utilizing the Riverside California Legal Last Will and Testament Form, married individuals with no children can have peace of mind knowing their estate will be handled according to their preferences after their passing. It is crucial to consult with an attorney to ensure compliance with California state laws and to address any specific concerns or complexities that may apply to individual circumstances.A Riverside California Legal Last Will and Testament Form for a Married Person with No Children is a legal document that outlines the specific wishes of a married individual who does not have any children regarding the distribution of their assets, debts, and other matters upon their passing. It is essential to have a legally binding will in place to ensure that your estate is handled according to your wishes, l as well as to minimize potential conflicts among loved ones. The Riverside California Legal Last Will and Testament Form for a Married Person with No Children allows individuals to name an executor or personal representative who will be responsible for carrying out the instructions laid out in the will. This person will be tasked with overseeing the probate process, including identifying and valuing assets, paying debts and taxes, and distributing the remaining property to the designated beneficiaries. When drafting a Riverside California Legal Last Will and Testament Form for a Married Person with No Children, it is important to include key elements such as: 1. Identification: The will should begin with the full legal names, current addresses, and contact information of the testator (the person creating the will) and their spouse. 2. Executor Designation: The form should include the name of the individual appointed as the executor. This person should be someone the testator trusts to handle their affairs and carry out the instructions without bias. 3. Asset Distribution: The testator must specify their desired distribution of assets, including bank accounts, investments, real estate, personal possessions, and any other property or valuables. This may include bequests to family members, friends, or charitable organizations. 4. Debts and Taxes: The will should address the payment of any outstanding debts or taxes owed by the testator. This may involve selling certain assets to cover these obligations. 5. Alternative Beneficiaries: In case the primary beneficiary predeceases the testator or is unable to inherit, it is advisable to name alternative beneficiaries to ensure that the assets are distributed as intended. 6. Guardianship: If applicable, the will should identify a guardian or guardians to care for any minor children or dependents in the event both spouses pass away simultaneously. Some variations of the Riverside California Legal Last Will and Testament Form for a Married Person with No Children may include specific provisions for unique circumstances, such as: — Testamentary Trust: This form may include the creation of a trust to manage and distribute the assets of the deceased if certain conditions or criteria are met. — Charitable Bequests: Individuals may opt to include provisions for charitable donations or endowments to organizations or causes close to their hearts. — Digital Assets: Some individuals may wish to address the management and distribution of digital assets, including online accounts, passwords, and files. By utilizing the Riverside California Legal Last Will and Testament Form, married individuals with no children can have peace of mind knowing their estate will be handled according to their preferences after their passing. It is crucial to consult with an attorney to ensure compliance with California state laws and to address any specific concerns or complexities that may apply to individual circumstances.