The Mutual Wills package with Last Wills and Testaments you have found is for a married couple with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.This package contains two wills, one for each spouse. It also includes instructions.

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills.

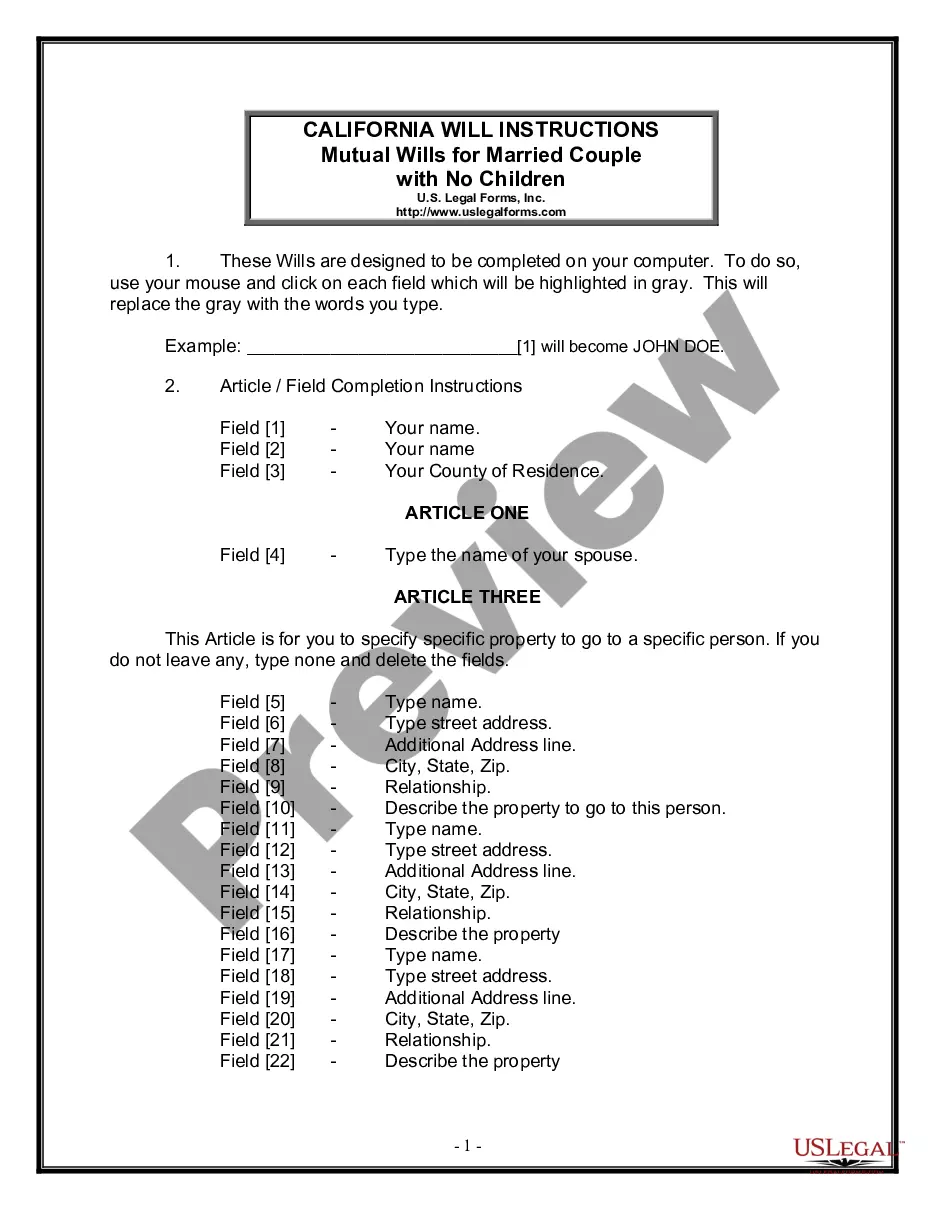

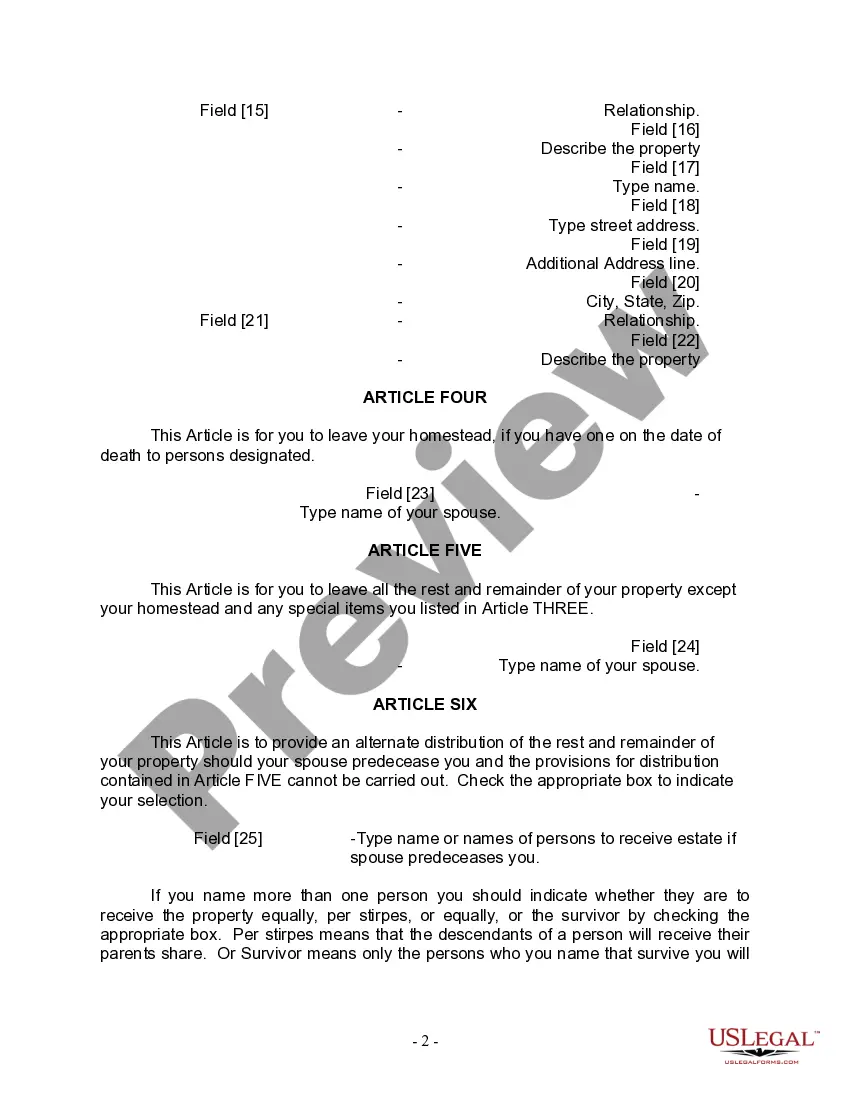

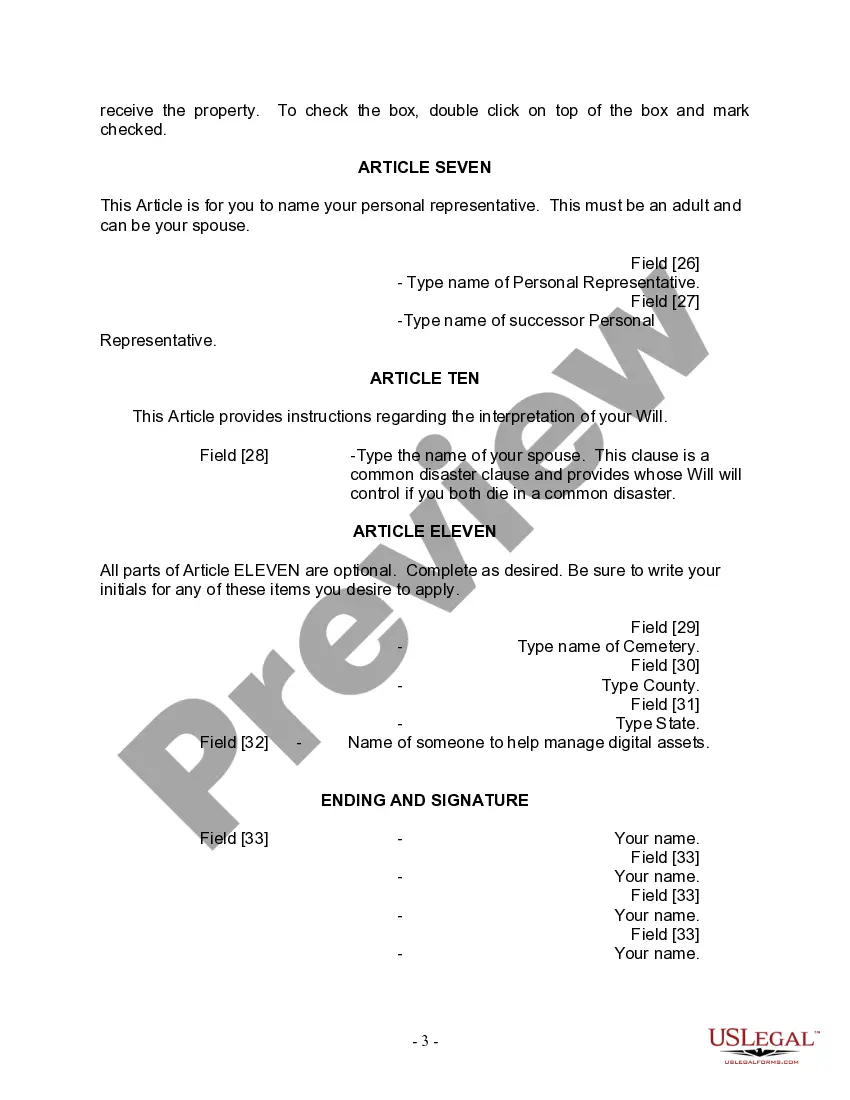

San Bernardino California Mutual Wills package with Last Wills and Testaments for Married Couple with No Children is an essential legal document package designed to address the specific needs and requirements of married couples in San Bernardino, California, who do not have any children. These comprehensive documents provide peace of mind by ensuring that the couple's final wishes and estate distribution are legally protected. The San Bernardino California Mutual Wills package includes Last Wills and Testaments, which are legal documents that outline a couple's final wishes regarding the distribution of their assets, appointment of executors, and designation of beneficiaries. These Last Wills and Testaments are crucial for married couples with no children, as they allow them to custom tailor their estate plan to their unique circumstances. By choosing the San Bernardino California Mutual Wills package, couples can effectively express their intentions and desires regarding the distribution of their estate. Without a proper will in place, the state's default laws may dictate how the couple's assets are distributed, potentially leaving the surviving spouse in a vulnerable position. There are various types of San Bernardino California Mutual Wills packages available, depending on the complexity of the couple's financial situation and their specific requirements. Some variations may include: 1. Basic San Bernardino California Mutual Wills package: This package is suitable for couples with simple estates and straightforward wishes. It includes all the necessary legal provisions to ensure the couple's assets are distributed according to their wishes after both partners pass away. 2. Advanced San Bernardino California Mutual Wills package: This package is ideal for couples with more complex financial situations, multiple properties, or significant assets. It addresses specific concerns such as tax planning, trusts, and charitable giving. 3. Comprehensive San Bernardino California Mutual Wills package: This package provides a robust estate planning solution for couples who have additional requirements beyond the basic and advanced packages. It may include provisions to handle business interests, retirement accounts, life insurance policies, or special instructions for unique assets. By utilizing the San Bernardino California Mutual Wills package with Last Wills and Testaments for Married Couple with No Children, couples can ensure that their wishes regarding the distribution of their estate and the management of their affairs are explicitly detailed and legally binding. These documents provide a solid foundation for estate planning, allowing the married couple to secure their financial legacy and protect their surviving spouse's future.San Bernardino California Mutual Wills package with Last Wills and Testaments for Married Couple with No Children is an essential legal document package designed to address the specific needs and requirements of married couples in San Bernardino, California, who do not have any children. These comprehensive documents provide peace of mind by ensuring that the couple's final wishes and estate distribution are legally protected. The San Bernardino California Mutual Wills package includes Last Wills and Testaments, which are legal documents that outline a couple's final wishes regarding the distribution of their assets, appointment of executors, and designation of beneficiaries. These Last Wills and Testaments are crucial for married couples with no children, as they allow them to custom tailor their estate plan to their unique circumstances. By choosing the San Bernardino California Mutual Wills package, couples can effectively express their intentions and desires regarding the distribution of their estate. Without a proper will in place, the state's default laws may dictate how the couple's assets are distributed, potentially leaving the surviving spouse in a vulnerable position. There are various types of San Bernardino California Mutual Wills packages available, depending on the complexity of the couple's financial situation and their specific requirements. Some variations may include: 1. Basic San Bernardino California Mutual Wills package: This package is suitable for couples with simple estates and straightforward wishes. It includes all the necessary legal provisions to ensure the couple's assets are distributed according to their wishes after both partners pass away. 2. Advanced San Bernardino California Mutual Wills package: This package is ideal for couples with more complex financial situations, multiple properties, or significant assets. It addresses specific concerns such as tax planning, trusts, and charitable giving. 3. Comprehensive San Bernardino California Mutual Wills package: This package provides a robust estate planning solution for couples who have additional requirements beyond the basic and advanced packages. It may include provisions to handle business interests, retirement accounts, life insurance policies, or special instructions for unique assets. By utilizing the San Bernardino California Mutual Wills package with Last Wills and Testaments for Married Couple with No Children, couples can ensure that their wishes regarding the distribution of their estate and the management of their affairs are explicitly detailed and legally binding. These documents provide a solid foundation for estate planning, allowing the married couple to secure their financial legacy and protect their surviving spouse's future.