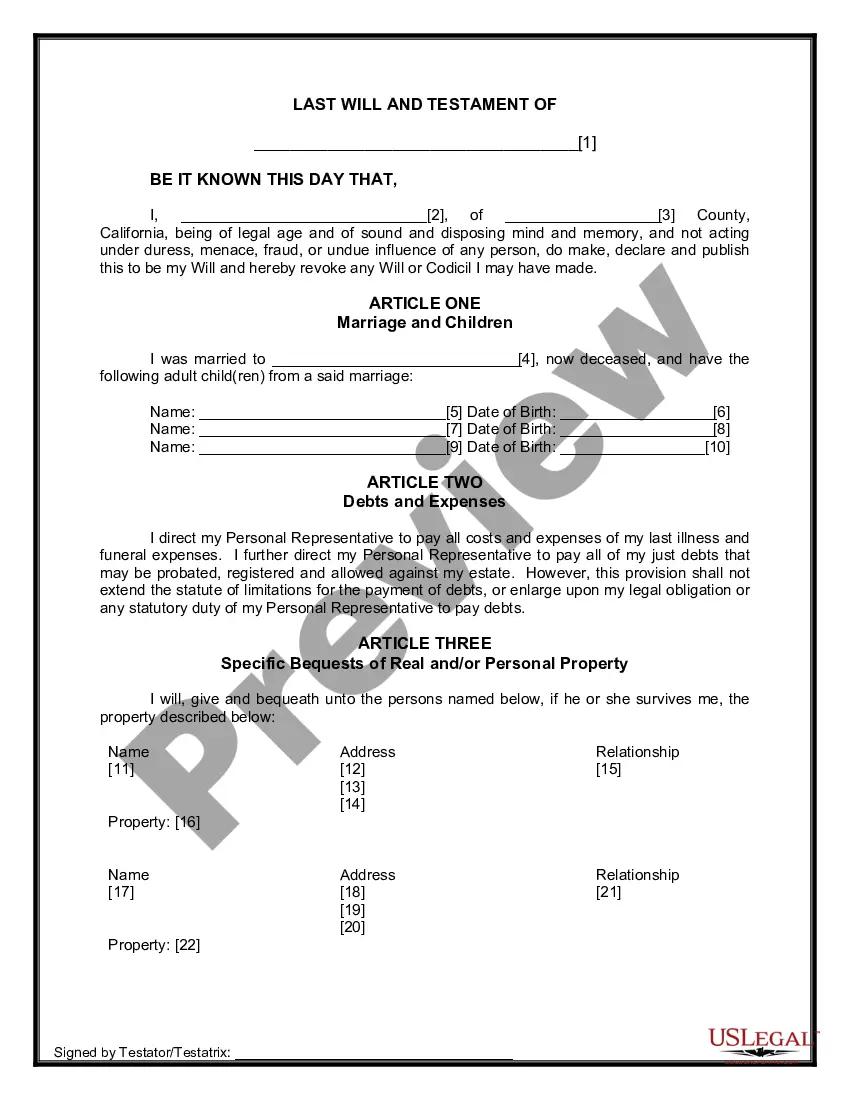

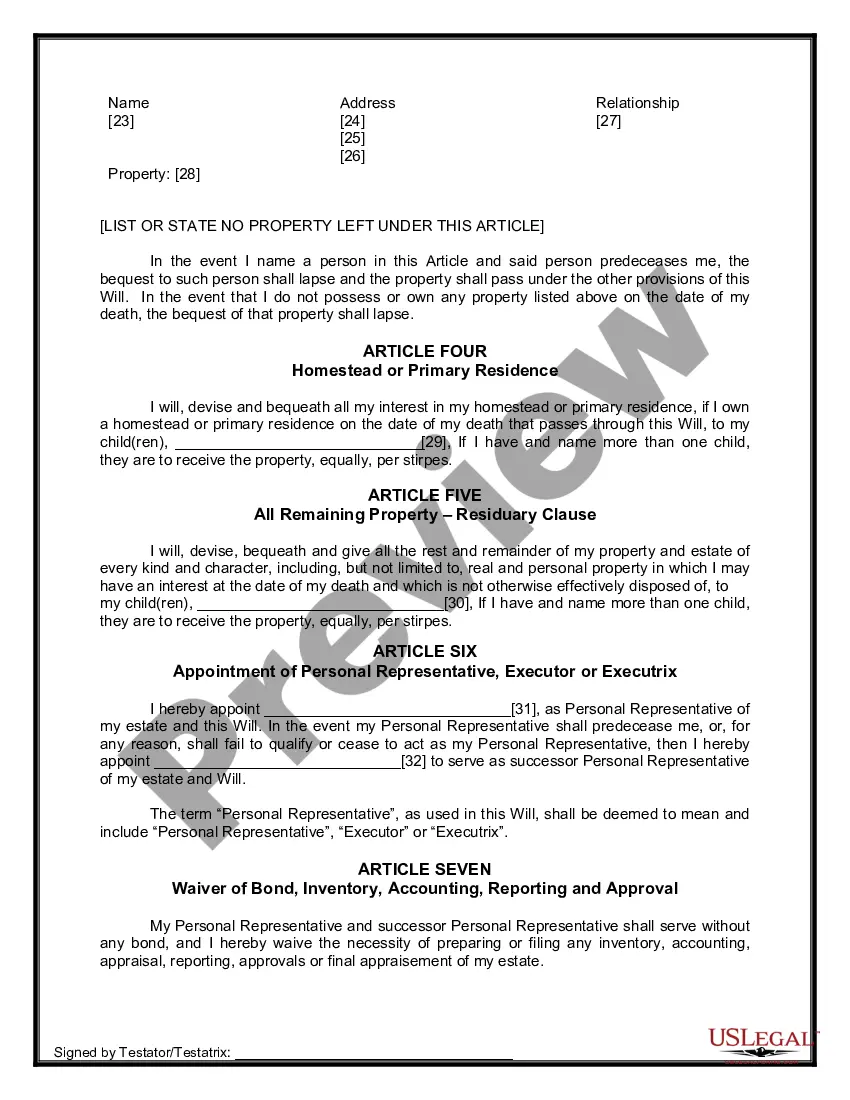

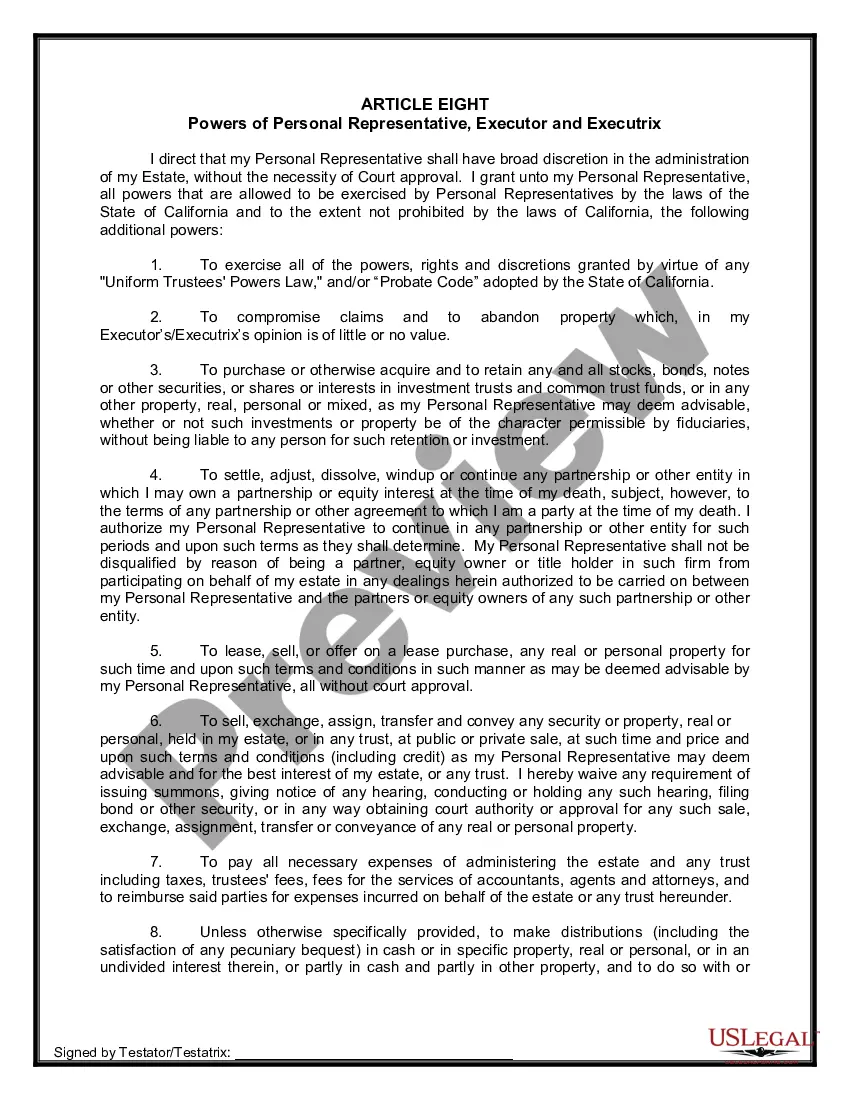

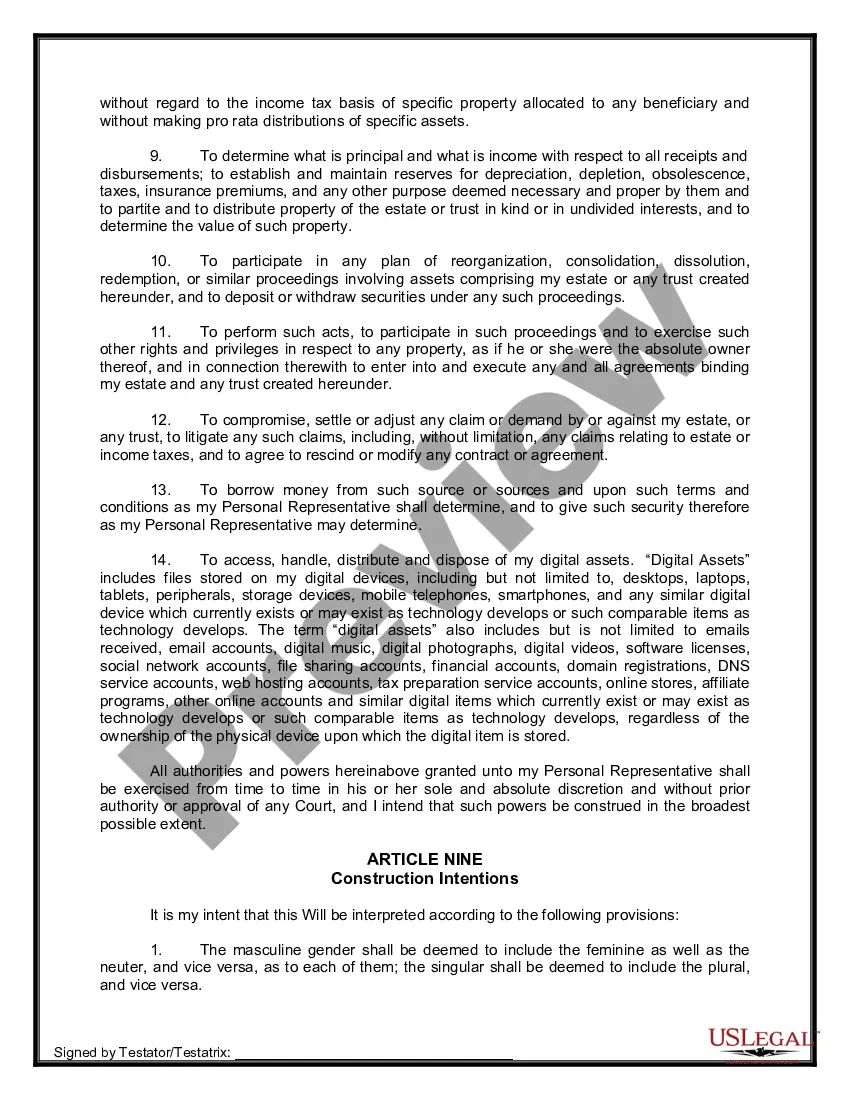

The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your adult children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

The Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legally binding document that allows individuals in Alameda, California, who have lost their spouse and have adult children to outline their wishes regarding the distribution of their assets upon their death. This legal form ensures that the wishes of the deceased are respected and followed. The Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children requires detailed information about the testator (the person creating the will) as well as the beneficiaries (the adult children). It includes sections relating to property and asset distribution, guardianship of any minor children, the appointment of an executor, and other provisions or requests. It is important to note that there can be different types or variations of the Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children. These variations may include: 1. Simple Will: This is the most common type of will. It allows the testator to distribute their assets among their adult children in equal or specific proportions. It may also designate an executor to handle the administration of the estate. 2. Living Will: A living will, also known as an advance healthcare directive, outlines the testator's medical wishes in the event they become incapacitated and cannot make decisions themselves. While not directly related to the distribution of assets, it is an important document to accompany a last will and testament for healthcare purposes. 3. Pour-Over Will: This type of will often is used in conjunction with a living trust. It allows the testator to "pour over" any assets that were not included in the living trust into the trust upon their death. This ensures that all assets are properly distributed according to the terms of the trust. 4. Testamentary Trust Will: Sometimes, a widow or widower may choose to create a testamentary trust within their will. This trust will come into effect upon their death and can provide specific instructions regarding the management and distribution of assets to their adult children. It is essential to consult with a legal professional or an attorney experienced in estate planning to ensure that the Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children accurately reflects your wishes and is in compliance with California state laws.

The Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legally binding document that allows individuals in Alameda, California, who have lost their spouse and have adult children to outline their wishes regarding the distribution of their assets upon their death. This legal form ensures that the wishes of the deceased are respected and followed. The Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children requires detailed information about the testator (the person creating the will) as well as the beneficiaries (the adult children). It includes sections relating to property and asset distribution, guardianship of any minor children, the appointment of an executor, and other provisions or requests. It is important to note that there can be different types or variations of the Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children. These variations may include: 1. Simple Will: This is the most common type of will. It allows the testator to distribute their assets among their adult children in equal or specific proportions. It may also designate an executor to handle the administration of the estate. 2. Living Will: A living will, also known as an advance healthcare directive, outlines the testator's medical wishes in the event they become incapacitated and cannot make decisions themselves. While not directly related to the distribution of assets, it is an important document to accompany a last will and testament for healthcare purposes. 3. Pour-Over Will: This type of will often is used in conjunction with a living trust. It allows the testator to "pour over" any assets that were not included in the living trust into the trust upon their death. This ensures that all assets are properly distributed according to the terms of the trust. 4. Testamentary Trust Will: Sometimes, a widow or widower may choose to create a testamentary trust within their will. This trust will come into effect upon their death and can provide specific instructions regarding the management and distribution of assets to their adult children. It is essential to consult with a legal professional or an attorney experienced in estate planning to ensure that the Alameda California Legal Last Will and Testament Form for a Widow or Widower with Adult Children accurately reflects your wishes and is in compliance with California state laws.