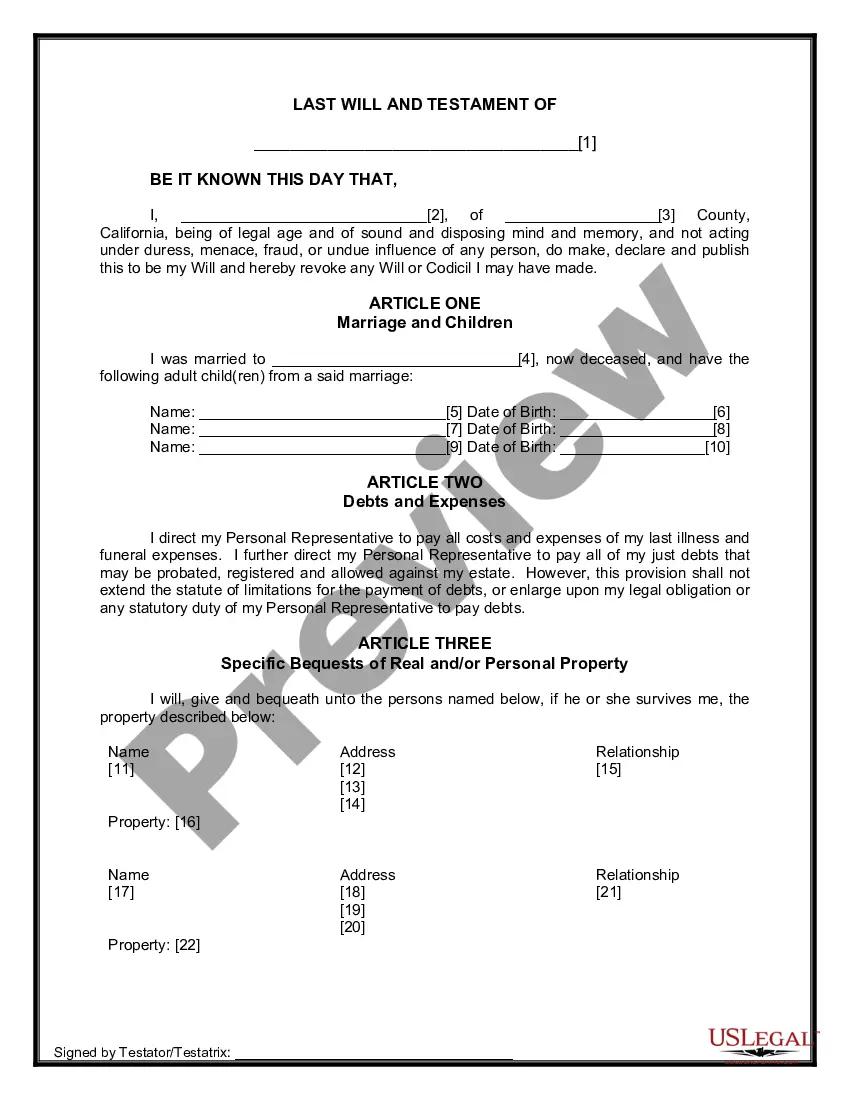

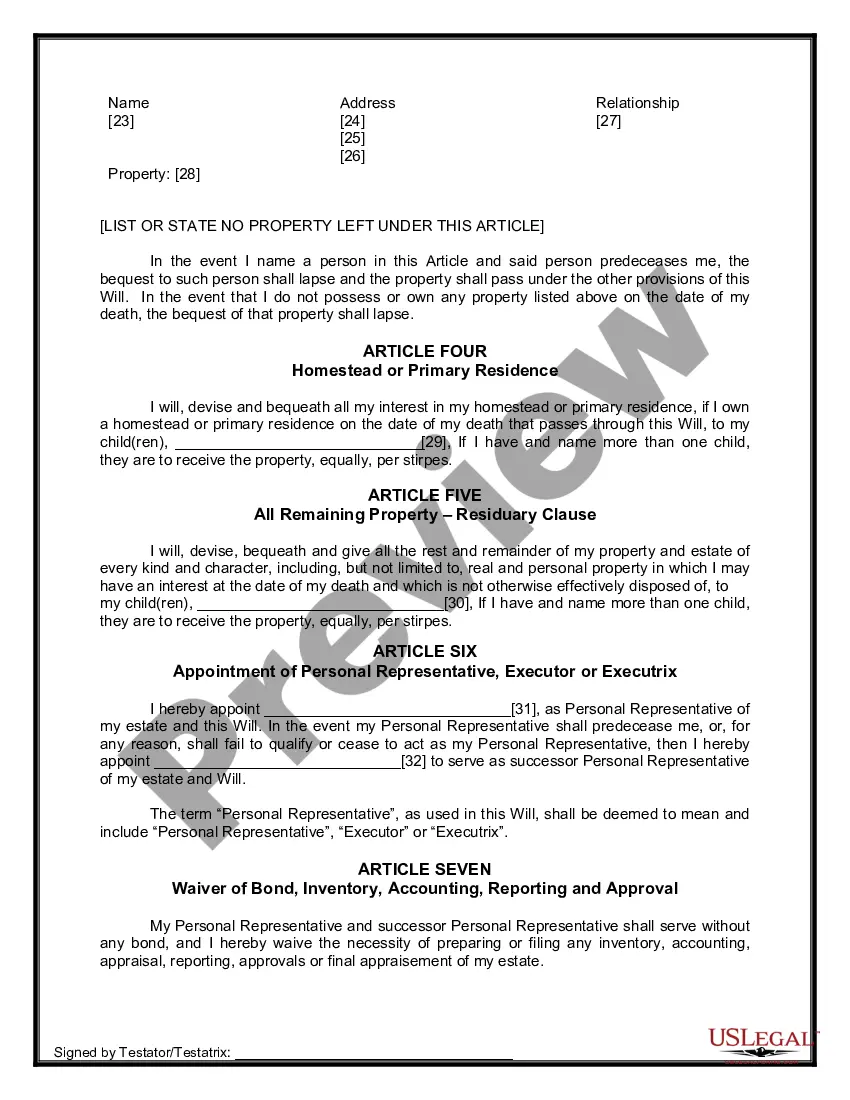

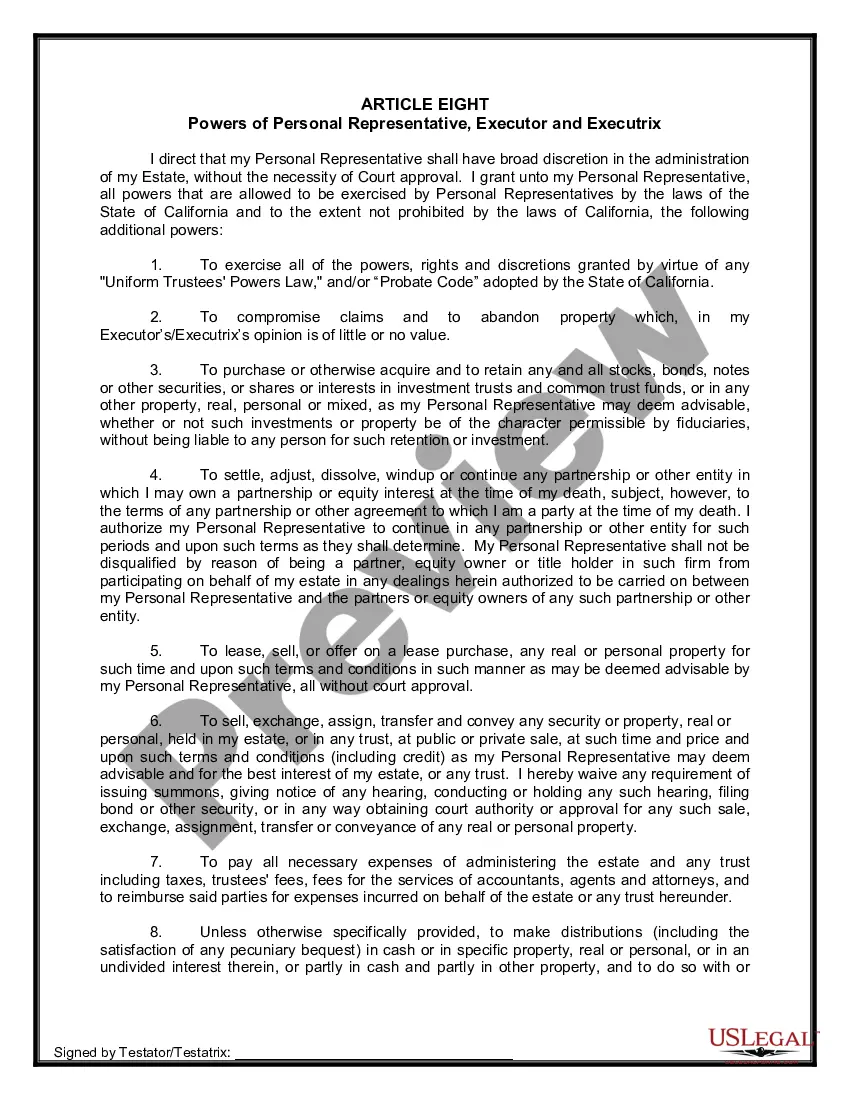

The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your adult children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

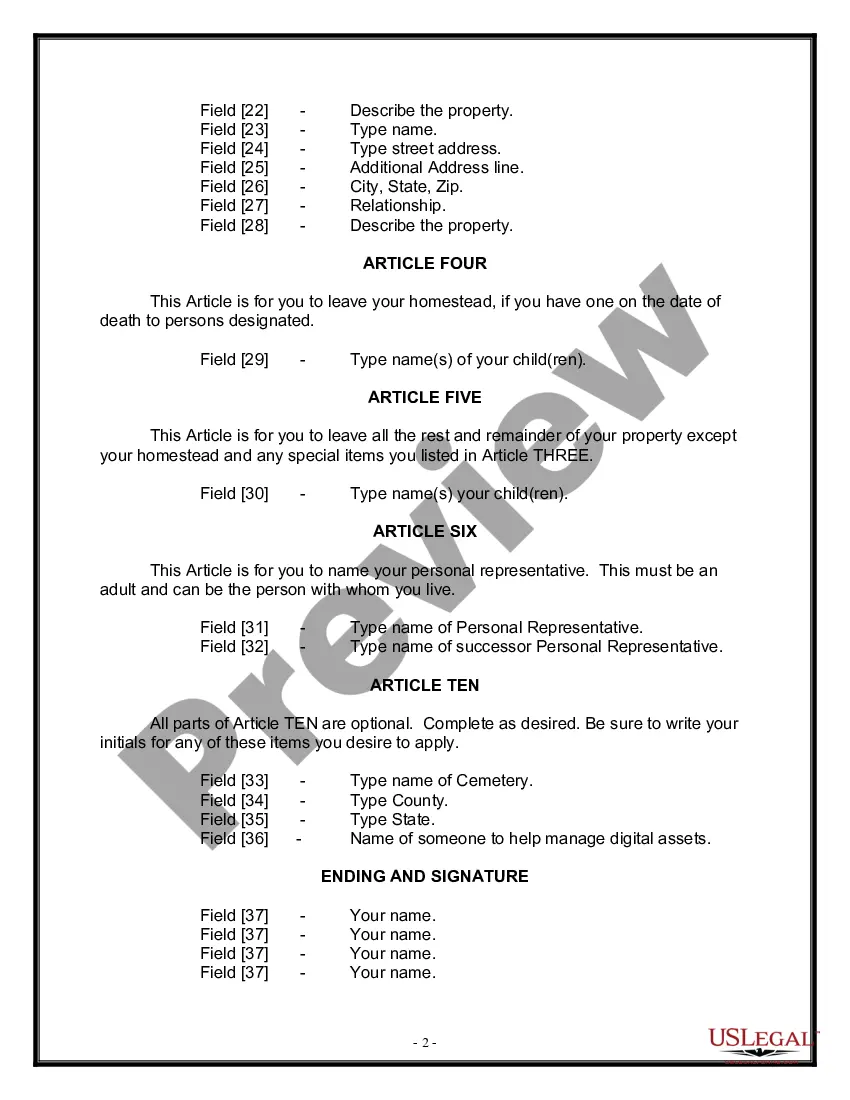

A Roseville California Legal Last Will and Testament Form for a Widow or Widower with Adult Children is an essential legal document that allows individuals in this specific situation to outline their final wishes regarding the distribution of their property and assets after their demise. This legally binding form ensures that the wishes of the testator (widow or widower) are respected and carried out appropriately. The Roseville California Legal Last Will and Testament Form is tailored specifically for widows or widowers who have adult children. It provides a comprehensive template with provisions designed to address the specific needs and concerns of individuals in this circumstance. The form typically includes the following important elements: 1. Identification Details: The form begins by collecting the relevant personal information of the testator, such as their full name, address, date of birth, and marital status. 2. Appointment of Executor: The testator selects an executor, the person responsible for administering the estate and ensuring that the will's provisions are carried out diligently. This individual should be someone trusted and capable of handling the responsibilities associated with settling the estate. 3. Asset Distribution: The testator lists their assets, including financial accounts, real estate properties, vehicles, investments, personal belongings, and any other valuable possessions. They allocate specific beneficiaries for each asset, designating whether it should be distributed equally or in specific shares among the children. 4. Guardianship Provisions: If the testator has minor children or dependents, the form may include provisions for appointing a guardian or guardians to ensure their well-being and care following the testator's passing. 5. Residue and Contingency Plans: The residue clause dictates how any remaining assets or property not already allocated will be distributed. Additionally, contingency plans outline alternative beneficiaries in case a primary beneficiary predeceases the testator or is unable to inherit. It's important to note that there may be variations of the Roseville California Legal Last Will and Testament Form for a Widow or Widower with Adult Children depending on specific circumstances. Some potential variations may include options for setting up trusts, charitable bequests, tax planning, or healthcare directives. Each individual's situation may warrant customizations to address their unique requirements, and seeking legal advice is always recommended ensuring compliance with the relevant laws and regulations.A Roseville California Legal Last Will and Testament Form for a Widow or Widower with Adult Children is an essential legal document that allows individuals in this specific situation to outline their final wishes regarding the distribution of their property and assets after their demise. This legally binding form ensures that the wishes of the testator (widow or widower) are respected and carried out appropriately. The Roseville California Legal Last Will and Testament Form is tailored specifically for widows or widowers who have adult children. It provides a comprehensive template with provisions designed to address the specific needs and concerns of individuals in this circumstance. The form typically includes the following important elements: 1. Identification Details: The form begins by collecting the relevant personal information of the testator, such as their full name, address, date of birth, and marital status. 2. Appointment of Executor: The testator selects an executor, the person responsible for administering the estate and ensuring that the will's provisions are carried out diligently. This individual should be someone trusted and capable of handling the responsibilities associated with settling the estate. 3. Asset Distribution: The testator lists their assets, including financial accounts, real estate properties, vehicles, investments, personal belongings, and any other valuable possessions. They allocate specific beneficiaries for each asset, designating whether it should be distributed equally or in specific shares among the children. 4. Guardianship Provisions: If the testator has minor children or dependents, the form may include provisions for appointing a guardian or guardians to ensure their well-being and care following the testator's passing. 5. Residue and Contingency Plans: The residue clause dictates how any remaining assets or property not already allocated will be distributed. Additionally, contingency plans outline alternative beneficiaries in case a primary beneficiary predeceases the testator or is unable to inherit. It's important to note that there may be variations of the Roseville California Legal Last Will and Testament Form for a Widow or Widower with Adult Children depending on specific circumstances. Some potential variations may include options for setting up trusts, charitable bequests, tax planning, or healthcare directives. Each individual's situation may warrant customizations to address their unique requirements, and seeking legal advice is always recommended ensuring compliance with the relevant laws and regulations.