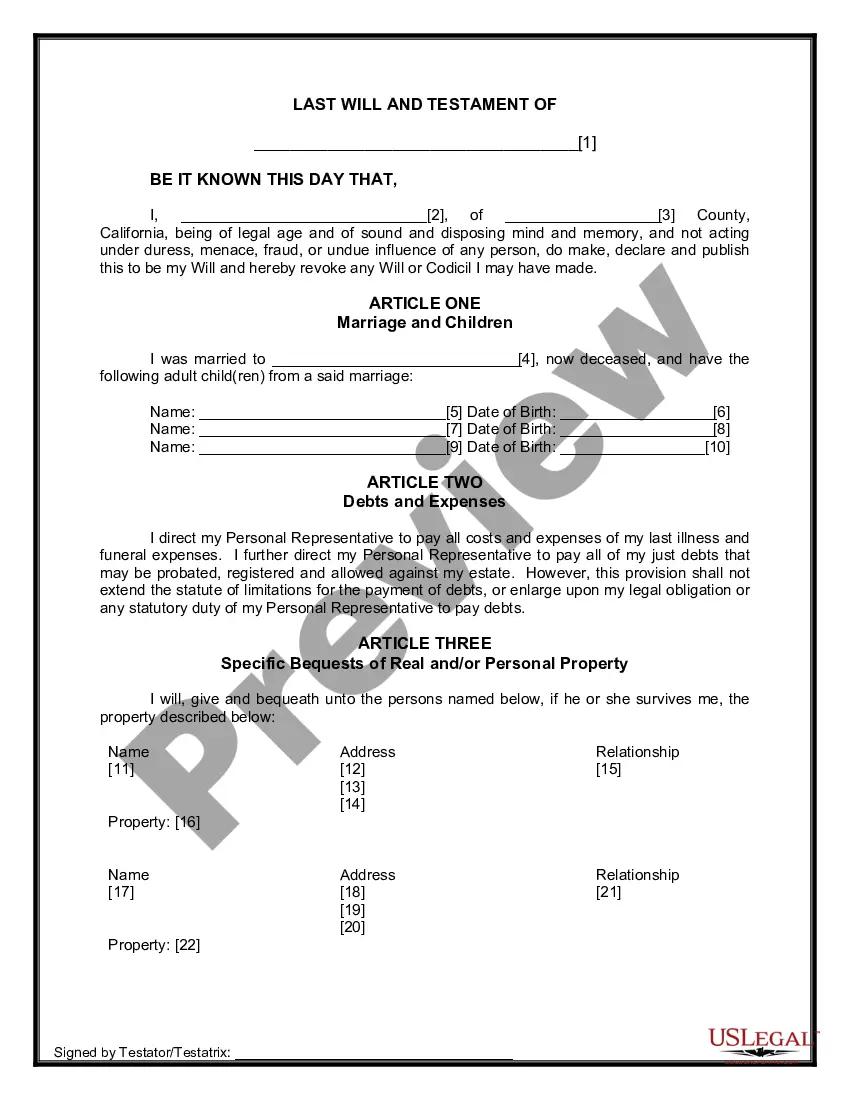

The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your adult children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

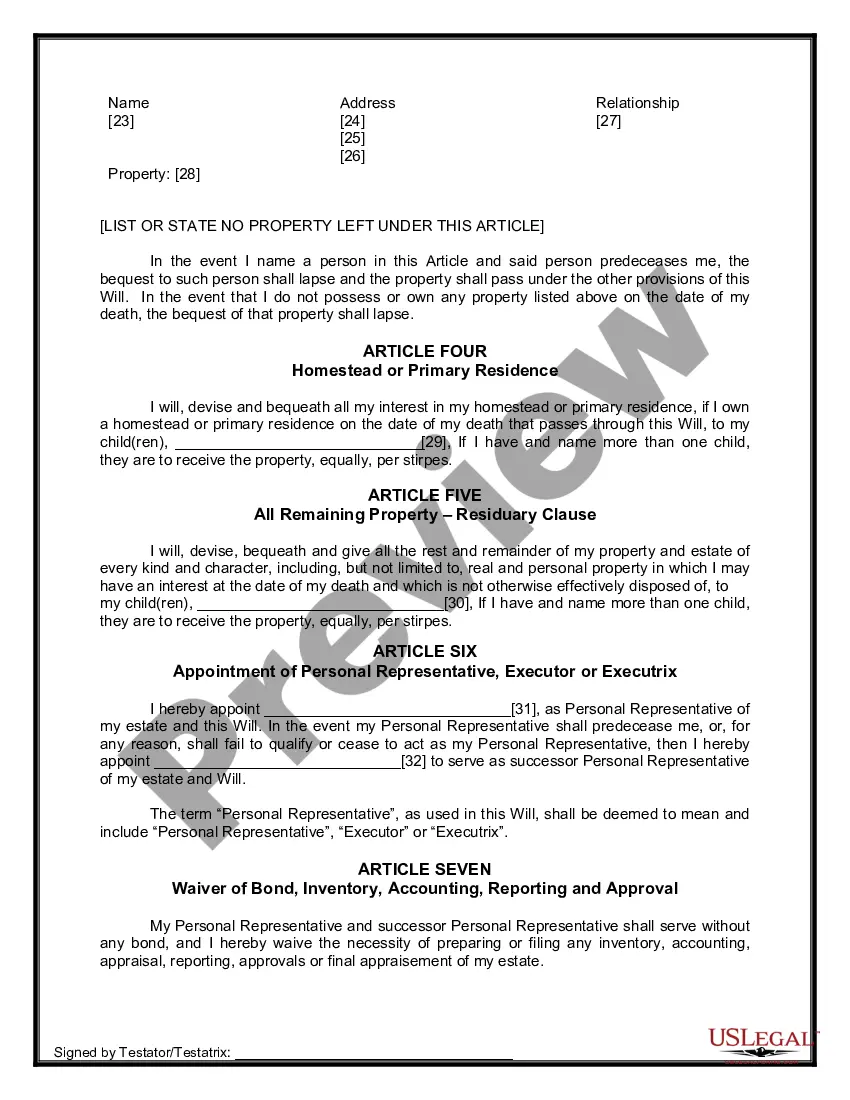

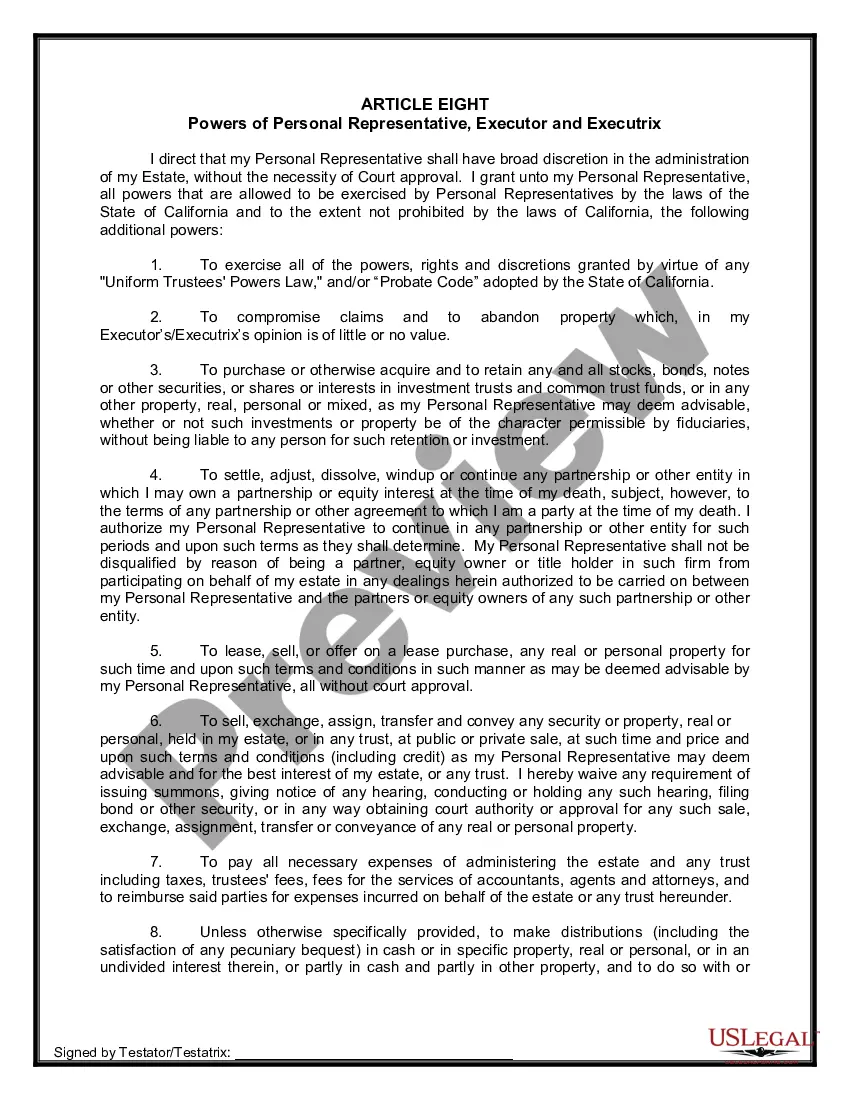

The San Jose California Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legal document that allows an individual who has lost their spouse and has adult children to dictate how their assets and estate should be distributed after their death. This form ensures that the wishes of the deceased are honored and helps prevent potential disputes among family members. The form begins with an introductory section that clearly identifies it as a last will and testament, stating the full name, residence, and legal status of the testator (the person creating the will). It may also include a statement affirming the mental capacity of the testator and their understanding of the importance and consequences of the decisions made in the will. One key aspect of this form is the appointment of an executor or personal representative. The testator can name an individual they trust to oversee the distribution of their assets and fulfill their wishes as stated in the will. It is essential to provide the full name, address, and contact information of the executor to avoid confusion. Next, the will allows the testator to outline how their estate should be divided among their adult children. Specific bequests of real estate, personal property, and other assets can be listed, ensuring that each child receives their designated portion. It is important to provide detailed descriptions of the assets and specify the percentage or specific amounts allotted to each child. This helps avoid ambiguity and potential conflicts. In cases where the testator wants to leave a portion of their estate to someone other than their adult children, such as a close friend or charity, there may be additional sections allowing for these bequests. The testator can clearly state their intentions and assign specific assets or amounts to these individuals or organizations. The will may also include provisions for the distribution of any remaining assets not specifically designated to the adult children or other beneficiaries. This section typically refers to the residuary estate and can include instructions on how to divide these assets among the adult children or heirs. In the event that one of the adult children predeceases the testator, the will may have provisions addressing this situation. It might state whether the deceased child's share should be divided among the surviving children or if their children (the testator's grandchildren) should inherit their parent's share. It is crucial to include a section on alternate beneficiaries. This allows the testator to name contingencies, such as grandchildren or other relatives, in case any of the named adult children or primary beneficiaries are unable to inherit or decline their inheritance. Lastly, the will requires the signature of the testator, along with the date and location where it is signed. It is highly recommended having the document witnessed by at least two individuals who are not beneficiaries or related to the testator by blood or marriage. This helps ensure that the will is legally valid and will be honored by the courts. Different types or versions of the San Jose California Legal Last Will and Testament Form for a Widow or Widower with Adult Children may exist based on specific preferences, additional provisions, or more complex family arrangements. However, the basic structure and key elements described above are typically present in all such forms.The San Jose California Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legal document that allows an individual who has lost their spouse and has adult children to dictate how their assets and estate should be distributed after their death. This form ensures that the wishes of the deceased are honored and helps prevent potential disputes among family members. The form begins with an introductory section that clearly identifies it as a last will and testament, stating the full name, residence, and legal status of the testator (the person creating the will). It may also include a statement affirming the mental capacity of the testator and their understanding of the importance and consequences of the decisions made in the will. One key aspect of this form is the appointment of an executor or personal representative. The testator can name an individual they trust to oversee the distribution of their assets and fulfill their wishes as stated in the will. It is essential to provide the full name, address, and contact information of the executor to avoid confusion. Next, the will allows the testator to outline how their estate should be divided among their adult children. Specific bequests of real estate, personal property, and other assets can be listed, ensuring that each child receives their designated portion. It is important to provide detailed descriptions of the assets and specify the percentage or specific amounts allotted to each child. This helps avoid ambiguity and potential conflicts. In cases where the testator wants to leave a portion of their estate to someone other than their adult children, such as a close friend or charity, there may be additional sections allowing for these bequests. The testator can clearly state their intentions and assign specific assets or amounts to these individuals or organizations. The will may also include provisions for the distribution of any remaining assets not specifically designated to the adult children or other beneficiaries. This section typically refers to the residuary estate and can include instructions on how to divide these assets among the adult children or heirs. In the event that one of the adult children predeceases the testator, the will may have provisions addressing this situation. It might state whether the deceased child's share should be divided among the surviving children or if their children (the testator's grandchildren) should inherit their parent's share. It is crucial to include a section on alternate beneficiaries. This allows the testator to name contingencies, such as grandchildren or other relatives, in case any of the named adult children or primary beneficiaries are unable to inherit or decline their inheritance. Lastly, the will requires the signature of the testator, along with the date and location where it is signed. It is highly recommended having the document witnessed by at least two individuals who are not beneficiaries or related to the testator by blood or marriage. This helps ensure that the will is legally valid and will be honored by the courts. Different types or versions of the San Jose California Legal Last Will and Testament Form for a Widow or Widower with Adult Children may exist based on specific preferences, additional provisions, or more complex family arrangements. However, the basic structure and key elements described above are typically present in all such forms.