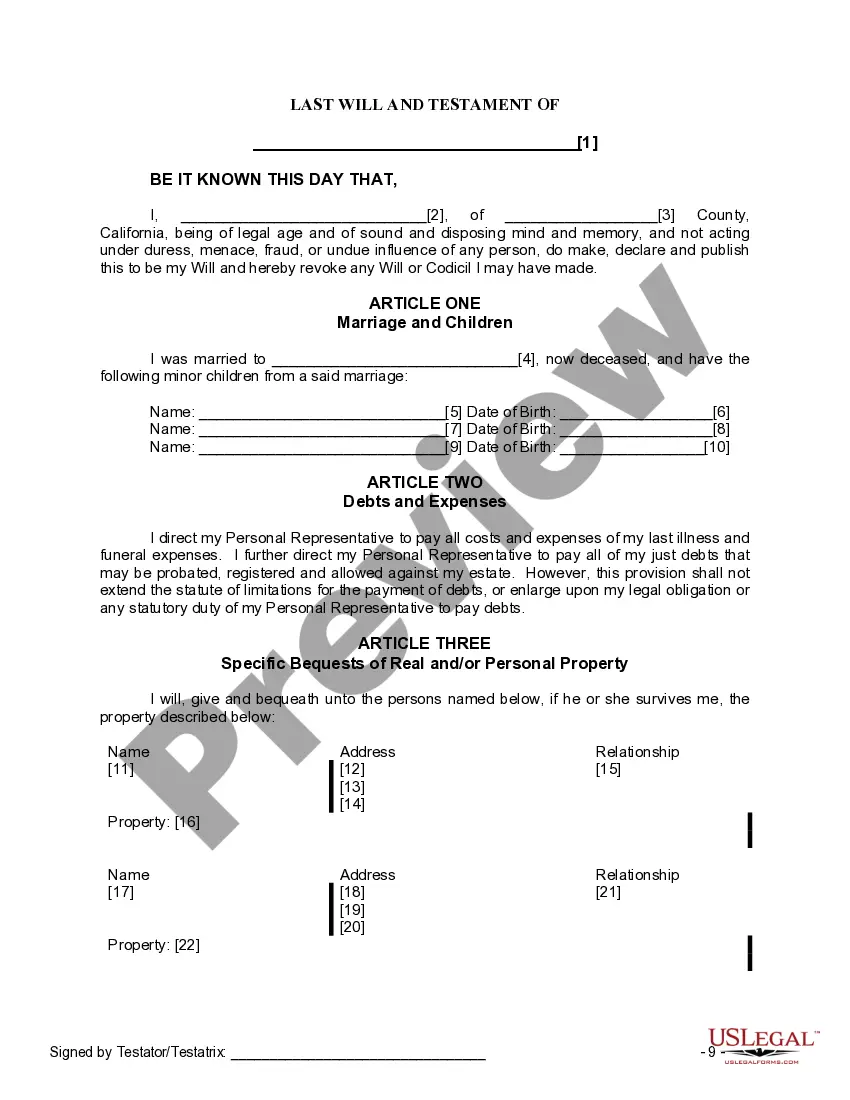

The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

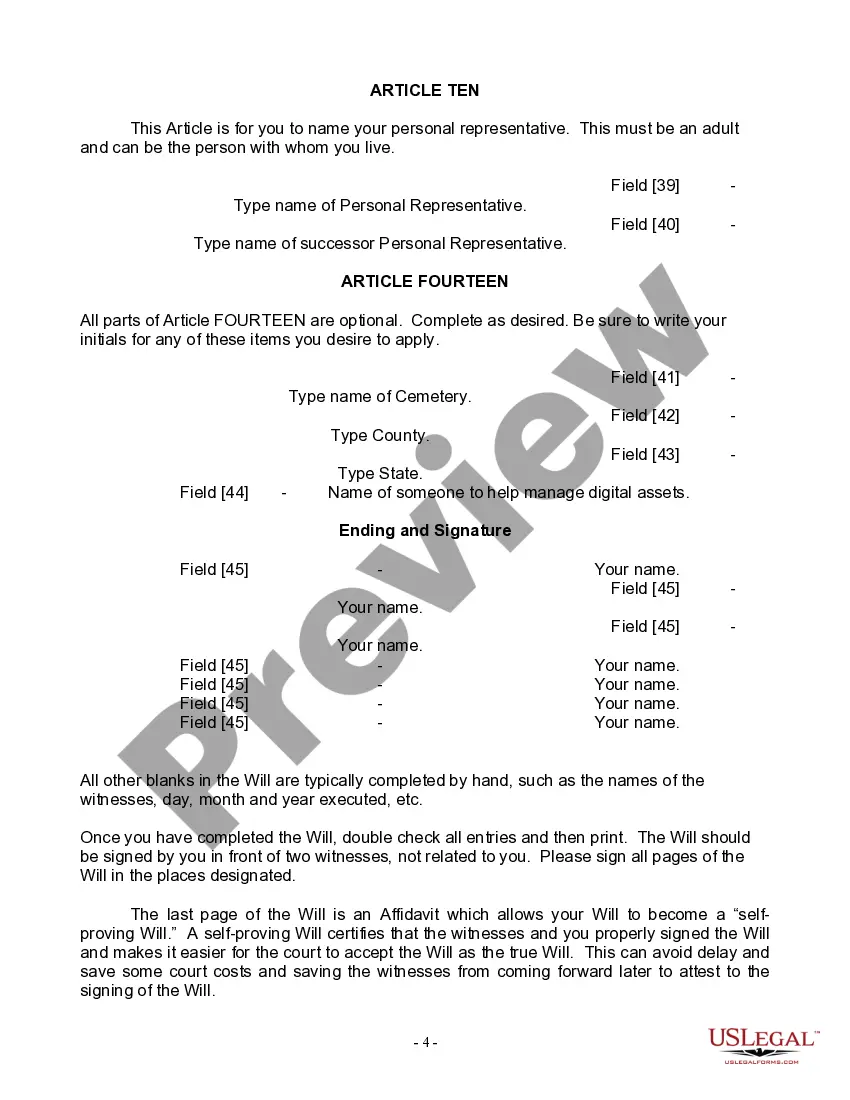

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

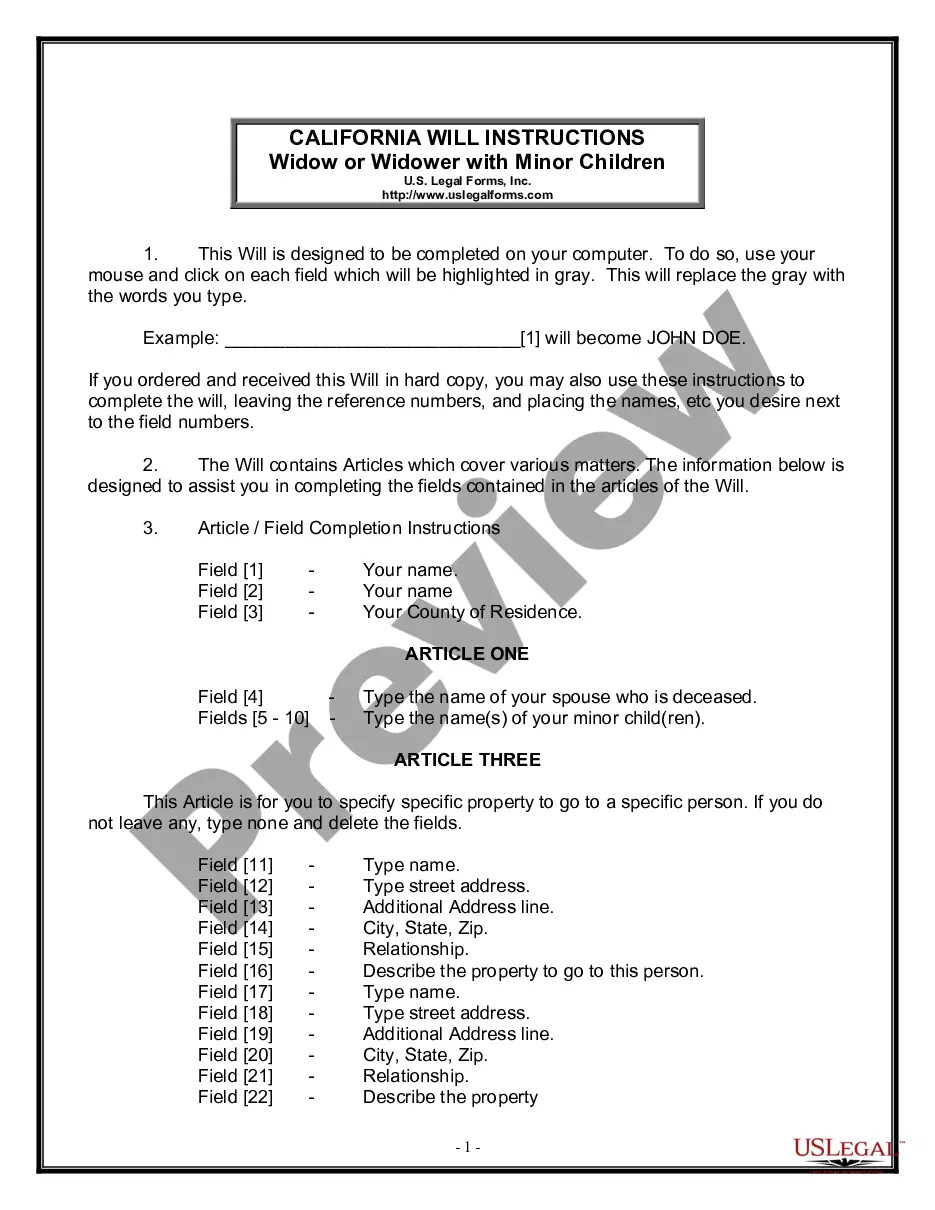

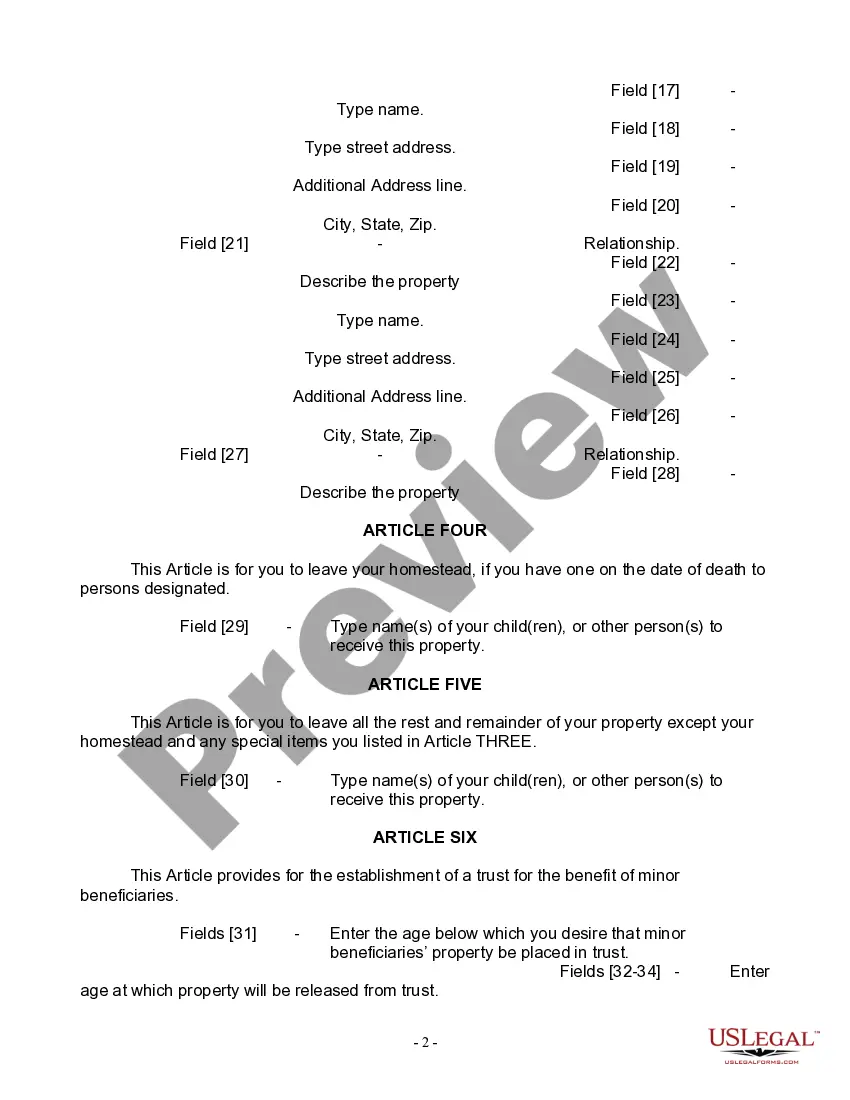

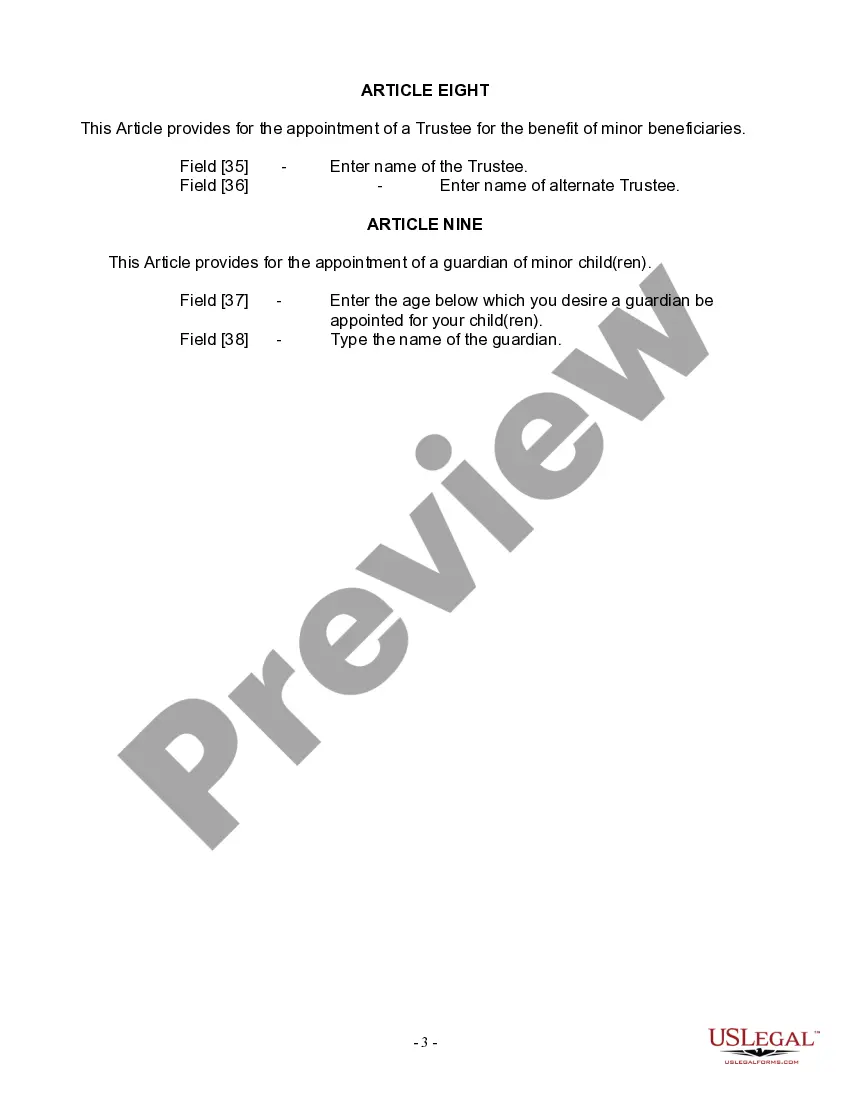

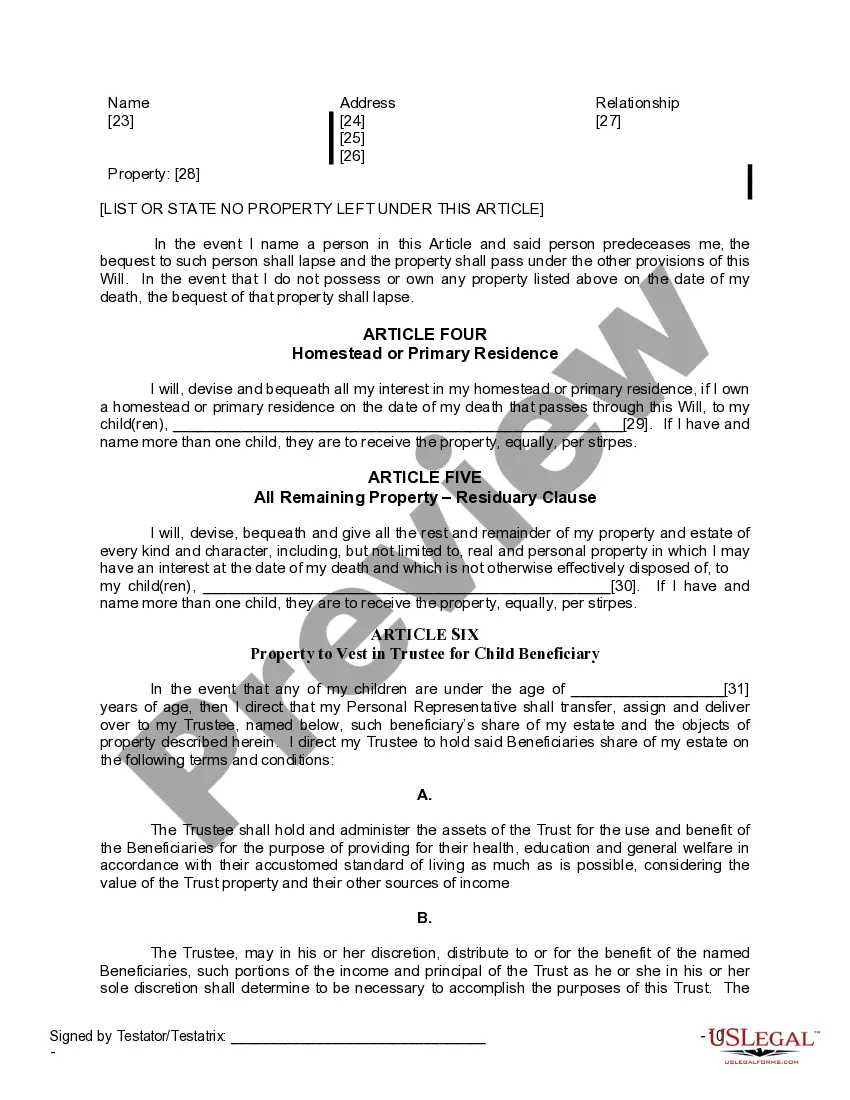

The Alameda California Legal Last Will and Testament Form for Widow or Widower with Minor Children is a comprehensive legal document specifically designed for individuals residing in Alameda, California who have become widowed and have minor children. This form allows widows or widowers to establish their final wishes regarding the distribution of their estate and the care of their minor children after their passing. This legal document includes various key sections that are crucial to protect the interests of the widow or widower and their minor children. Some important elements covered in the Alameda California Legal Last Will and Testament Form for Widow or Widower with Minor Children include: 1. Appointment of Guardianship: This section allows the widow or widower to name guardians who will be responsible for the upbringing and care of their minor children in the event of their demise. It ensures that the children are placed under the care of someone trusted and capable of fulfilling this responsibility. 2. Distribution of Assets: The widow or widower can outline how their assets, including property, finances, and personal belongings, are to be distributed among their minor children. This provision ensures that the assets are transferred in accordance with their wishes and in the best interest of their children. 3. Trust Creation: The form also provides an option for creating a trust for minor children. By setting up a trust, the widow or widower can designate a trustee who will manage the financial aspects of the inherited assets until the children reach a certain age or milestone, ensuring the assets are protected and used for their benefit. 4. Alternate Beneficiaries: This section allows the widow or widower to name alternate beneficiaries in case the primary beneficiaries, i.e., the minor children, are unable to receive the assets or pass away before reaching the legal age of inheritance. This provision ensures that the assets are not left unallocated in case of unforeseen circumstances. There may be different versions or variations of the Alameda California Legal Last Will and Testament Form for Widow or Widower with Minor Children that are tailored to specific circumstances or preferences. For instance, some forms might include additional provisions related to specific assets or address unique family situations. However, the core purpose of all variations remains the same — to establish legal guidelines for the distribution of assets and care of minor children in Alameda, California for widows or widowers.The Alameda California Legal Last Will and Testament Form for Widow or Widower with Minor Children is a comprehensive legal document specifically designed for individuals residing in Alameda, California who have become widowed and have minor children. This form allows widows or widowers to establish their final wishes regarding the distribution of their estate and the care of their minor children after their passing. This legal document includes various key sections that are crucial to protect the interests of the widow or widower and their minor children. Some important elements covered in the Alameda California Legal Last Will and Testament Form for Widow or Widower with Minor Children include: 1. Appointment of Guardianship: This section allows the widow or widower to name guardians who will be responsible for the upbringing and care of their minor children in the event of their demise. It ensures that the children are placed under the care of someone trusted and capable of fulfilling this responsibility. 2. Distribution of Assets: The widow or widower can outline how their assets, including property, finances, and personal belongings, are to be distributed among their minor children. This provision ensures that the assets are transferred in accordance with their wishes and in the best interest of their children. 3. Trust Creation: The form also provides an option for creating a trust for minor children. By setting up a trust, the widow or widower can designate a trustee who will manage the financial aspects of the inherited assets until the children reach a certain age or milestone, ensuring the assets are protected and used for their benefit. 4. Alternate Beneficiaries: This section allows the widow or widower to name alternate beneficiaries in case the primary beneficiaries, i.e., the minor children, are unable to receive the assets or pass away before reaching the legal age of inheritance. This provision ensures that the assets are not left unallocated in case of unforeseen circumstances. There may be different versions or variations of the Alameda California Legal Last Will and Testament Form for Widow or Widower with Minor Children that are tailored to specific circumstances or preferences. For instance, some forms might include additional provisions related to specific assets or address unique family situations. However, the core purpose of all variations remains the same — to establish legal guidelines for the distribution of assets and care of minor children in Alameda, California for widows or widowers.