The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

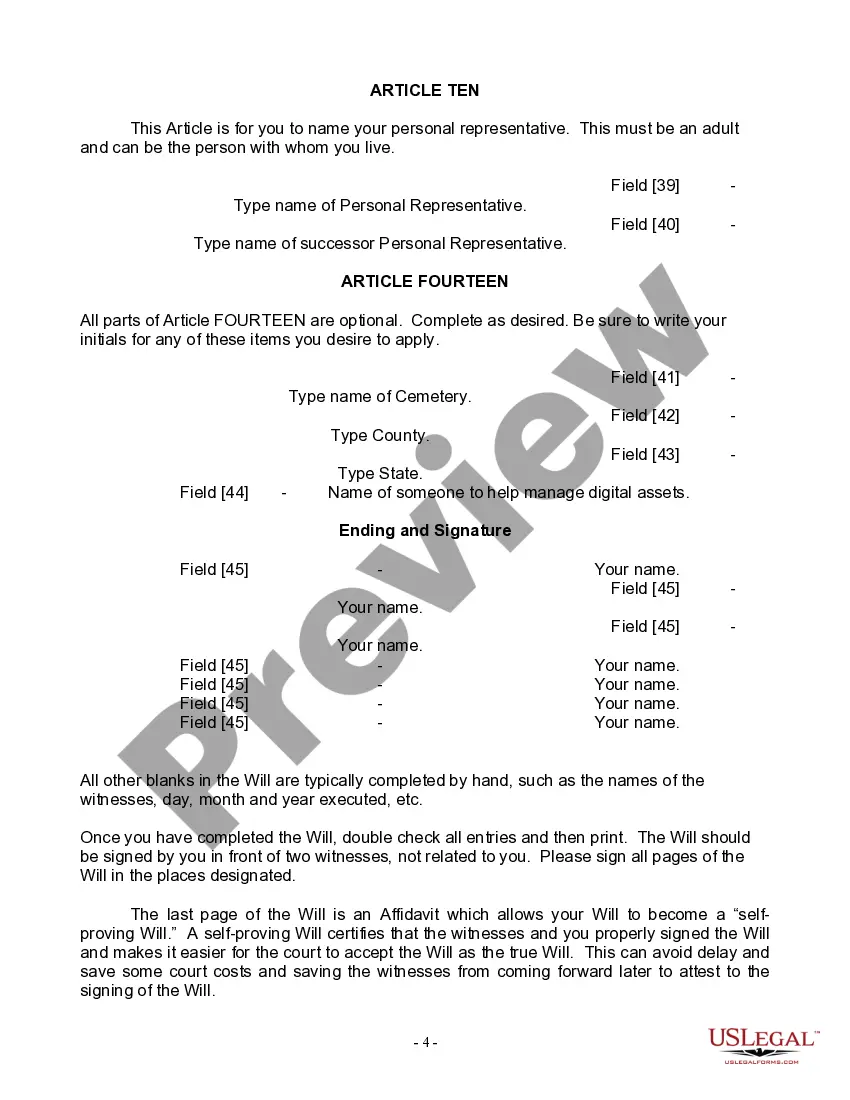

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

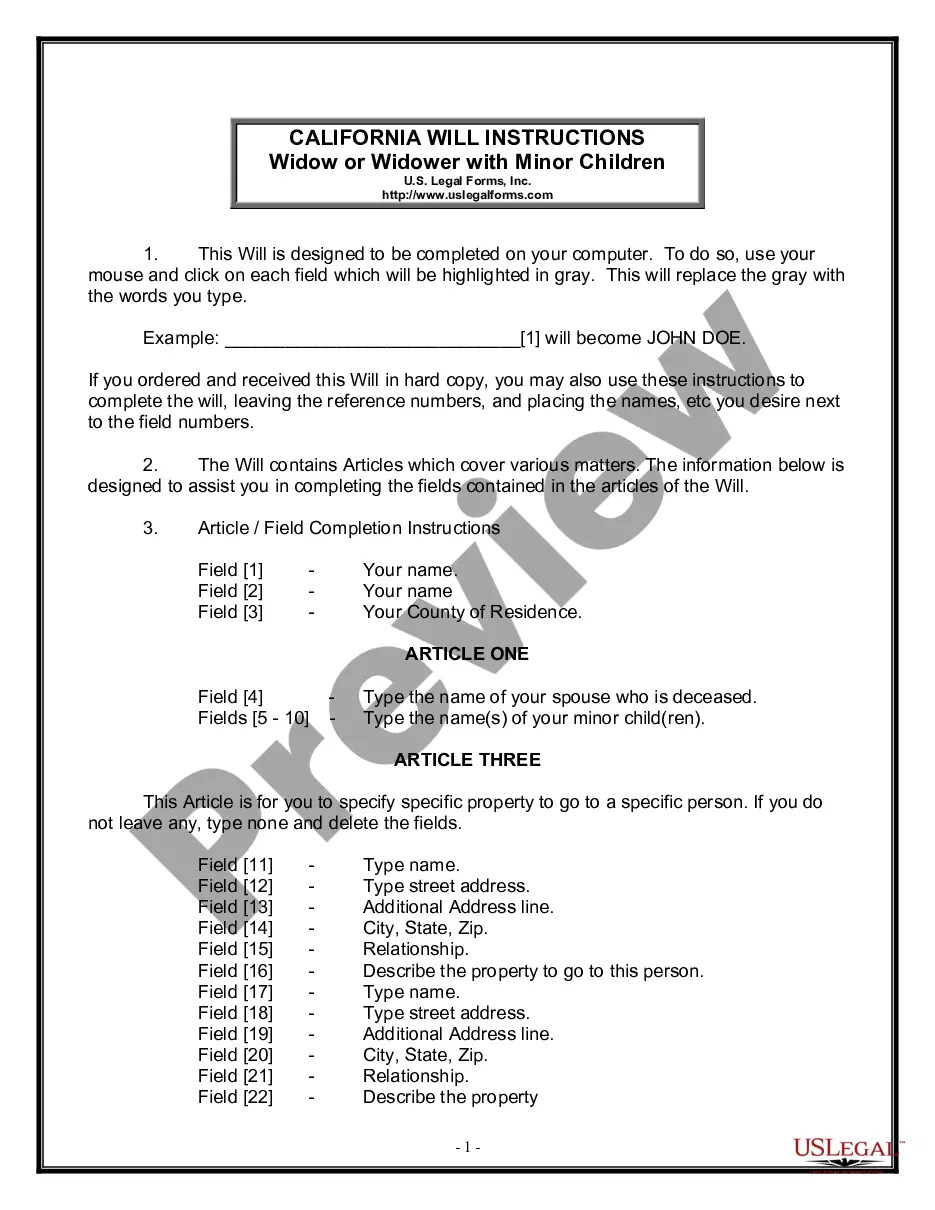

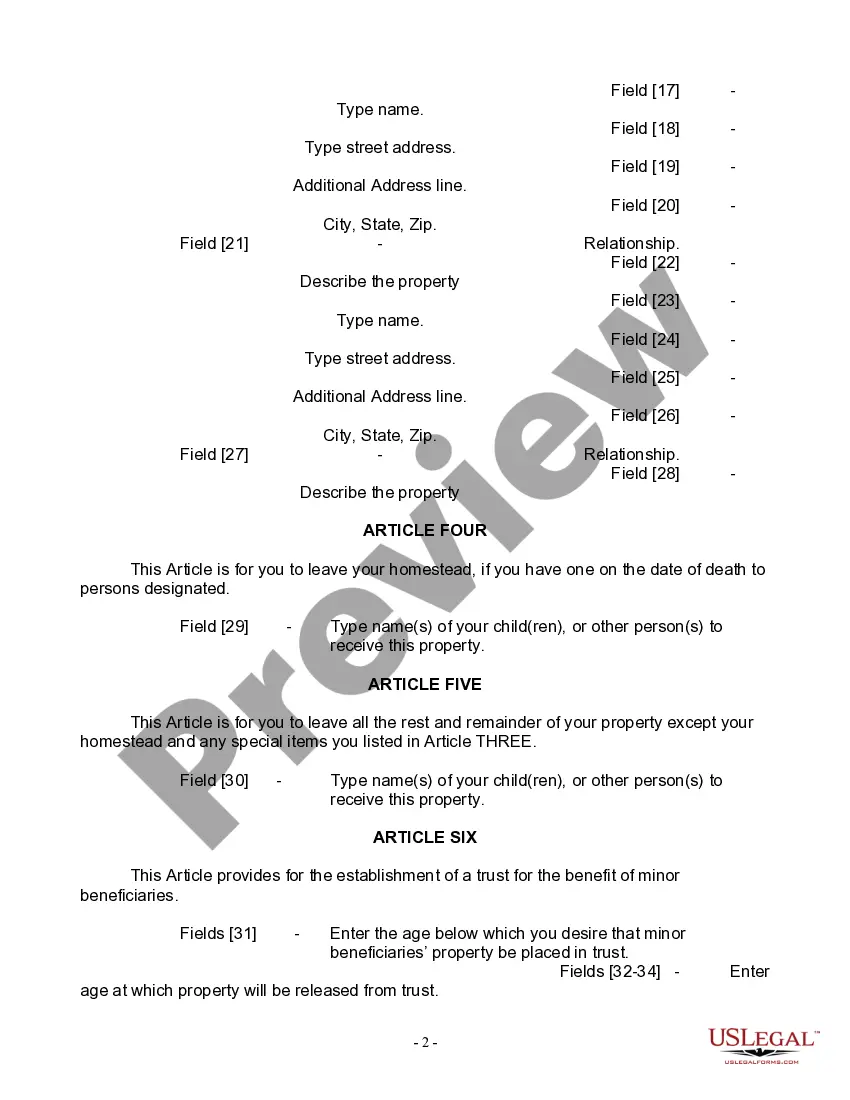

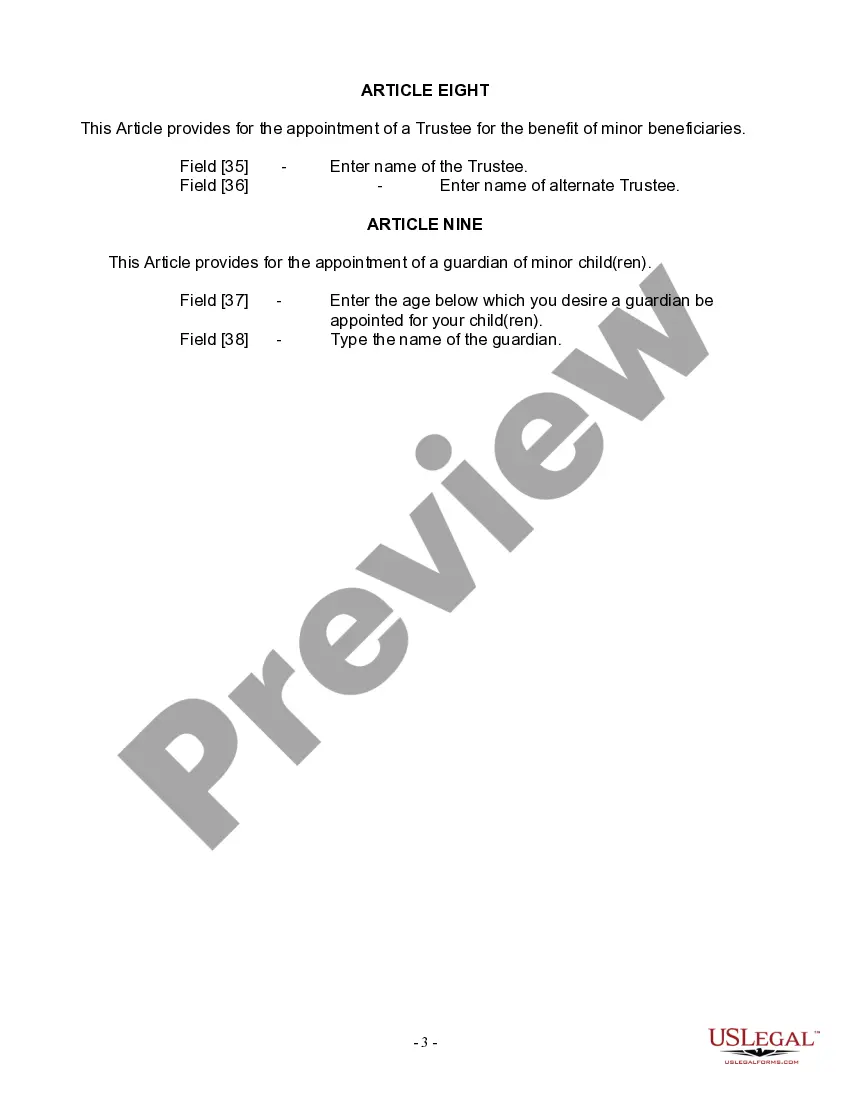

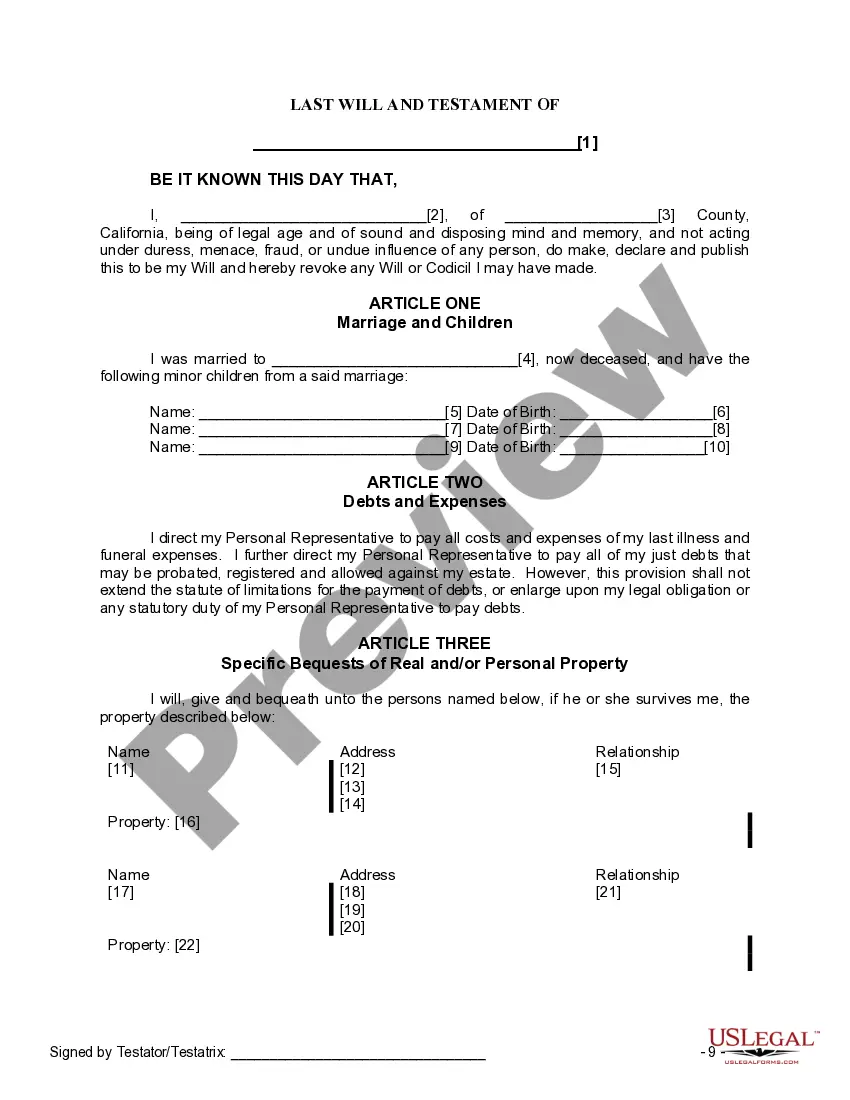

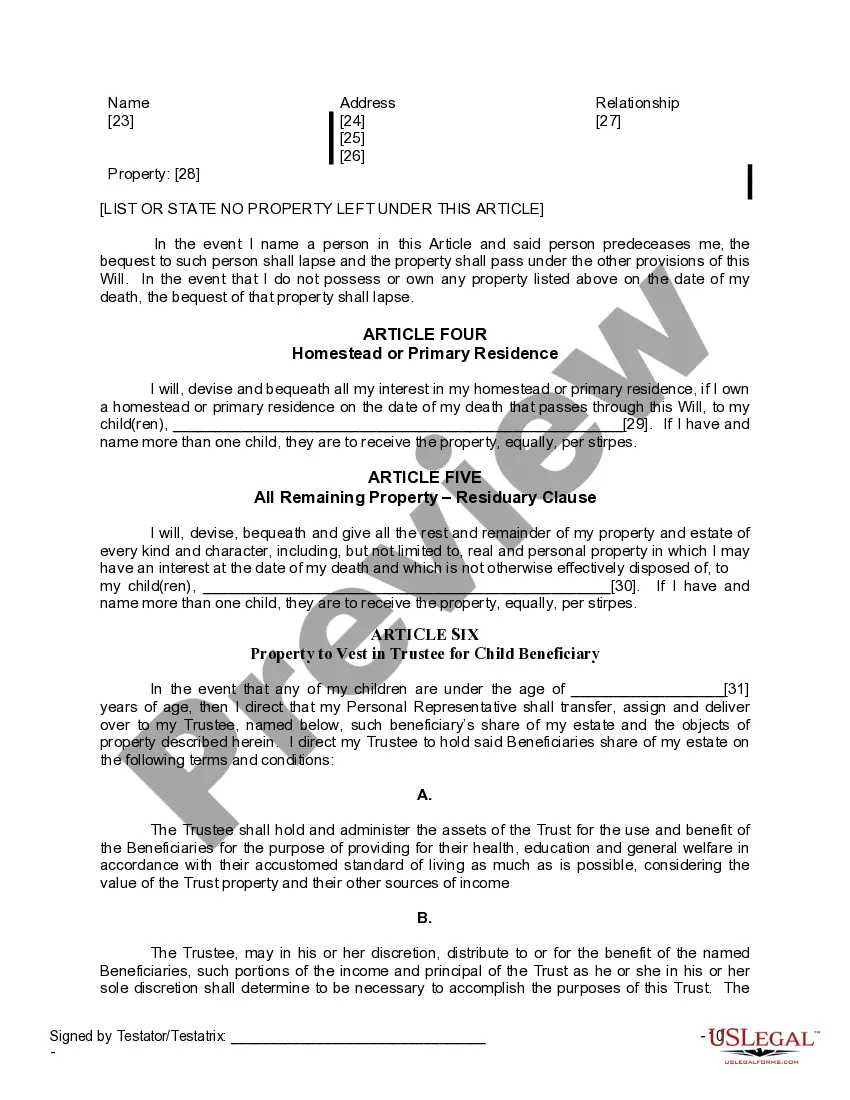

A Salinas California Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows individuals who have lost their spouse and have minor children to outline their wishes regarding the distribution of their assets and the care of their children after their death. This document ensures that the wishes of the deceased are followed and that their minor children are properly cared for. The Salinas California Legal Last Will and Testament Form for Widow or Widower with Minor Children typically includes the following key provisions: 1. Identification: The form begins by identifying the individual creating the will, their marital status as a widow or widower, and their minor children's names and details. 2. Executor and Guardian: The individual appoints an executor who will be responsible for administering their estate according to their wishes. Additionally, a guardian is appointed to take care of and make decisions for the minor children until they reach the age of majority. 3. Asset Distribution: The form allows the individual to specify how their assets, including property, bank accounts, investments, and personal belongings, should be distributed among their heirs and beneficiaries. They can allocate specific items or assets to specific individuals or provide for a percentage-based distribution. 4. Trusts: If the individual wishes to create a trust for their minor children's benefit, they can do so within the will. The trust ensures that the children's inheritance is managed and distributed appropriately until they reach a certain age or milestone, as specified by the individual. 5. Alternate Beneficiaries: In the event that the primary beneficiaries named in the will (e.g., spouse, children) predecease the individual, alternate beneficiaries can be designated to receive the assets instead. 6. Funeral and Burial Wishes: The will may include instructions regarding the individual's funeral arrangements, burial preferences, or any specific religious or cultural rituals they wish to be followed. Different types or variations of Salinas California Legal Last Will and Testament Forms for Widow or Widower with Minor Children may exist, depending on the specific requirements or preferences of the individual. However, the above provisions are typically included to ensure clarity, legal validity, and the proper protection of both the individual's assets and the well-being of their minor children.A Salinas California Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows individuals who have lost their spouse and have minor children to outline their wishes regarding the distribution of their assets and the care of their children after their death. This document ensures that the wishes of the deceased are followed and that their minor children are properly cared for. The Salinas California Legal Last Will and Testament Form for Widow or Widower with Minor Children typically includes the following key provisions: 1. Identification: The form begins by identifying the individual creating the will, their marital status as a widow or widower, and their minor children's names and details. 2. Executor and Guardian: The individual appoints an executor who will be responsible for administering their estate according to their wishes. Additionally, a guardian is appointed to take care of and make decisions for the minor children until they reach the age of majority. 3. Asset Distribution: The form allows the individual to specify how their assets, including property, bank accounts, investments, and personal belongings, should be distributed among their heirs and beneficiaries. They can allocate specific items or assets to specific individuals or provide for a percentage-based distribution. 4. Trusts: If the individual wishes to create a trust for their minor children's benefit, they can do so within the will. The trust ensures that the children's inheritance is managed and distributed appropriately until they reach a certain age or milestone, as specified by the individual. 5. Alternate Beneficiaries: In the event that the primary beneficiaries named in the will (e.g., spouse, children) predecease the individual, alternate beneficiaries can be designated to receive the assets instead. 6. Funeral and Burial Wishes: The will may include instructions regarding the individual's funeral arrangements, burial preferences, or any specific religious or cultural rituals they wish to be followed. Different types or variations of Salinas California Legal Last Will and Testament Forms for Widow or Widower with Minor Children may exist, depending on the specific requirements or preferences of the individual. However, the above provisions are typically included to ensure clarity, legal validity, and the proper protection of both the individual's assets and the well-being of their minor children.