The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

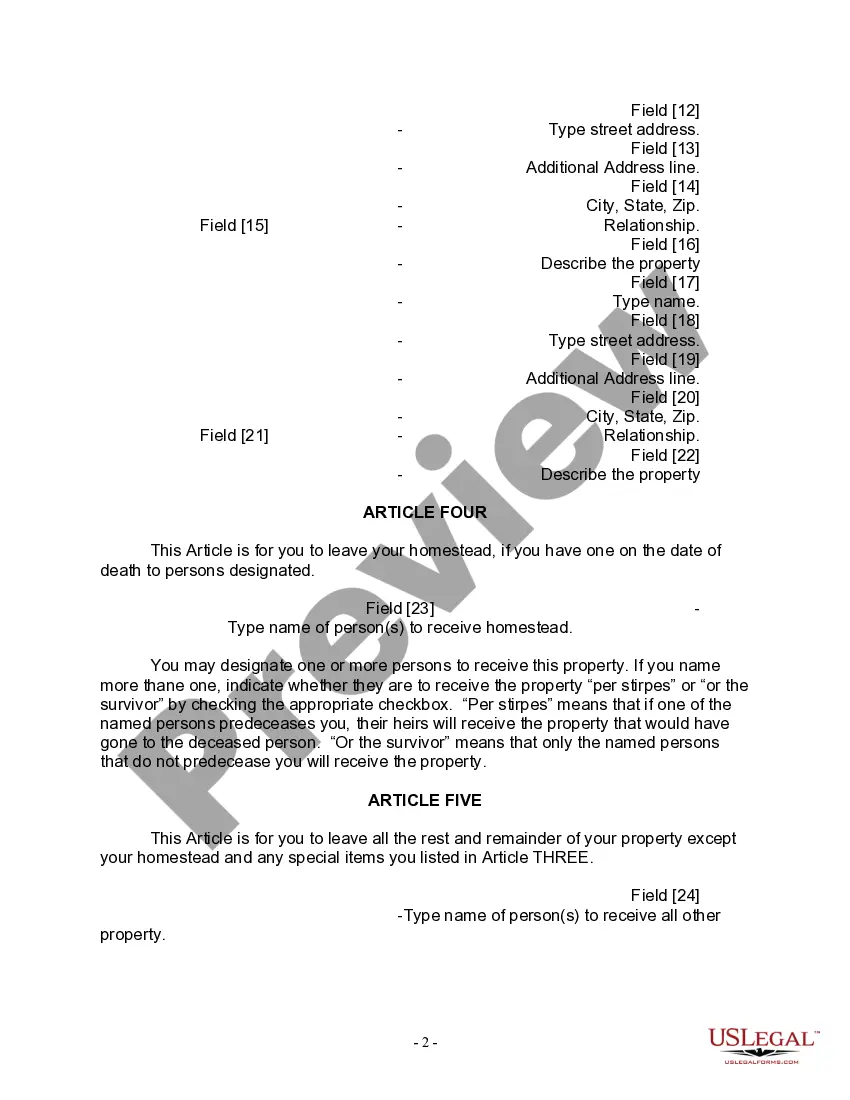

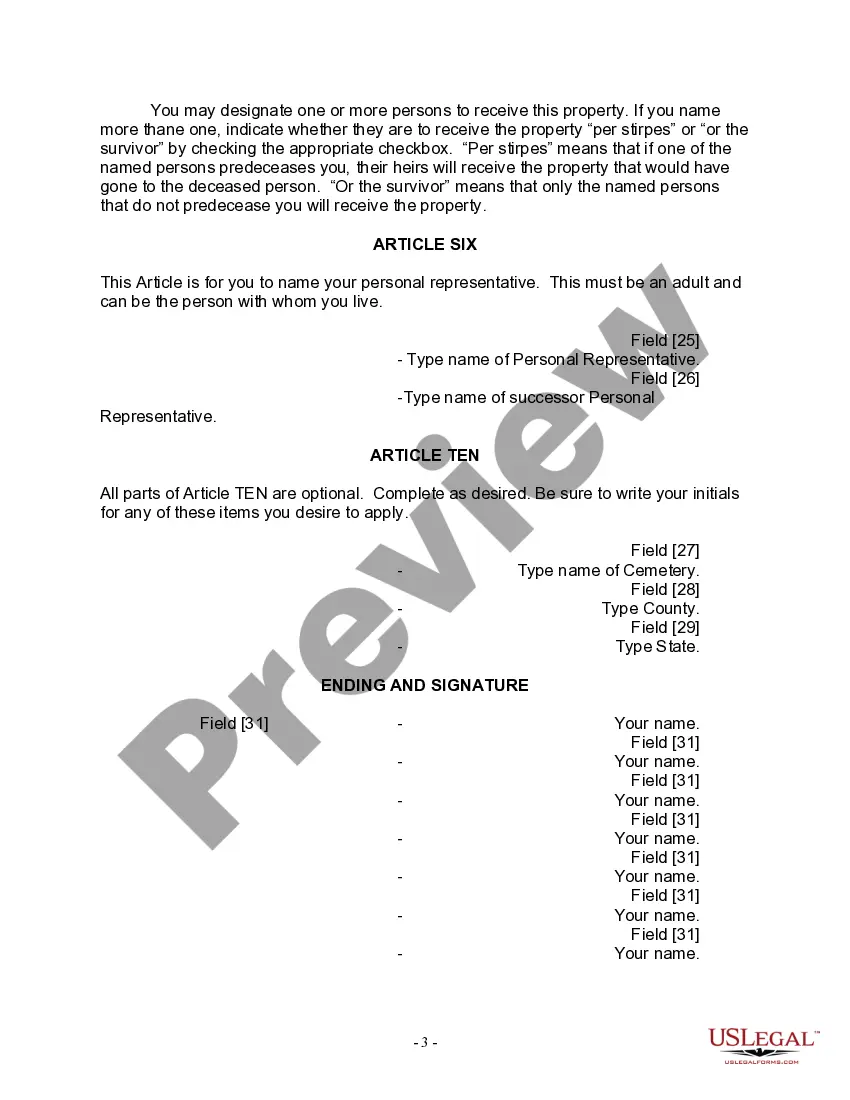

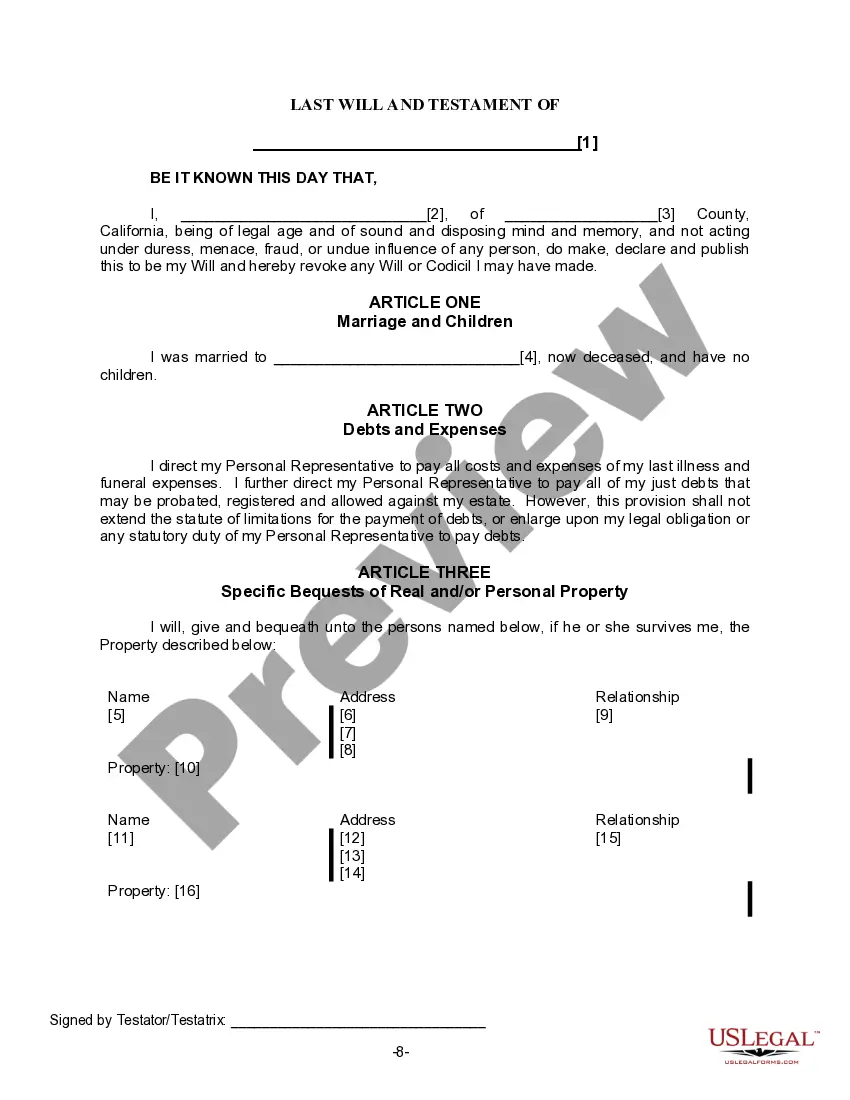

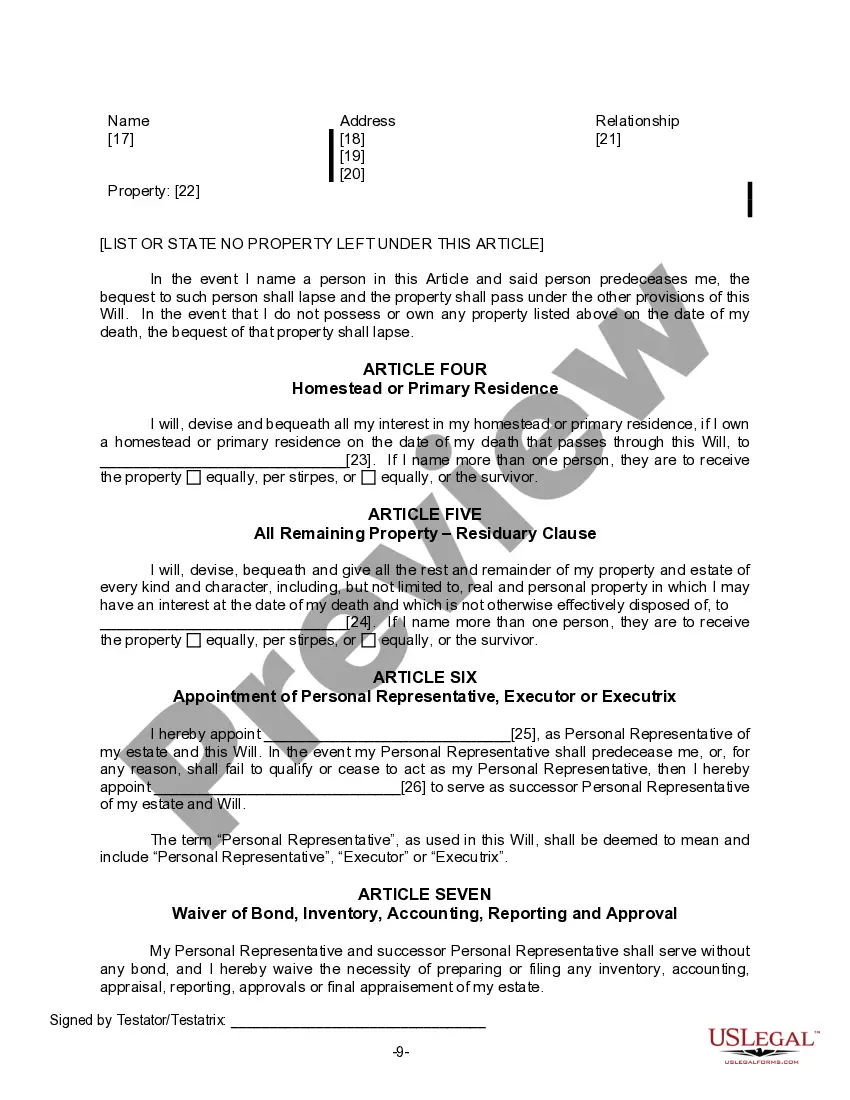

Downey California Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals to dictate how their assets and personal belongings will be distributed after their death. It ensures that their wishes are respected and that their estate is handled according to their desires. This specific type of Last Will Form caters to widows or widowers who have no children. It takes into account their unique circumstances and allows them to make specific provisions for their estate. By utilizing this form, individuals can ensure that their assets are distributed in accordance with their wishes, without any ambiguity or disputes among potential beneficiaries. The Downey California Legal Last Will Form for a Widow or Widower with no Children typically includes the following key elements: 1. Identification: The form starts by including the legal name, address, and any relevant identification information of the testator (the person creating the will). 2. Appointment of Executor: The testator names an executor, who will be responsible for carrying out the testator's wishes and managing the estate during the probate process. 3. Asset Distribution: The form allows the testator to specify how their assets, including real estate, bank accounts, investments, personal property, and other valuable possessions, will be distributed among beneficiaries. The testator can name specific individuals or organizations as beneficiaries and allocate specific portions or percentages of their estate to each. 4. Alternate Beneficiaries: In case any named beneficiary predeceases the testator or is unable to inherit the assets, the form may also include provisions for alternate beneficiaries. 5. Disposition of Remaining Property: The testator may include instructions regarding the distribution of any remaining assets that were not specifically addressed in the will. 6. Funeral Instructions: This Last Will Form may also give the testator an opportunity to provide guidance on their funeral arrangements or provide specific requests regarding their final rites or disposition of remains. It's important to note that while this description covers the general elements of a Downey California Legal Last Will Form for a Widow or Widower with no Children, there may be slight variations or additional clauses depending on the specific form or format being used. It is strongly recommended consulting with an attorney or legal professional to ensure the form is tailored to meet individual circumstances and to comply with applicable state laws.Downey California Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals to dictate how their assets and personal belongings will be distributed after their death. It ensures that their wishes are respected and that their estate is handled according to their desires. This specific type of Last Will Form caters to widows or widowers who have no children. It takes into account their unique circumstances and allows them to make specific provisions for their estate. By utilizing this form, individuals can ensure that their assets are distributed in accordance with their wishes, without any ambiguity or disputes among potential beneficiaries. The Downey California Legal Last Will Form for a Widow or Widower with no Children typically includes the following key elements: 1. Identification: The form starts by including the legal name, address, and any relevant identification information of the testator (the person creating the will). 2. Appointment of Executor: The testator names an executor, who will be responsible for carrying out the testator's wishes and managing the estate during the probate process. 3. Asset Distribution: The form allows the testator to specify how their assets, including real estate, bank accounts, investments, personal property, and other valuable possessions, will be distributed among beneficiaries. The testator can name specific individuals or organizations as beneficiaries and allocate specific portions or percentages of their estate to each. 4. Alternate Beneficiaries: In case any named beneficiary predeceases the testator or is unable to inherit the assets, the form may also include provisions for alternate beneficiaries. 5. Disposition of Remaining Property: The testator may include instructions regarding the distribution of any remaining assets that were not specifically addressed in the will. 6. Funeral Instructions: This Last Will Form may also give the testator an opportunity to provide guidance on their funeral arrangements or provide specific requests regarding their final rites or disposition of remains. It's important to note that while this description covers the general elements of a Downey California Legal Last Will Form for a Widow or Widower with no Children, there may be slight variations or additional clauses depending on the specific form or format being used. It is strongly recommended consulting with an attorney or legal professional to ensure the form is tailored to meet individual circumstances and to comply with applicable state laws.