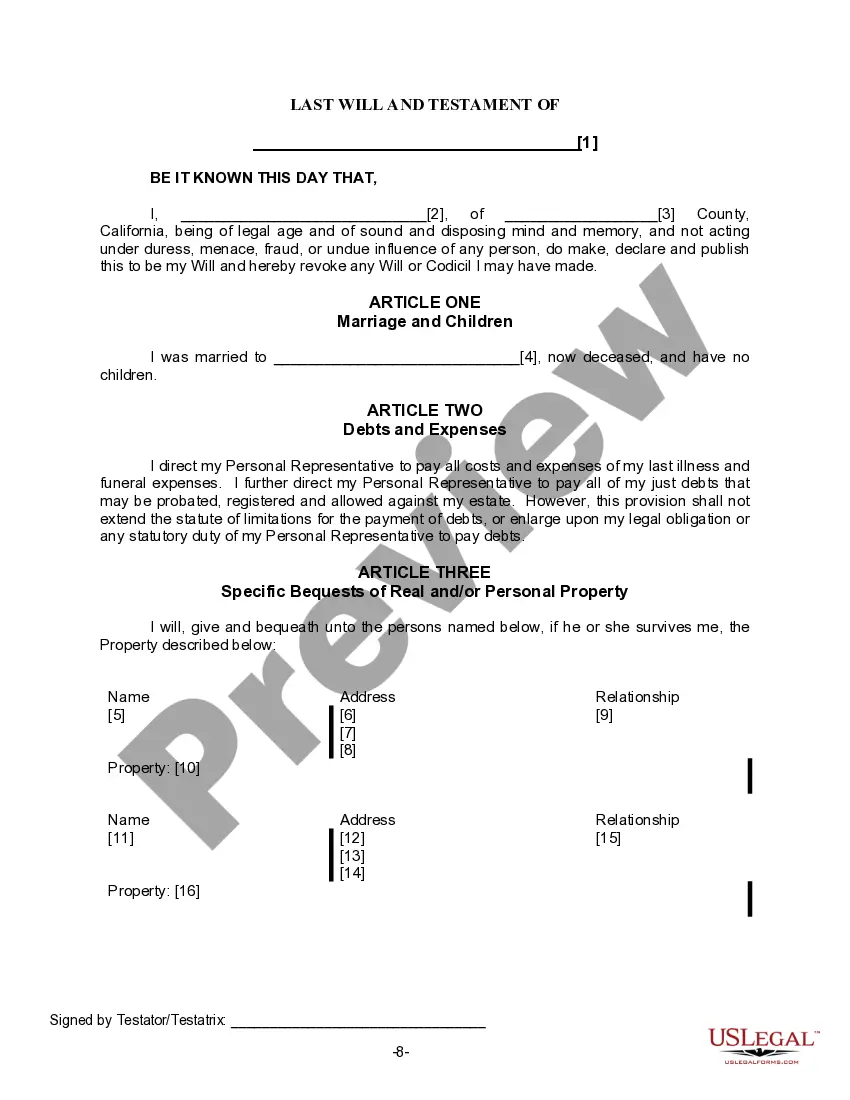

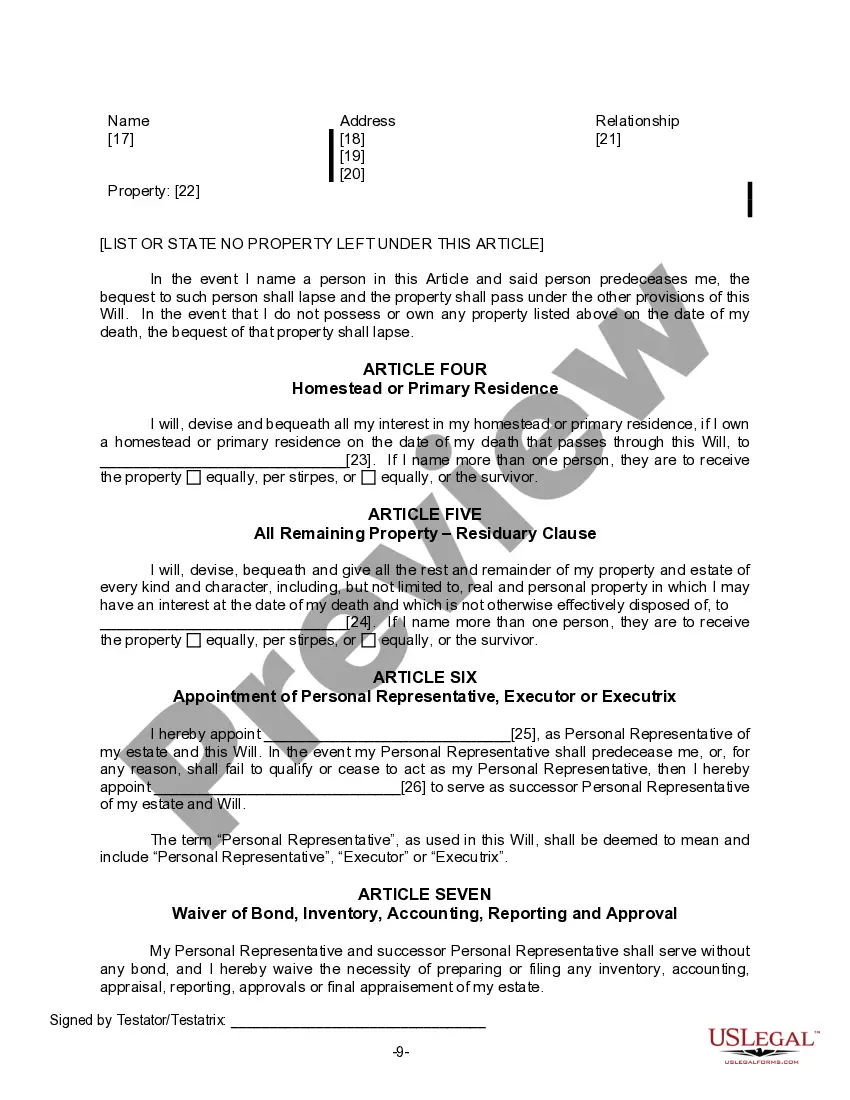

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

The Fontana California Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to clearly outline their final wishes and distribution of assets upon their death. It is especially crucial for widows or widowers without children to have a valid will in place to ensure their intended beneficiaries receive their assets as desired. This customizable form is designed to be completed by the widow or widower and should be prepared with the assistance of a qualified estate planning attorney. Keywords: Fontana California, legal last will form, widow, widower, no children, final wishes, distribution of assets, death, beneficiaries, customizable form, estate planning attorney. Types of Fontana California Legal Last Will Form for a Widow or Widower with no Children: 1. Basic Last Will Form for a Widow or Widower with no Children: This type of form provides a straightforward approach for individuals to document the distribution of their assets after their passing. It typically includes sections concerning the appointment of an executor, beneficiaries, specific bequests, and any additional instructions or provisions. 2. Testamentary Trust Will Form for a Widow or Widower with no Children: This form is ideal for individuals who wish to establish a trust that will come into effect upon their death. By setting up a testamentary trust, the widow or widower can ensure that their assets are managed and distributed according to their requirements. It also offers potential tax benefits and allows for more control over how the assets are distributed over time. 3. Living Will and Last Will Form for a Widow or Widower with no Children: This combined form not only outlines the distribution of assets upon the widow or widower's death but also includes instructions for end-of-life medical decisions. A living will grants the individual the ability to express their preferences regarding life-sustaining treatment, organ donation, and other crucial healthcare choices. It is crucial for widows or widowers with no children to choose the appropriate Fontana California Legal Last Will Form that best aligns with their personal preferences, financial situation, and desired level of control over their assets. It is recommended to consult with an experienced estate planning attorney to determine the most suitable option and ensure that all legal requirements are met.The Fontana California Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to clearly outline their final wishes and distribution of assets upon their death. It is especially crucial for widows or widowers without children to have a valid will in place to ensure their intended beneficiaries receive their assets as desired. This customizable form is designed to be completed by the widow or widower and should be prepared with the assistance of a qualified estate planning attorney. Keywords: Fontana California, legal last will form, widow, widower, no children, final wishes, distribution of assets, death, beneficiaries, customizable form, estate planning attorney. Types of Fontana California Legal Last Will Form for a Widow or Widower with no Children: 1. Basic Last Will Form for a Widow or Widower with no Children: This type of form provides a straightforward approach for individuals to document the distribution of their assets after their passing. It typically includes sections concerning the appointment of an executor, beneficiaries, specific bequests, and any additional instructions or provisions. 2. Testamentary Trust Will Form for a Widow or Widower with no Children: This form is ideal for individuals who wish to establish a trust that will come into effect upon their death. By setting up a testamentary trust, the widow or widower can ensure that their assets are managed and distributed according to their requirements. It also offers potential tax benefits and allows for more control over how the assets are distributed over time. 3. Living Will and Last Will Form for a Widow or Widower with no Children: This combined form not only outlines the distribution of assets upon the widow or widower's death but also includes instructions for end-of-life medical decisions. A living will grants the individual the ability to express their preferences regarding life-sustaining treatment, organ donation, and other crucial healthcare choices. It is crucial for widows or widowers with no children to choose the appropriate Fontana California Legal Last Will Form that best aligns with their personal preferences, financial situation, and desired level of control over their assets. It is recommended to consult with an experienced estate planning attorney to determine the most suitable option and ensure that all legal requirements are met.