The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

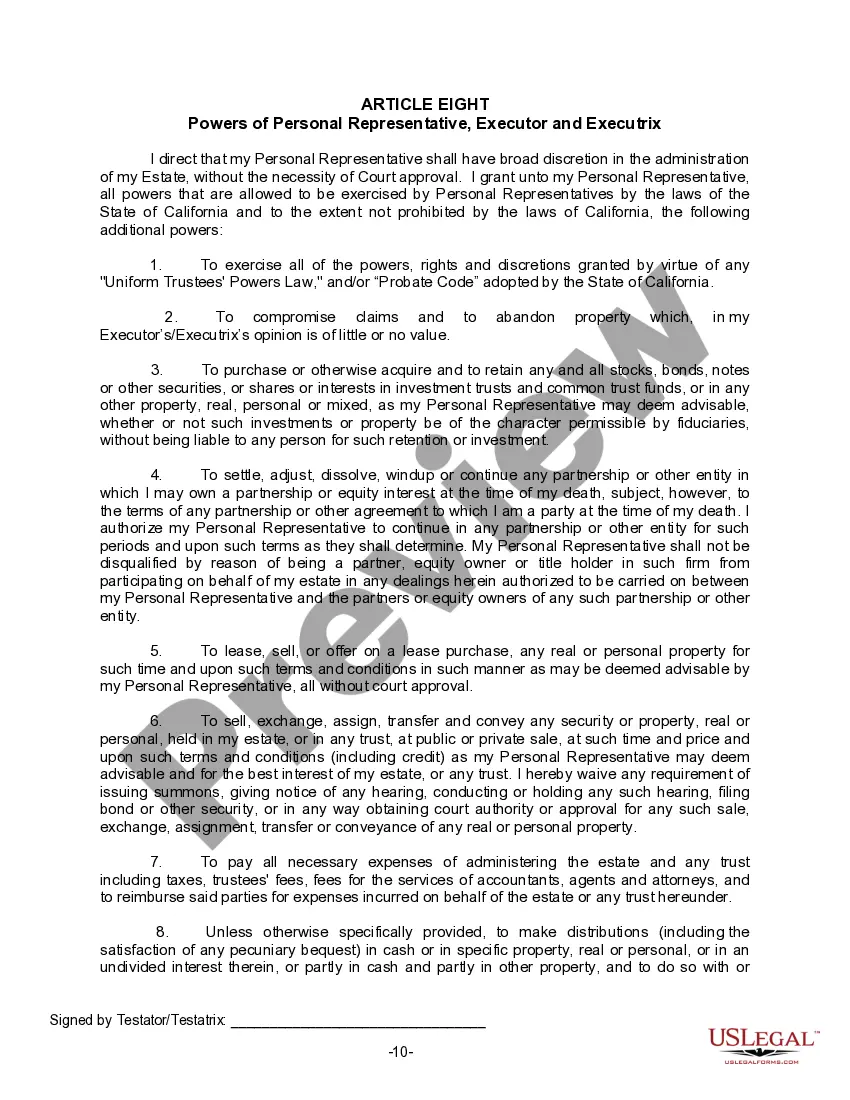

The Inglewood California Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals in that specific situation to outline their final wishes and distribute their assets upon their passing. It serves as a crucial tool to ensure that your estate is properly managed and your loved ones are taken care of according to your wishes. When creating your Last Will, it is essential to consult with an attorney or use a reliable and updated legal form specific to Inglewood, California. Working with an attorney will ensure that all legal requirements are met, and your will accurately reflects your intentions. Some of the key elements that should be included in this legal form are: 1. Personal Information: Start by providing your full legal name, address, and all relevant contact information. 2. Appointment of Executor: Choose a trusted individual who will be responsible for carrying out the instructions outlined in your will. The executor should be someone you have faith in to handle this role efficiently. 3. Asset Distribution: Clearly outline how you want your assets, including real estate properties, vehicles, bank accounts, investments, and personal belongings, to be distributed among your chosen beneficiaries. Specify each item and the person or organization it should go to. 4. Appointment of Guardian: In case you have any dependents, such as pets or disabled relatives, indicate who you would like to serve as their guardian. 5. Charitable Contributions: If you wish to leave any part of your estate to a charitable organization or cause, specify the details in your will. 6. Alternate Beneficiaries: Consider including alternate beneficiaries in case your primary choices are unable to fulfill their roles or pass away before you. 7. Residue Clause: This clause handles any assets that are not specifically mentioned in your will or those that may be acquired after the creation of your will. It ensures that the remaining assets are distributed as desired. Inglewood California offers several types of legal last will form for a widow or widower with no children, which can vary based on individual preferences, assets, and circumstances. Some common variations include: 1. Simple Last Will Form: This form is suitable for individuals with uncomplicated estates, limited assets, and straightforward distribution plans. 2. Pour-Over Will Form: This type of will work in conjunction with a trust and allows the assets to "pour over" into the trust upon your passing, making it an efficient way to manage larger estates. 3. Joint or Mutual Will Form: This form is often used by spouses who want their assets to pass to the surviving spouse, and then ultimately to chosen beneficiaries once both spouses have passed away. Remember, the precise details of these Inglewood California Legal Last Will Forms for a Widow or Widower with no Children may differ due to specific circumstances and the advice of legal professionals. Therefore, it is crucial to consult with an attorney or utilize trustworthy legal resources when drafting and finalizing your last will.The Inglewood California Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals in that specific situation to outline their final wishes and distribute their assets upon their passing. It serves as a crucial tool to ensure that your estate is properly managed and your loved ones are taken care of according to your wishes. When creating your Last Will, it is essential to consult with an attorney or use a reliable and updated legal form specific to Inglewood, California. Working with an attorney will ensure that all legal requirements are met, and your will accurately reflects your intentions. Some of the key elements that should be included in this legal form are: 1. Personal Information: Start by providing your full legal name, address, and all relevant contact information. 2. Appointment of Executor: Choose a trusted individual who will be responsible for carrying out the instructions outlined in your will. The executor should be someone you have faith in to handle this role efficiently. 3. Asset Distribution: Clearly outline how you want your assets, including real estate properties, vehicles, bank accounts, investments, and personal belongings, to be distributed among your chosen beneficiaries. Specify each item and the person or organization it should go to. 4. Appointment of Guardian: In case you have any dependents, such as pets or disabled relatives, indicate who you would like to serve as their guardian. 5. Charitable Contributions: If you wish to leave any part of your estate to a charitable organization or cause, specify the details in your will. 6. Alternate Beneficiaries: Consider including alternate beneficiaries in case your primary choices are unable to fulfill their roles or pass away before you. 7. Residue Clause: This clause handles any assets that are not specifically mentioned in your will or those that may be acquired after the creation of your will. It ensures that the remaining assets are distributed as desired. Inglewood California offers several types of legal last will form for a widow or widower with no children, which can vary based on individual preferences, assets, and circumstances. Some common variations include: 1. Simple Last Will Form: This form is suitable for individuals with uncomplicated estates, limited assets, and straightforward distribution plans. 2. Pour-Over Will Form: This type of will work in conjunction with a trust and allows the assets to "pour over" into the trust upon your passing, making it an efficient way to manage larger estates. 3. Joint or Mutual Will Form: This form is often used by spouses who want their assets to pass to the surviving spouse, and then ultimately to chosen beneficiaries once both spouses have passed away. Remember, the precise details of these Inglewood California Legal Last Will Forms for a Widow or Widower with no Children may differ due to specific circumstances and the advice of legal professionals. Therefore, it is crucial to consult with an attorney or utilize trustworthy legal resources when drafting and finalizing your last will.