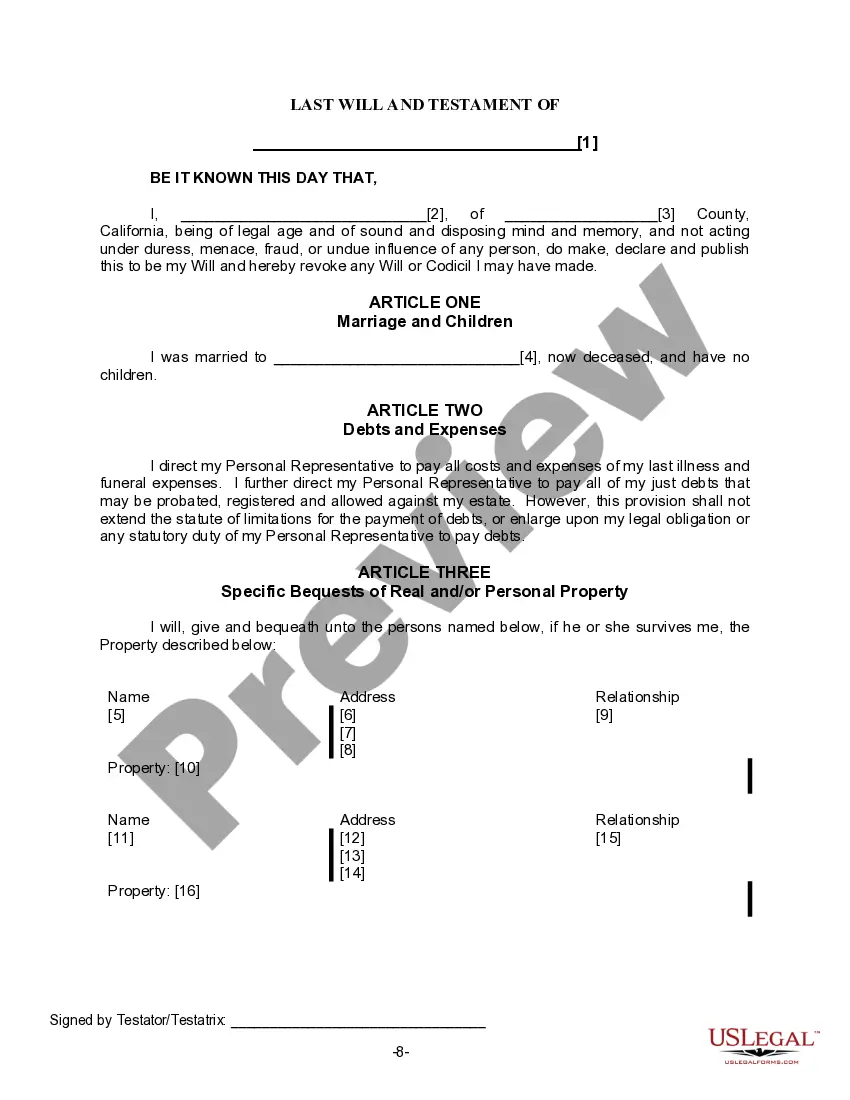

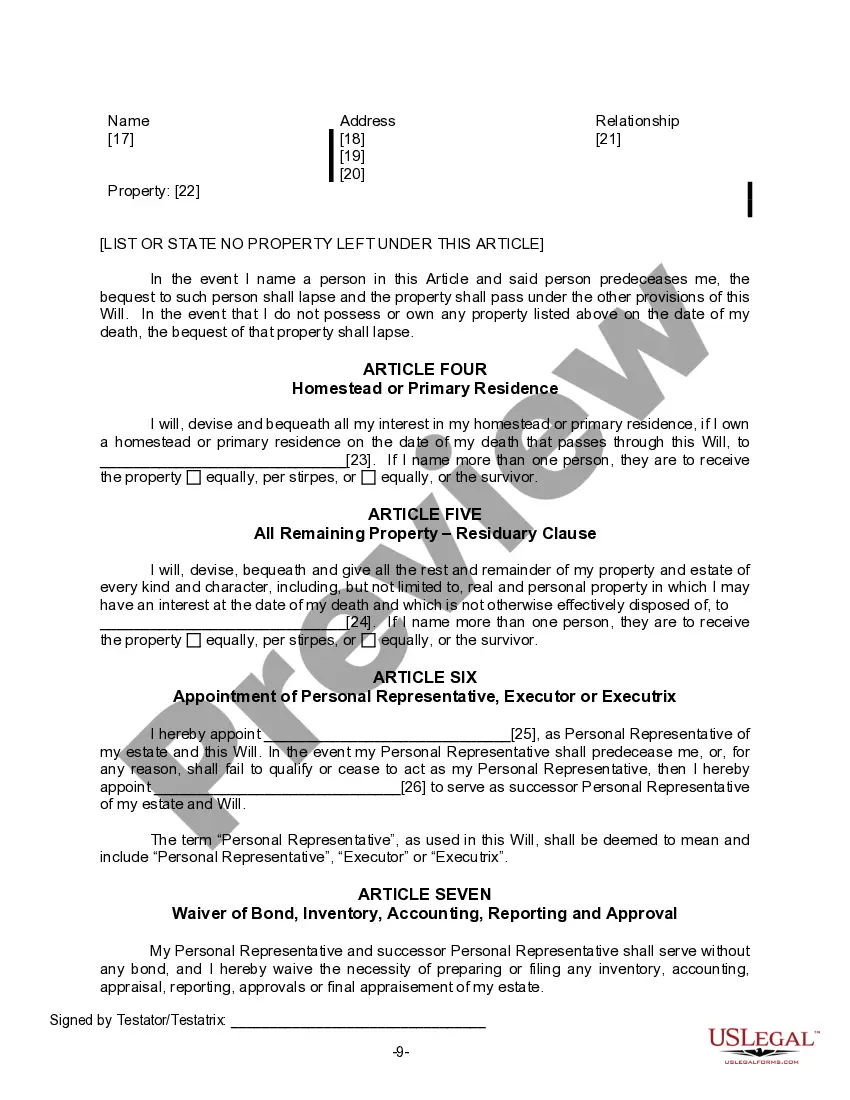

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

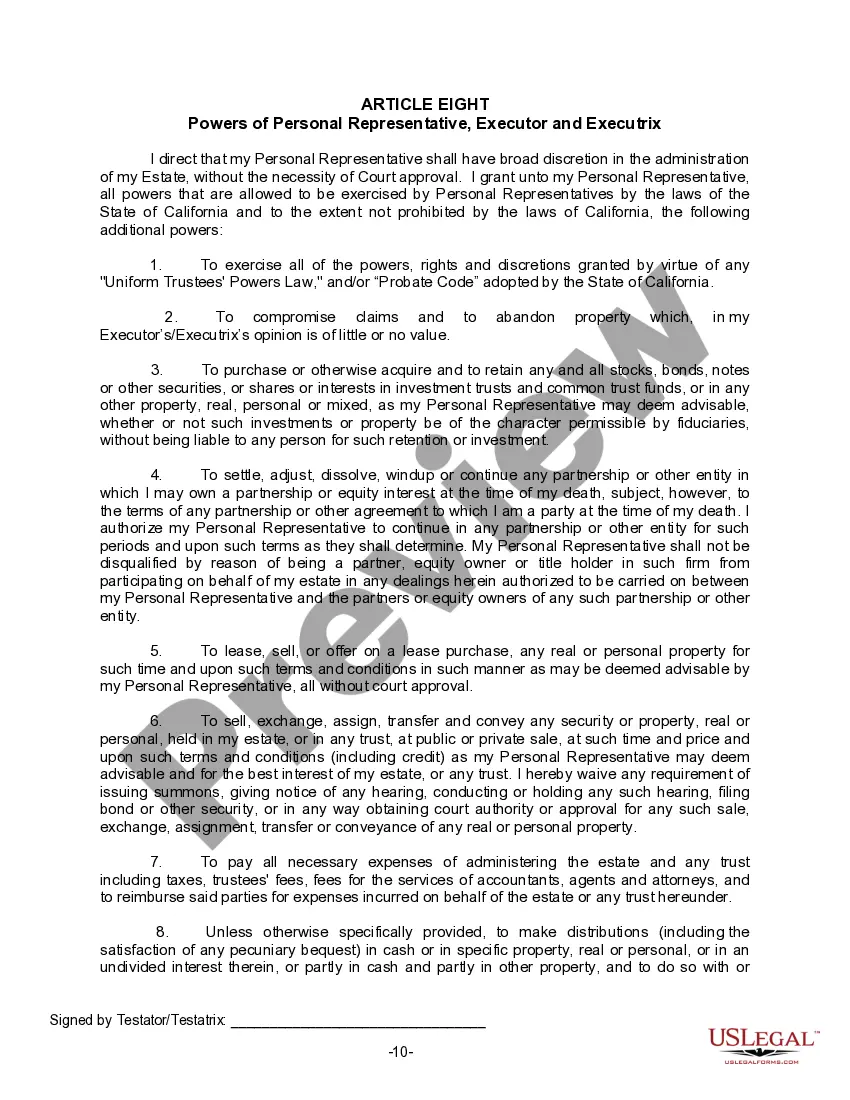

Keywords: Norwalk California Legal Last Will Form, Widow or Widower, no Children Description: A Norwalk California Legal Last Will Form for a Widow or Widower with no Children is a comprehensive and legally binding document that allows individuals in Norwalk, California, who have lost their spouse and have no children to plan and distribute their assets and estate after their passing. This type of will form is specifically designed to meet the unique needs and circumstances of widows and widowers without children. The Norwalk California Legal Last Will Form for a Widow or Widower with no Children provides a detailed framework for the individual to specify their desires regarding the distribution of their property, assets, and other possessions upon their death. It allows them to safeguard their legacy and ensures that their wishes are carried out according to the laws of California. There are various types of Norwalk California Legal Last Will Forms that widows or widowers with no children may consider based on their specific requirements. Here are a few common types: 1. Simple Last Will: This type of will is suitable for individuals who have straightforward estate plans with relatively few assets and possessions. It outlines the distribution of assets and appoints an executor to handle the administration of the estate. 2. Pour-Over Will: A Pour-Over Will usually is used in conjunction with a Revocable Living Trust. It stipulates that any assets not already transferred to the trust during the individual's lifetime will "pour over" into the trust upon their death. 3. Testamentary Trust Will: This type of will establishes a trust upon the individual's death, allowing for the management and distribution of assets to designated beneficiaries. It can be particularly useful if there are concerns about the appropriate management of assets or if specific conditions for distribution need to be implemented. When executing a Norwalk California Legal Last Will Form for a Widow or Widower with no Children, it is crucial to ensure that the document complies with all relevant California laws. Seeking legal advice or consulting a qualified attorney experienced in estate planning can help individuals navigate the complexities and nuances of the legal process, ensuring the last will accurately reflects their intentions and desires.Keywords: Norwalk California Legal Last Will Form, Widow or Widower, no Children Description: A Norwalk California Legal Last Will Form for a Widow or Widower with no Children is a comprehensive and legally binding document that allows individuals in Norwalk, California, who have lost their spouse and have no children to plan and distribute their assets and estate after their passing. This type of will form is specifically designed to meet the unique needs and circumstances of widows and widowers without children. The Norwalk California Legal Last Will Form for a Widow or Widower with no Children provides a detailed framework for the individual to specify their desires regarding the distribution of their property, assets, and other possessions upon their death. It allows them to safeguard their legacy and ensures that their wishes are carried out according to the laws of California. There are various types of Norwalk California Legal Last Will Forms that widows or widowers with no children may consider based on their specific requirements. Here are a few common types: 1. Simple Last Will: This type of will is suitable for individuals who have straightforward estate plans with relatively few assets and possessions. It outlines the distribution of assets and appoints an executor to handle the administration of the estate. 2. Pour-Over Will: A Pour-Over Will usually is used in conjunction with a Revocable Living Trust. It stipulates that any assets not already transferred to the trust during the individual's lifetime will "pour over" into the trust upon their death. 3. Testamentary Trust Will: This type of will establishes a trust upon the individual's death, allowing for the management and distribution of assets to designated beneficiaries. It can be particularly useful if there are concerns about the appropriate management of assets or if specific conditions for distribution need to be implemented. When executing a Norwalk California Legal Last Will Form for a Widow or Widower with no Children, it is crucial to ensure that the document complies with all relevant California laws. Seeking legal advice or consulting a qualified attorney experienced in estate planning can help individuals navigate the complexities and nuances of the legal process, ensuring the last will accurately reflects their intentions and desires.